In the world of competitive businesses, whether its radio, sports, or tennis shoes, great brands endure. But that doesn’t mean they last forever.

In the world of radio, we’ve seen monster brands that dominated their markets for decades go south. Sometimes it’s a new ownership team that comes in and makes a mess of things. At others, the market’s leading morning show is allowed to pick up stakes and go across the street. In still other instances, it’s a competitive attack that wasn’t anticipated or well-parried. And on occasion, a radio brand simply lives out its usefulness or relevance.

Consumer brands can fall into the same destructive patterns. For as long as most of us can remember, it was the venerable, cool Nike brand, typified by their inspirational “Just Do It!” mantra accompanied by their famous “swoosh.”

But now Adweek and other marketing sources insist the great Nike has been suffering for some time, failing to capture the buzz that permeated their brand when Michael Jordan and Tiger Woods were their bigger-than-life spokespeople. These days, Nike finds itself in a different arena, when they ink the hottest stars of the day – like Caitlin Clark – and yet, even she cannot apparently move the needle for a brand that has seen better days.

Over the last several decades, Nike was utilized again and again by experts as an illustration of brand marketing done right. Today, the company’s brain trust seems tentative and unclear in their approach.

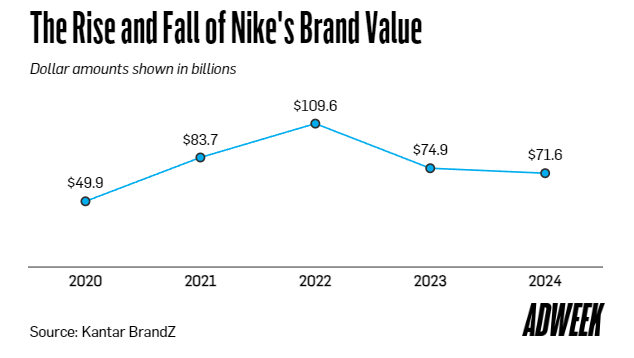

A look at how far Nike has fallen from grace in recent years is sobering, and a reminder than even the greatest, most dynamic brands often fall victim to down-cycles, fashions that get tired, and campaigns that simply age out. In Nike’s case, they’re not going out without a fight. If you’ve watched any of the Paris 2024 Olympics coverage, you’ve no doubt seen Nike’s aggressive marketing.

The question is whether their new campaign is on-brand, and can it help to recapture the energy Nike had more than 20 years ago.

According to Adweek’s reporting duo of Brittaney Kiefer and Rebecca Stewart, the strategy shift occurred during COVID when newly appointed CEO John Donahoe (from eBay) joined Nike. Like many companies during the pandemic, it was an unsettled time that caught many companies off guard.

In Nike’s case, the company cut ties with retailers like Foot Locker, Macy’s, and DSW in favor of digital direct sales. When the malls emptied during the early weeks and months of COVID, of course, this might have been the only strategy. And for a while, it worked, increasing Nike’s brand value. Until things stalled out and haven’t recovered:

And the recent results for Nike have been similarly discouraging. Kiefer and Stewart describe the company’s June earnings as a “disaster,” noting their shares initially plummeted by 23%.

For a company who’s branding was often considered to be superlative or even brilliant, Nike’s results in recent years have been more than disappointing. And now, nothing seems to be working that can turn around the company’s waning fortunes.

And that raises this question: What can formerly successful radio brands that have lost their mojo learn from Nike’s rough patch? Here’s the rundown from Adweek, allowing us to trace and even second guess Nike’s steps:

1. Massive layoffs – Following most other companies post-pandemic, Nike axed 740 staff members at their Beaverton, Oregon, main office earlier this year. These employees were generally from the company’s marketing, technology, and innovation teams. It is likely too early to make a call whether this radical move was an overreaction, too late to make a difference, or something else entirely. Like mass layoffs in radio, it usually takes some time to determine whether these cuts were a long time coming or a capricious mistake that will cripple the company down the road.

2. The Olympics commitment – Nike pulled out all the stops this summer to support the Paris games. But as those of us in radio know, marketing a flawed or lackluster product often turns out to be a bad investment. Nike is now up against competitors with better brand value (Adidas and On are both mentioned), as well as other up-and-comers in the space. Will its investment in the Olympics buoy its flagging marketing posture, or stimulate sales? Or will it turn out to be like so many Superbowl ads – very expensive, highly flashy, but offering nothing most consumers can grab onto?

3. Bold new creative – You’ve got to give Nike credit for trying something different for their much anticipated Olympics marketing. The “Winning Isn’t For Everyone” campaign feels very little like “Just Do It.” However, it is in your face, ultra-competitive, and it has a distinctive “take no prisoners” attitude, reflecting the taunting mindset so much a part of competitive sports today. Will it stimulate 16 year-olds to buy shoes? Or the homeowner who simply wears athletic shoes when cutting the lawn?

4. Throw marketing caution to the wind – Some look at Nike’s creative for “Winning Isn’t For Everyone” as smart risk-taking for Nike. Richard Exon, founder of the creative agency, Joint, gave Adweek his assessment of this campaign:

“It has the kind of edge, attitude, and distinctiveness that should be applauded.”

But will it reinvigorate a tired brand?

Adweek goes back to Nike’s very bold Colin Kaepernick ad back in 2018 to make the point creative risk-taking has long been a part of the Nike brand. It was very much a “Hail Mary” ad that attracted a lot of attention, going viral just about everywhere. As it turned out, the controversial campaign was responsible for a 10% sales increase when it was released. And one observer called it “the peak of Nike confidence,” an obvious morale booster for the Nike team.

