When you were once a monster entertainment brand whose fortunes have fallen on tough times, lousy ratings, and declining audiences, what’s your move?

No, we’re not talking about a radio station – we’re talking NASCAR. It wasn’t that many years ago when this brand, its cars, and its bigger-than-life drivers were all the rage. Sponsors were standing in line to get their piece of the action, and the industry was only too eager to stitch another logo on a jumpsuit or wrap one on a car.

On slow days at Sports Radio, it’s always interesting to hear the fun when the topic is, “Is NASCAR really a sport?” That’s usually more than enough “chum” to keep the phones and Facebook buzzing for at least one segment.

These days, the NASCAR juggernaut – that amazing combination of sports, entertainment, and gobs of revenue – is struggling to hold onto its fan base, its ratings, and its sponsors. It’s easy to do a post-mortem on brands gone bad (“I told you, so”), and many analysts and pundits have been more than willing to take their shots at NASCAR.

One of the best I’ve seen was written by Alex Gold, CMO of Myia Health in Entrepreneur. “What NASCAR’s Declining Popularity Can Teach Us About Responding to a Changing Market?” details how the once-mighty brand has fallen, and the mistakes it’s made along the way.

And it’s an object lesson for traditional entertainment brands – like radio stations, for example – that have slipped a gear or two or have fallen into disrepair. So, the “teaching moment” is to analyse the NASCAR decline, and figure out how to not let happen to your brand.

Many of us have been there. It’s one thing to launch an exciting new radio station. It’s another to bring a great station back from the brink of disaster. And it happens in the radio business with alarming regularity. Last week, the legendary WAAF in Worchester/Boston – once home to superstars like Bob Rivers, Drew & Zip, and Greg Hill, as well as music champions like Mistress Carrie – signed off for good. While hard to imagine that a rock brand in a major market for half a century would find itself out of business in 2020, it’s a trend that continues to happen in radio.

NASCAR may not be in these direst of straits, but their long time dominance is being harshly tested.

It doesn’t take a rocket scientist to determine where NASCAR’s strategy went off-track. Gold nails it in four (not-so-easy) steps:

- Know your fans and be true to their values

- Loop your audience members into your process

- Acknowledge and collaborate with new entrants in your category – when you can

- Disrupt yourself

Whether we’re talking auto racing or radio listening, these tenets hold up. And they go a long way toward explaining why certain brands lose their way.

A deeper dive into each of these core practices not only reveals NASCAR vulnerabilities, but also serves as a warning for radio operators not to fall into the same traps.

Whether you’re a fan or NASCAR or not, you probably know its roots: the redneck, “good ol’ boy” image is emblazoned in even non-fans’ perceptions. But as NASCAR tried to expand its base, these core diehards took a back seat to an emerging new suburban white collar audience. Every brand needs to have an audience growth strategy, but in NASCAR’s case, Gold’s first step might be amended to “Don’t piss off the core.”

Whether you’re a fan or NASCAR or not, you probably know its roots: the redneck, “good ol’ boy” image is emblazoned in even non-fans’ perceptions. But as NASCAR tried to expand its base, these core diehards took a back seat to an emerging new suburban white collar audience. Every brand needs to have an audience growth strategy, but in NASCAR’s case, Gold’s first step might be amended to “Don’t piss off the core.”

How many times have we seen radio stations express dissatisfaction with its ratings, seek to expand, but fail to keep their focus on their P1s or heavy users? Public radio is currently in this box, working hard to bring young, smart consumers into the fold, while not alienating the core audience (those especially likely to donate to the cause).

And then there’s the consumer research piece. “Listening to your listeners” has long been a Jacobs Media mantra, especially when we’ve found ourselves stepping out into new directions – Classic Rock in the 80’s, Alternative in the 90’s, mobile in the ’00’s, and podcasting in the ’10’s.

Every step of the way, audience outreach lays the foundation for the development of a continuous strategy, and the creation of a tactical plan. If you’re not regularly taking the audience’s temperature, you risk their defection to new and different options.

