I’ve been involved in the design and implementation of what are commonly known as perceptual studies for four decades, starting with my first real job out of college working for the venerable Frank N. Magid Associates based in Marion, Iowa.

Frank’s company was the gold standard of media research working for the biggest and best names in the business. He made his name in TV, and then branched out into the radio research space. During what I now believe was the golden age of radio research, I was fortunate to work alongside Jon Coleman, Bill Moyes, Bruce Fohr, Alan Burns, Doug Jones, and many others who went on to become successful media research entrepreneurs themselves.

Back in the ‘70s, Magid’s version of perceptuals was in-home studies. That’s right – armies of interviewers went block by block, surveying consumers in big and small markets. In many cases, these extensive interviews were an hour in duration, and included several hundred respondents.

When Moyes left Magid, he pioneered telephone surveys – a quicker, more efficient way of garnering audience information that was more efficient, less expensive, and considerably faster to turn around than those exhaustive in-home interviews.

Today, the phone is still used by many of radio’s research companies, often in conjunction with an online survey component. So we’ve come a long way. Or have we?

Most radio research studies conducted today focus on the same things we did at Magid back in the day. They are essentially surveys designed to determine how your station is doing versus the other stations in town. Given the longstanding tradition of radio competition and the quest for “radio dollars,” it’s understandable that broadcasters take a narrow focus. After all, it’s a model that’s worked for years.

Until it doesn’t.

While many of today’s perceptual studies allow for respondents to choose Pandora or Sirius XM as a station listening choice, that’s where it stops. The rest of the survey is about the meat and potatoes issues – DJs, music, and image statements.

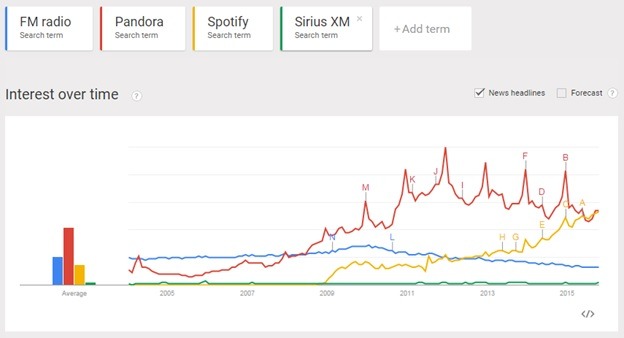

But it’s the incursion of new media that goes to the heart of radio’s new competitive challenge. A look at a 10 year trend of search terms on Google shows how Pandora, in particular, has made its climb, Spotify has become a major player, Sirius XM has never truly exploded, and FM radio has generally held its own while being surpassed in search by both pure-plays streaming channels. Broadcast radio, of course, is well ahead of any Internet radio brand, but consumer interest has clearly shifted – a warning sign that change is in the air.

If you conduct focus groups, you see this all the time. Among the Millennial audience, of course, Spotify, Pandora, and YouTube are serious players. They often perform a different type of role than an FM radio station (whether you want to actively build a playlist or let the service do it for you), but they occupy a portion of your audience’s music listening time. In News/Talk (and often in Public Radio), the competition isn’t usually other radio stations, but websites, podcasts, and apps.

When you actually listen to consumers – and don’t just rely on spreadsheets and pie charts – you begin to understand the changing nature of media consumption. And you also get a sense for the human factor that is radio’s true strength.

Because as much as consumers enjoy creating and sharing playlists, discovering new bands on Facebook, or reading polling stats on Politico, there’s no substitute for the local personal connection that only radio can provide.

Whether it’s acknowledgment on social media sites, airing listener phone calls, or connecting with consumers at concerts and events, radio has the ability to own its turf, work the streets, and make eye contact with the people that matter. Every station should have a game plan that takes into account its street presence as it was once called. But between budget cutbacks and an adherence to the way it’s always been done, this has become an afterthought for many broadcast groups and clusters.

It is interesting that companies like Townsquare that specialize in event promotion may derive residual benefits from producing hometown concerts, bridal fairs, and other audience get-togethers. These are listener networking opportunities that put call letters directly in front of consumers. You may enjoy Pandora’s skip feature or the ability to listen to satellite radio on road trips, but meeting a DJ, host, or staffer from a local radio station is a different thing entirely.

And the other piece is giving listeners a voice. Because the lesson of the last decade of so-called Reality TV is that consumers want to be heard. In fact, they want to be on the air. Ask anyone who tours your air studio or picks up a prize at the front desk, and you’ll learn that their desire to say “hi” to friends, co-workers, or family members is off the charts.

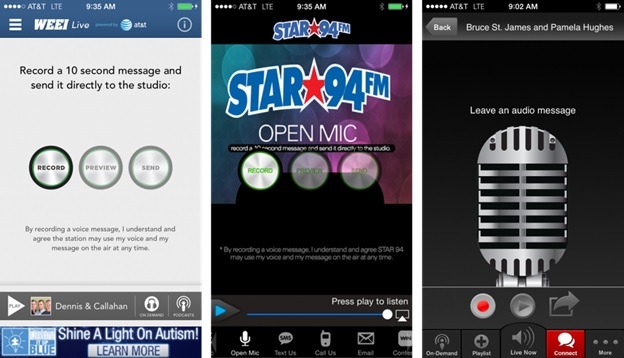

That’s why our app company – jācapps – markets a feature called “Open Mic,” giving the audience just that opportunity in a setting that stations can control. Just the push of a button and listeners can record a shout-out, reaction, quiz answer or anything else. The quality is great, the audio is sent directly to an email box, and stations can curate, edit, and arrange the sound bites they choose to air.

They can’t do this on Pandora, Spotify, or SiriusXM…yet.

Rethinking radio’s perceptual studies to accommodate the new competitive landscape, and the ways in which broadcast radio can remain relevant both with listeners and advertisers is how the conversation can be rebooted.

It starts with asking the right questions.

And listening to your listeners.

- Media In 2025: Believe It Or Not! - January 15, 2025

- Every Company Is A Tech Company - January 14, 2025

- The Changing Face Of Social Media (OR WTZ?!) - January 13, 2025

I’ve become something of a contrarian here. We do research on OUR audiences and then sell that through to our clients. It’s non-competitive – and drills down deep into what each of our station’s audiences are planning to buy over the next 6 months. The stations/groups that keep focusing on stealing from other Radio in their markets remind me of an old saw – “If Robin Hood had stolen from the poor, he would have been a common thief.” I’m after the $$$$$$ being spent in TV, print and the Yellow Pages (while they’re still around). “My ratings are better than theirs” only encourages rate cutting and bonus weight. Really knowing OUR audience helps our clients target better – and get better results with their ad dollars.

I think you’re in the right place, Charlie. When radio cannibalizes radio, everyone loses. A strong understanding of what resonates with your listeners is the key to staying vital and relevant no matter what the competition does. Thanks for chiming in.

Thanks Fred 🙂