Since we’ve been conducting our Techsurveys – all the way back to 2004-05 – Jacobs Media clients have probably gotten tired of us pounding the “digital transition” drum.

So in today’s post, I’m going to use data to tell the story – always a smart idea, whether you’re navigating whether states and cities should “re-open” during the pandemic or you’re trying to make sense of broadcast and digital revenue trends for the radio industry this year and next. As the former CEO of Ford, Alan Mulally believed, “The data will set you free.”

So, while I’ll provide interpretation along the way – that’s what good researchers do – I’m going to lean heavily on charts in this post to make the case that for the radio industry, not only is the digital tsunami upon us – it has been accelerated by the global pandemic, especially as listening locations and consumers needs have shifted.

The data don’t lie. And we’ve seen ongoing evidence – not just in our research – but in virtually everyone else’s research that the world has been undergoing a media transformation that’s nothing short of tectonic.

It’s why we started making our stylish green *”W.T.D.A”bracelets way back in ’06. And why we launched jacapps two years later to provide radio broadcasters with renewed portability on the most popular, ubiquitous devices – smartphones.

We see the tracking each and every year in those annual Techsurveys, now at the 500 station/40,000+ respondents level. True, these studies are comprised primarily of core radio listeners – and that’s the point.

We see the tracking each and every year in those annual Techsurveys, now at the 500 station/40,000+ respondents level. True, these studies are comprised primarily of core radio listeners – and that’s the point.

When more and more of them are seeking out digital distribution channels to listen to your morning show, enter your contests, or take your station with them wherever they may roam, the digital trend line becomes not only undeniable, but an imperative in order to stay in the content game.

And you don’t need to have MSNBC statistician and D.D.E. – designated data explainer – Steve  Kornacki (pictured right) on your team to determine which way the wind has been blowing in Radioworld these past many years.

Kornacki (pictured right) on your team to determine which way the wind has been blowing in Radioworld these past many years.

