It’s one thing to be trending down, never a fun circumstance no matter what end of the media business you’re in.

On the other hand, there’s the pure exhilaration of being on a roll where your station, company or platform are seeing up arrows everywhere.

And then there’s public radio, where the tea leaves are currently partly cloudy. On the one hand, a story in Inside Radio covers a new Pew Research analysis showing mixed messages about public radio’s current status.

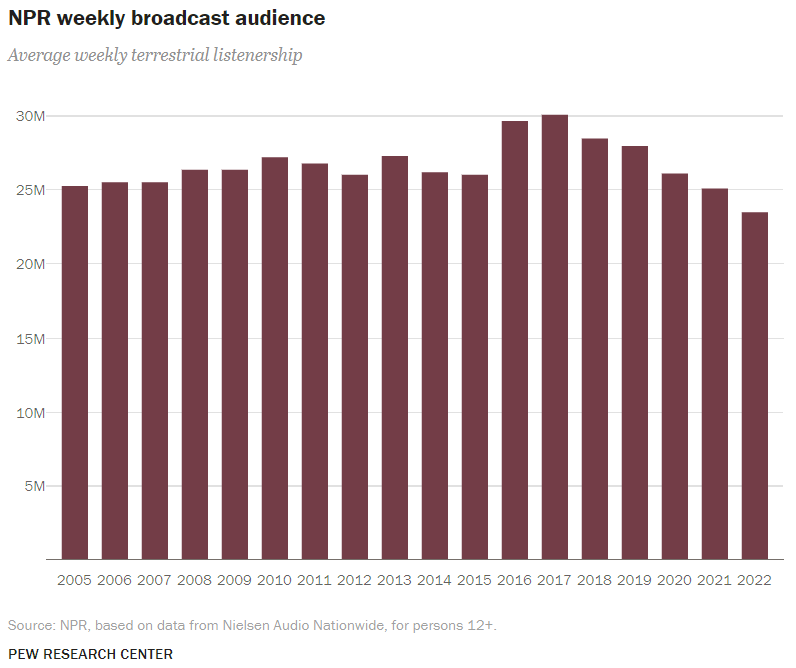

In its “State of the News Media Project,” Pew analysts provide a full palette of data pointing to the contradiction between lower ratings and higher revenues. One of their big takeaways is that public radio listening (measured as NPR usage) has gone steadily down since 2018, showing no signs of a turnaround.

As I’ve written in this blog about public radio’s trajectory the past few years, the rise you see in the chart below starting in 2016 corresponds with Donald Trump descending down that escalator in Trump Tower, setting off what became known as the “Trump Bump.” And as the chart also shows clearly, the subsequent “Trump Slump.”

And as of 2022, listening dropped to its lowest point since 2005.

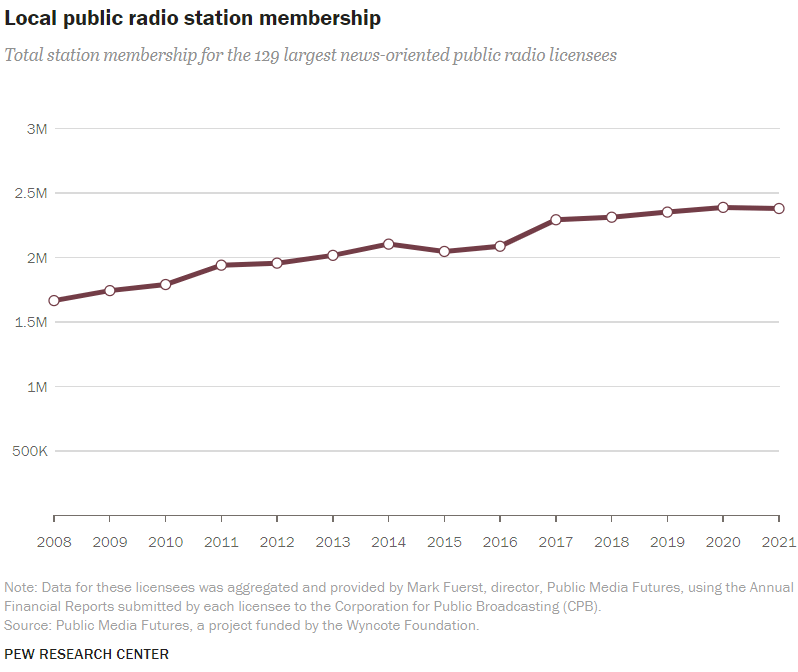

Interestingly, membership (that is, donations) continue to rise among public radio’s 129 biggest news formatted stations, another indication of financial health. Despite the fact station pledge drives are a listening repellent, they apparently are also generating more revenue.