Of course, it also helps to pay attention to the feedback you’re getting. Gold says NASCAR learned years ago their rules and schedule changes discouraged core fans from showing up to the races. Yet, management didn’t respond to the negatives they were seeing because the ratings and profits were rolling in.

It’s not unlike continuing to milk the cash cow. In the case of NASCAR, the status quo meant expanding sponsorships, adding races, and following  the money. But as we know in radio, too many commercials, bloated stopsets, yet another live read – all these are corrosive to keeping a fan base coming back for more.

the money. But as we know in radio, too many commercials, bloated stopsets, yet another live read – all these are corrosive to keeping a fan base coming back for more.

And then there’s the courage to accept and even embrace disruptors, rather than deny their rise in popularity. Radio broadcasters know this story well – streaming, podcasting, mobile phones – innovations that cut both ways for heritage brands. Do you ignore them, embrace them, or try to beat them at their own game?

For NASCAR, more youth-oriented spin-off sports were the culprits – dirt and short track racing started experiencing success a few years back. In the meantime, NASCAR’s viewership continued to crater.

And get older. Second only to golf and baseball, NASCAR’s percentage of 55+ fans has continued to rise over the years – moving away from digital’s core demographics that gravitate to sports that are quicker, faster, and more electrifying.

The solution? According to Gold, either mount a better defense against newcomers OR embrace them via partnerships. And as we know from radio, vigorously engage with younger fans on digital and social media channels.

The erosion of a once-mighty entertainment brand like NASCAR is a cautionary tale for any company or industry. It’s critical to walk that precarious line between satisfying the core, while expanding the cume.

The erosion of a once-mighty entertainment brand like NASCAR is a cautionary tale for any company or industry. It’s critical to walk that precarious line between satisfying the core, while expanding the cume.

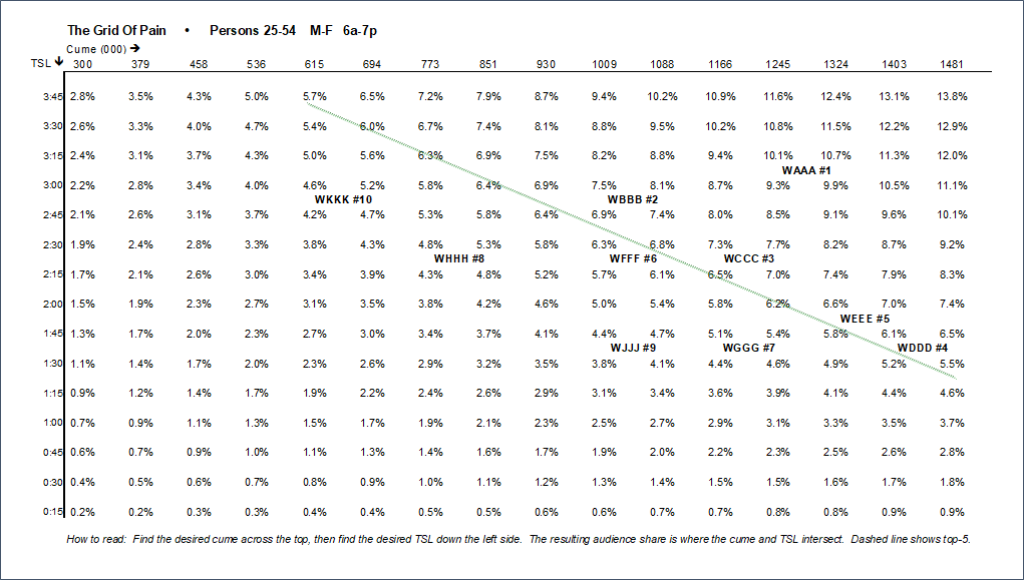

In radio, that chart – cume growth versus TSL increases – was often called “The Grid of Pain” by a veteran Arbitron exec, Gary Marince.

The idea is that you plot every station on the market on its cume (across the top) and its TSL (down the left-hand column. And where the lines meet, it produces your share.