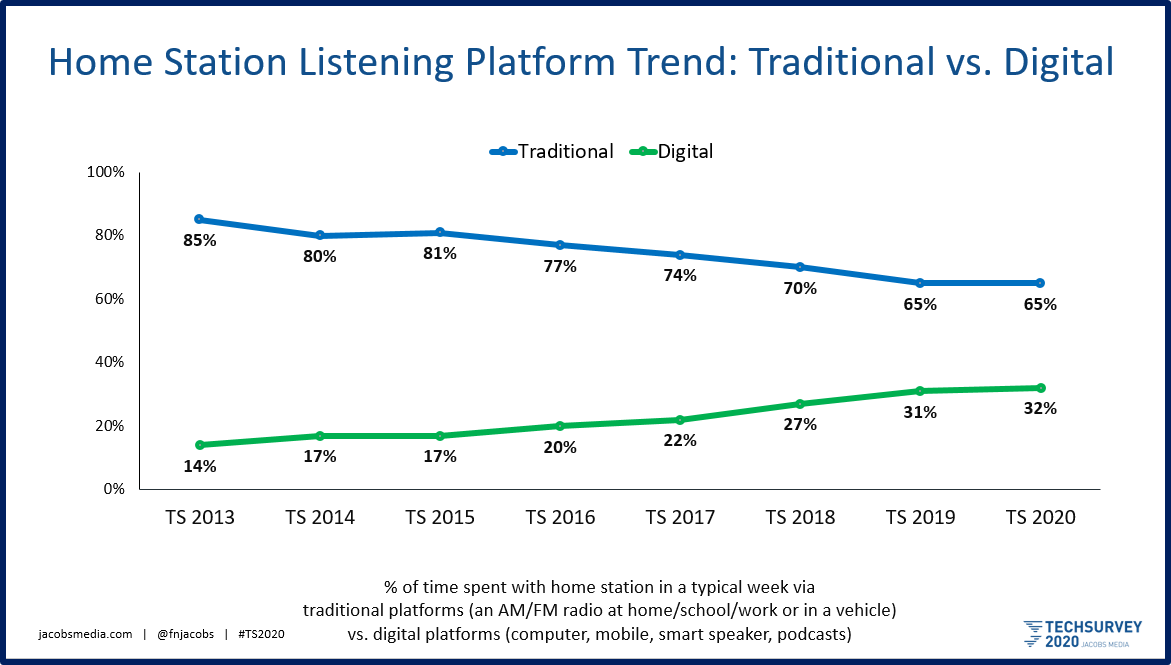

Below is a simple chart trending the last eight years of our Techsurveys. And it speaks volumes. It shows the devices radio fans use to consume their favorite radio stations. The “traditional” label equates to listenership on “regular radios” in cars, homes, and workplaces.

“Digital” represents virtually every other way to access a radio station’s content – largely audio streaming on various devices, such as mobile phones and tablets, smart speakers, laptops and desktops, as well as station-produced podcasts.

And the two trajectories are as clear as day:

You might even imagine a day when these two lines will meet. So, are these percentages somewhat exaggerated because we’re talking to core radio listeners savvy enough to fill out a web survey? Most definitely.

But the smartest people in the industry with access to even more data and insights have made up their minds. Industry leaders like Bob Pittman, David Field, Ginny Morris, Caroline Beasley, Jeff Warshaw, and a growing list of other movers and shakers have been aggressively stepping up their digital initiatives the past several years, placing their bets on new content and distribution strategies aligned with these changing consumer and societal trends.

Each of these CEOs is working to transform their radio companies into multi-media enterprises, providing information and entertainment on a variety of platforms that transcend transmitters and towers. Everyone’s model is different – and that’s a good thing – but they’re chasing the same puck.

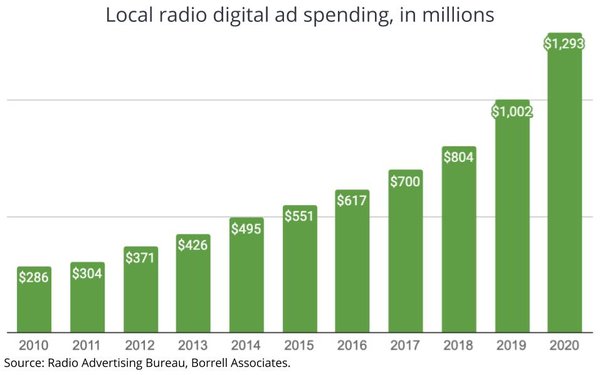

A look at Borrell Associates data indicates that puck should be colored green. The chart below covers a similar time period as our Techsurveys, and shows the very same trend line – for actual (and projected) local digital revenue. The RAB has been ringing this bell for some time now, too, prodding broadcast radio to commit to the digital arena because that’s where revenue is showing the most growth.

You might be looking at that 2020 estimate, published in early February, and question whether it is still relevant in a world rocked by a global pandemic. Clearly, any projections made for this year have to be treated with a grain of salt.

And while ad revenues will likely be down this year – across the board – the virus has turbo-charged changes that were already coming together. That’s especially the case when it comes to radio listening over the course of the past couple of months since COVID-19 has dominated our lives. Nielsen PPM data in the nation’s largest markets strongly point to the reality that digital usage has increased even more since so many have been cooped up at home. When and to what degree this will translate into revenue is anybody’s guess in this roiling economic environment where so many marketing plans are on hold.

