A question I’ve heard bandied about lately revolves around the monetary value of podcasts. After Spotify spent a reported $340 million to buy Gimlet and Anchor earlier this year, that query has been richochetitng throughout every podcast conversation. It was one thing when iHeartMedia shelled out $55 million (while still technically in bankruptcy) for the Stuff Works franchise. Spotify’s shopping spreed is a whole other thing. A day or so later, it was announced that startup Himalaya would receive $100 million in financing. And on it goes.

So, why the flurry to podcasting when the value of the platform isn’t always entirely clear? In Spotify’s case, many point out how the audio streamer needed to diversify its media portfolio; that simply trying to run a successful business from music streaming subscription fees alone is not enough.

Enter podcasting – still very much in the audio family, but a smart, strategic way for Spotify to increase its media menu in an effort to build revenue and (hopefully) profits in another wing of the audio building.

But $340 million for both Gimlet and Anchor? That’s a lot of money to spend on an audio product line expansion. Clearly, Spotify, iHeart, and other very smart companies envision a potentially huge windfall from podcasting.

Podcasting has become a form of Media Monopoly. Buyers, sellers, content creators, and publishers are attempting to value properties, oftentimes with intuition and gut rather than with metrics.

UK-based podcaster and writer, Nick Hilton, tackled this question in Medium in a story aptly called “How Much Is Your Podcast Worth?” earlier this month. He echoed the question on the minds of hundreds of thousands of podcasters throughout the world, whether they’re Adam Carolla or the woman in South Bend producing a podcast about quilting in her fourth bedroom.

What IS podcasting’s value – today, and down the road?

As everyone who follows the podcasting sweepstakes knows only too well, reliable, useful data are missing from the buying/selling equation. Sure, there are download stats, but no one has the granular metrics necessary to truly know whether consumers are actually listening to these podcasts, skipping through the commercials, and heeding the advice of their hosts doing live reads. That’s why podcasters keep arguing over the basics – podcast length, number of ads, and all the other questions that should have been answered by now.

We asked a number of these questions in Techsurvey 2019 which I’ll present this week at the Worldwide Radio Summit. While illuminating, our research cannot provide the essential data media buyers, planners, and sponsoring companies need in order to make intelligent decisions about where to deploy their marketing resources on behalf of their clients.

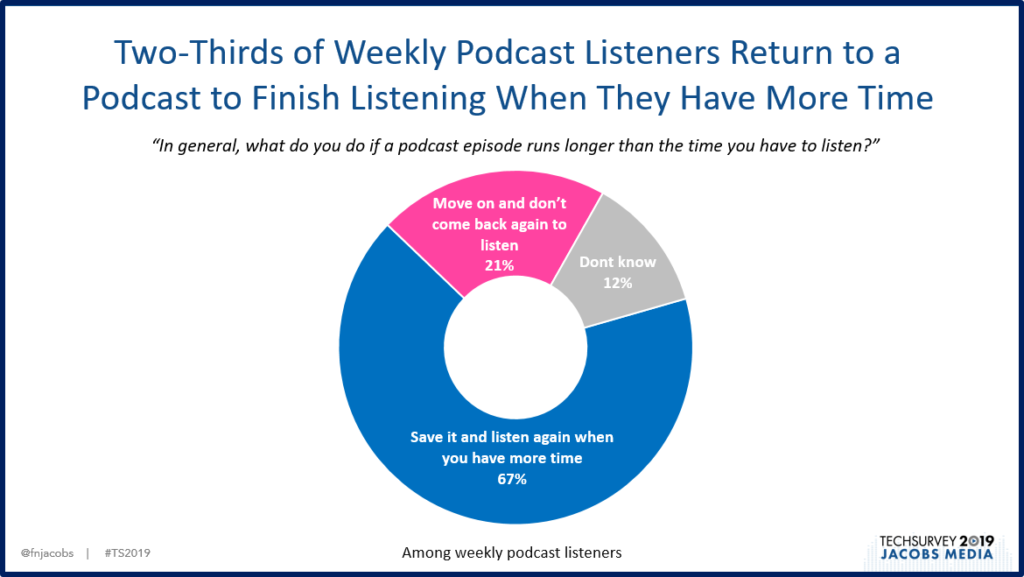

In our new Techsurvey, we learned most people listen to podcasts on smartphones while driving, and that word of mouth is the best discovery tool. And as the chart below shows, podcast listeners are committed – the vast majority make it a point to listen to the entire episode:

