The coming Facebook IPO is all you’re going to hear about during the next few weeks whether you watch CNBC or not. This is the biggest tech offering since Google (no, not Pandora), and all the “experts” will be chiming in about whether you should invest in Mark Zuckerberg’s stock or not.

Before I launch into my prediction, let me remind you that I am not a financial prognosticator. In fact, if my family’s money manager/financial advisor were free to tell you stories about some of my investment ideas, you would stop reading this post right here and now.

But there are some things that go beyond what Jim Cramer rants about or what you read in the Wall Street Journal.

But there are some things that go beyond what Jim Cramer rants about or what you read in the Wall Street Journal.

There are some things you just know.

That doesn’t always mean they will translate into stock market wins and losses the way logic might dictate. After all, the markets have a nasty habit of reacting in illogical ways even though the experts come on television every day to explain precisely what happened.

But in the case of Facebook, you know certain things, making it easier to analyze this IPO.

Then there’s Pandora. You know that while it’s a popular site that everyone from the automakers to your cousin is all hot over, the business model is shaky. How many ads can they run before their audience gets turned off? We saw it in Techsurvey8 and Pandora’s Joe Kennedy reinforced it at the Worldwide Radio Summit: very few Pandora users are paying the $36 fee to avoid commercials. And the more usage Pandora incurs, the more their royalty fees increase. It’s almost anti-American.

And Groupon. You could have bought that one, too. But you know there are problems with a service that while popular, still can’t figure out how to tailor deals to correspond to your shopping habits, desires, and geography. There’s simply a large percentage of the population that’s not going to be enamored with manicures and pedicures. And last week, Groupon’s young CEO Andrew Mason admitted he’d imbibed “too much beer” during a company town meeting covered by the Wall Street Journal, only reinforcing the immaturity of this deals company.

And you know Foursquare has issues. Yes, there will always be knuckleheads chasing badges at the Panera Bread store in Dubuque, or vying to become the mayor of your groery store, but geo-location has its limits, and this platform just isn’t connecting with consumers in a mainstream way. In Techsurvey8, Pinterest is already well ahead of Foursquare, and it’s hard to imagine a quick turnaround.

You know Research In Motion is screwed. We’ve shown you our Techsurvey data, clearly illustrating how more BlackBerry users will switch to Apple or Android handsets the next time they’re contractually able to do so. By not jumping into apps with a friendly interface, Research In Motion squandered their lead and their business credibility by ignoring obvious consumer needs and desires.

You know that satellite radio has had its day in the sun. Like Pandora before it, Sirius and XM were hot, unique, and offered something different than what you could get on AM/FM radio. But satellite radio has been leapfrogged by the seemingly infinite options of streaming media and entertainment options. Unless you just have to have Howard Stern, NASCAR or some other specialized channel – or you’re a truck driver – chances are you’ve moved on to other music offerings that you simply don’t have to pay for. It will never be as big as subscription television, and will be challenged to keep up with in-dash technologies. Stronger car sales will help but you have to question the value proposition.

And then there’s Facebook.

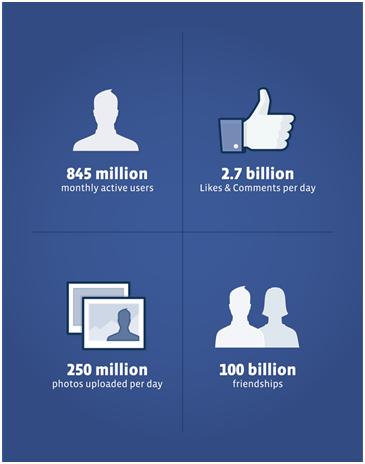

If you’re thinking that Facebook is just another tech offering that’s built on hype, think again. Facebook is something much bigger – and not just because 900 million plus people are on it.

It’s special because of the vision of Zuckerberg and what has been described as “The Hacker Way” by the man himself. Lori Lewis has put together a great presentation that you can see in July at the Conclave “Summer School” that ties together the Facebook philosophy in a way that makes this enterprise worth learning more about.

