Many brand managers in broadcast radio, as well as across the products and services spectrum, are struggling with strategy at this challenging moment in time. It’s not just about the problems posed by limited financial resources, depleted staffs, and unprecedented pressures to perform.

As programmers, marketers, and managers of media properties have found out, no one’s been through anything quite like this before. There is no playbook, “best practices,” or handy DIY marketing books for sale. Everyone’s in it for themselves, trying to hack out a way forward with the hope of not just surviving, but thriving.

It’s a tall order to be sure. But it’s also the task at hand. We have no choice but to forge ahead.

At moments like this, I move into listening mode, vacuuming up the best information I can from the smartest people, relying on research, logic, and experience to help guide the way forward.

So, let me share some of what we’re already learning, and what we believe is the most logical path ahead.

For starters, I appreciated a recent article in The Drum focused on John Sculley, former CEO at both Apple and Pepsi. Steve Jobs deservedly gets the credit for eventually creating the iteration of Apple we’ve watched over the past two decades. But in Scully’s decade at Apple starting in 1983, the company’s revenues jumped from under $600,000 to north of $8 billion. As any financial analyst might say, “Not too shabby.”

Sculley, along with David Steinberg, now runs digital marketing agency Zeta Global. And they talked about what brands should be focused on at this critically important time.

There’s a lot of smart advice from these two mavens, including “Keep on advertising” no matter how bad market conditions become. As Sculley noted, a brand that goes silent might be perceived as one that’s struggling in the midst of bad times. As he explained:

“Going dark during this time really raises a question mark. Are they concerned? Is there a problem in their company?”

But the one that jumped off the screen at me is labelled “Reward loyalty.” In other words, take care of your core customers. In the case of broadcast radio, that translates to P1 listeners – station fans.

Sculley pointed to a truism in today’s maelstrom of business challenges:

“The companies who come out of this pandemic in a better position than when they came in are the ones that will digitally know who their most loyal customers are, and then reward their loyalty.”

And he name-dropped Amazon Prime as a modern-day example of why it’s paramount to super-serve VIP customers – they buy more than four times more goods and services than the average Amazon customer.

If you’ve watched me present our Techsurveys over the years, you  no doubt remember me citing Pareto’s Principle, better known as the “80:20 Rule.” The math is similar to what Sculley cites about Amazon – 20% of most populations produce 80% of the results.

no doubt remember me citing Pareto’s Principle, better known as the “80:20 Rule.” The math is similar to what Sculley cites about Amazon – 20% of most populations produce 80% of the results.

And in radio, that’s more or less true whether we’re studying listeners, salespeople, or advertisers. The “20%” produce the majority of the results – ratings and revenue.

So, when the going gets tough, smart brand managers tend to their core.

Yet, there are some in the radio wilderness who pedantically cling to the old school ways of thinking about the audience – especially the misplaced notion that every listener has the same value. The thinking is that while fans matter, stations should be paying close attention to their entire audience – secondary listeners and even those who use the medium casually.

In a “normal” year, some might argue against core-focused research. (I’m not one of them, by the way.) But in times like these, where consumers are way out of their comfort zones, angsting about their jobs, worried about their families, as well as their own physical and mental well-being, circling the wagons around these all-important fans isn’t just logical – it’s the smartest, most efficient way to go.

In a “normal” year, some might argue against core-focused research. (I’m not one of them, by the way.) But in times like these, where consumers are way out of their comfort zones, angsting about their jobs, worried about their families, as well as their own physical and mental well-being, circling the wagons around these all-important fans isn’t just logical – it’s the smartest, most efficient way to go.

In the middle of a global pandemic, casual radio listeners aren’t going to magically find their way back to the medium. And a station’s P2s, much less their P3s, aren’t going to magically convert to fan status.

The ones that need your attention – your station’s version of Amazon Prime customers – are your core. And if you think all core listeners are alike, you’re sadly mistaken. Research in the radio space that looks at the total audience as one homogenous group isn’t just missing the nuances of what distinguishes radio listeners – they may be missing the big picture.

We know this from our Techsurveys where we break the commercial radio audience down into 14 different format groupings – from News/Talk to Hot AC to Active Rock. And as we discover with each passing year, the results by format vary wildly, whether you’re talking about gadget ownership (smart speakers, etc.), streaming (audio and video), or overall brand loyalty. They may all be core radio listeners, but that’s where the similarities end. Programmers need that essential format information.

