If you’re reading this blog, chances are you work in radio – or perhaps you once did. The industry, through incessant budget cuts, rapid attrition, and simply an aging workforce has shed a lot of employees these past few years. No doubt about it, COVID has accelerated this process, too.

I think it’s safe to say we still don’t know what the radio industry here in the U.S. will look like once the pandemic is in the rear-view mirror. Now the Omicron variant threatens to delay the recovery. So, until then, there’s no shortage of speculation about the relative health of broadcast radio in the rapidly expanding audio ecosystem.

We may not agree on much, but I think most would concur that audio has been experiencing a bona fide renaissance over the past 7-8 years, perhaps spurred by the rekindling of podcasting, catalyzed by the now-famous “Serial.” We’ve seen explosive growth for audio at the hub of innovation, CES in Las Vegas.

The onslaught of new platforms and audio products, among them Clubhouse, the many brand extensions from Spotify, and the ongoing offerings from SiriusXM provide more and more choices.

Then there’s the hardware and software innovations that have literally mushroomed during this time – mobile devices and apps, smart speakers and skills, as well as Bluetooth audio devices (“hearables”), home speaker systems like Sonos and Bose, and connected TV options where audio is now being consumed.

beyond the obvious places where audio is impacting our media lives. Snapchat recently announced a deal where users will have access to clips from “Shrek,” “The Office,” “Parks & Rec,” and other titles thanks to a new deal with NBC Universal.

beyond the obvious places where audio is impacting our media lives. Snapchat recently announced a deal where users will have access to clips from “Shrek,” “The Office,” “Parks & Rec,” and other titles thanks to a new deal with NBC Universal.

The idea is to integrate audio in videos and memes so Snapchat can remain more competitive with TikTok, in particular. And this deal features additional audio collabs with the likes of Universal Music Group, Warner Music Group, and Sony Music Publishing.

If you think audio is a secondary platform, think again. Video platforms increasingly are integrating it into their content fabric.

And on the outskirts of this rampant audio growth is inexplicably broadcast radio. Radio companies – especially the biggest ones – are hustling out podcasts, streaming channels, and apps.

And companies like Quu and Xperi are focusing their efforts on modernizing car dashboards with better looking metadata and systems like AutoStage (pictured).

and systems like AutoStage (pictured).

And yet, there’s this sinking feeling of falling behind – call it, FOFB, and it’s palpable.

When Paul and I walk the cavernous halls at CES in early January, I know from experience that will be my take.

Why is this? Because many radio companies don’t really have a master plan – at least one they can (mostly) agree on and can articulate.

And while there are some truly impressive efforts taking place, few (if any) are focused on the CX – the customer experience.

We have fallen behind.

We have fallen behind.

In JacoBLOG, we have been talking about the CX (or UX – the user experience) for a long time now.

A decade ago, Tim Davis – our first digital guru – attended SouthBySouthwest. And he came back home to Detroit talking non-stop about how so many startups across multiple industries were myopically focused on the customer or user experience.

As I thought about radio at that time, few – if any – broadcasters were thinking about this. It’s not much better or different today.

