You can learn a lot when publicly held companies report their quarterly earnings. And the more of these calls you sit through, the more you can decipher what may really be going on inside the collective heads of the corporate team. Sure, their job is to put a good spin on their numbers, but veteran analysts can usually suss out the real story by looking at those key metrics.

Radio broadcasting companies are no different. Over the last few decades, savvy observers have gotten pretty good at reading through the hyperbole to determine what really is happening inside the industry’s public companies.

Everything’s been complicated in recent years by the torrent of startups and new media companies, many burning through cash in order to achieve impressive shares of listeners and/or viewers. But some have been mega money makers, and one of the most amazing stories over this time period has been Netflix.

It wasn’t that long ago they were sending us rental movies – that is, DVDs – through snail mail in those little red pouches. But then they did their pivot, becoming the first in their class to embrace and harness the power and popularity of video streaming.

We don’t buy movies and TV shows on DVD, choosing to instead stream our favorites. Since they made their big move, Netflix has become the industry leader, setting the pace for everyone else.

But Netflix hasn’t rested on their laurels. If that was the case, they would still merely be a distribution company – streaming other people’s content. While most of the the movies and TV shows available on Netflix’s “table of contents” have been created by other production companies, Netflix has become a content creator themselves over the past few years. And a good one.

Interestingly, Netflix’s first foray into production was back in 2012, featuring our friend Little Steven Van Zandt and his series, “Lilyhammer.” Netflix hasn’t looked back. They realize their future – what will keep people paying those monthly fees – is pinned to their ability to sign big stars and make compelling programming.

Interestingly, Netflix’s first foray into production was back in 2012, featuring our friend Little Steven Van Zandt and his series, “Lilyhammer.” Netflix hasn’t looked back. They realize their future – what will keep people paying those monthly fees – is pinned to their ability to sign big stars and make compelling programming.

So when they released “Bird Box” late last year, starring Sandra Bullock, no one should have been surprised about Netflix’s appetite to create programming that makes noise. The film had a viral impact especially over the holidays, generating buzz, and more importantly, keeping subscribers connected to Netflix to see what was coming next.

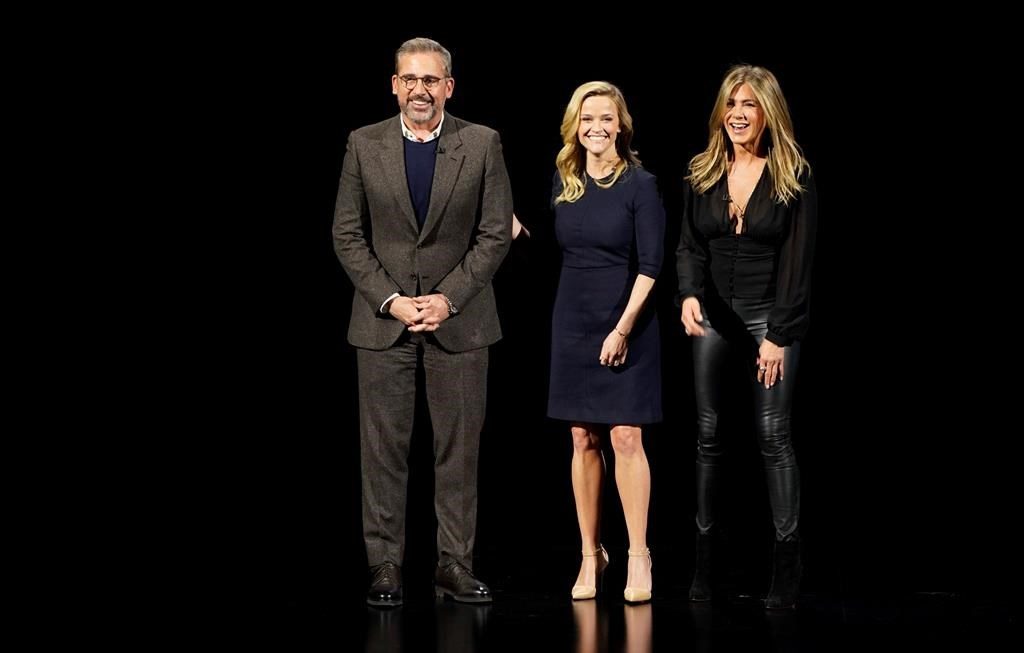

And the stakes are only getting higher. Apple is heavily promoting its first in-house production, “The Morning Show,” starring no-names like Jennifer Aniston, Reese Witherspoon, and Steve Carell.

