There’s lot of talk about AI everywhere you go in tech. Artificial Intelligence is simply the ability to predict behavior, based on learned data and tendencies. Its how tech companies, car makers, smart speakers, e-commerce sites, and other web-based companies study our behavior to suggest new things for us to buy, places for us to visit, and ways to spend our money.

It goes back to that saying, “In God we trust. All others must bring data” uttered by statistician and consultant, W. Edwards Deming. And of course, he was right.

And data has become even more important as radio segues from competing against a bunch of other stations in your market to going up against more formidable challengers – satellite radio, streaming pure-plays, podcasts, connected cars, smart speakers – and the list keeps getting longer and the quality of competition gets better.

That’s why no matter what else your station (or cluster or company) does in 2020, on the front burner should be aggregating data to help your programming, sales, digital, and marketing teams better understand the complexity and depth of your competitive environment. Where are your “pain points?” Where are you opportunities? How can you best deploy your resources – human and financial – to create great content you can monetize, while building your station’s brand.

That’s our mindset here at Jacobs Media, a shift in focus from what radio stations and the companies that owned them were aspiring to just a decade or two ago. Back then, it was about achieving ratings, revenue, and margins. The industry was a fertile, open field with a handful of competitors – newspapers, TV stations, the Yellow Pages, and direct mail.

Oh, those were the days. Through most of the 2000’s, that very simple, highly profitable model changed, morphed, and yes, was disrupted. And now, media of all sizes, shapes, and platforms are trying to figure it out. If you’re not Google, Apple, Facebook, or Amazon, you’re in scramble mode.

Even Netflix – essentially the first mover in the video streaming category – has now got its hands full as Disney, Apple, and others are becoming distribution outlets themselves, dedicated to cornering great content and the way in which consumers enjoy it. That’s how crazy it’s become.

And so in our annual Techsurvey’s – started back in 2004-5 – we’ve been tracking all the different ways radio audiences are spending time on other platforms, using new gadgetry, and consuming content in different ways.

As we spend more time with teams of corporate execs (and perhaps a little less time arguing about which Nirvana songs to play), the topics often revolve around new media that matters – and how broadcasters can navigate these changes as both challenges and opportunities.

Money has never been tighter in the radio business than it is today. And the current round of budgeting happening as you read this at many companies has pushed managers to the brink.

So, it stands to reason that investments in new media – podcasting, social media, streaming, mobile apps, Alexa skills, etc. – must be spent wisely and strategically. Sadly, most radio broadcasters can tell you whether they’re the concert authority or how well “Black Dog” tests. But they may be much more hard-pressed when it comes to knowing the percentage of their listeners that own a smart speaker, subscribe to SiriusXM, and listen to podcasts at least weekly.

That’s why we do Techsurvey. We break out 14 different formats – including Rock, Country, AC, and everything in between, along with News/Talk and Sports. And the big benefit is that “stakeholder” stations receive their own data – how their core audience uses media, technology, as well as why they still enjoy listening to broadcast radio.

Oh, the things you’ll learn.

In Techsurvey 2020, we’ll be tracking everything you’d expect, but of course, there will be new questions designed to help broadcasters better  navigate the changing landscape. We know headphone usage is of growing interest, especially as Nielsen is investigating how it plays into radio listening. We’ll tackle that issue, as well as learn more about “hearables” – devices like Air Pods and similar peripherals.

navigate the changing landscape. We know headphone usage is of growing interest, especially as Nielsen is investigating how it plays into radio listening. We’ll tackle that issue, as well as learn more about “hearables” – devices like Air Pods and similar peripherals.

We will spend considerable questionnaire “real estate” on both smart speakers and podcasting – two areas that continue to dominate conversations in both board rooms and at media conferences. We’ll track radio’s disappearance in the home, and whether Alexa and Google Home are becoming their replacements.

With 800,000 podcasts available to anyone with a smartphone or a laptop, how are consumers discovering podcasts and how do they listen to them?

What’s the latest in the iHeartRadio vs. Radio.com war, and how popular are individually branded station apps?

You can bet we’ll update how radio listeners are using social media. Is there a continued move away from Facebook? And how are emerging players like TikTok looking?

You can bet we’ll update how radio listeners are using social media. Is there a continued move away from Facebook? And how are emerging players like TikTok looking?

