Last week’s presentation of Techsurvey 2022 unleased a barrage of comments and opinions from all corners of the industry. Radio Ink’s Ed Ryan jumped on the story, and opened his publication to a variety of industry luminaries for more than a week. I read their remarks with great interest, along with many of you who commented on our blog posts this week, and on my social pages.

It culminated with Ed giving me the green light to sum it all up in yesterday’s Radio Ink.

I believe the dialogue has been healthy. We may not all agree on what’s happened to broadcast radio, and what needs to happen to revitalize the industry. But I think there’s acknowledgment we’re in a “moment.” Technology, media, and society as we know it are all undergoing great change. And whether stations play too many commercials, not enough songs, or incessantly voicetrack may pale in comparison to how our lives, our jobs, our cities, and our institutions are changing.

After all, radio is a reflection of the fabric of people’s everyday lives. It has long been a soundtrack for the commute, the workday, the weekend, and the nighttime scene. But as habits and patterns roil, radio listening and how the medium adapts to a very different America is up for grabs.

Today’s post is that “sum it all up” piece I wrote for Radio Ink, with a few tweaks and changes. If you read it already, it looks like you get Friday off. But if you haven’t seen it, I hope it provides perspective to some of the challenges radio – and all of us – are facing. To be sure, I don’t have all the answers. And I struggle just like many of you do, trying to see the landscape clearly and objectively. I very much have appreciated your comments; they help me sort things out, especially when I factor in how radio broadcasting’s shifting fortunes impact you and the stations where many of you work.

As always, feel free to use the “comments” section below, as well as our social channels. I know that for many of you, it can be helpful to talk about. I appreciate your passion and your dedication. – FJ

First of all, I’m honored so many radio industry luminaries were moved enough by this year’s Techsurvey 2022 to share their thoughts in Radio Ink these past two weeks. Dave Santrella, Joel Oxley, Mike McVay, Buzz Knight, Ed Levine, Steve Smith, Bud Walters, Alan Burns, and Lee Abrams are industry icons I admire, have worked with, and in some cases, competed against.

I read all their comments, observations, and action plans with great interest. They are all excessively smart people whose experiences have run the gamut. They’ve all enjoyed incredible success, they’ve taken a few lumps along the way, and they all have vivid memories about a radio industry that was much different than the one we’re working in today.

I read all their comments, observations, and action plans with great interest. They are all excessively smart people whose experiences have run the gamut. They’ve all enjoyed incredible success, they’ve taken a few lumps along the way, and they all have vivid memories about a radio industry that was much different than the one we’re working in today.

This is the 18th year Jacobs Media has produced an industry-wide Techsurvey. About a decade ago, we hit on the idea of format breakouts, and there are 14 formats we show every year. Unlike the Infinite Dial that is a measure of the country and how its populace uses media, our study focuses on core radio listeners, the people who join station email clubs.

In my presentations I describe our sample as “the 20” in “The 80:20 Rule” – those who generally profile as habitual listeners. When you understand how they use broadcast radio and other media, you have a clearer view of where broadcast radio in the U.S. actually stands. After all, if our sample of mostly radio fans are pointing to obvious weaknesses, what does they tell us about the broader audience?

other media, you have a clearer view of where broadcast radio in the U.S. actually stands. After all, if our sample of mostly radio fans are pointing to obvious weaknesses, what does they tell us about the broader audience?

And that’s what I saw when our research director, Jason Hollins, started sharing Excel spreadsheets with me in late February. Techsurvey’s annual tracking speaks volumes about the state of AM/FM radio. And this year, I saw those stress cracks growing.

Overall listening continues to tick down. You can blame COVID all you like, but the trend was in progress pre-pandemic. Yes, in-car listening isn’t back to 2019 levels. But even when people are on four wheels, the amount of broadcast radio they’re consuming is decreasing – like an oil leak.

Radio’s in-car status is paramount to its success, a fact radio people can agree on. And we hit a record high this year of consumers who are able to connect their smartphones to their cars. Eight in ten are now able to do so.

We also learned three in ten drive a truly connected car with a system like Ford Sync or Chrysler Uconnect. And we know when folks drive these vehicles, they spend less of their in-car time on AM/FM radio stations. The days of two knobs and six radio station presets in the center of the dashboard are over.

These are just a few of the facts that guided my initial Techsurvey observations this year, much to the chagrin of many radio pros who wish and hope the industry was doing better. The march of technology that began in the 1990’s is unstoppable. It has eroded broadcast radio’s strength and dominance. It has also all but eliminated radio’s swagger.

