These days, it seems like there’s a very line between the wisdom of “fish where the fish are” OR failing to do that and ending up “swimming with the fishes.” Those are the increasingly hard choices facing broadcasters as the ad world redefines itself and its priorities.

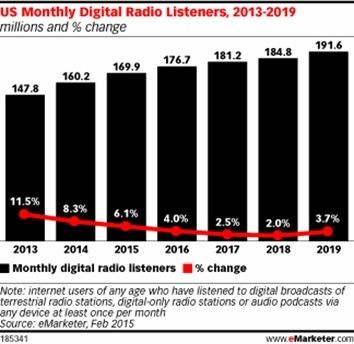

A recent eMarketer article points to the growing interest in digital radio in the advertising community. Its new report, “Digital Radio: Led By Pandora, Now Robust ‘Audio’ Ad Channel,” suggests that marketers have many choices in this new arena, and most don’t really care about whether it’s on-demand (like Spotify) or playlist-based (like Pandora).

As the article points out, the sector is growing, providing advertisers with the ability to reach a user “who can be precisely targeted by geography, demographics, social connections, listening behavior and other critical metrics.”

And even though digital radio has its flaws, shortcomings, and growing pains, companies continue to experiment with different ways they can advertise on these platforms,  whether it’s owning an hour or even partnering with streaming companies.

whether it’s owning an hour or even partnering with streaming companies.

Sadly, many marketers don’t even know exactly what they’re looking for when it comes to digital radio. They just want to be there. We hear that a lot from our clients in broadcast radio who complain about vague requests coming from advertisers.

But charts like the one pictured here from eMarketer are all about trajectory. And whether streaming radio brands are profitable and viable or not, ears are gravitating to this space. And consumers don’t care about royalties, fees, and monetization – they simply want the best entertainment and information they can get their hands and ears on, not to mention a seamless user experience.

Of course, it’s the auto companies that are especially desirous of working with channels like Spotify or Pandora, and that should get a radio sales manager’s attention.

eMarketer points to a BMW partnership with Spotify to create road trip playlists shareable on social media channels. The recently released RAB revenue numbers for 2014 show that while automotive is still radio broadcasting’s top category, it continues to slowly erode. And digital brands are well positioned to be able to capture those dollars.

It’s gratifying that audio advertising has never been more desirable for brands, but the challenge is that “radio” is now being defined very broadly.

Here’s a case in point: State Farm Ad Director Ed Gold notes that his company is “looking at all radio-type advertising as audio. When I look at my overall budget – that which used to be called the radio budget but is now called the audio budget – we are going where the consumer is, so if more consumers are going to digital radio, we are following them.”

This is part of a larger move to digital. The equity team at J.P. Morgan just announced that the 2015 advertising outlook is “encouraging,” but the report goes on to say that “many companies highlighted an above-average pickup in digital spend.” While Colgate Palmolive is a brand that is also increasing its traditional advertising, most of the buying action centers around ads on Facebook, Google, and Twitter, along with mobile.

And a newly released Borrell Associates study commissioned by the RAB, predicts that digital revenue for radio will break through the $500 million threshold this year – an increase of 18%. But Borrell also points out that nearly two-thirds of radio managers think their sales reps are calling on the wrong people. And more than three-fourths say sales training is a top priority in maxing out this digital revenue opportunity.

So it’s all about hanging out in the digital waters, and that ought to motivate radio broadcasters to have solid, robust streaming products in their tackle boxes, as well as trained-up sellers who can talk the talk and put those integrated digital deals together than can meet advertiser needs. Whether it’s on-demand podcasts, secondary and tertiary streams, or online videos, it continues to be incumbent on broadcasters to create digital vehicles that are in-sync with what advertisers say they want.

Instead of complaining about the lack of a streaming business model or continuing the old saw that Pandora will just keep losing money, the supportive ad spend data from multiple sources ought to be all the impetus that broadcasters will need.

When the “radio budget” becomes the “audio budget,” the competitive arena just got a whole lot more crowded.

The fish are swimming at a faster pace in the digital pond, and there are a lot of them.

Let’s follow the money.

Time to go fishing.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

The audience is making its move. Does anyone expect advertisers not to follow?

This “fish” concept was examined long ago: https://audiographics.com/agd/020510-1.htm

Very few in radio listened then. Not many more are listening now. The trend continues: Give excuses that push the blame away from radio.

