You often hear people who work in new media offer amazement when talking about consumers and how they use their products. That’s because startups and other tech innovations are by definition NEW. We don’t know much about who uses them initially, how they will be used, and whether they’re sustainable. And then the data starts pouring in, and the audience takes shape. Still, many technology companies have no earthly clue how their big ideas will stay relevant over time.

Over here in Radioland, it shouldn’t be that way. Broadcasters have a tremendous amount of institutional knowledge, born out of decades of ratings data, reams of perceptual research studies, and music research where most veterans can tell you the relative positions of hundreds of songs off the top of their heads. They know that in spite of the ups and downs, radio will be there. Stations will cover local emergencies, fund raise for national disasters, support community efforts, and be part of the habitual media use of millions of consumers every day.

If you’ve been working in programming or management in radio for a decade or more, you’ve probably seen it all. Shocking format changes, talent walking across the street, the impact of Christmas music and weather, and so many other variables that impact the performance of radio stations across the spectrum.

And yet, many radio execs struggle with the basics – the intrinsic knowledge necessary for everyday decision-making as well as long-term strategic planning. Simple lifestyle and media usage questions – such as “Where does our audience go when they leave our station?” – are often mysteries.

But they need not be.

There’s information “out there” that’s attainable and affordable, if you just know where to find it. There are syndicated research studies conducted by reputable companies like Pew Research, daily charts from companies like eMarketer, Business Insider, and Statista, actionable data from Nielsen that goes well beyond who’s listening to the radio, as well as research reports from national radio research companies like Edison and NuVoodoo.

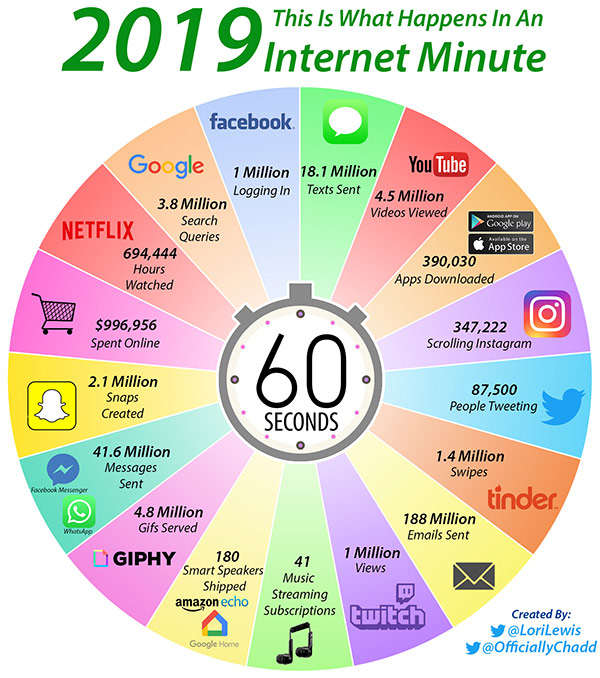

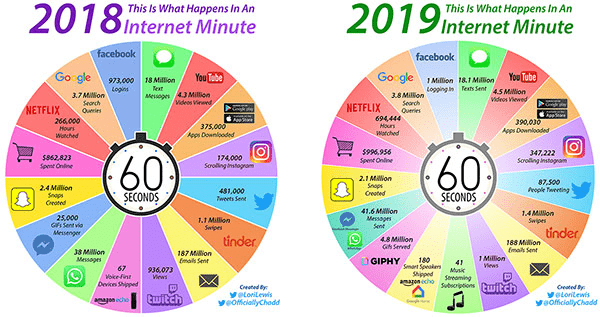

Last week, Lori Lewis and Chadd Callahan released their now-annual graphic that maps out what happens in an Internet Minute. Once again, it’s a revealing look at “the audience” from a digital point of view:

The bottom line, of course, is that virtually everything is “up” (except for Snapchat). Tinder and Twitch have made their way into the lifestyle mainstream for millions of consumers. The stats for Netflix underscore the streaming video explosion taking place right before our eyes.

And take a look at smart speakers shipped – 180 units end up on nightstands, kitchen islands, and desks every minute. That’s the smallest number on this wheel, but it may be one of the most important because it’s a big jump over the year before.

Last year, I lamented about why it’s apparently statistically too challenging to include broadcast radio listening on this wheel. How many consumers are listening in the average minute would complement this amazing pie chart.

Nonetheless, for radio programmers, GMs, marketers, and sales managers, this data is revealing and useful, increasing understanding about the consumer mindset. It also helps frame questions for perceptual research studies that go beyond what other radio stations in the market are doing.

In this way, this chart and the one below, comparing last year to this year, are a form of AI – or “Audience Intelligence.” There’s nothing artificial about it.

Radio broadcasters cannot adequately deploy resources human and financial – if they don’t have a true understanding and grasp of who the audience is and what they’re doing when they’re not listening to an AM or FM radio station.

