A blog post with two introductions?

That’s what happens when one of the most-read posts of the year was, in actuality, written by one of our esteemed colleagues and a good friend.

Today’s post from early last month fits the bill. It comes from one of the brightest and most thoughtful minds in our industry, so right there, it’s a good reason to pay attention.

Radio will continue to face existential issues during the coming year. Today’s missive is a good reason why we’ve got to look these challenges right in the eye – or be prepared to pay a stiff price down the road. – FJ

November 2023

So far this week in our JacoBLOG, the theme has been “radio reality checks.” I’ve gone back to data from this year’s Techsurveys to make the point that the radio “givens” many still accept as the norm are, in fact, a thing of the past.

Today’s post continues the series, but instead of me writing the next installment, I’ve turned to one of the industry’s savviest analysts of trends and research. Most of you know Larry Rosin, co-founder and president of Edison Research. But if you’ve never met him or seen him present, you’ve no doubt read his oft-quoted research reports – everywhere. From podcast rankings to his “Share of Ear” studies to election exit polls, Larry hasn’t just seen it all – he’s done it all.

For today’s “Guest Post,” Larry takes a look at the most basic – and perhaps most important – piece of data in every ratings report – cume audience.

Radio veterans know “cume” is comparable to a newspaper’s circulation – it’s the number of listeners who spend a minimum of five minutes a week listening to broadcast radio. To be considered a “cumer,” a ratings respondent can listen for scores of hours – or just a few minutes. Everyone is counted the same.

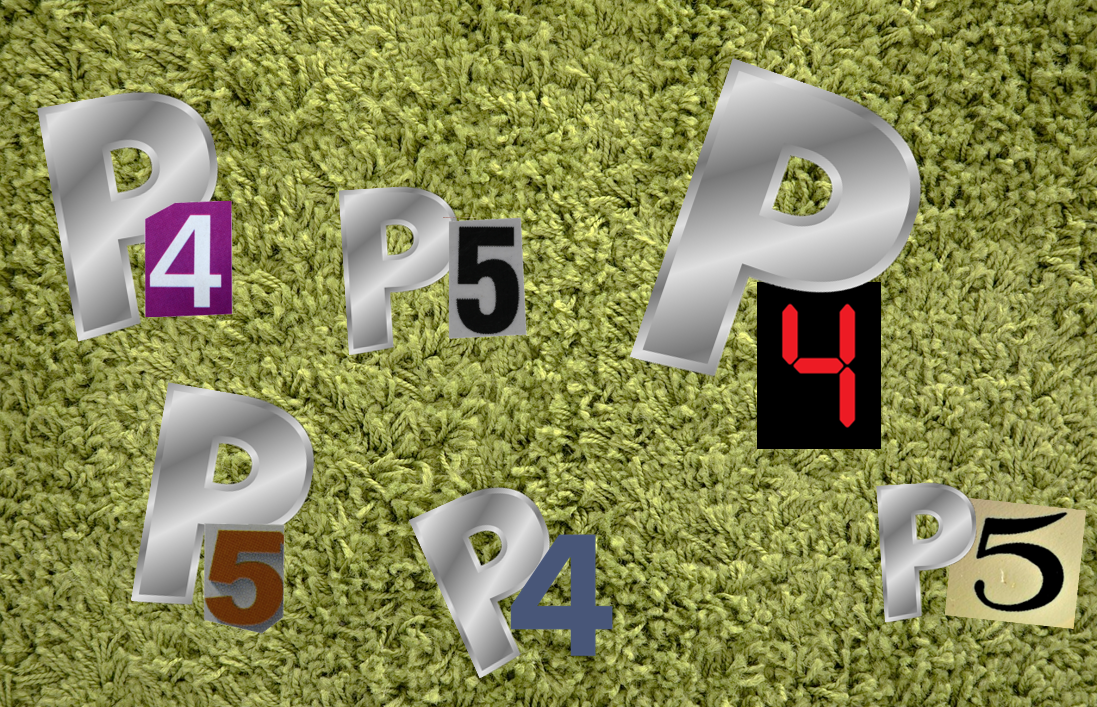

Where it gets interesting is when we look at the cume audiences for radio stations in a given market. For analysis purposes, the data are divided into segments based on how much of a respondent’s listening goes to an individual station. A person who spends more time listening to your station than any other in the market is known as a P1.