So, the Pew analysis cuts both ways. Other public radio voices express more concern about the state of the system. One of the more concerning comes from former St. Louis Public Radio general manager, Tim Eby. Last month, Tim’s popular “Three Things” newsletter did a deep dive into the precipitous ratings drops experienced by major NPR news stations all over the country.

In his report, Tim looked at public radio stalwarts that have experienced erosion in recent months. In fact he referred to this moment in time a “Public Radio Major Market Meltdown.”

Among the stations in Tim’s report are KQED (San Francisco), WBEZ (Chicago), WNYC (New York), and others. Tim’s newsletters have sparked conversations throughout the system as public radio executives try to get their heads around this moment in time.

And that takes us to the next big meeting of the minds, the Public Radio Program Directors Content Conference next month in Philadelphia.

The conference will open on Tuesday, September 19, with what promises to be a blockbuster – a new study that aggregates more than two dozen local market research studies conducted by public radio stations in an effort to identify key trends that help explain what’s going on.

Sponsored by the Station Resource Group (SRG), Greater Public (the system’s organization focused on underwriting and membership), and the Public Radio Program Directors Association (PRPD), the study is an important one for a system trying to find its core essence.

I have read the report and the “playbook” put together by researchers City Square Associates. It promises to set the tone for the entire PRPD Content Conference. City Square founder and president, Chris Schiavone, will walk attendees through this report.

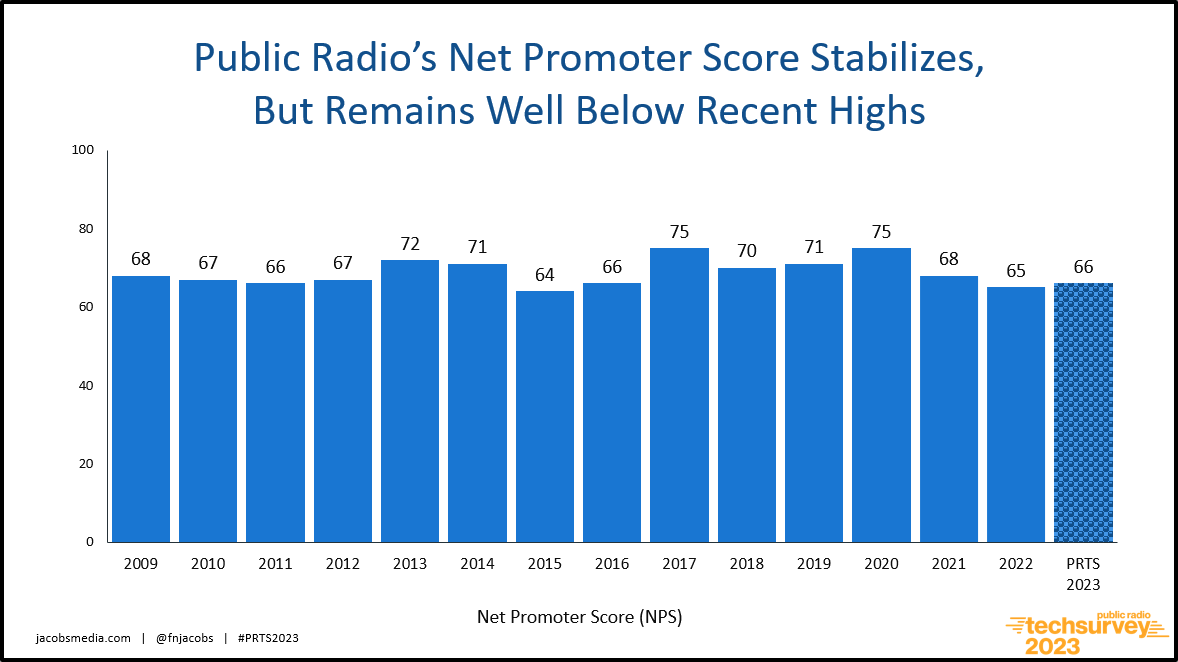

I’m excited to announce I’ll wrap up the day with my summary of our brand new Public Radio Techsurvey 2023. This year, 64 public radio stations participated, generating a robust 26,000+ respondents.

Much of the data mirrors the City Square analysis. And as usual, we got to ask a lot of questions germane to public radio’s understanding of the new lay of the land, including AI, the definition of “local,” and membership and fundraising.