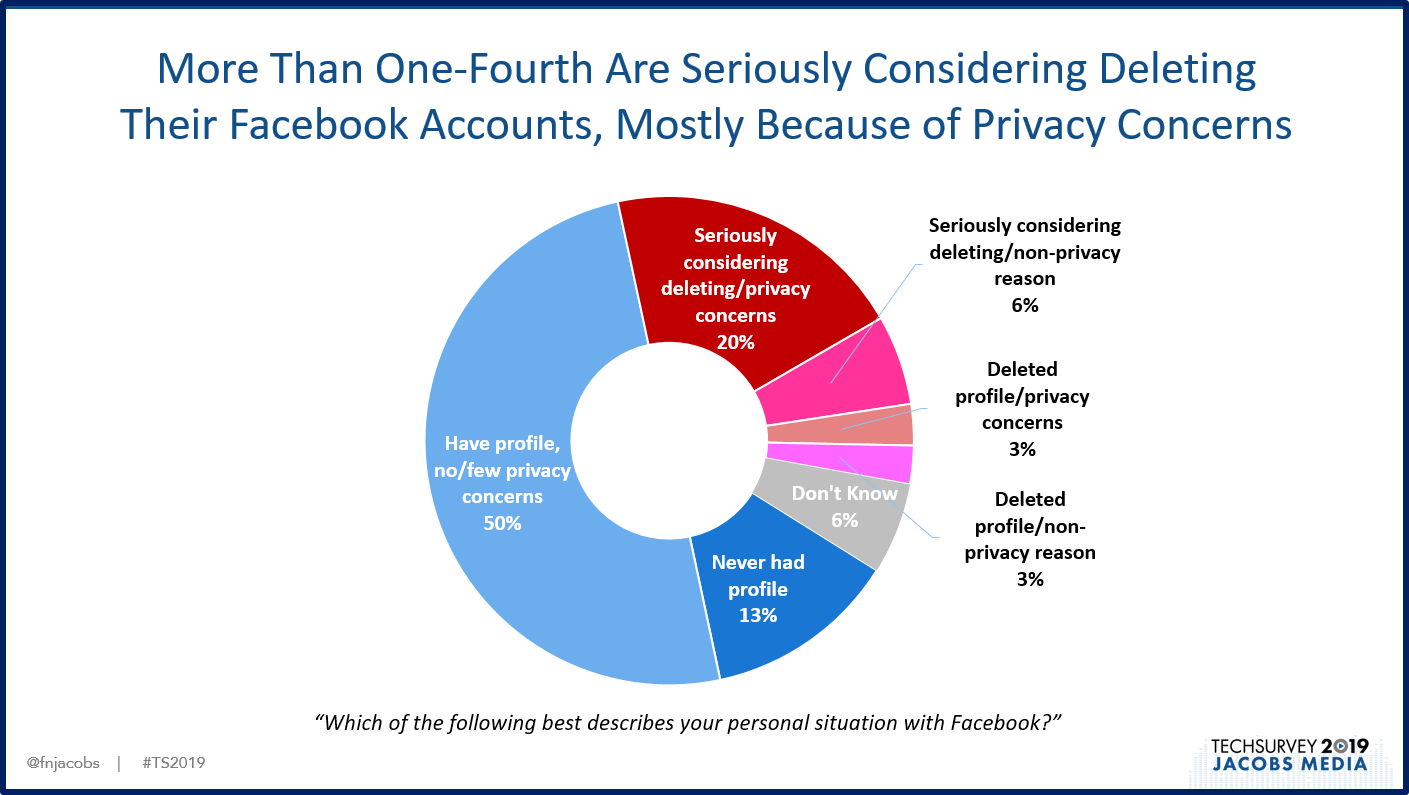

BuzzFeed CEO, Jonah Peretti told CNN’s Brian Stelter over the weekend on CNN’s “Reliable Sources” that we’re experiencing a “digital winter,” thanks to the many privacy issues, hacking incidents, and social media outrage that’s been fomenting over the past few years. He talked about the “billions of dollars” it now requires for companies like his, Facebook, YouTube, and Google to design and implement moderating protocols that ensure safety for both users and advertisers.

That said, Google’s UK director of Google Ads admitted to the Drum that her company will never achieve a level of “100% safety” when it comes to advertising on YouTube. For radio marketers, this marks a key differentiator in ad platforms.

In fact, this privacy issue is something we explored in the soon-to-be-released Techsurvey 2019. We asked a number of questions that go to the heart of Facebook’s current struggles over privacy as well as the near impossible challenge of keeping “fake news” off its platform.

Our new study tells us a surprising percentage of consumers is seriously considering leaving Mark Zuckerberg’s platform, largely due to privacy concerns.

Lori and Chadd’s Internet Minute research is reflective of the same guiding principle behind our Techsurveys.

