When it comes to competitive decisions, there’s research and then there’s gut. If you’ve been involved in the radio programming game for a bunch of rating books, you’ve likely been involved in all sorts of decisions. There are the rational ones you make unemotionally based on logic and data. And then there are the seat-of-the-pants calls you make often in the moment.

These are the moments where the line between proactive and overreactive blurs. Are you doing the best thing for your brand or are you getting sucked into the competitive pressures all around you.

I have asked about what’s more difficult – launching a brand, building from nothing, and making it a force in your market. Or working for a powerful brand, a market leader, and having to play defense against all comers.

Personally, I’m a fan of the climb. As a consultant, I’ve found myself in this position a lot, especially in the early years. That’s when Classic Rock was the “David” up against “Goliath” radio stations.

In those crazy 80’s when the radio world was first learning about the power of a gold-based, nostalgia format, I worked with fledgling newcomer up against monsters like WMMS, KMET, WBCN, DC101, KYYS, and many others.

When you’re an established brand used to having your way, coming under attack will test you. The very best brand managers keep their cool and don’t let the pressure get to them (even if it is).

But there are those times when the big boys find themselves on their knees, facing an immense challenge that can’t be fixed with a fresh music test or a few billboards in town. When an upstart, brash new competitor comes along that truly steals your thunder, it is a moment of truth.

That’s precisely what has happened to Facebook – at the hands of TikTok. And the audience group where most of the damage is occurring is teens – those legions of increasingly valuable Gen Zs. In the world of social media, when you lose them, so goes your cool factor. After all, Facebook got its start based on young people – college students – and Zuckerberg built his empire from there.

And it seemed like every time Facebook was challenged by “the next big thing,” it managed to buy its way out of trouble. Like a big station that buys its in-market competitors to build a cluster, Facebook has dug deep to scarf up its disruptors.

Zuckerberg swiftly took Instagram out of his competitive arena, stealing the company a decade ago for the low, low price of just $1 billion.

Two years later in 2014, he did it again, purchasing WhatsApp, but this time it cost him. The tab? $19 billion. And while it cost a lot more than Instagram, the philosophy of solving a problem by buying the company and adding it to the portfolio is an old radio trick.

Problem is with TikTok, we’re dealing with a more formidable competitor, and one that is owned by China.