Here, for example, is a sneak peak of PRTS 2023’s Net Promoter Score trending – going all the way back to the beginning of our surveys 15 years ago.

While we see a slight uptick in this year’s study, the trend is well off the strong numbers we saw during the Trump years, reaching a high of 75 in twice. Again, you can clearly see the falloff over the last two years.

By the time “opening day” of this conference is in the books, I believe PRPD’s agenda will offer up a lot more perspective about what public radio is up against and the best ways to move forward.

Registration and details for PRPD’s Content Conference is available here. If you’re in public radio, I hope you’ll take this opportunity to join your community as attendees work together to better understand the challenges and opportunities.

One last thing that may have occurred to you, revolves around the spirit of cooperation and collaboration that exists in public radio. Imagine 24 or so commercial stations (owned by different companies) pooling their research in an effort to make a greater contribution to their medium, not worried about any issues that might arise from sharing proprietary data with others. No, it could only happen in public radio.

This is an important and exciting moment for America’s public radio stations. All of us at Jacobs Media are thrilled to have had role in this process. I hope to see you next month in Philly.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Great piece, although it does leave me with a lot more questions than answers, some of which are also illustrated in the comments on Tim’s blog piece: are there specific demos that are suffering more than others or is across the board; are these problems systemwide, or is do other markets (and markets where there is more public radio “competition) show different results; are these latest numbers truly the start of a death spiral, or just a return to pre-Covid (and even pre-Trump) norms? When I read Tim’s referenced blog, I also found the comments, especially from Mike Henry, very instructive.

Bruce, thanks for the note, and for the smart observation about whether the current erosion is a trend or a momentary loss of audience. As always, there is rarely a big smoking gun. More ofen that not, it’s usually a lot of things that have weakened station brands and NPR.

The secret to Public Radio is Content presented in the Right Style for the Specific Market. It’s a special process.

Indeed it is, Clark.

Even if there’s a decline in the absolute number of listeners, Fred, the steady increase in station supporters (ie, listeners demonstrably willing to pay for the content) tells an important story: The public radio “base” is solidifying. I think that is a good omen for the medium.

An innovation in recent years has been what’s often called “evergreen support,” the retrospectively obvious boon of steady revenue from supporters who know the value and don’t need the distraction of manual renewal every year. Despite the inevitable tedium of pledge drives (yes, I’m guilty of mic-abuse too), the numbers also surely benefit from the fact that streaming technology now lets listeners “retune” temporarily to other NPR stations/networks that aren’t pledgedriving at the moment. These things foster easy perennial support, molto conveniento.

John, thanks for engaging post that has lots of moving parts as the other commenters demonstrate. Near-adjacent audiences, alternative forms of fund-raising, and a refocus on refreshing the content will play key roles in rekindling success moving forward. Over-dependence on news cycles is a recipe for inconsistency, not necessarily disaster.

Under the hood, the details show (according to Blackbaud) that the dollars per member are steady or up…but in truth, new member joining is down. So pub radio is surviving on the generosity of existing loyal members, but without recruiting new members…that’s a recipe for big concern. That plus a perceived “tone” issue in content across the board. The old conflict of “are we straight down the middle, or are we left leaning as many perceive us to be?”

Tim, you bring up key points – the cume is dropping while the donations (ie.time spent listening) has crept up. Not a great long-term strategy. And the “tone issue” is real if there’s to be a new generation progress.

Music consumers no longer really need radio…

They have plenty places to go and instantly connect.

When it comes to news and information consumers…

How many news feeds to you get these days?

How many others did you get tempted to join lately?

Now, let’s say you already get 2-3 national newspaper feeds.

They are now offering a dozen specialized feeds you can sign up for.

Now add in the local paper, business journal, news channels…

Google news, Apple news, Flipboard, business trades—

And that damn Fred Jacobs blog.

So now let’s finally turn on the radio.

Bluetooth automatically connects to the last podcast you had on.

Wait…what was this email supposed to be about?

Marty, appreciate the wit and perspective as always.

Thank you for this post, Fred. I have some followup questions about the membership numbers from 129 stations, ending in 2021.

* The vertical axis is in M – is that millions of dollars average? Or should that be Billions, as a total including all stations? Or is it people?

* You say numbers are increasing, but it appears to go down from 2020-2021, and was leveling off before that. Is there newer data? I haven’t (yet) found a current analysis of overall public radio fundraising trends (dollars and members). Do you know of one?

Thanks!

Seth Lind

director of operations

This American Life