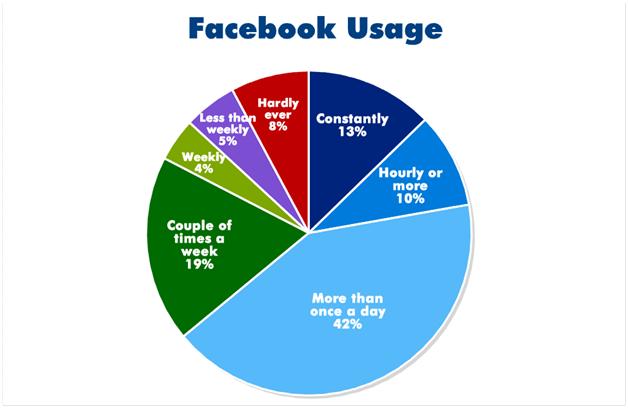

But don’t take my word for it – look at Facebook’s engagement among those who have a profile and use the site on this pie chart from the newly released Techsurvey8. Nearly two-thirds visit Facebook at least once a day, while a quarter show up hourly or more often. If you translated that into TSL or “occasions” for a radio station (or ALL of radio), it would make the RAB, Katz, and broadcasters everywhere very happy. Talk about engagement!

Facebook’s purchase of Instagram speaks volumes about the company’s commitment to connecting social with pictures and mobile. They know what they have to do to keep the brand fresh, and they are not resting on their laurels.

Oh, and unlike just about every other Internet darling, Facebook had revenues in 2011 of $3.8 billion and an operating profit of $1.5 billion. (And essentially none of that was from their mobile efforts.) Now I totally “get” that Facebook has steep revenue challenges ahead, especially monetizing mobile. But when you have this much traffic, heft, and engagement, don’t you have to believe they’ll figure it out?

But if you really want to know why that FB symbol on the NASDAQ could be the next big thing – not just on Wall Street but for the U.S. economy, talk to one of Facebook’s original subscribers – a person who was in high school or college when the service first launched.

They may have become jaded or even discouraged with the service over time. Some may have even considered getting off the Facebook bus or off the grid entirely.

But they simply can’t. They are tied into Facebook – their relationships, photos, the bloodstream of their lives. Like it or not, they know that to be in touch with many of the important people in their lives, they are going to have to stay with Facebook.

So we’re not just talking about a social media platform. We’re talking about a necessary commodity. Like oil or oxygen.

So we’re not just talking about a social media platform. We’re talking about a necessary commodity. Like oil or oxygen.

Some digital polls suggest considerable dissatisfaction with Facebook because of architectural changes like Timeline or privacy rules (or lack thereof). But at the end of the day, it doesn’t matter because Facebook has simply become a necessity – the way that many people navigate their lives and their relationships.

There’s the ongoing controversy about whether companies have the right to request passwords from employees or job applicants. There is significant paranoia among job seekers and job holders about what they post on Facebook.

None of that matters because deep down inside, most Facebook users will tell you they have no choice. It is how they communicate, stay in touch, keep current, and remain plugged in. More and more Facebook apps will keep consumers tied (or manacled) to the channel in the years to come.

You cannot have a baby, get married, graduate, get a new job, lose a loved one, or get a new pet without sharing it on Facebook. It has simply changed the way we interact and connect with other people. Like the telephone more than a century ago, Facebook brings people together in a unique and compelling way. I believe a lot of people are going to want a piece of that.

So, don’t come back to me if it doesn’t somehow work out this way, but I have to say BUY.

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

- Can Radio Afford To Miss The Short Videos Boat? - April 22, 2025

Because it is so omnipresent, (900M worldwide) Facebook is somewhat like buying a utility stock…. except it’s the ONLY utility in the social media space that matters — and that’s a good thing. The IPO, however, will be frothy and way over subscribed, but that doesn’t make it a good INVESTMENT long term. Remember, Facebook still depends on advertising revenue for its growth going forward and that normally follows retail sales.

Good observations, Peter. Penetration and usage matter, but to Wall St., those ad revenue numbers will rule. Thanks for taking the time to comment.