In this year’s Techsurvey, we explored an area we’d only touched on before – pay content in the form of subscriptions. Twenty years ago, the only media content most people paid for was newspaper and magazine subscriptions. Today, it’s a different world, and an overwhelming majority of consumers are subscribing to audio and video content platforms.

So, in TS20, we set out learn about how willing core commercial radio listeners are to fork over their hard-earned cash for online entertainment. It turns out video subscriptions are considerably more popular than their audio counterparts. Overall, 84% of our respondents subscribe to one or more video services. In contrast, six in ten purchase an audio channel of one kind of another. Netflix, of course, continues to be the big dog in subscription video, but is now facing serious challenges from Hulu, Amazon Prime, and newcomer Disney+.

Keep in mind, TS20 was fielded way back in January/February of this year – a lifetime ago from where we are now. And that’s why it’s so interesting and insightful to look at this data through our new – and rapidly evolving – coronavirus lens. For example, we asked our 46,008 participants whether they’re concerned about the subscription fees they’re paying for this content. And it turns out, more than six ten expressed concern about how much they were shelling out each month for video and audio programming.

A faltering economy, massive unemployment, and heavy 401K and investment losses may put a point on this chart. How many credit card bills away are we from consumers staring at the rising number of subscription fees they’re incurring, and deciding to make some necessary cuts? Among heads of households, it is clear these charges will be scrutinized like never before as money tightens during a crisis with no clear end in sight.

Don’t think these streaming service providers aren’t concerned. AdWeek reports several are offering 30-day free trials and other goodies to keep subscribers engaged. Some are extending these free sampling periods as well, while Disney+ and Hulu have made programming available sooner to subscribers to keep them locked in.

And most know the extreme lengths – and rate reductions – SiriusXM normally goes through to retain subscribers when things are “normal.” In many ways, their business model is threatened by COVID-19, because so much less time is now being spent by consumers in cars. Maybe that’s why Howard Stern announced on Monday that SiriusXM streaming content will now be delivered free from now until May 15. That’s six long weeks to try to capture folks in their homes.

And most know the extreme lengths – and rate reductions – SiriusXM normally goes through to retain subscribers when things are “normal.” In many ways, their business model is threatened by COVID-19, because so much less time is now being spent by consumers in cars. Maybe that’s why Howard Stern announced on Monday that SiriusXM streaming content will now be delivered free from now until May 15. That’s six long weeks to try to capture folks in their homes.

Providing longer free trials, free sampling, and deep discounts isn’t just smart business; it’s an awareness that more people are spending time at home on their couches – and in a growing number of cases, out of work. Yes, they’ll have more time to watch a lot of television. And while you would expect video streaming platforms to experience growth during this new “stay at home” era, it’s not certain consumers will remain copacetic with buying content from multiple channels month after month.

