Our third DASH Conference is history, but by all accounts, this event may have been the most substantive, with several groundbreaking, buzzworthy sessions.

A number of attendees have asked us to summarize DASH, to come up with the key takeaways that occurred across 18 different sessions. So how do you boil down nearly two days of panels, keynotes, and presentations in a succinct paragraph or two?

If it were only that simple. A lot happened at the conference that caused attendees to stop and think. And many took copious notes, snapped many photos, and fired off hundreds of tweets, all in an attempt to understand, chronicle, and clarify the common space that exists in the intersection of the automotive/radio Venn Diagram. While the two industries continue to share a great deal in common, DASH illustrated that much of the thinking and strategizing common to automotive and radio is diverging.

In thinking about what transpired, it is clear there were several unifying themes that many DASHites told us hit home for them. And you can see them in the word cloud above, based only on our observations of the conference. To many, it felt like a roller coaster at times. A session that was encouraging for radio was followed by a keynoter forecasting a movement away from Marconi’s medium by the car community.

Our sessions included some of the best thinkers and key executives from both the world of automotive and radio. And at times, it felt like we were watching two very distinct views of the same media ecosystem.

Much like the ways in which Democrats and Republicans look at the exact same conditions and events with wildly different perspectives, DASH featured disparate takes on two industries that are clearly being disrupted in multiple ways.

To some degree, your “take” depends on the Kool-Aid you drink, your agenda, and the information that is most meaningful to you.

On the one side, a key DASH theme revolved around the importance of data. On the other, it was about the value of ratings.

So where do broadcasters, automotive execs, advertisers, and agencies place their chips? Data believers like Ford Direct’s Dave DiMeo and our entire car dealer panel continue to point to the need for actions and not just reach. To them, it’s about the data that proves our ROI and accountability. They believe this is the new Holy Grail, trumping anything that Nielsen could claim as the behavioral truth of media usage.

As DiMeo told the crowded Westin ballroom at DASH, “Radio needs to be aware we need to spend money on digital. There must be some way to spend digital money in a way that generates a call to action, and we (have) metrics to see that engagement. How many heard my ad and then took action?”

From the data being retrieved from drivers by both the OEMs and the invasion of Apple and Google in dashboards, there’s a growing dependence on metrics for both sales and marketing, accountability, and measurable impact.

On the other side, iHeartMedia COO/CFO Rich Bressler and Westwood One’s Pierre Bouvard quoted Nielsen ratings, as well as other key studies, to make the case that radio listening in cars continues to be dominant and strong. Each admits the incursion of new media and other audio options into the mix, while pointing out that radio’s time-honored dominance remains largely intact. Bressler noted that radio dominates media usage while driving, and Bouvard backed him up, featuring impressive “Share of Ear” data from Edison Research.

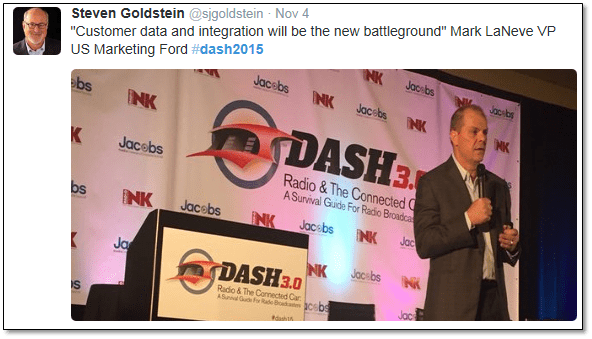

Ford’s VP/U.S. Marketing Mark LaNeve (and Entercom board of directors member) took the middle ground, noting that his company’s CEO Mark Fields often preaches the value of keeping “one foot in today and one foot in tomorrow.” LaNeve added, “Customer data, integration, and impact will be the new battleground to figure out new media mixes. Radio plays a big role in driving traffic for reinforcing brand awareness.”