We will also continue to explore privacy issues – how are they impacting the ways in which consumers use media and are they stunting the growth of gadgets like smart speakers?

We will also look at audience awareness of many new features radio stations are now offering. What are the awareness levels of station mobile apps, podcasts, videos, and other outlets broadcasters are investing heavily in?

Oh, the things you’ll learn.

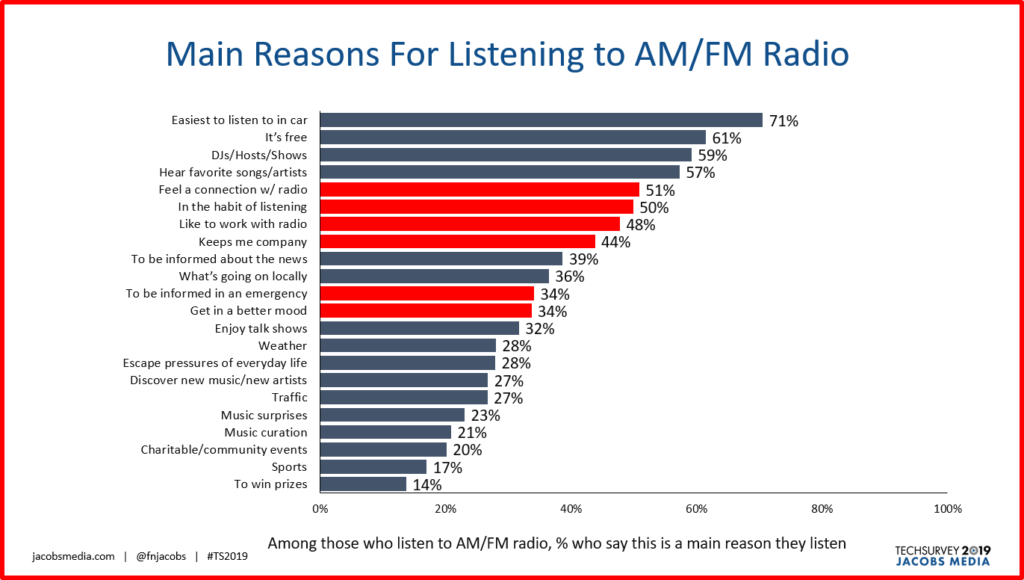

Then there’s the chart that keeps getting more interesting with each passing year. With all the new media, gadgetry, and technology available, why are consumers still turning to radio? What is broadcast radio’s “job-to-do” in 2020, and how can broadcasters reinforce the reasons why the medium continues to be viable?

This is how it looked this year – among all 50,000+ respondents. Yes, radio has inherent strengths – it’s simple, easy, and free. And of course, music and personalities are integral to why consumers make radio a media habit.

But as we’ve highlighted in red, for many consumers, radio provides emotional benefits – companionship, a friend at work, mood elevation, and as a source for emergency information when things go awry. And as you’d expect, these charts look a lot different when you isolate format listeners, and individual station audiences.

So, I’m hoping you’ll join the 560+ radio stations who took part last year in Techsurvey 2020. These collective research studies are what the Internet has become about – a shared experience, crowd-sourced data gathering. For just a few hundred bucks, you’ll deliver more ROI for your radio station brand than any other investment you can make.

We go to the field at the start of the new year, and the exclusive stakeholder presentation is set for mid-March. And then late that month, I’ll be at the Worldwide Radio Summit in L.A., showing off the top-line data for Joel Denver’s attendees. Meanwhile, your station will have your data, ready to meet the challenges that lay ahead in 2020.

It’s all designed to raise your AI – your Audience Intelligence. Whether it’s meeting with the airstaff, the sales team, or plotting out your course for the foreseeable future, this is the information that helps you make smarter, more strategic decisions.

After all, if we don’t have data, your guess is as good as mine.

Oh, the things you’ll learn.

Here’s a favorite quote that says it all about why we continue to create and produce Techsurvey:

“If we have data, let’s look at data. If all we have are opinions, let’s go with mine.” – Jim Barksdale, former Netscape CEO

More info about Techsurvey 2020, a nifty video, and registration info is available here.

Info for the Worldwide Radio Summit is here.

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

- Can Radio Afford To Miss The Short Videos Boat? - April 22, 2025

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

Leave a Reply