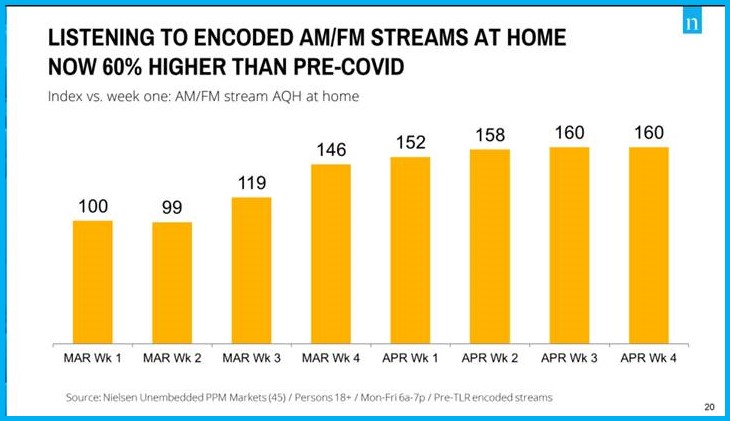

But the usage data is unmistakable. Last week, Nielsen unveiled listening trends for April in PPM markets – data that will begin spilling out today. And their actual listening behavior data clearly show how digital is rapidly earning a more significant share of the pie. While the car may still be broadcast radio’s top listening location, the shrinking percentage of working radios in people’s homes we’ve been tracking is shifting usage to streaming.

And this data is just for the encoded streams, indexed against Nielsen’s March week 1 numbers – before all hell broke lose. And the trend line looks like every other chart in this post. Nielsen tells us radio listening is on the rise in the early weeks of May, as people are beginning to move around more as restrictions are being lifted. That will obviously facilitate in-car radio usage, but rapidly-forming habits in the digital distribution arena won’t just come to a halt. Consumers will continue to stream their favorite stations in a variety of locations, including mobile devices and the growing number of smart speakers.

For stations with competitive streams, a smart mobile strategy, and a clue about how to set up and market smart speaker access, recovery will be a faster, less painful process. In market after market when you look at the stations in the best ratings shape in March, April, and likely May, it may be less about their formats and more about their preparedness on the digital front.

The data I’ve presented in this post are probably research findings you’ve no doubt seen here and in other places before. But now because of the global pandemic, many of the trends already in place have been turbo-charged. As a result, the players inside your station or company who have been on the digital forefront will have to do less arm twisting. While the burden of change has often been on their shoulders, now the virus is doing the heavy lifting.

There is no question the impact of COVID-19 is powering these changes, in much the same way the virus is reshaping the way we work out, shop, dine out (or in), and consult with physicians.

In retrospect, it doesn’t really matter how radio’s digital evolution happens. We’re all going to end up at the same place – sooner or later. Understanding how the reverberations from the pandemic will spike these changes in the lifestyle fabric of our nation is the topic of other posts this week. We’re going to talk about how attitudes and lifestyles are already morphing, and what those changes portend for radio content creators, distribution strategists, and sales marketing teams.

Tomorrow, our second COVID-19 study among radio stations in the commercial, public, and Christian music sectors goes into the field – exactly six  weeks after the first one launched on the last day of March. We will gain more insight about the audience’s state of mind, their reactions to the economy “re-opening,” and of course, how their media habits – specifically radio listening – are tracking.

weeks after the first one launched on the last day of March. We will gain more insight about the audience’s state of mind, their reactions to the economy “re-opening,” and of course, how their media habits – specifically radio listening – are tracking.

The better we understand the new landscape, the more we can optimize our results and get our companies back on track.

Pandemic or not.

* “W.T.D.A.” is the acronym for “What’s The Digital Application?” The idea was for radio station employees who wore the wristbands to remind them to think digital, whether it was a programming, sales, or marketing initiative.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

You can’t argue with the trend, although with 2/3 still listening on radios, a case could be made that for many people listen to radio because it isn’t digital. But the trend line is clear.

Radio has been faced with a Hobson’s choice since the Real G2 codec (remember that?) made streaming music listenable. Give em what they want and transform listeners from money generating assets to money losing ones, or fight the trends and hang on to the higher revenue that accompanies traditional radio.

Radio should have addressed that years ago and now success or failure here could literally make or break the medium. CPMs for digital streams are lower than traditional radio metrics and (unless it happened and I missed it) radio still hasn’t fixed that ridiculous AFTRA rule.

The 2008 recession cost radio 1/3 of its revenue that it never recovered. How radio handles its digital transformation and the accompanying ad metrics will determine how it comes out of this one.

Last sentence: TRUTH.

That sums up exactly how I’ve been thinking about it these past several weeks. It’s a reckoning, a shakeout, whatever you want to call it. Those who invested in content, talent, and digital assets stand the best chance of coming out of this mess. Thanks, Bob, for the always thoughtful response.