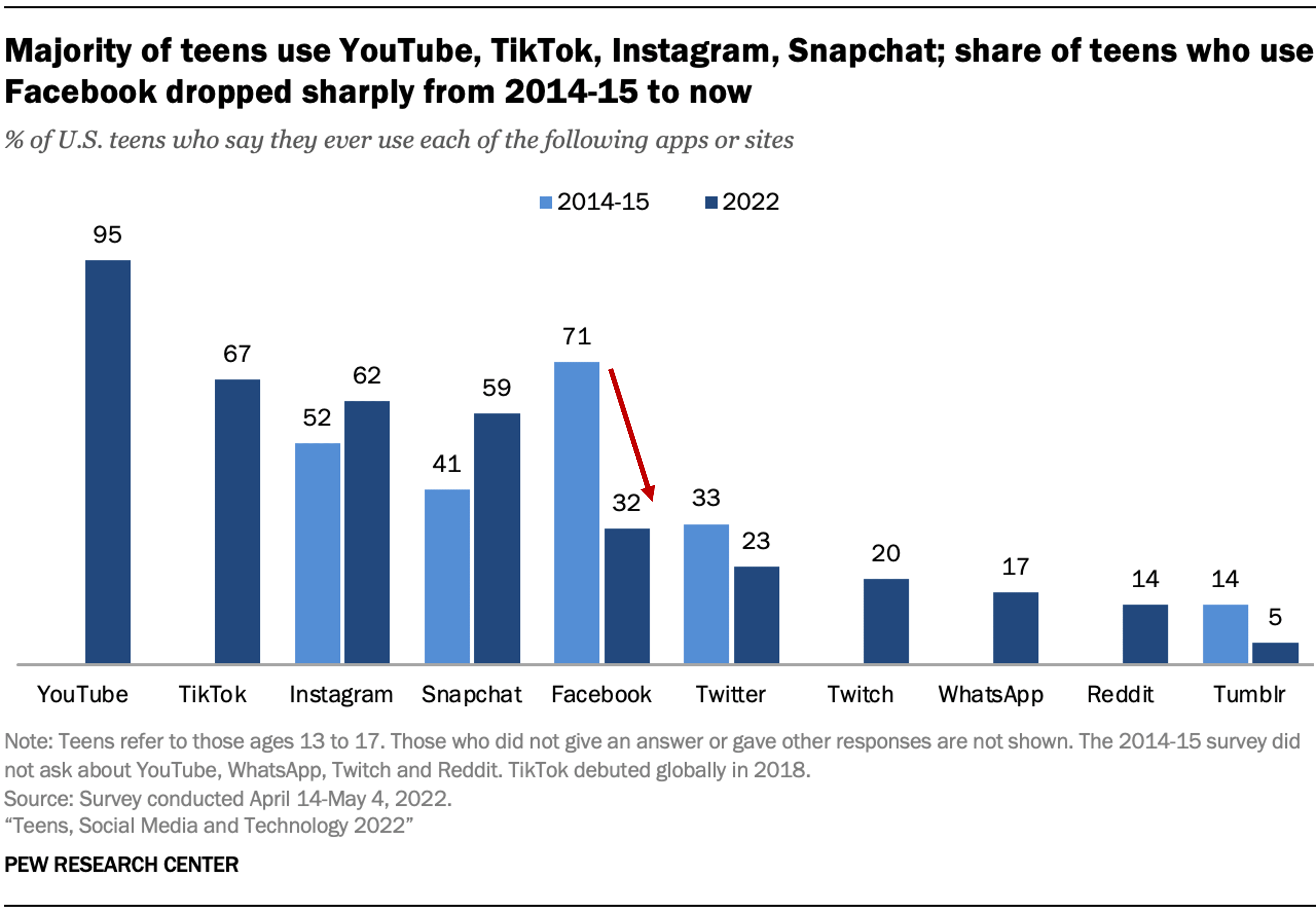

To get a grasp of just how Facebook has lost its “younger end” (as radio PDs would say it), a new Pew Research Center white paper graphs the company’s loss of audience and influence. “Teens, Social Media and Technology 2022” is a must-read, providing an expansive look at the social spectrum.

Talk about bad rating books, this Pew chart focused on 13-17 year-olds summarizes the hot water Facebook now finds itself as it has considered “next steps.”

For Facebook, its teen tumble is dramatic, losing more than half its share. And TikTok now owns double what’s left of its teen users.

Note also that during TikTok’s rapid runup, spiking during COVID, Twitter and Tumbler have also lost much of their young teen turf.

