Here we are – a new year, the same challenges, but a different ratings company with a new mindset.

Here we are – a new year, the same challenges, but a different ratings company with a new mindset.

If you attended the Nielsen Client Conference/Jacobs Media Summit last month, you got a glimpse of the new guard that will be in charge of the data that radio has to work with. From Steve Hasker’s speech about Nielsen’s priorities to Matt O’Grady and Farshad Family’s “executive introductions,” there was a sense of change in the air.

For radio, this comes at an opportune time as the industry struggles to get its head around the expanding universe of gadgets, outlets, channels, and choices. And while radio has done an admirable job of expanding into streaming, mobile, and social, the inability of data measurement to keep up by providing a unified product to advertisers has hampered growth and dampened investment.

In Techsurvey9 (and in its public radio companion study, PRTS5), we explored this very issue by asking respondents to think back to the prior week and assign percentages to the different outlets, devices, and channels they use to listen to content that is produced and broadcast by the station that sent them the survey.

The results were telling, controversial, and informative to the question at hand. They revealed that even among core radio listeners – the people who sign-up for station databases – they are wandering off and consuming content in a variety of different settings.

Whether we like it, whether it’s measured, or not.

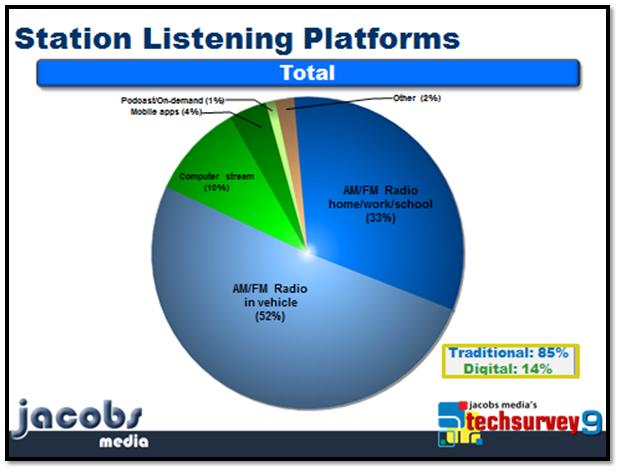

Here’s a look at the total sample, but know that these results vary by format, age demographic, and generation. And while this question only measures recall rather than reality (sort of like diary versus meter), you can see the trajectory.

More than half of broadcast radio consumption is occurring in cars (wonder why we did DASH?), while a third occurs in places like home, work, or school. Combined, that amounts to 85% of all listening is taking place on “regular radios.”

But what about the rest? That 14% that is occurring digitally is the linchpin, the fulcrum, the key to radio’s long-term future. That’s the sign that considerable consumption of radio’s content is indeed occurring on computers, mobile apps, and via on-demand offerings.

That’s a lot, but when it’s not adequately measured and additive to traditional listening, radio runs into that uncomfortable scenario of holding back on marketing and promoting its digital outlets because it cannot measure or monetize this usage. For the long-term health of radio, this is obviously not a smart plan.

And hopefully, that’s where Nielsen comes into the picture. At the recent 2013 Investment Day, new Nielsen CEO David Calhoun reiterated that his company measures “consumption, not distribution.” And that means measuring all audio, not just traditional radio.

Of course, this has implications on radio because it means that new competitors will be part of the measurement cycle as well. As Calhoun pointed out, “What has to happen is, we’ve got to work with the industry to define the right metrics. Because at the moment, you’ve got one set of metrics for terrestrial radio and a very different set of metrics for digital streaming.”

Late last year in Inside Radio, SVP Farshad Family talked about the importance of measuring everything, including the installation of a meter into apps or players “at the point where the consumption happens, not at the server end.”

And as Tom Taylor reported, Calhoun predicted, “There’ll be some brawling as we go through that, but that’s part of the fun.”

And fun it will hopefully be. We may not like everything we see, but we have to face the uncertain truths that come with disruption, new options, and a changing consumer mindset.

It starts with measurement. And maybe a brawl or two.

But let’s get it right.

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

Leave a Reply