Unfortunately, many radio executives and managers have spent years suffering from digital denial. Some still suffer its effects today. The tropes are familiar: radio survived television, MTV, and other technology challenges – it will similarly come out stronger in the Internet Age. Or: despite the growth of streaming, mobile devices, smart speakers, podcasts, video streaming, social media, and other tech incursions, 90-odd percent of Americans still tune in AM/FM radio each week.

Unfortunately, many radio executives and managers have spent years suffering from digital denial. Some still suffer its effects today. The tropes are familiar: radio survived television, MTV, and other technology challenges – it will similarly come out stronger in the Internet Age. Or: despite the growth of streaming, mobile devices, smart speakers, podcasts, video streaming, social media, and other tech incursions, 90-odd percent of Americans still tune in AM/FM radio each week.

The industry’s embrace of many of these technologies has been tardy, to put it kindly. At various points on the curve, broadcasters have had the opportunity to buy tech companies or start up their own. But for years, most stood pat, content to duke it out with other radio stations for market share and revenue. Some actually prayed the Internet would turn out to be a tech fad that would simply fade away. The data has suggested otherwise, and that’s why studies like Techsurvey are so important so we can all look at the same trendlines.

One of the key findings in this year’s Techsurvey has received little coverage, but I think it speaks to radio’s lack of awareness about who IS the competition. A new question simply asked respondents to tell us their first choice destination when they’re in the mood for content similar to what the station that sent them the survey provides.

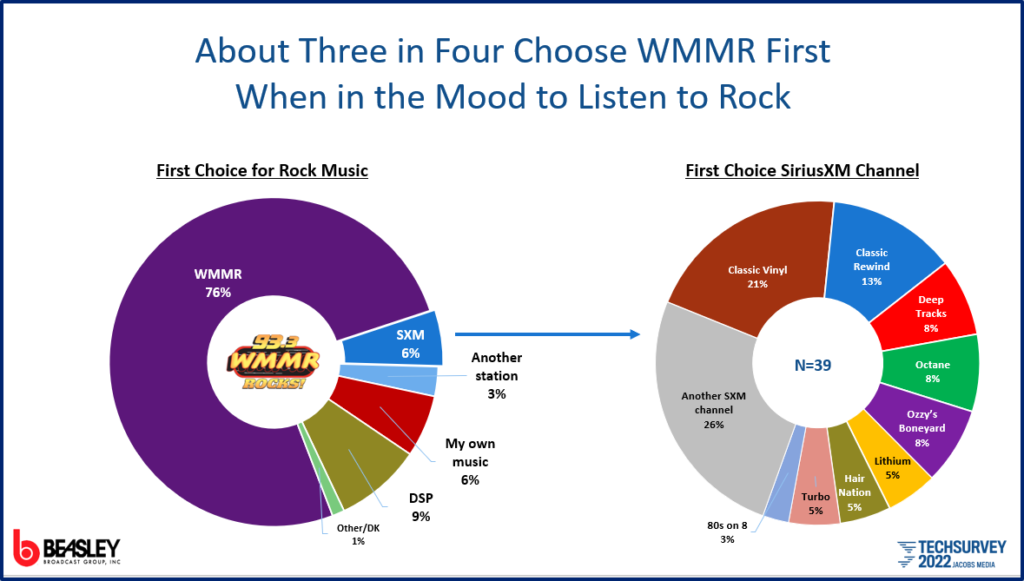

Of course, the “right answer” is to choose that same station. But only about three in four made that choice. The rest fanned out, selecting other terrestrial stations, satellite radio, digital streaming platforms, and podcasts. That tells us many of them are up for grabs.

The example below shows WMMR Philadelphia. On the left, you can see that WMMR is the choice among 77% of its own respondents, nine points higher than the average for all Rock stations – 67%. Notice that nearly one in ten (9%) chooses a digital streaming platform (Spotify, Apple Music, etc.), 6% opt for a SiriusXM channel, while only 3% go for another Philly station (unusually low). On the right, you can see the most popular SXM among these MMR respondents, where Classic Vinyl leads.

We’ll know next winter when Techsurvey 2023 is conducted whether broadcast stations are, in fact, losing more ground to these competitive forces. Like most key measurement points, the data is richer when we trend it over time. For WMMR and the hundreds of other stations that are Techsurvey stakeholders, we’ll have a longitudinal analysis that hopefully shows progress in this critically important dimension for AM and FM stations fighting it out for loyalty, attention, and relevance.

The moral of the story is that broadcast radio now competes for time and attention with everybody. But you’d never know it by how stations conduct research and how many of them sound. Almost all efforts are directed at beating other stations in the market for ratings…and revenue. Most sales departments are competing for a diminishing reservoir of “radio dollars” instead of looking at the broader revenue landscape – not a good plan for the future.