At times, DASH was about who will reach the future first – and the costs of being too early or being too late.

Many at the conference discussed the impact of their children’s media behavior, as they closely following the actions of teenagers and even 9 year-olds as early indicators of how society will use (or won’t use) radio, mobile, and other gadgets and content sources.

But others noted that while cultures, habits, and actions are changing, the people buying cars today and in the foreseeable future are still adults, many of whom are rooted in traditional media behavior – like listening to AM/FM radio in their cars. While innovations like Apple CarPlay or autonomous driving will one day be ubiquitous, that day is a long way off.

This hit home for me in a recent Bloomberg article about how CD players are disappearing from dashboards, especially in vehicles targeted at Millennials, like Scions and Honda Civics. Writer David Welch reports that in 2014, 17% of all new vehicles were CD-playerless, and that’s projected to skyrocket to 46% by 2021. For many OEMs, the CD player has fallen out of favor, occupying too much dashboard real estate.

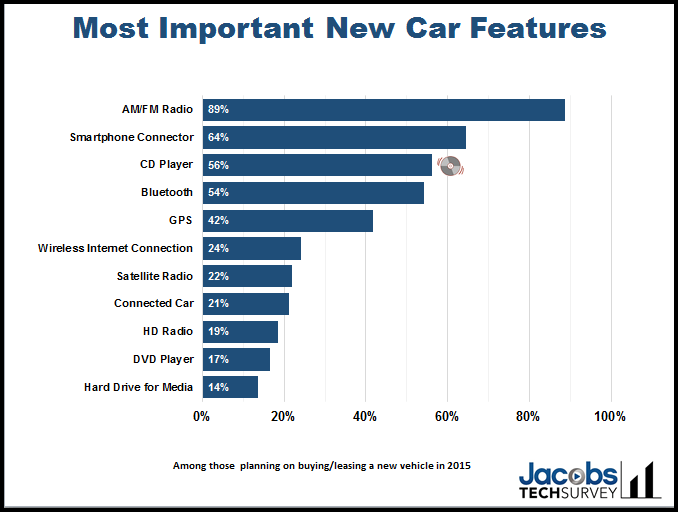

Yet, even analysts admit there’s interest in CD players in cars, especially among the adult demographics – the same groups purchasing and leasing most new cars, SUVs, and trucks on the road today. You can see the disparity in our Techsurvey11 data from earlier this year. Once you get past their loyal desire to AM/FM radios and their interest in pairing their smartphones, new car consumers say the old school CD player is the second most important dashboard feature:

This is just one illustration of how automotive is trying to stay competitive and future-focused, without damaging the industry’s Q4 sales figures.

And so it became obvious as the DASH agenda unfolded that in order to stay competitive in a rapidly changing environment, radio will need to be more committed and creative when it comes to digital integration.

Wes Lutz, one of the car dealers featured in a panel called “Training Consumers To Use Their Connected Cars,” reminded attendees that his industry is experiencing the same unsettling feeling of disruption and change as radio. As he pointed out, “We are just like you.”

But along with the other dealers on the DASH stage, Lutz was very clear in his belief that ratings are far less importance than actions to his company’s sales strategy. Two of the three dealers on the panel say they now spend zero dollars in radio, opting instead for marketing that delivers a measurable ROI. Broadcasters that ignore their words do so at their own peril.

Fortunately, DASH featured several solutions-based sessions from industry pros that are making the adjustment and creating new ways for radio to stay competitive in the brave new world of automotive.

We will continue to write and blog about this radio industry challenge in the coming days and weeks. And we appreciate the great attendance, enthusiasm, and energy that continue to characterize the DASH Conference.

In the meantime, what Kool-Aid are you drinking?

Coverage of DASH day one is available here, courtesy of All Access.

Coverage of DASH day two is available here, courtesy of All Access.

Thanks to David Gariano for the tip on the CD player article.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Leave a Reply