The year has started out as it always does – with a ratings whimper. As the last of the Holiday books have finally been released, we now know whether Christmas music was as big as it was in 2016 as well as which formats were most impacted by it. Beyond that, most radio broadcasters ignore this ratings period, because it drives very little advertising business while measuring a period of time where habits and lifestyles are very different than the norm. And yet, they have to pay for it. So if someone can explain the purpose of the Holiday book to me, please have at it.

It’s the time of year that’s completely off the charts because of the holidays, made even more anomalous by the flurry of Christmas music that dominates the airwaves. Analyzing Holiday books may be something that is meaningful to the industry trades, pointing out all those double-digit stations that fall back to normal once the decorations are put away and the trees are taken to the curb for removal.

And yet, Arbitron and now Nielsen continue to release these numbers as if they mean anything. Often ignored by agencies and clients, the only true impact of Christmas music is in the real-time sales activity that occur in November and December before these ratings are taken – not after the fact in the Holiday book.

But then there is a much bigger issue impacting the business – how radio’s combined usage, terrestrial + digital, can be aggregated to create a comprehensive measure of a station’s true reach.digital measurement. And we don’t know where radio truly stands against the likes of Pandora, Spotify, and SiriusXM. There are no answers because we’re left with only press releases and other cobbled together streaming information that truly doesn’t provide a level playing field view of listening behavior from which to learn and market to advertisers.

Some in radio prefer not to know these answers, continuing to view pure-plays and the like as entities that are so different from radio that head-to-head measurement just isn’t valid. After all, they aren’t “radio.”

Of course, that was essentially the point of view about public radio during the diary years. Before the PPM Era, public radio ratings weren’t printed in “the book.” Commercial broadcasters barely acknowledged these so-called “non-commercial” stations on the left hand of the FM dial, thinking they were alien life forms.

But PPM changed all that. And now we see the true ratings impact of stations like WAMU, KQED, KUOW, and others that regularly crack the Top 10 in the coveted Adults 25-54 demo in their respective markets. Arbitron simply waved the ratings wand and began to include them in every ranker. And you know what? The world didn’t come to an end. The industry simply absorbed this information and moved on.

Programmers and marketers get smarter when they can see the entire landscape of radio, however it’s defined. And that’s why I was intrigued when I ran across a recent article in Fast Company whose title was this stimulating question:

“Can One App Revolutionize TV Ratings for The Streaming And Binge-Watching Era?”

Writer Rina Raphael chronicles the story of Symphony Media’s VideoPulse app that measures cross-platform viewing using “audio fingerprints” (of all things) to measure all television programming. The app is run in the background on mobile devices, TVs, and laptops, enabling measurement for everything from terrestrial TV to Netflix and Hulu.

Interestingly, the Symphony buzz started when broadcast TV researcher, Alan Wurtzel of NBC, showed data indicating that Netflix, Hulu, and Amazon  Prime aren’t especially threatening to traditional television companies. Of course, that presentation at the 2016 Television Critics Association’s Winter press event stirred up the competitive fires, notably from Netflix Chief Content Officer, Ted Sarandos, who declared the Symphony data “remarkably inaccurate.”

Prime aren’t especially threatening to traditional television companies. Of course, that presentation at the 2016 Television Critics Association’s Winter press event stirred up the competitive fires, notably from Netflix Chief Content Officer, Ted Sarandos, who declared the Symphony data “remarkably inaccurate.”

Game on.

In TV world, much of the controversy and consternation revolves around just how much content is consumed on-demand, rather than in real-time like last night’s Super Bowl. Nielsen measures 7-day viewership (known as L7), while Symphony extends its measurement 35 days after the original air date.

Symphony’s research employs a panel of 17,000 people, and ironically, young people are actually easier to attract than other demographics. Symphony Advanded Media CEO (and former Nielsen exec) Charles Buchwalter says, “We have more millennials than we need.” The harder-to-find groups are the wealthy and those over 65. Go figure.

Symphony is one of several research firms that has tried to crack the on-demand/DVR/streaming code in TV. As viewing habits become more disrupted by technology and personalization, the industry depends on it. As Wurtzel told Fast Company, “Because we’re in new territory now with cross platform and various digital components, I think the industry benefits when we can evaluate different ways to measure content and consumption.”

Radio broadcasting may not be enduring anywhere near that same level of change and stress. But streaming usage continues to grow, while satellite radio remains a force. Podcasting is gaining traction as well. All of this signals something of an audio renaissance in which broadcast radio still remains the major player.

But until a trusted measurement tool is developed that encompasses all audio media, as well as all the ways in which consumers can access traditional radio content, Nielsen ratings data only tell part of the story. That leads to media buying schizophrenia and chaos, exacerbated by everyone touting their own data.