But Techsurvey 2022 isn’t about pointing out radio’s weakness or predicting its demise. Yes, there are troubling signs for AM/FM radio in the data. But there are also clear and obvious pathways for improvement, and ways for broadcasters to optimize the medium’s inherent and historic strengths.

The data clearly shows how personalities have become more important to many people than the music stations play. So, let’s stop laying them off, and let’s start training them to be better communicators and entertainers.

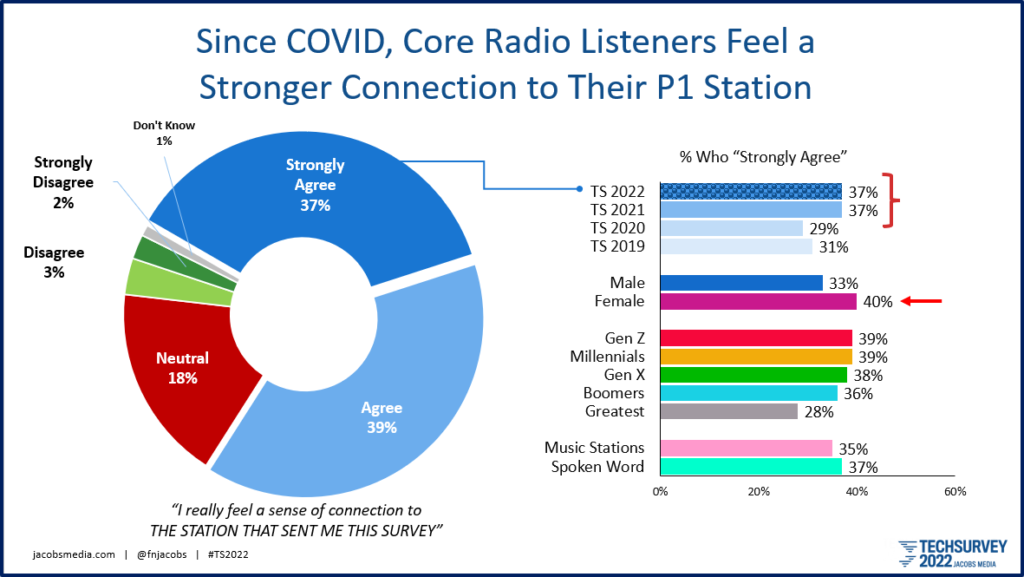

The values of being local and feeling connected are foundations many stations can and should build on. We’re seeing some growth in these areas since COVID, not surprising when you think about the emotional state of the country. Great radio stations lean into those strengths. They are values and benefits digital competitors cannot easily provide, much less replicate.

On the pie chart, focus on the 37% who “strongly agree” with the statement, “I really feel a sense of connection to the station that sent me the survey.” But when we look at the trending (upper right), we see the more complete story. In most years, that percentage has hovered around the 30% level. But since COVID, there’s been a marked increase that has now settled in two consecutive series. This suggests a number of stations have solidified their engagement with their P1 station, a nice data point during one of the most challenging times for most stations.

That’s a key point. Techsurvey identifies the expanded competitive landscape terrestrial radio stations now face. Broadcasters need to identify how they can differentiate themselves from digital brands, satellite radio, and podcasts. What can radio provide that is truly meaningful and unique? How can broadcasters use their digital assets to enhance their terrestrial value?

It means radio broadcasters need to work harder on their strategic plans, and invest in research, personnel, and other resources that contribute to fighting a different war. This isn’t about winning a monthly in the ratings. It is about understanding how consumers now use media, access content, and what they value.

The data suggest to me that many radio broadcasters will have to level up to stay competitive. Radio needs to look and sound better. These are not simple fixes. They require discipline, sacrifice, attention to detail, and stellar execution – characteristics that have been in short supply over the past couple of decades.

The point is that good enough is no longer good enough. Consumers expect more from their media. If broadcast radio can deliver, there is every reason to believe it can improve its current position.

And that’s been my premise all along – in Techsurvey, our blog, the DASH Conferences we did with Radio Ink, and our CES tours. Radio has to do better. It no longer operates in a vacuum. It’s on the big stage with the panorama of media content. The public demands great experiences from every medium it accesses. That’s the mindset radio companies need to adopt.

The value of Techsurvey isn’t about walking around holding a sign that reads “The end is near.” I’m not the angel of doom. But if at times I can serve as an agent of change, then I’m using the data and my position in the industry for positive purposes.

