One of our big takeaways from CES this year was how ubiquitous cars were on the floor of the Las Vegas Convention Center. But not where you’d expect them to be. Sure there were many automakers like Ford, Toyota, Mercedes Benz, and Hyundai at the show.

But as we saw again and again, cars were a part of scores of exhibits – whether we’re talking shared mobility, 3D printing, autonomous driving, and of course, HD Radio. It seems like just about every platform and brand has its own “car play” – a sure sign that diverse industries want to be part of one of the most profitable and scalable businesses – automotive.

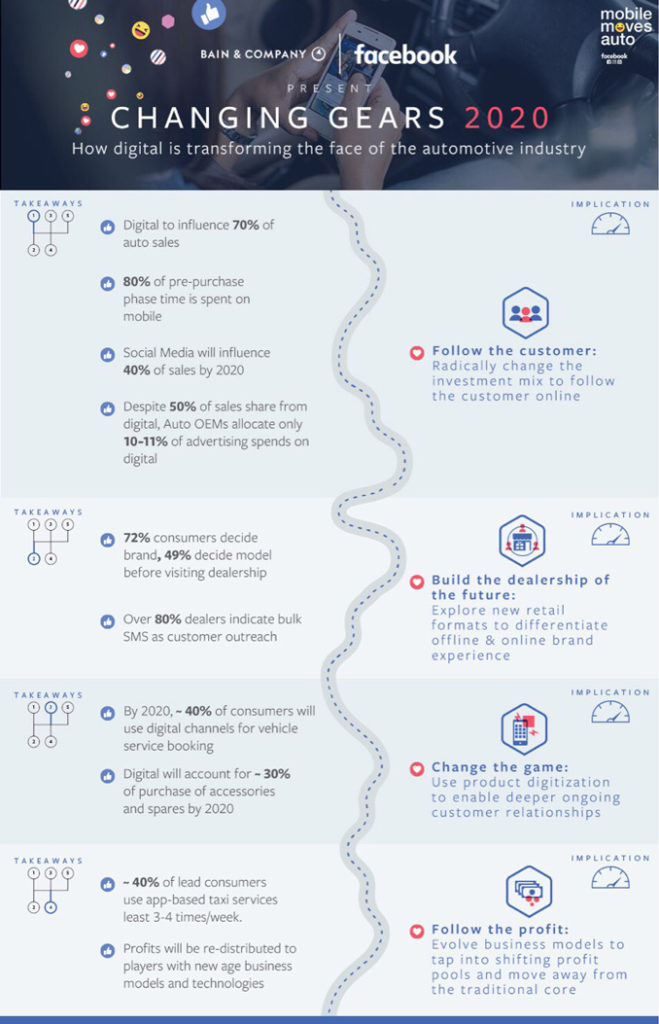

And now Facebook is diving in head first. They’ve recently released a new study in partnership with Bain & Company that points to how digital platforms are transforming the auto industry. But their focus is on how cars will be sold and marketed. Their conclusion:

By 2020, nearly 70% of annual auto sales – amounting to 19 million vehicles generating $40 billion – will be digitally influenced.

A recent article in Social Media Today by Andrew Hutchinson lays out the research study and what it means to automakers and car dealers – and by inference, media brands and platforms. It concludes that “if you’re working the auto sector, you need to be utilizing digital platforms to stay in touch.”

Methodologically, the study was comprised of 1,551 auto customers in India (not mentioned in the article), but it also drew from Bain research in the US, the UK, Germany, and China.

The infographic below from this Changing Gears 2020 study (“How digital is transforming the face of the automotive industry”) lays out a 4-step plan for how car dealers can better compete in the future.

It’s first advice nugget – “Follow the customer” – involves the imperative to “radically change the investment mix to follow the customer online.” And it makes the case that OEMs and dealerships aren’t deploying enough of their marketing dollars in digital media.

For broadcasting companies in general, and radio sales organizations specifically, it’s a message from a respected consulting firm (and Facebook) that the digital tool kit will play an even greater role in the automotive buying and selling process. As dealers continue to get this message, the trajectory will be for them to look for the digital component in media and marketing plans.

For broadcasting companies in general, and radio sales organizations specifically, it’s a message from a respected consulting firm (and Facebook) that the digital tool kit will play an even greater role in the automotive buying and selling process. As dealers continue to get this message, the trajectory will be for them to look for the digital component in media and marketing plans.

Given that automotive continues to be radio’s leading sales category, the message implicit in the research and the way the findings are presented point directly to digital becoming the dominant ways cars will be marketed and sold in the not-so-distant future.

In the past, we have suggested that companies (and even major clusters) consider a DOA – Director of Automotive – to directly work toward the development of strategies and tactics designed to keep broadcast radio relevant and effective as the space evolves in the inevitable direction of digital.

Moving forward, it will be essential that radio sellers walk into automotive pitches armed with more than offers of a remote broadcast, the prize wheel, and live reads. Digital juggernauts like Facebook are raising the bar by asserting (with the help of research) that a digital marketing strategy is table stakes when it comes to selling cars, as well as after-market products like service – often the lifeblood of dealerships.

If that has a familiar ring to readers of this blog, you may recall that Ford’s VP/U.S. Marketing Mark LaNeve (also on the Entercom  board) echoed that same sentiment at DASH back in 2015. Taking the middle ground, he noted Ford has become known for keeping “one foot in today and one foot in tomorrow.” He concluded that a mix of digital and traditional is part of the marketing elixir:

board) echoed that same sentiment at DASH back in 2015. Taking the middle ground, he noted Ford has become known for keeping “one foot in today and one foot in tomorrow.” He concluded that a mix of digital and traditional is part of the marketing elixir:

“Customer data, integration, and impact will be the new battleground to figure out new media mixes. Radio plays a big role in driving traffic for reinforcing brand awareness.”

But it’s now mandatory that digital is part of that mix.

The automotive challenge for radio goes well beyond what’s on the touchscreen display in new car dashboards. The industry’s marketing efforts need to include digital tools – databases, landing pages, video, content marketing – in order to satisfy the increasing and expanding needs of car dealerships.

As an industry, radio has to conduct research of its own to reinforce its proof of concept that the medium – in concert with digital marketing tools – can effectively and cost-efficiently market cars nationally and locally, new and used, sales and service. At from there, develop an action plan that keeps pace with the rapidly changing automotive industry.

Pandora, for example, has long had offices in Detroit to bolster both its dashboard software development and its advertising efforts. Radio needs similar presence in the Motor City – as well as at key automotive conferences and conventions – to be top-of-mind and vital in the minds of automakers. Proximity, connections, and collaboration are all part and parcel of what it takes to create meaningful partnerships with this important industry.

Not only does the lion’s share of radio listening take place while people are driving, the industry’s revenue generation and profitability are inexorably tied to this sector.

With players like Facebook pushing their aggressive digital marketing agenda, radio needs to buckle up for a new car ride.

The Facebook/Bain & Company study is available here.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

The “one foot in today and one foot in tomorrow” quote is likely one of the most memorable I can recall from those amazing conferences.

This is a vitally important read. Thanks for getting it in front of our industry Fred.

Dave, thanks for the kind words. As a regular DASH attendee, you know the importance of these sales and marketing challenges. I am more confident the industry is getting the message, but today’s post reinforces things are moving quickly in the space.