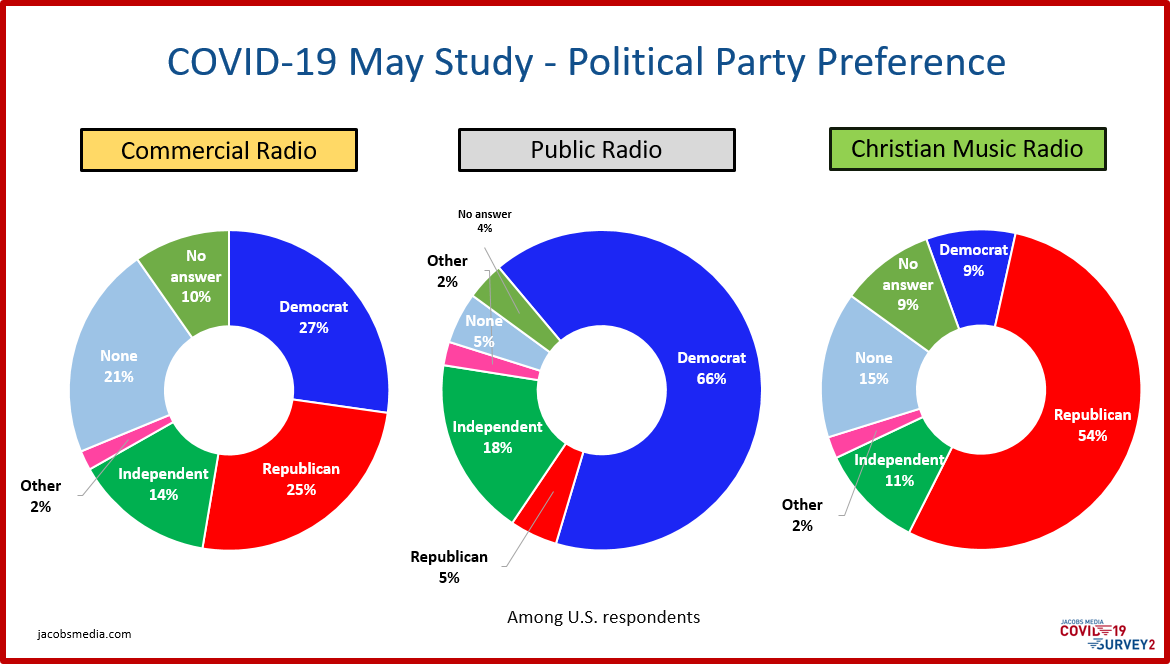

More recently, in our COVID-19 tracking research conducted in mid-May, we actually fielded three separate core audience studies – for commercial, public, and Christian music radio. As we are seeing right now before our very eyes, opinions about the pandemic – right down to the wearing of face masks and attitudes about re-opening businesses – have become highly politicized. Consumer “isms” and beliefs are behavioral drivers.

Case in point: when you look at political affiliation across all three of our samples, the truth is right in front of you. There are three very distinct audiences here, and that’s going to alter the way PDs, marketers, and sales management strategize pretty much everything.

The public radio audience is especially interesting. They are, by far, the most educated of the three radio groups, coupled with the fact their favorite stations tend to be less dependent on ratings, but live or die on listener support. Talking to their listeners over the airwaves, via social media, and in email communications during turbulent times and an economic meltdown requires finesse – and facts.

There’s a figure in the public radio community who’s a stone-cold pro. George Bailey is the person behind Walrus Research. He has a PhD and has been conducting research in the public radio sector for more than 40 years. He has studied this audience in depth, and is considered one of the premier analysts of public radio ratings and behavioral trends.

Last week in Current (the go-to publication in public media), George authored a detailed article with this title:

“Amid pandemic, core listeners prove their importance to news stations”

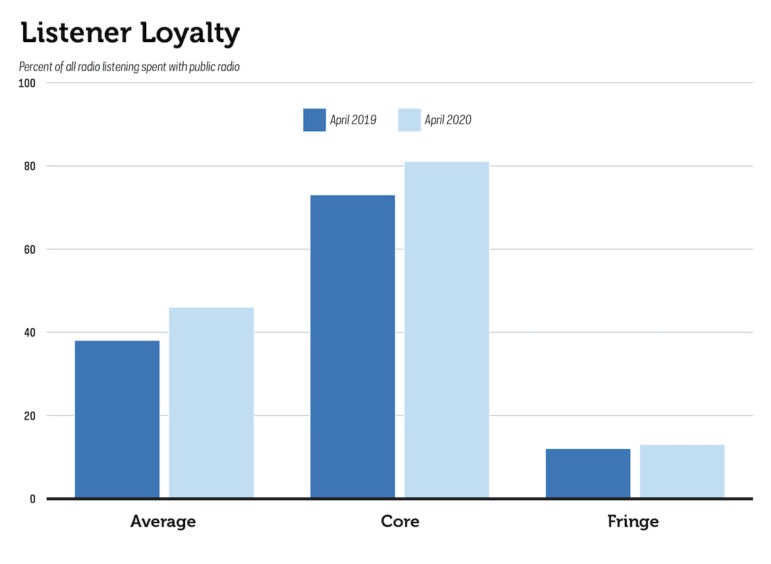

Working with key experts in the public radio research community from NPR and Radio Research Consortium, George painstakingly broke down the Nielsen PPM ratings since the start of COVID-19 among 91 NPR News stations from around the country that reach listeners in PPM markets. As we saw across the spectrum in these markets, cume audiences and PUMM levels suffered precipitous drops as the lockdown took hold.