The value of Techsurvey isn’t about walking around holding a sign that reads “The end is near.” I’m not the angel of doom. But if at times I can serve as an agent of change, then I’m using the data and my position in the industry for positive purposes.

I am making numerous presentations of this year’s survey to media companies, and at conferences and industry gatherings. I’m happy to do so.

Radio broadcasting is an industry in dire need of more and better research. If these studies can answer key questions, settle disputes, and help industry leaders navigate the future, I’ve done my job.

Thanks, Radio Ink, for the opportunity to discuss these important issues.

You can access the other Techsurvey commentaries here:

Day One – Steve Smith, Mike McVay, Nate Deaton

Day Two – David Santrella, Joel Oxley, Ed Levine

Day Three- Bud Walters, Lee Abrams, Alan Burns

Day Four – Nick Martin

Day Five – Vince Benedetto, Sean Bos and Buzz Knight

And finally, Day Six – Sandy Edie Hansen

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

I wholeheartedly agree Fred. Thank you for the Techsurvey and for your “reaction to the reaction” in Radio Ink.

I’ve been saying for years that we have to give the listeners something that they can’t get anywhere else. Voicetracking across multiple platforms, condensed playlists, 6 minute long stopsets and “doing it the way we’ve always done it,” is not going to sustain us into the future.

Nielsen just released their “State of Play” report saying that the video streaming industry has reached a “tipping point.” And, for the first time, Netflix has reported a decrease in subscribers. We’re competing for our listeners time and video streaming is a huge part of that.

This is a pivotal time for the radio industry to make impactful changes to not only stay relevant but become more relevant.

I understand that it’s not easy. I don’t own stations, so I certainly can’t appreciate the financial investment that it will take to make these changes, but continuing to cut and lose talented people from our industry is not going to get us there.

I feel that all of us who have the heart of a broadcaster and truly love this business, need to do some real soul searching and think about what we want radio to become and how we’re going to get there in each of our individual markets. And, in my mind, this is not about bringing radio “back.” It’s taking radio to a new place and figuring out what that place is, because we’re never going back to “the way it used to be.”

Thanks for doing what you do for the radio business and giving us these insights with the Techsurvey.

We live in a 37% world. That number seems to pop up a lot. People who read, people who are still loyal to certain brands, people who see through the lies and propaganda out there. I want to live in a 57% world, Heinz Ketchup, Hellman’s mayonaise, a morning team who knows me and my town and makes me believe if I don’t listen I will be missing out. The homogenization makes me crave the time I could drink water out of the tap and not be afraid of saying what I think to any American. Radio, it’s pretty simple. LOCAL people, REAL people, ENTERTAINING communicators. Hey, with no fees to listen and with radios all over the place, there is ZERO distribution problem. Why not try to say something, stupid? Okay, sorry, but Podcasts are great for specific topics and people, but can we push that 37% into 57%? Mass appeal radio means more local, more meaningful words and hey, great music. Worth a try.

Fred, I couldn’t agree more with your analysis of the data. I ran across an article by Leigh Jacobs a month or so back. In it Leigh advocated for a shift away from AQH Share as our benchmark as it is a zero sum game in a declining market. I sent this to my programmers:

“I ran across this in Jockline Daily today. It only scratches the surface of the problems we face. That said, I think we’re doing an exceptional job at rethinking our value proposition with each of our properties and are focused on building brands that compete with other stations as well as streaming services and podcasts.

Leigh points out the AQH Share is the wrong number to be looking at but doesn’t say what the right number is. What are your thoughts? Is it AQH Persons? Weekly Cume? And how do we measure our success versus the entire universe instead of just against our radio competitors?

Interested in each of your thoughts.

Sean”

Our attitude inside our building is that the playing field is ten times as wide as it was even two years ago. And it requires us to understand where our listeners are finding music, connection and a sense of community anywhere in the audio space. In a time where consumers are spending more time than ever with audio, we’ve got to widen the lens if we’re going to compete. The mantra here is innovate or die.

Speaking only for myself, I’ve tended to favor AQH listeners and (to a lesser extent) cume over rating or share. However, it’s still tricky in that both types of measures do have uses–and that it’s possible to confuse matters by using them without any context or even explanation. That said, I do think that rating/share by itself is relied upon way too much.

One big stumbling block to discounting AQH share as the main measurement figure is that the agencies aren’t going to go along with the idea. We all know that the ad buyers are set in their ways and if they could they would order a version of the Nielsen numbers that had nothing but the AQH shares sorted by the key demographics.

As an example of how resistant they are to change: How many times, over how many years, have we tried to get them to accept that the 55+ (aged-out Boomers) is a viable demo for buys? And how much success have we had with that? Rhetorical questions, yes.