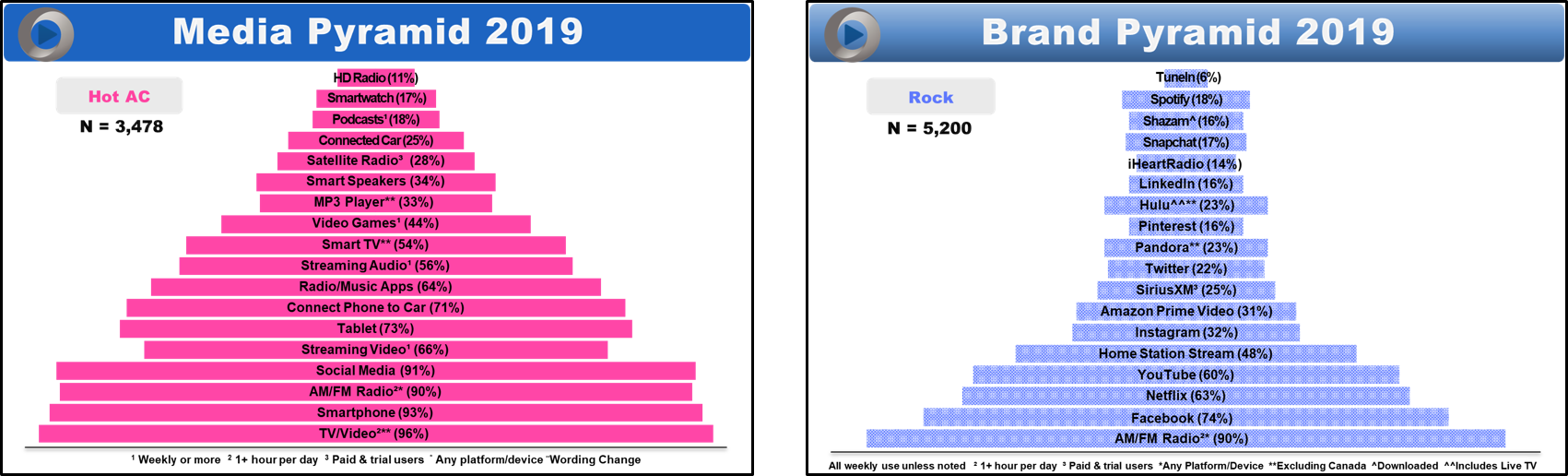

Our massive databank – more than 50,000 respondents in the North America, generated by more than 500 radio stations – provides deep insight into the media habits of radio listeners. And unlike syndicated studies that represent everyone – non-radio users, public radio fans, Techsurvey is a deep dive among who not only are commercial radio listeners, but they’re the actual listeners of our coalition of 500+ participating stations.

Thus, we can provide data about the actual audiences of rock, news/talk, hip-hop, and sports radio stations to help guide their planning – hiring, investment, and spending.

Our Media Usage and Brand Pyramids provide a great deal of granularity – by format and by a station’s actual listeners – to help airstaffs and sales teams understand who they’re talking to as well as who they’re truly competing against. Below are the AC and Rock pyramids for both media and brand usage – key components in establishing high levels of Audience Intelligence.

Knowledge is power. Audience Intelligence – radio’s AI – is a superpower. It goes to the heart of how the smartest, most strategic radio broadcasters will innovate their way to a successful future, despite the headwinds, hardships, and challenges.

The old skillsets – spot inventory management, music testing, gaming the ratings – will continue to play roles in separating great stations and companies from the also-rans.

But it is in the understanding of lifestyle groups, local and regional differences, and changing media habits that are the new building blocks needed for developing solutions that can help broadcasters navigate this rapidly changing ecosystem.

Our TS19 “sneak peeks” start in AllAccess today, and will run daily right up to the WorldWide Radio Summit in beautiful, downtown Burbank, California at the end of this month where I’ll do a live presentation in front of hundreds of eager broadcasters, label execs, and media mavens from North America and around the globe.

It is now more important than ever for broadcasters to pay attention to this research – whether you opted to become a stakeholder this year or you’re simply an interested party who cares about the future of your station, your company, and your career – not necessarily in that order.

Lori and Chadd accomplished this in an Internet minute. It will take me a little longer to lay out and present the narrative. But I think you’ll find this year’s journey valuable and insightful.

We sincerely hope you use this “Audience Intelligence” to spur conversations, brainstorms, and the development of “next steps” for broadcasters here in the U.S., and internationally.

This is going to require some effort, and even uncomfortable moments. But the result should help us all better navigate the future.

That’s what AI for radio is all about.

Audience Intelligence.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Looking at the 2019 Internet Minute chart, how is it possible for there to be 694,444 hours = 41,666,640 minutes of watching Netflix per minute?

That’s like saying there’s more than 40 million people watching Netflix at any given minute.. a figure I find quite hard to believe. Or maybe 1 Internet minute is not the same as a normal minute? If so, this will affect how we interpret the overall data.

All in all, great article, looking forward to the TS19 results, thanks Fred!!

Sounds like the “new math.” I’ll let Lori & Chadd answer that.