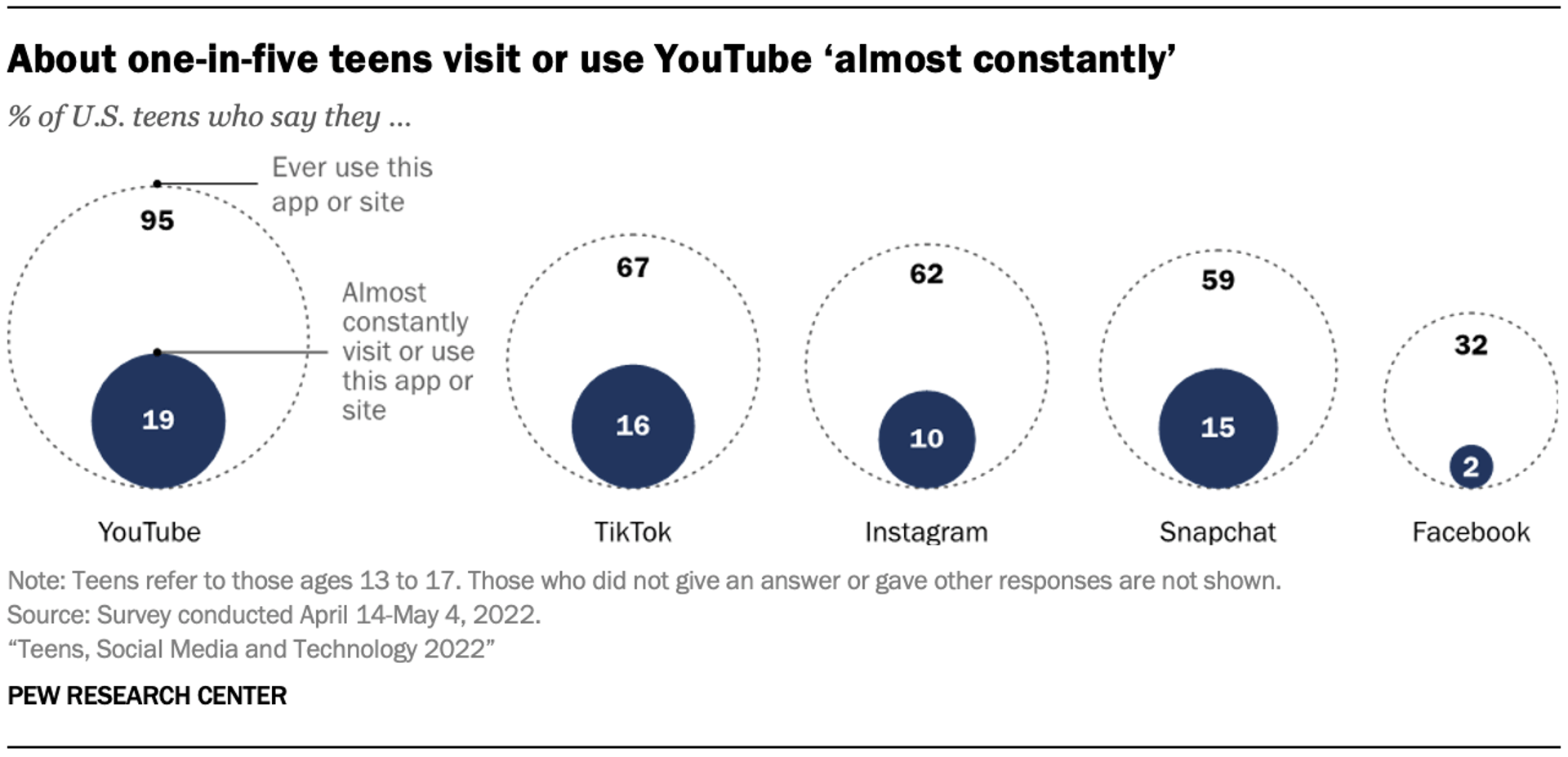

As the Pew analysts also remind us, Instagram has grown despite TikTok’s growth spurt, while YouTube is a juggernaut. Pew reports that nearly one-fifth of its teen sample reports being on YouTube “almost constantly.” TikTok and Snapchat are competitive, but lack the massive “cume” of YouTube:

So, what’s the game plan when you’re Facebook – or any of these other social sites that put a value on teens?

A great piece in Marketing Week by Mark Ritson earlier this month walks us through the strategy. His title says it all:

“You can’t beat TikTok by becoming its clone”

You start with breaking down why a new competitor is eating your lunch. Ritson says it amounts to four main pillars that explain TikTok’s success:

- A huge monthly active user base – now over 1 billion strong

- Great “TSS” (time-spent socializing) – now 45 minutes a day is the incredible average

- A strong “ad-appropriate” architecture, allowing commercials to be easily integrated into TikTok’s habit-forming feed

- Hyper-growth of the platform, allowing TikTok to seemingly come out of nowhere to do its damage.

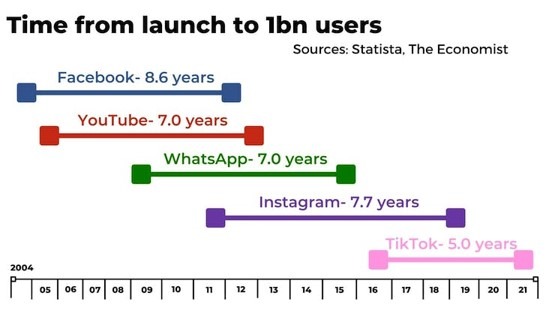

The road to 1 billion users sums up just how quickly TikTok has struck, truly catching its “establishment” competitors off-guard. This Economist chart via Statista shows just how fast TikTok has pulled it off:

In short, what it’s taken a minimum of 7 years for the other social media players to accomplish, TikTok has done in just 5 short years. Credit COVID with supplying the rocket fuel of isolation meeting boredom, and you’ve got an incredible story of “from worst to nearly first” (with apologies to Scott Shannon).