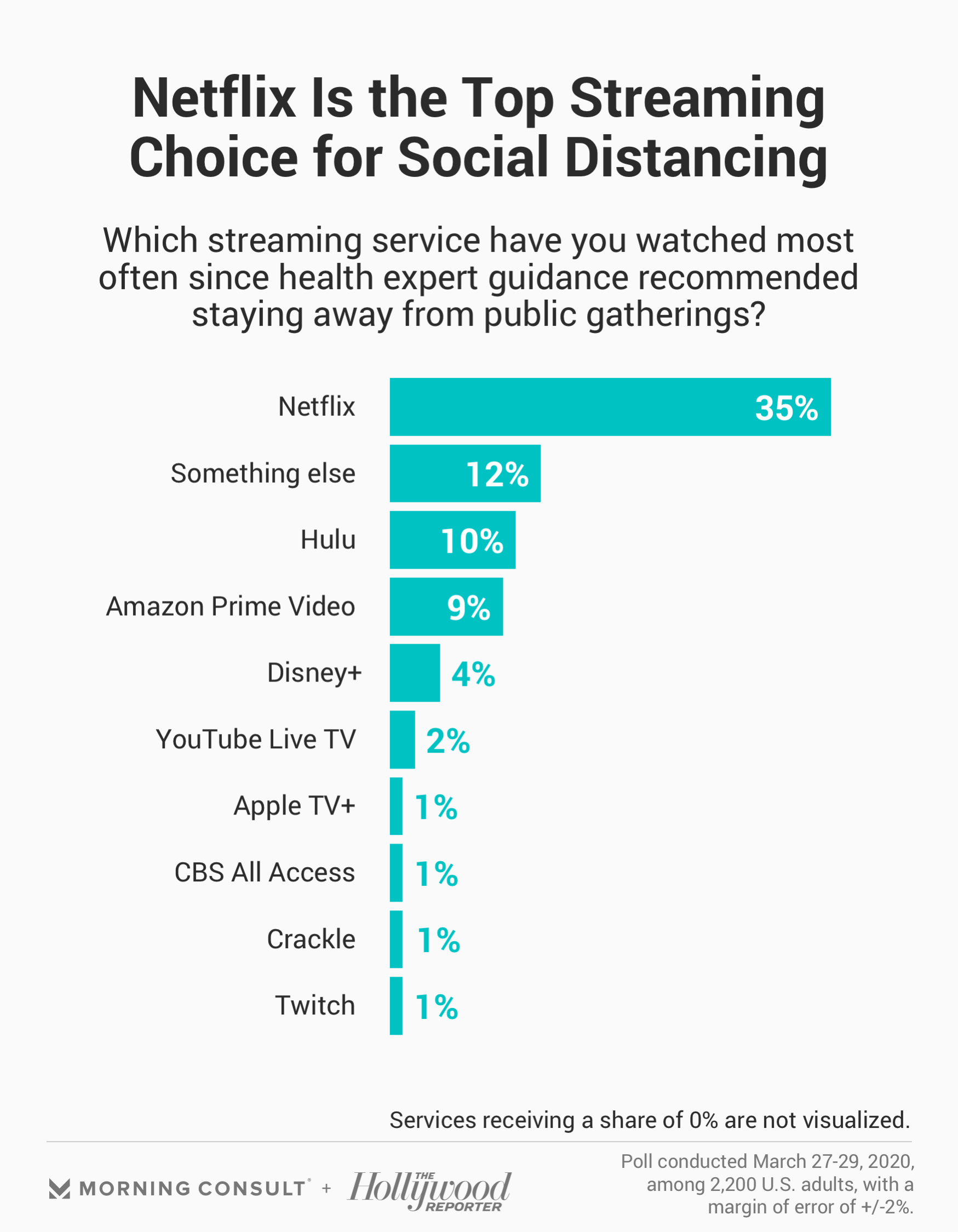

Now all that said, not everyone agrees with my premise. A new survey from Morning Consult indicates streaming video platforms will have a field day with more people at home – at least Netflix will. Incidentally, we’re seeing trend in our in-the-field Coronavirus Survey I’ll be able to share with you next week.

The Morning Consult survey is very fresh. In partnership with The Hollywood Reporter, their field dates were March 27-29, and the data predictably shows a marked increase in video streaming since earlier in the month when most people were still out and about.

But it’s been all about Netflix. When the 2,200 respondents in the Morning Consult survey were asked which video streaming platform they watched most since the coronavirus crisis started to heat up, Netflix has established better than a 3:1 lead over every other brand – including Hulu, Amazon Prime Video and Disney+. That’s how you define dominance, and it suggests that while there are many competitors, Netflix owns the category.

Netflix spent $15 billion (with a B) on programming content last year. And when people wonder why so much money is earmarked toward content, this chart tells the story. Netflix has a buzzworthy hit on its hand with “Tiger King,” as well as other series that are especially bingeable while people find themselves in their homes.

It’s clear in this study the pandemic has spurred increased interest in subscribing and consuming video streaming services. But it was conducted before the rent was due yesterday, before 401K statements for March were mailed out, and while many were in the process of being furloughed or fired.

What will their attitudes be toward subscribing to multiple streaming platforms – above and beyond the big dog, Netflix?

And that’s why – especially in the audio streaming world or even with satellite radio – I believe radio has a chance to stand apart at this crazy time in our lies.

