The question broadcasters have been grappling with over for the past several years is figuring out their digital strategies. As virtually everyone has learned by now, there is no one-size-fits-all solution. iHeart does it one way, Townsquare another, while Cumulus takes a different path. And still other companies are marching to their own digital drummers.

One thing is for certain – it’s about creating content. But that leads to the question, what does that look like? Is it podcasts, streaming, SEO/SEM, newsletters, website design, app development, digital agencies, or a combination of these solutions? And to that end, what are the available content verticals that are a good fit for a company’s multimedia wheelhouse?

Answering those questions is easier said than done. There are loads of variables at play when a traditional media company gets serious about digital. They include, but are not limited to, time horizon, expense, expertise, marketing, and staffing. In order to narrow the time frame and talent gaps, more and more broadcasters have either invested in existing companies or have purchased them in whole.

Whatever works, but neither approach is a guarantee of success. These new digital products and platforms need to be integrated into the existing company, either by merging them with existing assets OR by having them live (and hopefully) grow outside of existing divisions. It is not hard to recall mergers that have gone south, due to culture clashes and other unforeseen sand traps.

Many of these efforts to create, develop, and build out a digital strategy are expensive and time consuming. And if a new product or service is in an already crowded highly competitive marketplace, it could end up being a pricey failure. Sometimes, you don’t know until you know.

Everyone is in search of so-called “best practices,” a proven way to leverage content in a business model that grows audience, provides recurring revenue, and just as importantly, sustainability.

The one media organization that has best captured those values isn’t a radio or TV company. It’s The New York Times. And they’ve succeeded from perhaps the worst starting point possible – a newspaper reliant on paper, printing presses, trucks, and delivery people. Here’s how they’ve progressed in just a 5-year window. If there’s any business where radio can model digital transformation, they’re “the one.”

There’s a lot about The Times’ strategy worth emulating, not the least of which has been their research and development. While they may do radio-like research to rank their readers’ favorite columnists or to find out which types of news are “stickiest,” The Times has proved to be much smarter than that. They’ve focused on identifying the lifestyle interests of their readership. What else do they enjoy, and how can The Times brand be extended to other verticals?

That’s why a significant part of the organization’s energies has been directed to both food and games, their version of NTR or non-traditional revenue. They have served as massively profitable “side hustles” for The Times, but highly lucrative ones that not only throw off impressive revenue, but bring in new subscribers (or “cume”) to the organization.

That’s why a significant part of the organization’s energies has been directed to both food and games, their version of NTR or non-traditional revenue. They have served as massively profitable “side hustles” for The Times, but highly lucrative ones that not only throw off impressive revenue, but bring in new subscribers (or “cume”) to the organization.

Along the way, they have found a pathway that is both highly successful and reasonably easy to attain. At the end of their fiscal in December, the big story – their MVP – will be a division with mass appeal that isn’t particularly people intensive and that doesn’t involve years and years of development and testing.

Online games.

But not just any games. Depending on who you are, the umbrella category of “games’ or “gaming” can run the gamut that includes Fortnite, Candy Crush, Angry Birds, and Pong.