And the stakes are only getting higher. Apple is heavily promoting its first in-house production, “The Morning Show,” starring no-names like Jennifer Aniston, Reese Witherspoon, and Steve Carell.

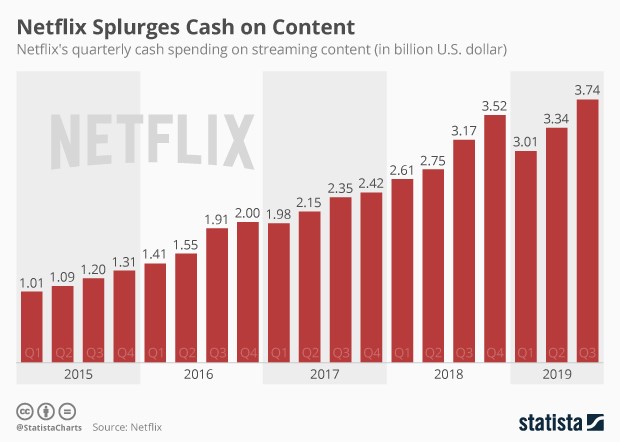

So, Netflix’s strategy is set. This year alone, they will shell out a reported $15 billion to buy, license, and produce programming – more than just about every network and content company. And those are spending numbers that continue to rise, pretty much each and every year.

And for good reason. While distribution matters, Netflix knows the secret to sustainable growth is producing its own great content – programming that motivates subscribers to keep paying those fees every month.

It’s like any other business – buy enough little cars and you can deliver pizzas. But the money is in making those pizzas in the first place. That’s the hard part.

It’s like any other business – buy enough little cars and you can deliver pizzas. But the money is in making those pizzas in the first place. That’s the hard part.

So, why did Netflix struggle last quarter? It’s spelled out in a story by CNBC’s Steve Kovach – “Netflix finally admitted two things we already knew about the streaming wars.”

Thing 1: They raised their prices. Back in January, the main plan jumped $2 to$12.99 a month. And that cost the company subscribers.

On top of that, its new competitor – Disney+ – will offer its impressive archives from the parent network, Marvel, and Pixar for the low, low prize of $6.99 a month. Apple TV+ (with less programming) will even be cheaper.

Thing 2: They have more competition now. (Or see Thing 1). While Netflix was the first mover among video streaming services, the space has gotten much more crowded. Hulu, Amazon Prime Video, and network and premium channel offerings are cluttering the market. Yes, the content creators are jumping into the distribution business. Oh, and let’s not forget about YouTube.

To wit, Netflix now warns they’ll have at least 1 million fewer new subscribers this coming quarter, compared to a year ago because of all this competitive turbulence. Many subscribe to multiple video streaming services, but there’s a point reached where consumers will shop elsewhere for a better, cheaper deal.

To wit, Netflix now warns they’ll have at least 1 million fewer new subscribers this coming quarter, compared to a year ago because of all this competitive turbulence. Many subscribe to multiple video streaming services, but there’s a point reached where consumers will shop elsewhere for a better, cheaper deal.

So, what’s a platform like Netflix to do under these conditions?

In an environment where competitors – and really good ones – are coming out of the woodwork, some of which will have better programming than Netflix at a lower price point, what’s the right move?

Is this the time for layoffs?

Will they institute cutbacks in programming, research, or marketing?

Add commercials to certain programs to see if subscribers might tolerate them?

Reduce employee training and benefits?

Panic over the viability of its business model?

Burn the furniture?

So, WWND? What will Netflix do?

As Kovach reports, their strategy is a simple one:

“Content. Content. And more content.”

At a time when people are spending more and more time with video (and audio) entertainment and information, Netflix’s is doubling down on what got them to this dance:

Great programming content.

They realize that as the competition improves and proliferates, creating buzzworthy, sticky programs, movies, and documentaries is the only pathway to ensure future success.

It makes you wonder where else that same strategy might work.

- Like A Pair Of Old Jeans - April 2, 2025

- What’s Fair Is Fair - April 1, 2025

- What’s On Your Bucket List? - March 31, 2025

Excellent radio content / presentation can be delivered on very short money, beyond existing expense.

Challenging, but doable. Thanks, Clark.

Thanks for putting this one out there. “Content. Content. And more content.” It is still the king! Well said!

Much appreciated, Lloyd. For Netflix and other market leaders (and their competitors), it is the ONLY way.