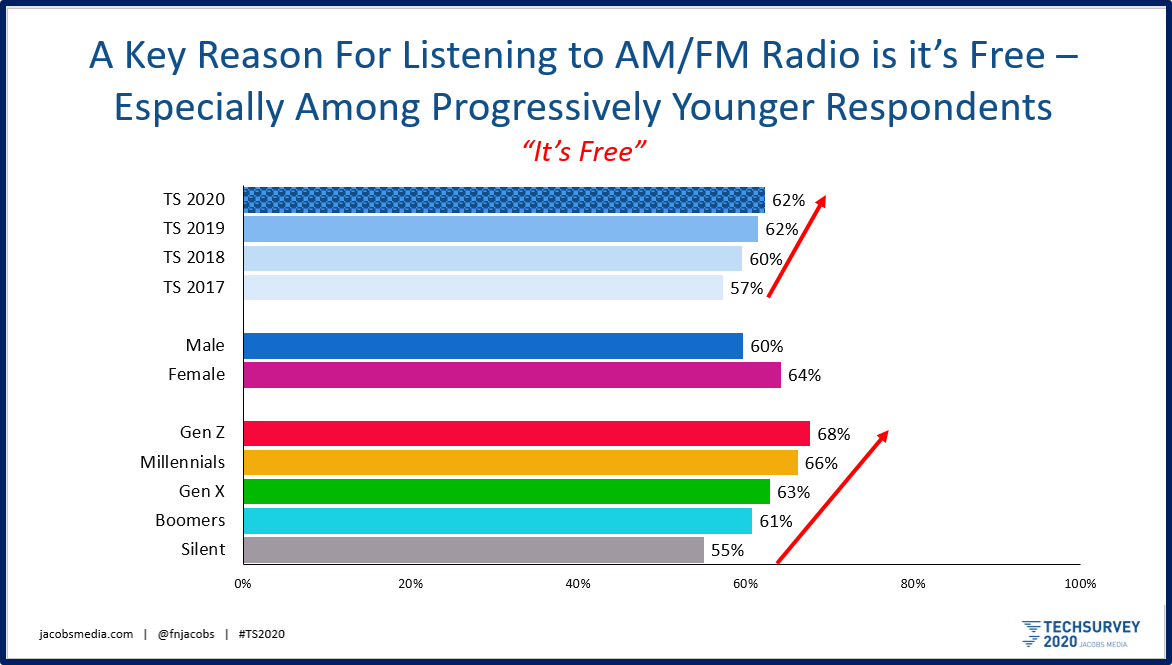

Our Techsurvey data indicates that because AM/FM radio is gratis, no charge, complimentary, no dough, yes, FREE, that’s a big deal. Because so many credit card invoices are littered with multiple media content fees, radio’s value proposition could prove to be a boost – if stations devise clever ways to communicate it.

In our “Why Radio?” series- the question that helps us better understand why people are still listening to broadcast radio in a sea of seemingly infinite choice, “It’s free” is the #2 response. It is mentioned by more than six in ten as a main reason why they tune in to radio. (“Easy to listen to in the car” is the top reason.)

And when we zoom in on those who value radio’s no cost benefit, we see an interesting trend in the demographic groupings:

The trend line is clear. Being free has been at this same high level now for at least four years. The idea of free radio is even more appealing to women, as well as increasingly younger consumers, ostensibly more conscious of their cash flow.

Of course, the quality of radio station content very much figures into this. Free is great. And live and local, in the moment, quality content is still the foundation of consistent usage.

It’s not possible to accurately extrapolate how the financial downturn is going to affect radio or streaming content services, because there are many key lifestyle differences at work here – age, gender, ethnicity, and of course, where we live, where we work, and where we are situated with the COVID-19 outbreak.

But even before we were beset with a global pandemic, broadcast radio’s basic bargain was already a positive for a majority of our core radio  listeners. As many Americans find themselves hunkering down at home and rediscovering their relationship with radio, it might be a good time to remind them that the more they listen, the cost of listening to the radio remains the same – FREE. And that your call letters won’t show up on their Visa, Discover, Master Card, or American Express bills.

listeners. As many Americans find themselves hunkering down at home and rediscovering their relationship with radio, it might be a good time to remind them that the more they listen, the cost of listening to the radio remains the same – FREE. And that your call letters won’t show up on their Visa, Discover, Master Card, or American Express bills.