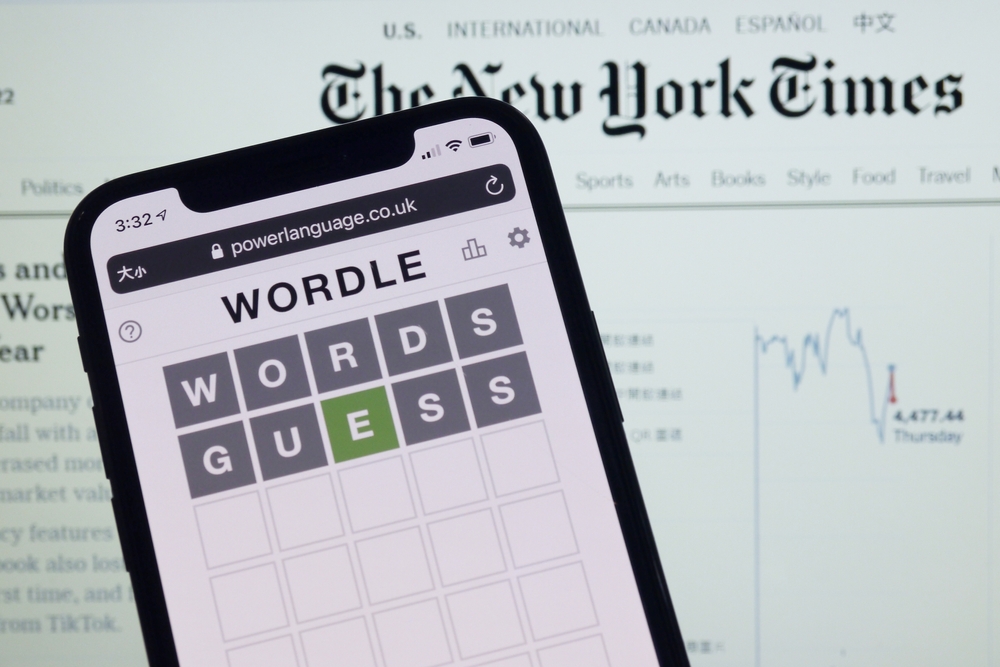

So, let’s make sure we’re talking about the same thing. I’m looking at the proliferation of simple daily online games – the ones that give you a pleasant but challenging distraction once a day or so. Like Wordle.

In the past year, these non-frilly games have proved to be immensely popular, a great diversion, very shareable, hugely viral, highly habit-forming, and immensely profitable – without having any negative effect on the mothership. In fact, if done right, these games can be additive to the enterprise, generating revenue, subscribership, sponsorships, database members, or all of the above.

In the past year, many radio companies have embraced gaming – online gambling, to be exact – another manifestation of the interest in competing in a game-like environment connected to sports. But there’s another whole side to gaming available to anyone in media, and for an entry fee that’s more than reasonable.

environment connected to sports. But there’s another whole side to gaming available to anyone in media, and for an entry fee that’s more than reasonable.

That’s exactly what the New York Times has done with online games, notably their famous crossword puzzles. For years now, they’re proved to be a popular online attraction. To their credit, they put a face on the initiative, Will Shortz, wh0 heads up the division.

Shortz also has a popular broadcast media presence as “puzzle master” on NPR’s “Weekend Edition Sunday,” a post he’s held now for a quarter century. As radio people know very well, connecting a personality with a program or feature is often an optimal way to brand it.

So, we shouldn’t have been the least bit surprised when The Times swopped in and bought the viral sensation Wordle early in 2022. I blogged about this brilliant purchase (in “the low seven figures”) for a game that was already fully developed with a “cume” of millions.

the viral sensation Wordle early in 2022. I blogged about this brilliant purchase (in “the low seven figures”) for a game that was already fully developed with a “cume” of millions.

Along with the wildly popular “Spelling Bee,” there seems like no question The Times will continue to reap the benefits of its multimedia investment in online games.

Earlier this month, Spotify jumped on board, purchasing a variant of Wordle, a name that tune version called “Heardle.” Again, the price was not disclosed, but I’m willing to wager it was a heckuva lot less than the estimated $100 million Spotify paid for Joe Rogan’s podcast.

And “Heardle” may prove to be more popular, less people-intensive, more sustainable, and “lower maintenance” than managing the controversial podcast host who has made all sorts of waves since hopping aboard the Good Ship Spotify.

Spotify says the game – which they are describing as a “tool for music discovery” – will remain free. But one of the enhancements is that players will be able to listen to the entire song after the game concludes.

Talk about a “gateway drug” for the music streaming platform, this purchase of Heardle is very much on-brand for Spotify, a jewel in their growing crown of content development – that won’t cost them in their music royalty fees wallet.

But could broadcasters make this model work, and is there an appetite for online games among radio audiences?

