The close of a year is often a period of reckoning. And in the case of 2021, tension is high and nerves are fraught as COVID is close to wrapping up its second year.

We’ve talked about those nasty end-of-year layoffs these past few years in the radio broadcasting business. It wasn’t that many years ago when companies waited until after the new year to issue pink slips, the idea being that even lousy employees deserve their holiday time without being on the beach. Let’s hope this year is different.

Tis the season for predictions. And this post takes a look at what has become a major habit here in the U.S. and round the world – streaming subscription video and by extension, audio streaming for a monthly fee as well.

We’ve talked a great deal about “The Subscriber Economy” in this blog, a phenomenon that was building pre-COVID, and exploded when the lockdowns and stay-at-home orders became realities in 2020.

So, here we are at the end of another year of the pandemic, taking stock of the world and our place in it. Many of us use this quiet time to reassess, to consider a diet and a fitness regimen – one of the reasons why health clubs and gyms enjoy a joyous January.

Others of us examine our financial situations, often aided by a CPA or an income tax service. After all, those credit card bills covering all that December gift giving come due sooner rather than later. It’s the time when many begin to question their spending habits, especially for non-essential goods and services.

And now Deloitte has issued a new analysis with the ominous title, “As the world churns: The streaming world goes global.” Their report suggests the term “churn” could become a much bigger part of our vocabularies. This is especially the case for SVOD providers such as HBO Max, Disney+, Hulu, and all the others that offer subscriptions in exchange for on-demand, (mostly) commercial-free content.

suggests the term “churn” could become a much bigger part of our vocabularies. This is especially the case for SVOD providers such as HBO Max, Disney+, Hulu, and all the others that offer subscriptions in exchange for on-demand, (mostly) commercial-free content.

Now, Deloitte is suggesting a “churn rate” in the U.S. that could go up to 30%. That’s a whole lot of cancellations – 150 million to be more accurate. Deloitte tells us America is #1 for churn.

For SVODs, that comes with a huge cost. Consider this: In the U.S., streaming video brands may spend as much as $200 to capture a single subscriber. At those rates, retention becomes critically important.

Americans lead the world in paying for content. And that may explain why the “churn rate” here is expected to be very high. As the Deloitte team explains:

“Many have become overwhelmed by managing and paying for all those subscriptions, and they have become more sensitive to their cost. These conditions can drive customers to cancel subscriptions and/or seek less expensive ad-supported offerings, both to manage costs and as a way to pay only for the content they want by adding and cancelling services as needed.”

Where have we seen this phenomenon before? In this year’s Techsurvey, of course.