While Ritson nails down the four legs of TikTok stools, as a user myself (no, not close to 45 minutes a day, but still a victim of the platform’s “rabbit hole” quality), there are other attributes that are perhaps more difficult to quantify.

First, TikTok is buzzworthy. If there was an equivalent of the Net Promoter Score for sheer “noise,” TikTok would be off the charts. Second, it is fun. And when you’re “doom scrolling” on another social site, TikTok often provides escape.

First, TikTok is buzzworthy. If there was an equivalent of the Net Promoter Score for sheer “noise,” TikTok would be off the charts. Second, it is fun. And when you’re “doom scrolling” on another social site, TikTok often provides escape.

It’s that “serendipity” (you never know what you’re going to run into, and if you don’t instantly like it, keep swiping) that is impossible to quantify.

And finally, the TikTok algorithm is impressive, studying your every move, like, swipe, etc., and then serving up more of what you apparently like. As you know, I cannot write a line of code, but there’s no question the AI in this platform is top-shelf.

It’s as if the other social media platforms – the giants that once roamed the Internet – hit a virtual brick wall.

Against that backdrop, what might Facebook and the other social sites, caught flat-footed by TikTok, do to get back into teen contention? Or should they even bother? After all, once you’ve lost your cool, it’s near impossible to get it back.

Ritson says it’s a simple case that “the disruptors are now ripe for disruption.” He points out Facebook, Instagram, and the other players on the board simply did not have the agility or the presence of mind to mount a sensible strategy.

His take?

“For all their billion-dollar budgets and talk of strategic agility, the established social media platforms are responding with an astonishingly underwhelming reaction to TikTok’s nascent ascent.”

Ritson points to “copycat” tactics by the rest of the social media field that has served to take them off their own games.

Instagram developed “Reels” as “a new way to create and discover short, entertaining videos.” In other words, the old radio strategy of stealing their technique, talking about it more, and “sit on them.”

This idea of replicating TikTok was recognized and mocked by Instagram influential users, including Kylie Jenner and her friend, Kim:

But it didn’t stop there. YouTube announced Shorts, Snapchat rolled out Spotlight, and Facebook struggled with its Stories, moving away from its core competency as a social platform that connects people with other people. That’s what got Zuckerberg to the dance back in the 00’s.

The lesson in all of this, of course, is that when you overreact to a competitor by shamelessly copying them, you run the risk of coming in second (or worse), and you open yourself up to losing your own brand essence along the way.

Ritson believes Facebook, Instagram, and others simply aren’t built for disruption. It paralyzes them.

He avers that “the Tiktokificaation of social media is one of the biggest strategic errors in decades.” And he may be right.

But as radio programmers know too well, when frontally attacked by a competitor, the smart response is often to understand your vulnerabilities but to take a “you be you” approach.

That is, if you’re a personality station facing a music-intensive commercial-free challenger, be the best personality station you can be – while also cleaning up your vulnerabilities and excesses along the way.

And of course, the other approach is to come up with an innovation of your own. The best way of stealing a competitor’s thunder is to break their momentum by developing something fun – a feature, an event, a new personality, a timely community effort.

In radio, we’re famous for simply signing on a copycat format, hoping it will blunt the attacker. While this sometimes works, it’s a scorched earth, short-term tactic that rarely yields sustainable success. Wouldn’t a new, innovative format or a new personality show recapture the attention and zeitgeist of the market in a more meaningful way?

Yes, these are “radio things,” but social media content creators for Facebook, Instagram, and Twitter have an edge on us broadcasters. They have the cash, the crews, and the content to creatively innovate. They don’t have to decide between doing a perceptual study or a music test. Their resources are bottomless. They can do whatever they need to do in order to meet the moment.

Instead, they opted to copy their competitor.

The strategy worked so poorly that the one-time leader in the category – Facebook – thought it would make sense to change its name and rebuild their brand from there.

category – Facebook – thought it would make sense to change its name and rebuild their brand from there.

Not exactly a meta-move.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

“You be you” has always been the path to success for music artists!

And to a great degree, it works for all of us.