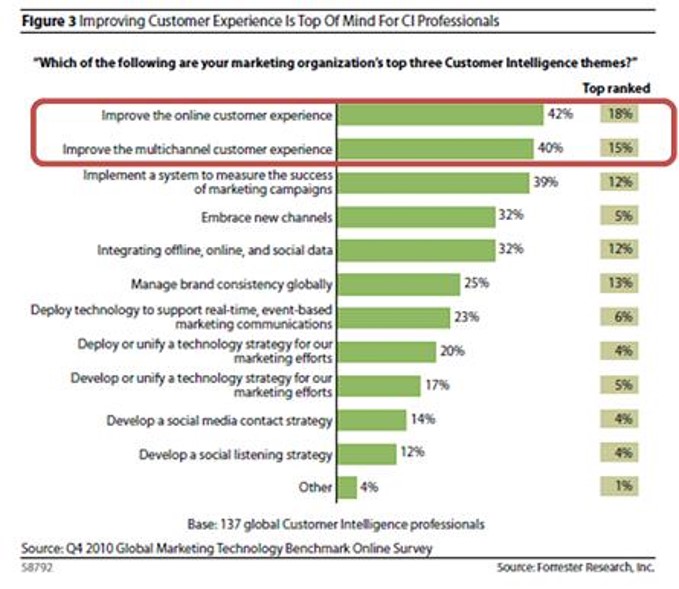

I wrote a blog post titled “CX/UX” back then that looked at a study conducted by Forrester Research in 2010. The sample was comprised of 137 “customer intelligence” professionals representing myriad sectors. When asked to list their top three themes, here’s how it shook out back then:

There it is – “Improve the online customer experience” and “Improve the multi-channel customer experience” – the top most-mentioned company themes, and the ones that garnered the most first-place votes. In 2010.

Imagine what might have been if broadcast radio’s leadership would have read that study, and taken it to heart. But hindsight being 20:20, this was just one study among hundreds that were released that year. And back then, there were few corporate staffers in charge of content or the customer experience in most sectors. These sounded like tech terms that had little-to-no application to AM/FM radio a decade ago.

But it turns out that companies and brands that focus on CX/UX have done pretty well over the past decade or so. Amazon, Apple, Costco, Starbucks, Trader Joe’s – they all sweat this dimension of the marketing process because it matters.

But it turns out that companies and brands that focus on CX/UX have done pretty well over the past decade or so. Amazon, Apple, Costco, Starbucks, Trader Joe’s – they all sweat this dimension of the marketing process because it matters.

More and more, consumers are losing patience with brands that don’t deliver a clean and seamless way to conduct business.

I concluded that old post with a question:

“How your station’s CX?”

And in fairness, radio wasn’t the only industry more focused on profits and margins than on the UX or the CX, especially back then. The airlines, restaurants, hotel and car rental chains, and yes, the auto companies – every one of them – were consumed by hitting quarterly goals and watching their stock prices soar. While some were involved with customer surveys, measuring variables with tools like Net Promoter, most were riveted by product, price, and profit.

Including the OEMs, every car manufacturer, whether here in the U.S., or in Germany, Sweden, Japan, Korea, and every other manufacturing center was focused almost entirely on P&L. And here we are headed into 2022, and they are all entrenched in a wild race for the future, traying to transform, while dealing with the pressure from a host of bold new competitors.

We’re talking about Tesla, of course, but also Rivian, Lucid, Polestar, and others – not just wowing the world with their electric vehicles, but rapidly taking over the space with a laser-focus on the customer experience, whether it involves the purchase, upgrades, new features, and service. At every point on the customer curve, the traditional OEMs know they’re being lapped by their new competitors.

You can see that unfold vividly in a new analysis by McKinsey. In a story they published earlier this month, “The new key to automotive success: Put customer experience in the driver’s seat.” The authors claim that in the evolving car business, CX has usurped engineering as the most important battleground variable.

It is a slick analysis of a legacy industry undergoing change as impactful as the assembly line was a century ago. I have no earthly clue how many auto execs will even read this McKinsey schematic of what could be a new, data-driven auto sector – after all, all the OEMs do their own proprietary research. But this report is a smart look at a changing industry that must move quickly and decisively in the face of sweeping change.

It is a slick analysis of a legacy industry undergoing change as impactful as the assembly line was a century ago. I have no earthly clue how many auto execs will even read this McKinsey schematic of what could be a new, data-driven auto sector – after all, all the OEMs do their own proprietary research. But this report is a smart look at a changing industry that must move quickly and decisively in the face of sweeping change.

That means features like the cylinders, braking distance, cruise control, wheelbase, payload, and reliability must now be considered “table stakes.” Every vehicle sold must compete on these basics. Instead, it is now about the rising importance of the customer experience.