During an unprecedented time for Americans as the financial crisis worsens by the day, one of radio’s true advantages could become part of the industry’s post-COVID-19 story.

FREE is good.

Post script: After this blog posted, the U.S. Labor Department announced nearly 10 million American workers have filed for unemployment in just the past two weeks. Yes, it’s a tragic record, and yes, I rest my case.

Post-post script: Morning Consult just released another key chart from this study – the services and expenses you’d be most or least likely to cut back on if you or someone in your family lost their jobs. Given the economic news we’re seeing this morning, that day is rapidly upon us. Note that music streaming services would go before video services. But even four in ten say they’ll cut back on platforms like Netflix and Hulu. Things are moving quickly.

To download our new Techsurvey 2020 deck, click here.

And a special thank-you to Andy Bloom.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Awesome as usual. Thanks Fred.

Appreciate it, Tommy. Be safe.

The focus of your discussion is paid video streaming, as contrasted with free radio, but what about paid audio streaming? There seem to be three categories of audio streaming: (a) pay or you can’t have it, such as SiriusXM; (b) pay if you don’t like hearing ads, such as Pandora; and (c) please pay, but you’re not required to and you’ll hear ads (underwriting tributes or at least liners) regardless.

This last category includes public and community broadcasters heard both over the air and via stream from afar, as well as “broadcasters” whose only channels are online. Using the fingers of both hands, I count myself as supporting five or the former and two of the latter. The amounts in each case are not large, but they are regular and I know the payees are grateful for my support. I enjoy their broadcasts and streams and consider it churlish not to pay. I can’t imagine cutting them off on account of temporary belt-tightening during a crisis like this pandemic, but I recognize many people are not so fortunate. It would be interesting to see a survey of listeners’ responses in these straitened times.

John, we have a national study in the field right now, to learn about what your thinking. The survey is being conducted among commercial, public, and Christian (mostly listener supported). We’ll have the results next week. Thanks for the comment.

Fred: There is one media subscription that most people had twenty years ago that was much bigger than magazines and newspapers: cable TV. It proved very resilient during tough economic times, but less resilient when lower-cost options were available that provided similar benefits. Having seen WBRU/Providence’s transition from FM to online (at http://www.wbru.com), 2+ years ago, I don’t think there is any development in the interim that has strengthened the hand of FM radio. Radio being free/advertiser-supported/listener-supported doesn’t look like a long term meaningful competitive advantage, either. There are a lot of high quality free digital listening options out there — in addition to online-only radio stations like WBRU, ad-supported Pandora and Spotify aren’t going away, nor are the listener-supported ones John Covell noted above. What radio has, right now, is a distribution advantage and, often, very high brand awareness. The distribution advantage is eroding rapidly, however. WBRU is just as available on a smart speaker as it was when it had an FM transmitter. As smart speakers proliferate and traditional home radio penetration declines, in time that will give digital services parity with FM in the home. They already have parity in an office environment full of computers and in the portable/handheld environment. All that’s really left is the car. Over time the digital options in the car get more convenient (cassette adapter > aux cord > Bluetooth > CarPlay/Android Auto) and the per-GB cost of mobile data will likely continue to decline, especially as 5G is more widely available. As we see companies discontinue brands like the once-mighty WBCN and WPLJ — both URLs just redirect — it seems there is a real question about how enduring many radio brands really are.

Peter, this is a well thought-out comment. We see radio’s distribution problems in the home in TS, as well as the invasion of the dashboard now that so many consumers can connect their phones. Still, “free” works for radio if – and only if – stations are providing unique personalities and an embrace of the community. During COVID19, that is coming out the speakers from many stations in markets all over the country. Obviously, the quality varies greatly, but this crisis provides radio with a rare opportunity to do its best work in the absolutely worst time in American history (with apologies to Doris Kearns Goodwin). We will see. Thanks again.