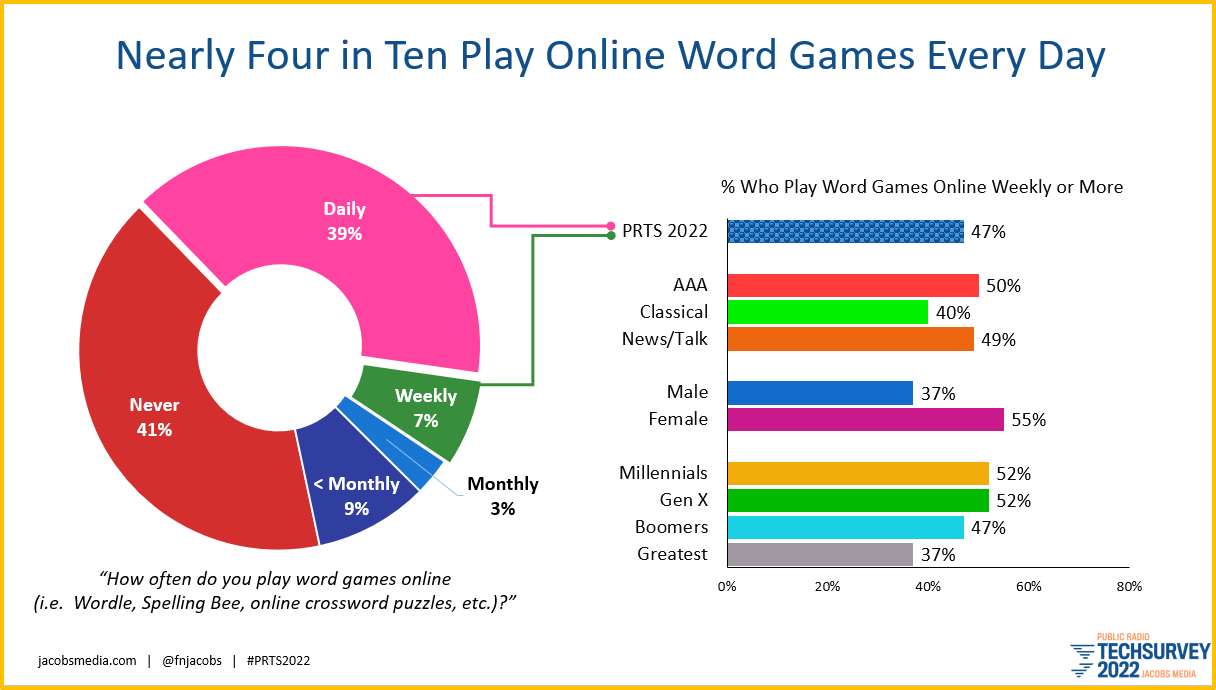

I can tell you this: there’s a huge appetite for Wordle-like games in the public radio community (thank you, Will Shortz). Our new Public Radio Techsurvey 2022 just came out of the field, more than 27,000 respondents strong. While our research director, Jason Hollins, was out to lunch, I snuck a look at the data and discovered this nugget:

Yes, this is the first year we asked this question, and it produced a highly interesting finding: nearly four in ten core public radio listeners play these online games every freaking day, twice as many who tune into podcasts on an everyday basis. And a look at the demos reveals that women and younger respondents are most apt to favor these games for distraction, stimulation, or to simply pass the time.

But unlike so much of the content they consume, online games are truly immersive. You can listen to radio and podcasts while doing other things. Same with video, social media, and web browsing. But when you’re involved in a game, you’re riveted. The engagement is truly amazing.

In May, I asked the question: “What if a radio broadcaster had bought ‘Wordle’?” Now, I’m asking the same question two months later about Heardle.

At a time when public radio is looking for younger, more diverse demographics (along with the rest of radio), online games offer that opportunity for reasonable dollars, and a low barrier to entry.

dollars, and a low barrier to entry.

There’s something here – whether it’s developed internally or a lock, stock, and barrel purchase.

These online games count as digital revenue, and Wall Street will respect your company the next trading day.

Looking beyond the obvious – podcasts, streaming channels, and the other very crowded digital spaces – is a smart way to start.

So is knowing your audience, and what they’re doing when they’re not listening to radio.

That’s how you play the game.

This is the first data point released for PRTS 2022, a great study I’m excited to share with you. It is one of three major research studies that will be presented at the PRPD’s Public Radio Content Conference this August in New Orleans (in person!).

one of three major research studies that will be presented at the PRPD’s Public Radio Content Conference this August in New Orleans (in person!).

Join me, along with Edison Research and Coleman Insights, for these PRPD general sessions. Info on the conference, agenda, and registration is here. – FJ

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Leave a Reply