Electrification and the emergence of Tesla are major forces accelerating this change. McKinsey points to these factors as now being essential parts of strategic planning for traditional automakers vying to compete in the new arena. And it’s analogous to traditional radio broadcasters remaining viable in the face of its formidable digital competitors:

- A commitment to bold change – Everywhere you look in automotive, it is companies like Tesla leading the way in innovation, similar in many respects to what we see from Spotify, SiriusXM, and other digital players in the audio space. McKinsey believes incumbent brands will have to get much more comfortable with the idea of risk-taking and innovation.

- It comes from the top – The analysts believe that CEO leadership is an imperative to providing a strong CX. When you think of the ways in which radio broadcasters have fallen short over the past few decades, it’s not hard to identify initiatives that never had the total buy-in from company leadership. HD Radio is a case in point – its promotion, its “side channels,” and incentives to succeed were all lacking from the corner office. And the rank-and-file are not deaf to a lack of commitment from the top of the org chart.

These two conditions flow through the McKinsey report. And they are reminiscent of the post I wrote a few weeks back about CEO Jim Farley’s aggressive approach at Ford – “The Transparent CEO.”

Commitment to the CX in the auto business is an imperative because the way cars are bought and sold is changing. Google search trends point to the reality that 60% of car buyers under 45 are apt to purchase their next vehicle online, bypassing the dealership experience. That’s why you see upstarts like Carvana and Vroom marketing their experience as never having to set foot in a showroom again.

60% of car buyers under 45 are apt to purchase their next vehicle online, bypassing the dealership experience. That’s why you see upstarts like Carvana and Vroom marketing their experience as never having to set foot in a showroom again.

And the McKinsey analysts warn that when online shoppers encounter a less-than-seamless transaction, they’ll simply find another brand that does it better. Tesla has embraced the direct-to-consumer model, making the auto purchase easier, less cumbersome, and (gasp!) more enjoyable. Other EV sellers have followed suit.

This process takes the CX to a whole new level. Consider this statement from the McKinsey report’s authors:

“Selecting the right customer-experience strategy depends on identifying the experiences most likely to delight customers.”

For decades, customer satisfaction in the car business meant the buyer loved the way the car looked and how it accelerated. It was about not having to wait at the dealership too long for that oil change. Now we’ve entered a different zone – one in which delighting a car buyer is the goal. The new guard like Tesla have figured this out.

“Planned obsolescence” was the reality when buying an American-made vehicle. While the quality of cars and trucks from traditional automakers has made quantum leaps, it does not compare to the software update model common to EV makers. Consumers love the idea their cars can easily be modernized and adapted in the same way our phones, tablets, and computers receive updating over the Internet.

And then there’s the data. McKinsey calls auto analytics “the new competitive muscle.”

Cars throw off tons of user information related to where they go and how they’re used – are they driven solo or with other passengers, what is the most common windshield wiper speed, and what audio choices do drivers (and passengers) make when commuting to and from work, dropping the kids off at school, or taking a road trip to the country?

Cars are loaded with sensors and computers that measure and aggregate this data. McKinsey says OEMs can utilize the data to manage the best purchasing, leasing, and financing options by focusing on the personalizing cars and services like upgrades and repairs.

The devil, of course, is in the data details. Car makers are siloed, and data is being generated by many different departments and groups. Finding the best way to aggregate the data is key for making the most of it.

Radio is also grappling with the data issue because its digital competitors have a huge edge with metrics. Between the ratings, email database, and web/apps data, radio operators have a broad array of data. But most are lacking the expertise and insights to best manage, utilize, and apply it. Seth tackled some of these issues in his “Connect the Dots” post yesterday: “Where Does Your Radio Station’s Data Live?”

As the automakers are learning, the data can also be used to improve the CX with their cars and trucks. But few have cracked the necessary codes to bring datafication to their user experiences. Radio is very much in the same boat.

The bottom line is that while radio broadcasters have developed proficiencies in many new areas – social media, podcasting, multi-platform, and programmatic – data is generally not part of most company skill sets.

The bottom line is that while radio broadcasters have developed proficiencies in many new areas – social media, podcasting, multi-platform, and programmatic – data is generally not part of most company skill sets.