Depending which one you move – reach or duration – determines whether you reach your new share goal.

So, “If we can grow the cume by 10,000 and hold our TSL, we’re top 3 25-43 adults.” Oh, if it were only that simple.

The chart lived up to its name. It is one thing to talk about getting bigger, expansion, making more profits – it’s another to execute strategies without creating….well, pain. In theory, the chart is deceivingly simple. In practice, pulling this off is a tightrope walk that rarely turns out the way you planned it.

NASCAR has learned this lesson the hard way.

It’s easy to look back, and “shoulda, coulda, woulda” the moves that were – or weren’t – made over the years. Especially when the brand was riding high.

These are the moments to stay open-minded and agile, while bringing in the very best thinkers and doers you can afford, studying the audience intently, and taking your best shot.

And hopefully, you avoid that wreck that takes you out of the race.

Thanks to Ted Ruscitti for sending me “The Grid of Pain.”

Speaking of sports, I’ll be presenting at the Barrett Sports Media Summit today in New York City. Hope to see you there.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

As someone who has been in radio since I was 16 and interested in it since age 9…I also have been a NASCAR fan at the same time. I’ve seen NASCAR expand into markets that didn’t really have that many fans, just money. They were NFL wannabes and expanding in states like California and cities like Chicago.

Building cookie cutter mile and a half tracks. Traditional NASCAR tracks in the heart of NASCAR like North Wilkesboro and Rockingham, North Carolina lost dates. They take away dates from legendary tracks like Darlington, South Carolina. Plus, team owners were allowed to expand and own 4-5 cars…reducing “racing” competition among team drivers. Drivers constantly switching cars because they were hiring cheaper and younger talent…some barely out of high school.

As some owners got greedy on dollars for sponsoring the cars, sponsors and decals seemed to change every week too, reducing brand identity and loyalty. No need for fans to buy products plastered on the cars—as they seemed to change every week—along with the paint schemes. There was no longer a familiar car look to identify with. It affected souvenir sales too. Why buy a $150.00 driver/car jacket that would be obsolete in months. These are just a few reasons core fans stopped trusting the product.

As with Radio, owners buying up 4-5 stations in a market reduced competition and formats. Combining some stations in markets to one station on three frequencies. Kinda like having 3 McDonald’s on one street intersection. Fragmenting loyalty and passion for the unique and specific location. Reducing staff and taking well-known personalities off the air for changes in formats that were created to “muddy the waters” in specific markets is careless.

Also, putting formats and music as the star and not caring about listeners loyalty to the local, unique brand or “dj’s”. Thinking a computer can create entertainment with canned announcements. Ones that just fill holes between songs is radio owners/programmers lazy way of saving money at the expense of losing core fans or caring about what they think. Always wanting more P2’s is a great way to lose sight of what makes P1’s happy. If it was a marriage between station and listener, why is the station looking to make other stations’ listeners happy?

Be the brand…be true to your core…keep the passionate listeners happy and you won’t have to advertise as much,…they’ll do it for you. When they have an opinion about your station, then radio becomes the”listener”. Treating them like a special part of the family and respecting their thoughts, good or bad.

In radio, it comes down to trusting that what you say in positioning statements, is what you are, not what you wanna be. Luckily, there are still great radio people and owners that have learned that…in racing and in radio. Strong talent still exists in both and the ones that prep, embrace changes, stay fresh and provide an entertaining product…are the ones that win every time. Thank you for the article!

Mike, thanks for providing perspective to the post. Someone who knows both NASCAR and radio like you do provides more insight about where NASCAR (and radio?) went wrong. Thanks for confirming my notion there are object lessons here for radio to prevent us from going down the wrong path. I added paragraphs to your comment to make it easier to read. And I hope many people do. Appreciated.

What an excellent, thoughtful commentary, Mike! Nailed it! Radio needs more like you and Fred. Thank you.

Great to get that perspective, Dave. That’s why I love writing this blog – when the “community” offers up great perspective.