While Bailey looks at the standard metrics – cume and TSL – he studied the data across multiple dayparts during the weekdays and on weekends. One of his key metrics is “loyalty,” defined as the percent of overall radio listening spent with public radio. That’s a clear indicator of the dyed-in-the-wool public radio audience. Comparing this April with April 2019, the data shows that for NPR News stations, loyalty actually increased among core listeners.

Based on his analysis, here are George’s key takeaways for public radio brand managers:

- Away-from-home listening (in-car and at-work) cratered in April, but core listener loyalty actually improved

- For NPR News stations, core listeners are of primary importance

- “Sustainers” – those who automatically make monthly contributions to their favorite public radio stations through their credit cards should be asked for higher donations

By the way, the research shows that public radio’s classical music stations experienced similar drops in cume, but increases in the all-important loyalty metric.

George refers to these COVID-19 April to April comparisons as a “natural field experiment” – a researcher’s dream – where we get to measure the norm against a completely new condition – in this case, a pandemic where a large percentage of “out-of-home radio listening” (in-car, at-work) disappeared.

Interestingly, we saw a similar pattern among the core listeners in our COVID-19 study we conducted among public radio fans. Overall, we found that of our member-heavy sample, more than 90% of these respondents say they plan on continuing their financial support through 2020. That’s a good sign public radio stations are fulfilling their missions – and satisfying their core.

And not a moment too soon, because public radio is hurting just as much as commercial radio companies. Just this week, Minnesota Public Radio cancelled its replacement show to Prairie Home Companion – Live From Here. And in the process, 28 people lost their jobs.

WBUR in Boston – one of public radio’s premier major market news stations – cut 10% of its staff, and cancelled one of its syndicated weekend shows, Only A Game. That amounts to another 29 public radio professionals freshly out of work.

There is pain in public radio system-wide – even more impetus to circle those wagons around the core audience.

Core-focused research like our COVID-19 studies and our Techsurveys shouldn’t be the only research radio stations engage in. But they should be part of the total mosaic of research – alongside perceptual studies, music tests, focus groups, and the ratings themselves are all important tools to better understand the complexities of the audience.

That’s true under so-called “normal” circumstances, but during the most anomalous event of our lives, it is essential to connect with core radio station audiences – those who demonstrate their regularity, their loyalty, and in the case of these public radio listeners, monetary support.

The Executive Director of the Public Radio Program Directors, Abby Goldstein, is our partner for our Public Radio Techsurveys (this survey will launch in just a few days). Recently, she summed up her philosophy about programming and research this way:

“Good programmers use all the tools at their disposal; they know better than to follow one set of results blindly and proclaim them to be the one and  only truth. Nobody uses just one tool to build a house; it takes many different tools for different jobs, in this case research, audience data, metrics, market info, national trends, peer to peer, Scarborough, Media Audit and many others to make the best decisions. The tools give people guideposts to help them choose the right path, but programmers still have to walk that path and ultimately, it’s the programmer who is responsible for reaching the destination.”

only truth. Nobody uses just one tool to build a house; it takes many different tools for different jobs, in this case research, audience data, metrics, market info, national trends, peer to peer, Scarborough, Media Audit and many others to make the best decisions. The tools give people guideposts to help them choose the right path, but programmers still have to walk that path and ultimately, it’s the programmer who is responsible for reaching the destination.”

And there’s no right or wrong way here – as Abby points out, brand managers and their parent companies are tasked with using the best available resources to make their judgment and strategic decisions.

During the biggest crisis radio has faced since its inception in the 1920s. Programmers can’t Google their way to solutions here. But they can use their heads, take care of their most dependable listeners, and live to fight another day.

We’ll do everything we can to help you get there.

If you’re a public radio station – news, classical, Triple A, or jazz, there’s still time to register for our Public Radio Techsurvey. Information and registration is here.

To read the Walrus Research analyses of public radio ratings trends during the pandemic, use the links below:

The Audience for NPR News Stations in the COVID Epidemic — Walrus Research — Publication

The Audience of Classical Stations in the COVID Epidemic — Walrus Research — Publication

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Leave a Reply