And if you’ve ever talked to a radio programmer about her ultimate goals, the idea is to attract as many P1s as possible – the folks who spent more time tuned into whatever it is you’re programming. They are the gold standard that contributes to achieving great rating books.

And it follows that a P2 spends the second most amount of their time listening to a given station, a P3 third most, and so on. While P4s and P5s spend more of their radio listening time tuned into your competition in the market, programmers have long strategized over what it might take to convert some of them into more frequent listeners.

And all those listeners add up. While a P4 or P5 – also known as “fringe listeners” might not spent much time with your morning show or your music, if you have enough of them, they add up. And they all contribute to your overall cume – synonymous with “reach” – a radio station’s ability to penetrate a market. With that ratings housekeeping out of the way, here’s Larry with some timely thoughts about the ways in which ratings are trending in most markets these days. – FJ

“Where Did All Those P4s and P5s Go?”

By Larry Rosin

Ten years ago, in August of 2013, the venerable Z100/New York boasted a weekly cume of an amazing 4.87 million listeners per week.

Consider the fact that the New York metro area has added about 400,000 people over the last ten years. Then try not to let your eyes scan down to the next paragraph and ask yourself what Z100’s reach is today.

Did you guess – 2.73 million? Yes, the big CHR cume-monster radio station has lost about 44% of its cume in ten years. But Z100 is hardly alone among CHR radio stations – in fact it is doing better than average for CHRs in major markets.

Did you guess – 2.73 million? Yes, the big CHR cume-monster radio station has lost about 44% of its cume in ten years. But Z100 is hardly alone among CHR radio stations – in fact it is doing better than average for CHRs in major markets.

There are 26 CHR stations in the top 20 markets that were in format in 2013 and still today. On average, they have lost 51% of their weekly listeners over the last ten years. In total and not accounting for duplication, these 26 stations went from 31.7 million weekly listeners to 15.2 million.

Now, CHR radio has unique issues and challenges and some of this won’t come as too much of a surprise because the share drops for CHRs are well documented. But don’t break out the schadenfreude – check your own station’s cume over time.

Among the top 20 market Country stations with the full ten-year history, the drop is a whopping 36% on average.

And what about Classic Rock, which has consistently risen in the share rankings in so many markets over this past decade? The cumes for top 20 market stations have “only” dropped by 27% on average. Even Fred can’t be happy with those cume shortfalls.

Not a single station in any of these three formats has maintained its reach levels from a decade ago. Send a prize – perhaps a gold medal – to WKIS – the Country station in Miami – which is the “champion” in this analysis, having only dropped 7% – the least of any of the 70 or so stations in these three formats with at least ten years’ tenure.

The silver medal goes to WMGK in Philadelphia, the market’s Classic Rock station. Only 9% of their cume has eroded during the past decade.

The silver medal goes to WMGK in Philadelphia, the market’s Classic Rock station. Only 9% of their cume has eroded during the past decade.

After these two “cume magnets” – relatively speaking – third place is not even in the teens – so the bronze will not be awarded.

What’s fascinating to consider when you look at these precipitous drops is that total market cume has not fallen by anything close to these average numbers for individual stations. So what does it mean when all these stations are shedding mass quantities of cume and yet the market is only receding a little?

It means that people are listening to radio, but to fewer total stations over the course of the week.

A little digging on the New York ratings front allows us to see the change over the most recent four years. In Spring 2019, people in New York averaged 3.3 different stations listened-to over an average week. In Spring of this year, the number is just 2.6. People just aren’t “tuning around” as they once did – another “reality check” especially for veterans of the radio wars.

In fact, the days of having robust numbers of P4s, P5s or higher are just gone.

Without a doubt, the pandemic and its aftermath are factors in this cume falloff. The car is a key location for “punching presets” as many people still have their go-to stations assigned to their car radio buttons. Of course, many of today’s vehicles don’t have the traditional two-knob-six-presets array where AM/FM radio was front and center in the dash. Now, it’s more likely to be a touch screen where broadcast radio has to coexist with satellite radio, digital streaming platforms, podcasts, and other audio options. It is logical to conclude this wide array of choice has contributed to fewer radio stations listened to by the average consumer.

course, many of today’s vehicles don’t have the traditional two-knob-six-presets array where AM/FM radio was front and center in the dash. Now, it’s more likely to be a touch screen where broadcast radio has to coexist with satellite radio, digital streaming platforms, podcasts, and other audio options. It is logical to conclude this wide array of choice has contributed to fewer radio stations listened to by the average consumer.