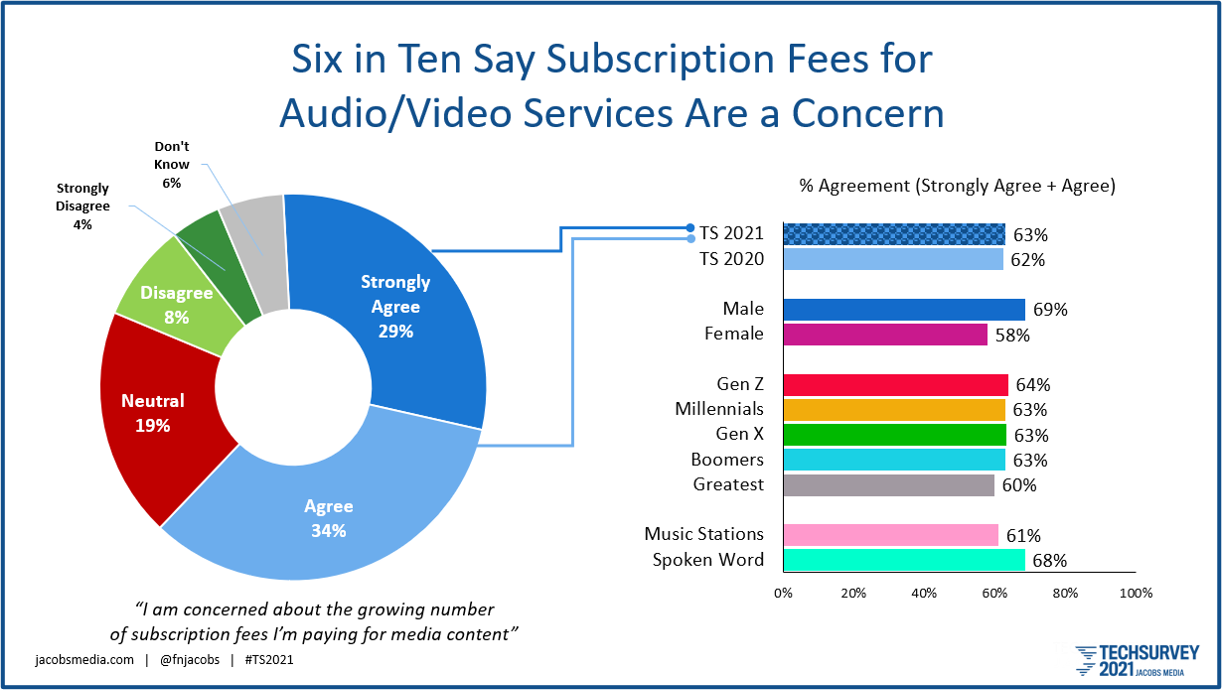

We asked respondents whether subscription fee for video and audio streaming services are a concern, and more than six in ten agreed; nearly three in ten agreed strongly. And remarkably when you look at the demographic breakouts, mounting subscription fees are very much a problem no matter who is answering this question. It’s no wonder the Deloitte report reflects this phenomenon.

If Deloitte’s projections are accurate, 150 million chickens will be coming home to roost. Interestingly, a companion feature in NextTV by David Bloom treats the study like a four alarm fire. His “hair on fire” sub-headline says it all:

“Deloitte shocks – shocks! – the streaming biz by projecting a massive 150 million service cancellations next year”

Bloom says two SVODs will probably get through this dicey period relatively unscathed:

Netflix and Disney+

The former uses the “more is more” strategy, throwing a cornucopia of video content at our big screens hoping to find that big hit. They pulled it off with “Squid Game” earlier this year, and “Tiger King” back when we first started wearing face masks. Netflix also has the edge for being first-in, almost always an advantage.

For Disney+, it’s simpler. That service, launched right before the pandemic in November 2019, has the good fortune of appealing to a hugely important and massive tribe – kids. And parents appreciate both a peaceful and safe household.

I would add a third – Amazon Prime Video. It has a force field around it known as Amazon Prime, the all-encompassing service that now includes 153 million subscribers in the U.S. That helps keep their SVOD service in second place behind Netflix.

For everyone else in the space, it’s a demolition derby of subscription services. May the best content win.

For everyone else in the space, it’s a demolition derby of subscription services. May the best content win.

What are the implications of this coming cancellation frenzy? As Deloitte suggests, consumers will not only nix some of their subscriptions – they’ll “seek less expensive ad-supported offerings, both to manage costs and as a way to pay only for the content they want…”

And for broadcasters – radio and TV – that spells potential opportunity. Bloom notes that traditional media brands will need newly crafted strategies to take advantage of this churn fest.

Will the same phenomenon take place for streaming audio, as subscribers assess fees for Spotify, Pandora, Amazon Music, Apple Music, and of course, SiriusXM? It’s hard to say, of course. But Techsurvey suggests that if they view video and audio fees in one big expensive bucket, cancellations could impact on-demand content services in general.

So, what to do?