This is good stuff, and helpful to podcasters. But it is not even close to providing the necessary metrics to facilitate commerce. The fact is, many people ensconced in podcasting don’t know as much about the platform as they should – through no fault of their own. And in that type of environment, many of the old rules about how you value, price, and market media content go out the window.

While both podcasters and broadcasters would benefit from learning more about on-demand audio – how to make it, promote it, and market it – there are other factors at work that go well beyond data.

In his essay, Hilton ponders the power of podcast brands – like Gimlet, Wondery, or WNYC Studios. Rather than placing all their eggs on podcasts produced by people all over the spectrum, Hilton points to the reputation of key publishers as a possible indicator of determining value in the advertising community.

Hilton’s main premise is that audience size – the metric that matters in traditional media – may not be the secret sauce in setting the price for podcasts.

He refers to “The Monacle Model” – which essentially translates to the notion that if your audience is high quality, its size is secondary to its spending power and influence.

Hilton also notes publishers get bonus dollars if their podcast is near the top of the heap in a desired genre or category. Just like in radio, being the #10 podcast that deals with reverse mortgages is much like being the third Country station in Indianapolis. You’re not going to get on a whole lot of media buys.

What makes the Boardwalk the most valuable, prestigious property on the Monopoly board, while Mediterranean Avenue is more like the slums – even though they’re virtually next door to one another?

“Boardwalk” podcasts – like “The Adam Carolla Show,” “This  American Life,” “This Week In Tech,” and “WTF with Marc Maron,” are embedded with celebrity and brand credibility. They have cache and respect, and that’s why they command top dollars.

American Life,” “This Week In Tech,” and “WTF with Marc Maron,” are embedded with celebrity and brand credibility. They have cache and respect, and that’s why they command top dollars.

You can make the argument they weren’t always this way. But when you’re thinking about celebs like Carolla, Ira Glass, Leo Laporte, and Maron, their podcasts have baked-in value that no one disputes.

Yes, they have amassed large audiences, but they also have that celebrity glow, that special something that puts them in the front of the podcasting class. As Hilton concludes:

“Podcasting is in a battle against its perception, which is why slick suited folk like Alex Blumberg, who looks and dresses like a young(ish) Tim Cook, get a look in, but plenty of rambling, sweary bros recording in their basement with huge audiences, don’t.”

A big name, a sizable audience, and “The Monacle Model” – they all conspire to make a financially successful podcast business.

As we’ve learned in our Techsurveys, podcasts are more popular in public radio circles than among Hot AC, Country, or Classic Rock fans. Not only do fans of Ira Glass and Terry Gross listen to more podcasts, they also tend to be better educated radio listeners. To Nick Hilton’s point, “The Monacle Model” is very much in-play when you study how different demographic groups consume podcasts.

So, what are podcasts worth?

Here’s Nick Hilton’s final words, and they hearken back to a day before cost-per-point and programmatic buying:

“The value is the audience — the extent to which they are monetised as an advertising or subscriber group is the ultimate question/problem in podcasting, but it is one that will be solved top-down (I’m afraid).

And maybe that’s how podcasting will end up – with the biggest players making the calls about what matters and what doesn’t. Because for now, most podcasters are spending a lot of time and effort creating content. Will they end up playing for more than a pile of Monopoly money?

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

We could consider all this investment in audio delivery is good for radio. We could also eliminate podcast middle people and continue to improve on radio’s 100 year legacy, accessibility & service. Thank you, Fred.

Radio is part of the expanding audio ecosystem. And that’s good news. Thanks, Clark.