That being said, there are all kinds of ways to use the “other” Nielsen numbers, such as weekly cume or AQH persons for local sales. But if you’re in a major market, how much local ad buys are there … and how much of those are also handled by a local ad agency?

As to how to measure broadcast radio against Sirius XM, or against streaming, or podcasts, or even someone’s phone being used as an MP3 player … I’m still scratching my head trying to find the answer.

KM, you KNOW where I stand on the 55+ (and under 25) issues. It is maddening how either media platforms excel in these “extremes,” and reap beaucoup dollars.

In the larger markets and especially with agency dollars, Average Rating drives spot rate and is measured vs. the metro population, not just people listening to radio at the time, so Average Rating is the metric that is typically most important. AQH Persons is also often used by sales, especially if one is bundling a few stations together. Leigh is right, Share is a zero sum game – there will always be 100 shares up for grabs, but there are now fewer Rating Points because Cume has shrunk 20-30% (depending) vs. pre-pandemic levels, which is why revenue and Cume hasn’t (and probably won’t ever) fully recover.

Radio is not dead, the medium can still thrive, but the mission at this point is to be GREAT, not average, for the Cume that is still there on a daily or weekly basis.

I’m with you, Keith. We make ourselves feel better when we look at share. It looks the way it always has. But it IS deceiving when we ignore those average ratings.

I believe average rating and cume rating each tell a story. They are both measured against the population rather than share (which is deceiving). As for how we should compare radio to other media, Nielsen has the capability to measure other media. I’m not sure that politically, it would fly. Hope this helps.

Thanks!

For you, anything!

As of the latest count, the country’s six biggest cable TV providers, including Comcast’s (CMCSA -0.02%) Xfinity, Charter’s (CHTR 0.94%) Spectrum, and Altice USA (ATUS 0.56%) — which account for about 95% of the market — are serving 65.2 million households. That’s down more than 20 million customers as of the same quarter of 2018, and down on the order of 40 million from 2013, according to estimates from eMarketer. – from the Motley Fool May 19/2022

I haven’t had the time to digest this blog that well yet but – and as a person on the sales side it pains me to say this – I believe we have less of a product problem and more of a sales problem.

Many media, especially Cable and Broadcast TV would love to have the erosion you describe. Cable subscription is down 40% in less than 10 years? And there will be less subscribers tomorrow than today because it is accelerating? To me, we have been remarkably resilient in spite of the problems you lay out.

While not minimizing the very real product problems you mentioned, we have never properly monetized this industry when it was at its strongest and we are even more woefully behind now that there are more challengers.

Lack of sales training, antiquated pay systems, a “second class citizen” feeling, a race to the bottom mentality, the crab like way we try to pull down industry competitors – these are all problems that have caused this industry to get pennies on the advertising dollar when are TSL and impact should have gotten us a lot more.

Also, if we had the revenue, would we still have the product problems? I don’t know the answer to that because when consolidation happened, the big companies tried to make us into a growth industry instead of the cash flow generator we traditionally have been so they cut, cut, cut.

I guess it is a familiar refrain – we have met the enemy and he is us.

I have long felt this way, Mike, but have honestly become resigned to the sales limitations. You are right on the money.

THIS. Plus, what would anyone in sales or programming say to a client who is facing increasing competition? Make sure the product is perfect and everyone knows it thru mass marketing. We ask clients to do it, and yet we don’t.

Mass Marketing any station reminds listeners to listen and advertisers that we exist.

Mr. Simon tackled this very issue today…

https://www.allaccess.com/the-letter/archive/34811/let-me-know-when-you-re-here

Yes, I was gonna say…

I can always count on the Sultan of Snark for a well-refined point of view. Thanks, Eric.

Wow, what a great read, Eric. Thanks for sharing. Great reminder we need to have a product WORTH finding before we start spreading the news on HOW to find it!

Good one, Phil. Thanks for weighing in.

I’ve worked in public radio program marketing and distribution for three decades and what Fred is saying applies to noncom stations. To me, another sign of radio’s decline is the lack new, magnet programming. Until recently, I frequently received pitches from producers with new ideas for public radio programming. Now, that seldom happens. Public radio, and radio in general, needs to “ring the new bell” again. It will be interesting to see if the 2022 Public Radio Techsurvey (now in the field) echoes the results of the commercial Techsurvey 2022.

Thanks for this, Ken. I agree public stations have a similar set of challenges. BTW, PRTS 2022 doesn’t go into the field until next month. There’s one more week for stations to sign up here.