Ken, no excuses. The clock is ticking. Thanks for weighing in.

It is well past go time, but better to start now, then not at all. Let’s do this…

Well stated Fred,

Jay

Thanks, Jay. The clock IS ticking.

So advertisers really don’t care if it’s “radio” or not. Some stark realities. First, the fact that there is no business model for streamed music is way more than just a whining excuse. Yes, Spotify and Pandora are taking a nice chunk of radio’s audience and revenue, but they’re losing money at it and will continue to. Fact: Streaming music is a GUARANTEED MONEY LOSER now and for the foreseeable future. Royalties are a HUGE issue and unless and until radio confronts it head on and fights for a reasonable solution it will be forced to face a Hobson’s choice – give listeners what they want and hemorrhage money, or refuse to and hemorrhage audience.

As for radio’s digital sales efforts, if radio management is right in thinking that their sellers are selling digital to the wrong people, it’s probably a good thing. The right people would laugh them out of the room as not bringing enough media value to the table to be worth their time, much less their money. I’ve said this before (I hope some sellers will let Fred know privately that I’m right – they dare not say so publicly), but much of the digital revenue attributed to radio is terrestrial revenue moved to the digital line (pay for the digital and get free or greatly reduced price terrestrial) to demonstrate progress.

Radio does need to do everything Fred suggests here, but not in a vacuum. Building a digital platform that really garners audience will result in more people being fired – because it will cost more than it brings in and radio only knows one way to deal with less profit – no matter what the reason…FIRE PEOPLE – ideally just before Christmas.

Digital could over time, eat radio’s lunch, but royalties WILL are eating digital’s lunch now. The radio industry has way more clout than all of the digital players combined right now and should leverage that advantage in negotiations (ugly ones if necessary) with the music industry.

This will be a long, tough fight, but a worthwhile one but radio needs to face the music.

Bob:

I’ll agree that “Streaming music is a GUARANTEED MONEY LOSER…” when done within a CPM sales environment. It will also be a bigger money loser for broadcast when performance royalty payments arrive. It’s now a case of parity. Broadcasters will eventually pay.

I don’t hear new forms of audio commercials with a basis of pushing people to specific URLs for campaign ad tracking. I’m not reading of the radio industry creating new sales packages which include cost-per-click or cost-per-action pricing. There’s no hint that radio execs understand the power of domains yet, either. Who owns RadioAdvertising.com It’s not a broadcaster. Until a few months ago it was Apple. Now, Spotify owns the domain. (Think about “why” these two digitally savvy companies would be interested.)

What’s being delivered by a broadcaster’s stream or web site is not “digital.” It is delivered digitally, but metrics are not acquired and analyzed in the digital sense. True digital companies offer post-campaign analysis.

Royalties will soon be paid by both sides. Then what happens when broadcasters are still relying on pricing in CPM?

With no media value (few users) cost per click won’t buy radio a ham sandwich. The reality must be tackled before pricing can ever be an issue.

Bob

Thanks for the perspective and the thoughts, Bob. It’s a tough issue, but as you point out, radio has a lot of assets on its side of the ledger. But there’s much work to be done. Appreciate you taking the time.

I don’t think that radio is slowly dying and it goes all digital. Of course Spotify and others will continue to grow especially to younger audience, but i think that the future shows something else. The audience loves radio. If the radio companies go digital (most of them are really changing the last years and they invest in digital platforms) then the audience will follow those companies because they have to offer them something.

It’s not only about music, it’s about so many other things that people listen to radio. So, if the companies play the game well on digital platfoms (apps etc.) then the audience will follow. It’s all about the people and the vision. Of course the money goes where the audience does. Let’s hope for radio companies to grab the chance of this new era thing and sell their product the right way.

As i said, people love radio cause it’s not only about the music. Podcasts might be growing the next years, but they don’t offer what radio does. And it seems to me that because everybody will be podcasting soon, as they did with soundcloud and music productions, it will reach a level where nobody will pay so much attention anymore. If it’s completely free to do what everyone does (as it happened with music, that everybody can buy an audio home studio program and release whatever comes to mind for free) the same will happen to podcasts or whatever comes easy.

Nick, radio has all sorts of advantages – first in, ubiquitous, and lots of listening even out of habit. As you note, the investment in digital offerings to take advantage of agency spending shifts is critical. Thanks for the comment and for reading our blog.