In the “old days,” the only option during commercials, a longwinded bit, or a bad song was to just keep hitting “scan” or “seek” and rummaging through the presets, or maybe popping in a CD. Today, it is just as easy to just move to Sirius XM or perhaps a streaming service like Spotify or Pandora.

The other factor, of course, is less in-car listening time in the aggregate – thanks in no small part to COVID and the work from home trend. It all adds up to fewer stations “cumed” by ratings respondents.

So what does this mean for sales and programming? Well, for sellers, perhaps there is a silver lining. Having more of your total listening coming from fewer people means your station is a lot harder to buy around. Your audience is your audience, and they are not straying nearly as much as they once did. Sure, you are delivering fewer gross total impressions and reaching fewer people in the aggregate, but fewer stations today are controlling more of their audience’s radio-listening time.

And even for programming, the implications are similar – fewer stations are splitting quarter-hour listening so a strong brand has an advantage. At least that’s true among people who spend most of their listening time on AM and FM stations. For everyone else, cume numbers from a decade ago are in the rearview mirror.

There are many reasons station cumes are down so much, even as market cumes have gone down by a much more modest amount. One can’t fail to consider the near-total blackout of “external marketing.” Radio tells its own clients about the importance of advertising to stay top-of-mind, and yet generally American radio fails to do this itself.

There are many reasons station cumes are down so much, even as market cumes have gone down by a much more modest amount. One can’t fail to consider the near-total blackout of “external marketing.” Radio tells its own clients about the importance of advertising to stay top-of-mind, and yet generally American radio fails to do this itself.

When individual stations advertised “off air” – on TV, billboards, and print – many would experience “cume bumps” during those weeks – or even months – of marketing. But what about when more than a dozen stations in markets like Chicago, Atlanta, St. Lous, and Los Angeles were all engaged in advertising campaigns at the same time? It may be anecdotal, but there was often a palpable market buzz for radio. Regular folks talked about what radio stations were doing – contests, morning shows, promotions, and events.

Yes, all of this happened in the “B.I.” days – before Internet. That was perhaps the last time local radio was often able to dominate the media conversation. All of that would seem to have contributed to boosting the collective cume of the market.

But today, we’re living in a different world. The days of having significant numbers of P4s and P5s are rapidly leaving us behind.

What can radio do – what is your radio station doing – to make sure the P3s and P2s don’t drift away as well?

We know from our research that it’s often a matter of staying top-of-mind. In fact, “unaided awareness” – all the radio stations a respondent can think of without prompting – continues to be a key metric in determining whether individual stations succeed, fail, or end up mid-pack.

determining whether individual stations succeed, fail, or end up mid-pack.

While few stations have the pockets to finance sustainable marketing campaigns, perhaps there are opportunities to partner with other local media outlets that might find themselves in a similar boat. After all, what’s more important at this point – $5 remnant spots that fill up a log – or trade units with a local television station?

The other answer may be digital. How can broadcast radio stations benefit from the same digital media outlets that have disrupted linear listening? How might marketing presence on social media and in other new media platforms expose radio to new audiences? Campaigns featuring TikTok videos, gaming channels like Twitch, or producing popular podcasts are ways any station can use the digital tool kit to stand out and get noticed.

Critics may argue – with credibility, by the way – that all these activities should have been happening for years now. And they would not be wrong.

You never know – maybe a true commitment to this activity would regenerate some of those forgotten P4s and P5s – “fringe listeners” tuning in to find out what a station is doing, on and off the air.

Over time, maybe they would turn out to be actual fans.

Thanks to radio ratings historian Chris Huff for the station data and Westwood One for the New York analysis.

You might find it helpful to read “Radio’s Reality Check” blog post here. And its companion piece “More Radio Reality Checks” here.

And you can still get your own market and format level data to help guide you in 2024. Register your station for Jacobs Media’s 20th annual Techsurvey 2024 here. Technically, it’s too late, but if you sign up before the week’s out, we’ll get you in. – FJ

- Under The Influence(rs) - March 14, 2025

- Radio’s Dilemma: Trump Or Get Trumped - March 13, 2025

- What About Bob? - March 12, 2025

Leave a Reply