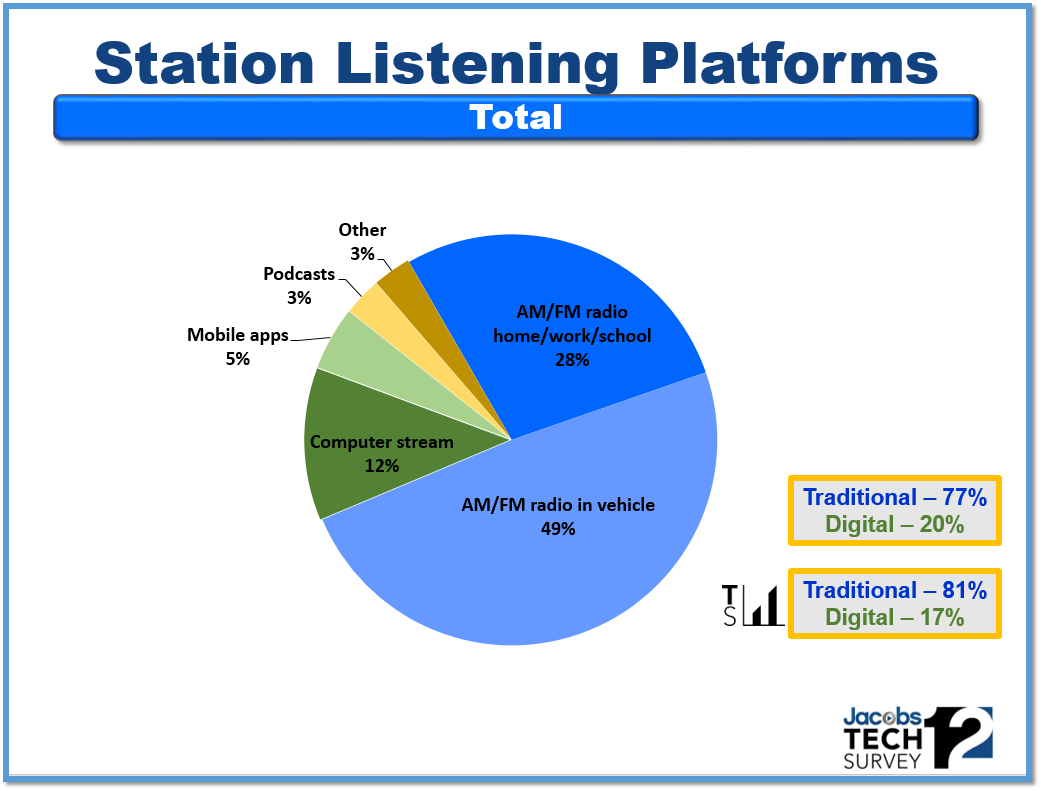

For the past several years in Techsurvey, we have asked respondents to total up the surce percentage usage of their favorite radio station. This slide shows that digital usage (streaming, podcasts, etc.) has hit the 20% consumption mark, up a few points from the previous year’s survey. TS13 is in the field now, and we’re anxious to see how these levels have changed.

From the outside, it’s easy to simplify problems…and solutions. I’ve spent enough time with the former Arbitron Advisory Board, as well as doing extensive project work with the former ratings giant to know that it’s always more complicated than it looks. And this post is not meant to suggest there’s a Holy Grail solution that no one’s thought of yet.

From the outside, it’s easy to simplify problems…and solutions. I’ve spent enough time with the former Arbitron Advisory Board, as well as doing extensive project work with the former ratings giant to know that it’s always more complicated than it looks. And this post is not meant to suggest there’s a Holy Grail solution that no one’s thought of yet.

But it’s also clear the times in which we live have provided innovative technological solutions to problems that seemed unfixable and insurmountable. From GPS to Uber to TSA Pre-√, technology, we never get lost, we can book a courteous ride on our smartphone, and we can breeze through airport security without taking off our shoes. Tech and innovation are providing solutions to puzzles that have dogged business people and marketers for decades.

In the case of audience measurement – whether it’s TV or radio – a guy like Wurtzel will no doubt tell you that solving the ratings conundrum that has only intensified in the digital age requires a concerted effort – as well as lots of money – to solve. Viewership patterns and the screens people are using are in a state of rapid flux, so ratings companies must remain both nimble and responsive to change in order to keep up.

It might also be necessary for Nielsen to grow a pair, and let radio broadcasters big and small alike know that the time has come to “measure everything.” There may be kicking and screaming, but radio is a pragmatic industry that will adjust to new numbers, new buying protocols, and new programming threats. If there’s one thing about radio people – they’re adaptable.

Chances are, it will make us all smarter. And better for Nielsen to develop its own audience ratings technology, rather than to invite a competitive incursion from the outside.

Radio’s measurement challenges may ultimately be less complex than television’s, but solutions are just as important for the continued health and viability of the industry. We may be entering a new era in ownership hierarchy, stimulated by the seismic Entercom-CBS announcement last week.

Given what’s at stake, radio deserves a more comprehensive and elegant solution to its ratings problems and challenges.

Radio, whether it wants it or not, deserves more from the ratings it’s paying for.

Measure everything.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

(As the kids say)

THIS.

Many thanks. 🙂

Excellent & timely. All radio stations need to have a top line number listed for proper comparison. All audio ratings account for all forms of delivery. Digital marketing success is dependent on broadcast content. Thank you, Paul. Clark, Boston where the media excitement never stops! Hooray Tom B, Bill B & The Super Super Champion Patriots.

Thanks, Clark!