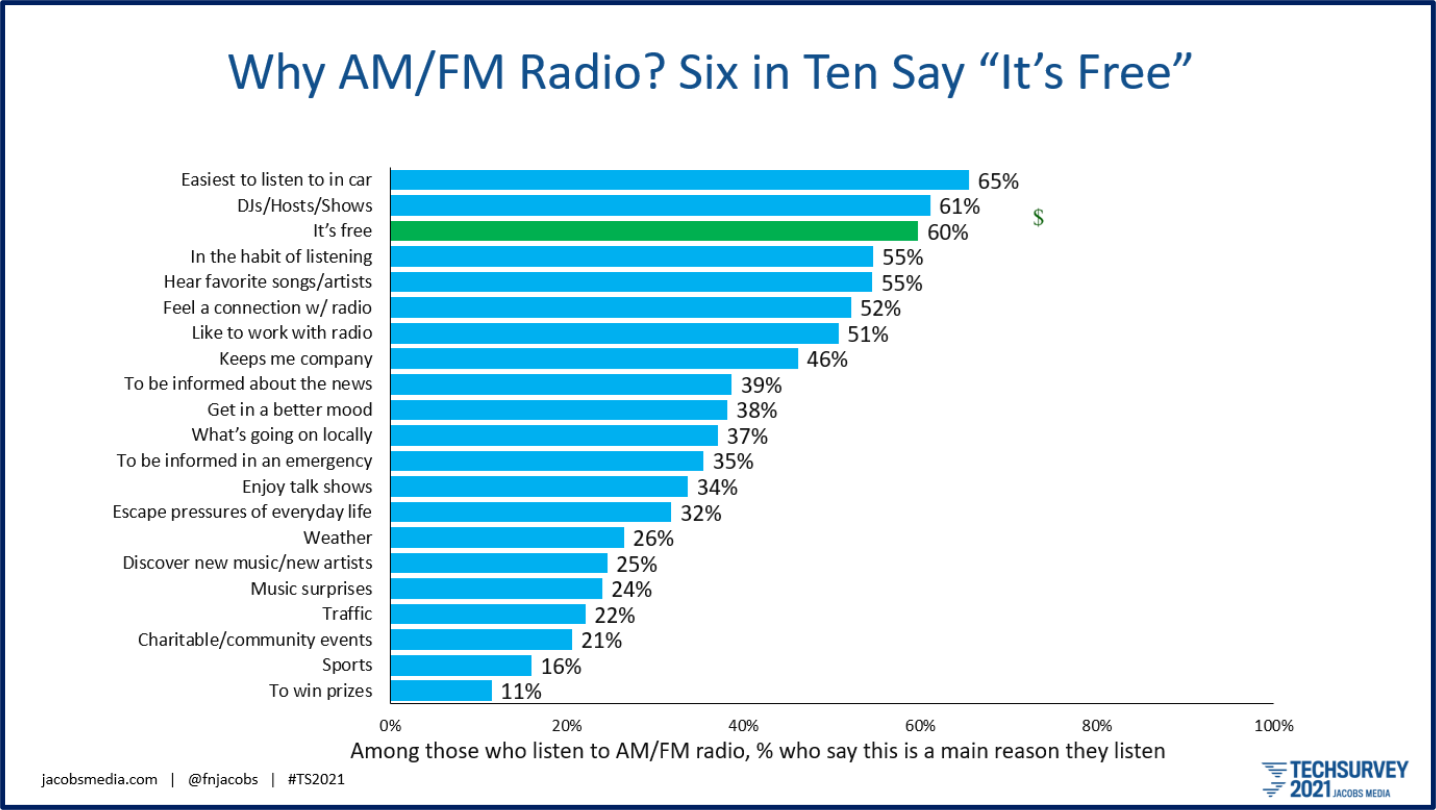

Remember that a key motivator for listening to broadcast radio in the first place is that the service is free. In some years that matters more than in others. In our 2021 Techsurvey, it ranked a solid #3. In fact, six in ten respondents said radio’s toll-free business model is a key driver in their listening – ahead of music, news, sports, traffic, and contests.

Techsurvey 2022 hits the field right after the new year, so we’ll see whether radio’s “no monthly fee” attribute holds up. But I can tell you that since we’ve added this stealth radio benefit to the above list, it’s finished in the top 5 each and every year.

As more and more consumers point to the rising costs of everything, there’s no reason to think those nasty subscription fees won’t be top-of-mind when they begin to scan their credit card statements next month.

At a time when inflation is raging and the price of everything is heading north, a business predicated on subscription fees just might find they’re living in a house of cards.

living in a house of cards.

Let’s get real: radio’s commercial (over)load is an industry-wide self-inflicted wound (hello, public and Christian radio!). And an ad-supported business model has its disadvantages in 2022.

That said, the second most powerful word in the world of marketing after “new”…

…may be “free.”