Nike brand. It was very much a “Hail Mary” ad that attracted a lot of attention, going viral just about everywhere. As it turned out, the controversial campaign was responsible for a 10% sales increase when it was released. And one observer called it “the peak of Nike confidence,” an obvious morale booster for the Nike team.

The question is, how much of this edgy advertising can any brand actually do before it becomes overbearing?

5. The shift to digital – Some point to Nike’s departure from brand marketing and going all-in on digital sales revenue as a miscalculation. In the process, Nike pretty much decimated its “ground game” – its former emphasis on retail. Instead, it was all about sending all eyeballs over to its website and apps. By going full-on content marketing, former Nike brand director Massimo Giunco says the company starved its brand marketing initiatives.

In response, Kiefer and Stewart note the web activity has been greatly curtailed. Meanwhile, they tell us Nike has re-established relationships with retail brands rather than sink the bulk of its resources into e-commerce.

So, will any of these machinations actually work?

It is obvious from the Adweek article that none of the analysts agree on whether Nike is on the right track, including those who formerly worked for the brand. In researching this story, Kiefer and Stewart spoke with half a dozen experts who were either on the Nike leadership team or worked intimately with the company, along with other marketing experts.

The question?

“How can Nike regain the edge that defined its brand for so long?”

And their conclusion?

Everyone has a different take on Nike’s challenge. Some are concerned the culture has passed the brand by. Then there are those who feel Nike has lost its advantage allowing other brands to catch up or even blow by the “swoosh.”

One even feels Nike should once again cast itself as an underdog, similar to its early run-up to the big time.

The fact is, no one knows. And it is reminiscent of what can happen to once-dominant radio brands that have lost their way. Success, as we know, has many fathers (and mothers). When it all goes south, everyone has a theory – current staffers, past employees, marketing experts – you name it.

know, has many fathers (and mothers). When it all goes south, everyone has a theory – current staffers, past employees, marketing experts – you name it.

Interestingly, audience research is not mentioned in this entire 1,748 word article. And yet, everyone from athletes to amateurs to the entire population wears what used to be known as “tennis shoes.” What type of research is being conducted and how has it informed Nike’s strategy? Sadly, talking to actual customers is not part of this marketing saga.

When we’re talking about consumer-facing brands, perceptions matter. Are the old Nike loyalists hanging tough with their famous shoe brand? And what of the millions of Gen Zs and Gen Alphas who don’t know Tiger Woods from Tony the Tiger?

What do they think of these millions of dollars worth of marketing, digital/e-commerce marketing, storytelling, and brand marketing?

The one thing I couldn’t help but come away with from Kiefer and Stewart’s analysis is a condition that often is common to “sick” radio stations that have lost their compasses.

In the case of Nike, you get the sense they may have forgotten what they stand for. Or perhaps better put, what the brand is now all about seems to have hard-shifted away from what it used to be – for better or worse.

seems to have hard-shifted away from what it used to be – for better or worse.

In the go-go days of “Just Do It,” it was easy to hold up any idea against that standard and quickly determine whether it was “on brand.” Today, you get the feeling Nike is struggling to nail down its brand essence, from the writers’ room to the C-suite. Every decision is most likely difficult when a brand’s identity which was once clear becomes partly cloudy.

That’s why brand focus is so important. And yet, many consumer products and radio stations often lose their moorings, especially when they’re looking quarter-to-quarter, rather than staking out the long haul.

Nike has the funds to make this a marathon. Given enough time, you can’t help but think even a newly reconstituted team will figure it out. After all, everybody wears athletic shoes, and most people own several pairs. It’s a fertile market for the right product with a great message.

You might make the case broadcast radio’s time horizon is shorter, and fraught with even deeper challenges. And you’d get no argument from me. How radio brands can navigate these waters with fewer people and even less dollars is a genuine conundrum.

It begs the question why more companies don’t run bifurcated strategies – one for those few still-powerful brands and those almost always in the middle of the pack.

Supporting its biggest brands is the best pathway for radio’s future…even one that is tenuous and unpredictable.

Just do it.

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

- Can Radio Afford To Miss The Short Videos Boat? - April 22, 2025

An interesting and insightful read, as always. Thanks, Fred!

As a former Sony employee, I remember when Sony had much greater prominence in our cultural consciousness: hit movies, powerful record labels, Walkmans, Discmans, PlayStations, home entertainment systems, etc. Their game in the 90s was to own the entertainment landscape, from content to the devices we used to consume it.

People thought of Sony almost like we think of Apple today. What happened?

Their story might have similar lessons for radio.

Sony didn’t respond when faced with innovative competition, such as Apple’s iPod, Canon’s digital cameras, etc.

They lost focus, expanding too far in too many directions.

In 2012, a new CEO stepped in to halt the decline, spinning off unprofitable assets, laying off almost 10,000 employees, and working to overcome a stifling bureaucratic management structure. Today, while they are still a player in electronics and entertainment, their most profitable sector is financial services.

Sony didn’t invent the transistor radio but their innovation in the ‘50s and ‘60s made their portable radios the most popular in the world. The trajectory from creative, radio/electronics people to bankers feels strangely familiar…

Wow, what a line, Laura — pointing out how Sony went from being an electronics/radio company to being more of a financial business. If Radio doesn’t learn from the likes of Sony, it may fail in both businesses.

Laura, the Sony perspective is a valuable one here. Thanks for sharing it. Sony was once a great brand. Before there was Microsoft, Apple, and Google, American tech companies what Sony had accomplished. Today, that seems like a very long time ago.