The McKinsey reports recommends car makers conduct audits of customer data they already have. S0me may be usable as is, but some need to be improved in order to be useful. They suggest the bottom line is to develop a measurement system that provides information on developing an optimal customer experience.

They sum it up this way:

“Companies can go from asking ‘How are we doing?” to “How do we deliver on what customers want now?'”

For automakers that’s a heavy lift. For radio broadcasters, it’s like moving mountains. But a focus on an improved CX, supported by data is a great place to start.

That means measuring the experience – not just perceptions. In some ways, radio broadcasters think of PPM as being well behind their own data or even flawed. But the fact is meters are providing analytics that measure the experience – not “Which station that plays too many bad songs along with the good ones.”

Understanding the why behind why consumers do what they do is a starting point. It leads to primary consideration of giving the consumer a prime seat at the table.

seat at the table.

So, let’s stop talking about drivers, and start thinking about listeners: what they want, how they want it, where they want it, and how it feels while they’re doing it. That’s precisely how Spotify, SiriusXM, and serious podcasters are thinking about it.

But it goes beyond just being OK at the basics. Radio needs to think in terms of the CX. The term “delighting the listener” needs to enter our strategic planning process.

For radio, CX thinking would be like starting with a fresh sheet of paper. What would an RCX – radio consumer experience – look and sound like? How would it compete against the many new competitors in the audio space?

It makes you wish a company like McKinsey would do a workup on radio. How would they evaluate radio’s CX in the face of digital competitors? Its spot loads? Streaming experiences? Spotty on-demand access? Cluttered, generic websites?

What would they learn about our business?

More importantly, what would we learn about our business?

- Why “Dance With Those Who Brung You” Should Be Radio’s Operating Philosophy In 2025 - April 29, 2025

- The Exponential Value of Nurturing Radio Superfans - April 28, 2025

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

CX is an interesting term, Fred. I spend a bit of time these days on Sirius/XM and broadcast radio and can tell you the CX on both, in the 2nd biggest marketing area for broadcasters is lacking. The quality of music on Sirius is horrendous, just a little better than AM radio. Example? The Beatles put a tambourine in “Day Tripper”. On Sirius, you can’t even hear it. Then there’s AM/FM where the music seems to be an afterthought, 2nd to “it’s the greatest, most relaxing”, and the latest Kanye/Kardashian news. Broadcasting-when it was live-used to help us be connected, The minimalist approach to radio these days doesn’t do that much, and we know the issues. Is there a CEO out there who realizes that the boat is leaking and wants to plug it?

As you point out, Dave, they each have their downsides (many of which could be rectified). Radio broadcasters have experience in strategic warfare. But maybe it’s more about admitting who the competition is. As always, Dave, thanks for engaging with me on this one.

I wonder what the cupholders of broadcast radio are.

Good question.

I think there’s a lot of good to be gained from having all this research…but the whole time I’m reading I’m thinking that’s still not enough. Radio seems to just be missing those “radio people”–artists (of the radio craft, not musical)–who “got” how to produce content that drove you to the radio. Granted, radio has myriads of competition beyond “the guy down the street” now, but short of “radio people” who know how to put “can’t miss programming” on those speakers, everything else combined seems like”programming by committee.” The Spotifys of the world can give a great CX to each listener–because they can PROVIDE a unique CX to each listener. Radio can’t. To be sure, radio can improve in many areas (clean up garbage websites, maybe make it possible to reach a real PERSON if someone calls in, etc.), but it can’t give each listener in a city exactly what each listener wants. It will have to provide a different reason to listen, lest they produce a “horse” that looks like a “camel” that no one is happy with.

Dave, you’re right that radio’s CS will look different from Spotify. In some ways, SiriusXM has some of the same limitations as broadcast radio, some upsides (commerecial-free) and some downsides (monthly fee). But to your point – can radio fight this war with conventional weaponry? No way. And hopefully a McKinsey (or other analyst) would make that clear. Thanks for chiming in.

The reader comments to your blogs very often are as entertaining and stimulating as the blog posts.

The earlier comment by Laureatte Loy, “I wonder what the cupholders of broadcast radio are” rang close to profound.