Time is growing short – to take care of your holiday shopping AND to make sure your station is signed up for Techsurvey 2022, the biggest radio research study on Planet Earth. Join more than 400 commercial radio stations across the U.S. Information and registration is here.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Fred. And I cannot agree with you more about the commercial overload. Radio needs to learn is to say no to bad spots. I heard a local burger spot this morning with a voice so shrieking shrew piercing, I had to change stations. Gone are the days of Dick Orkin’s Radio Ranch quality material. People will sit through spot sets, if the fare there is well done. Letting sales people do their client’s copy and then heaping it onto the pile of a guy who handles several stations or even clusters is detrimental. The Production Department sausage machine is a huge impediment to ratings growth, IMHO. The Gambling App spots may be lucrative, but are the audio doo-doo that fertilize long term tune away.

Ed, it’s a lot of factors as you point out. The load (too heavy), the poor quality of many spots, and the lack of product separation (all those gambling spots, especially in a market like Detroit) for starters. As you know, there is often one production person (if that) for an entire cluster. It’s hard to enforce quality control when you’re churning them out like that. I totally get radio has an opportunity because it is FREE – something many people recognize – but it would sure help to address the substandard experience you get when you run into a stopset.

Thank you, Fred. Huge broadcast opportunity for smart, quality & connected presentation. Make commercials entertaining. Bring the best local information and music to the audience. After all, we’re supposed to be the trained professionals. We can offer much better than homemade selfies. Here’s to the New Roaring ’20s!

Here, here, Clark. Thanks for commenting.

Oy, Fred so much to unpack. The problem with studies such as Deloittes is that they sometimes make fruit salad out of a topic.

Here’s what I take away. First- “free” is not a strategy and if radio believes it can thrive on “free” I’d reckon that’s a mistake. The real question is whether radio, or any other entertainment platform is delivering value for the price paid- or not paid. A free platform without a strong value proposition is doomed. For radio the price paid is my precious time and attention rather than my money. More and more consumers are comfortable paying for content. Video and audio are massively different thanks to the way catalogs are constructed. Billing overload may be an issue for some but equally churn relates to the utility we get from the services. How many of us signed up to get a TV show and then cancelled after finishing the season; example being Line of Duty on Acorn. In studies MusicWatch has conducted on brands such as Spotify Premium and Apple Music we see very low churn rates. Audio, including radio, offers more utility than video. We can listen at home, in our cars, on-the-go, at the gym. Many music streamers listen seven days per week, much like fans of radio. It’s not unusual to meet a listener in a focus group who streams music nearly all day long. In research we have conducted paid streaming services have some of the best KPI’s of any product or service on the planet, with high Net Promoter Scores, Passion Metrics, and satisfaction ratings. Radio, by contrast, lags far behind on all of these KPIs.

Broadcasters hoping that streaming subscribers will exhaust themselves when bills arrive will be waiting an eternity. After all, Pandora, Spotify and YouTube offer ad-supported alternatives for those who prefer not to pay.

I’d suggest that 2022 needs to be the Year of the Listener. We have to be asking different questions about audio. Less about having playlists or DJ’s or traffic or podcasts- and much more about what is creating connections between providers and listeners.

Awww, Russ, now you’ve gone and done it! I’m not suggestion broadcast radio has a clear path because it’s free. On the contrary, it’s an edge, but as you point out, the medium must step it up in order to provide a better experience and capture the attention of an audience that has their choice of pretty much anything. Radio does lag behind in its KPIs as you note, but still has the biggest audience. Now it has to do a better job of surprising and delighting its audience, while providing personality and a sense of place.

There are still radio stations that are doing just that – just not enough of them. We learned during the worst days of COVID that connected radio stations could create a special connection, providing comfort, distraction, and joy – to a scare populace. Now we have to build on that at a time when the economics no longer favor broadcasters.

Thanks for the comment, and for keeping me honest.

The nasty word here is “churn”. In case we missed it, a lot of broadcast “customers” have churned broadcasters. I like “The Year of The Listener” most. Yes, radio is still “free” – but if you compare what people hear in 2021 vs. what they heard in 1981 you might be intrigued. One spot, one song. In many cases (on major market radio) the spots were usually as fun as the music. If radio cared for “the listener” they’d treat spots like they do music. If it fits, use it. If not, re-do it or refuse it. Jim Schulke comes to mind on his philosophy for the abundance of #1 stations he helped create. There are dozens of examples, and virtually none are being utilized today. Last time I heard, the digital services mentioned here are struggling to monetize their efforts. What about you, radio?

Right! Said Fred, er.. Ed.

I’m too sexy for my Nielsen meter.