A funny thing happened on the way to processing and presenting Techsurvey 2025 these past several weeks. On the surface, nothing was a whole lot different this year than what I’ve experienced over the more than two decades of producing these massive studies for the radio broadcasting industry.

This year, 500 commercial stations across North America took part – a lot of cats to herd. And our sample size – more than 24,500 respondents strong – was as robust as always. And in typical fashion, we’ve already presented the top-line findings to our stakeholder stations. More recently, I showed off the report to the industry at large. (If you missed it or need a refresher, go here.)

This week, I start up a series of presentations for individual radio companies that went all-in with Techsurvey 2025. We do custom reports for those groups so they can see how their individual brands perform on more than two dozen key measures. And soon enough, I’ll be putting together “data cuts” for conferences and clients. In a couple weeks, I’ll be presenting “Techsurvey 2025: The Sports Radio Edition” at Jason Barrett’s sports summit in Chicago. More info on that event is here.

brands perform on more than two dozen key measures. And soon enough, I’ll be putting together “data cuts” for conferences and clients. In a couple weeks, I’ll be presenting “Techsurvey 2025: The Sports Radio Edition” at Jason Barrett’s sports summit in Chicago. More info on that event is here.

But one thing is very different this year. And it jumped out at me a couple weeks ago in a conversation with one of radio’s trade publications. The reporter never asked me whether Techsurvey is somehow diminished in value because the vast majority of its respondents are from station databases – in other words, P1s.

For years, I’ve heard this criticism. And I patiently explain that the only way to produce a study of this magnitude with custom breakouts for individual stations (that cost $500 or less per station) is to use a database sample frame. Fortunately, most well-built radio stations have highly usable email databases that have been aggregated and well-maintained. This enables these stations to glean vital information and important insights from their most loyal listeners.

But the methodology also underscores the problem: Techsurvey barely represents P2s – secondary listeners to stations, much less P3s and P4s. Or people who used to listen to AM/FM radio but have moved on. If that’s what you want to see, you’re going to have to pay for it.

Nope, Techsurvey includes mostly radio station P1s – in many cases, “super P1s” – listeners who consume a lot of radio, by and large. In addition to the commercial radio version of Techsurvey, we also design and produce similar studies for public radio (this year marks our 17th study), and Christian Music Radio (later in 2025, it will be our 12th). In those surveys. we not only have a huge majority of core listeners, but these respondents are also especially likely to donate to their favorite stations. Obviously, these listeners provide immense value, over and above whatever ratings they generate to the stakeholder stations representing these radio platforms because they pay their own way. Even though public and Christian stations are obviously very different from one another, they are both mission-based, sharing essentially the same business model. I can’t even begin to explain how valuable the Techsurvey strata of listeners is to the stations trying so hard to attract and retain them. And to take that extra step and donate.

Nope, Techsurvey includes mostly radio station P1s – in many cases, “super P1s” – listeners who consume a lot of radio, by and large. In addition to the commercial radio version of Techsurvey, we also design and produce similar studies for public radio (this year marks our 17th study), and Christian Music Radio (later in 2025, it will be our 12th). In those surveys. we not only have a huge majority of core listeners, but these respondents are also especially likely to donate to their favorite stations. Obviously, these listeners provide immense value, over and above whatever ratings they generate to the stakeholder stations representing these radio platforms because they pay their own way. Even though public and Christian stations are obviously very different from one another, they are both mission-based, sharing essentially the same business model. I can’t even begin to explain how valuable the Techsurvey strata of listeners is to the stations trying so hard to attract and retain them. And to take that extra step and donate.

As I say every time I host a Techsurvey presentation, it is of critical importance to understand what your core fans are doing when they’re not listening to the radio. And it’s especially valuable to know where they are (that is, other entertainment and information platforms they frequent) if broadcast radio is to successfully “meet the audience where they are.”

The interesting thing about the radio industry in the post pandemic phase we’re in now is that I’m getting fewer and fewer questions about more casual listeners – the P2s, P3s, P4s, and beyond. Beyond radio’s inability to market to these removed listeners, broadcasters also face an ever-widening array of competition from so many different sources in the digital media world.

Just last week, Spotify announced yet another product designed to help its subscribers build and create “radio stations.” Its new “AI Playlist” beta is being expanded to 40 more countries. And that’s just in time as YouTube rolls out its version called “Ask Music.”

Amazon has been in a similar place since last year with its “Maestro” product, Deezer has thrown their hat in the ring with “Playlist with AI,” while Apple is testing a version that include an AI artwork generator as part of its package. In this way, your “radio station” can have a professional look in addition to its sound.

Amazon has been in a similar place since last year with its “Maestro” product, Deezer has thrown their hat in the ring with “Playlist with AI,” while Apple is testing a version that include an AI artwork generator as part of its package. In this way, your “radio station” can have a professional look in addition to its sound.

In short, there have never been more competing products by behemoth companies trying to dilute AM/FM radio listening. Once again, they all persist in trying to “do radio.” And while many of the predecessors of this year’s radio-like models, it doesn’t negate the fact the field remains overcrowded, putting a great deal of pressure on the incumbent, especially while research and marketing resources have dwindled, or in many cases, just disappeared.

Now, a responsible advisor would tell radio’s CEOs the best course of action is to “circle the wagons” around your core fans, ascertaining the best content and smartest innovations to keep them engaged and loyal. And emphasize the products, services, content, and connections only local radio stations can provide that these behemoths cannot.

Now, a responsible advisor would tell radio’s CEOs the best course of action is to “circle the wagons” around your core fans, ascertaining the best content and smartest innovations to keep them engaged and loyal. And emphasize the products, services, content, and connections only local radio stations can provide that these behemoths cannot.

Now wouldn’t it be nice to expand broadcast radio’s reach to casual listeners, former-fans and ex-pats, along with younger people who may not even know what radio is? Of course. But realistically, reaching unserved communities of consumers only peripherally listening to AM/FM radio in 2025 is a fool’s errand that isn’t likely to pay off in this decade – if ever. It might have been a noble notion before the age of social distancing, rapid tests, and face masks, but it is not viable or practical today.

Most radio stations in 2025 have an intrinsic understanding of the new rules of the radio game which is about retaining and maximizing every last listener you have. Keep those loyal to radio and your station as happy and satisfied with your product as possible. And above all else, listen to them and create content that keeps them coming back for more.

Instead, most radio companies today are using the same rule book that was successful in the 1990’s – before streaming, smartphones, social media, and podcasts.

So, interestingly enough, I don’t remember anyone this year raising a hand to ask me, “How valid is Techsurvey because you’re mostly talking to super fans of the stations that participated this![]() year?” In other words, aren’t we just preaching to the converted? It’s a question I’m typically asked when they first see a Techsurvey presentation.

year?” In other words, aren’t we just preaching to the converted? It’s a question I’m typically asked when they first see a Techsurvey presentation.

I won’t waste your time with the cost efficiencies that using your database as the sample frame brings. Nor will I grouse about how for the low fee of $300, $400, or $500 (depending on market size), stations can have their local data, in addition to the national trends. And wouldn’t you know it, a majority won’t even spend that to get those insights. But that’s for another blog post on another day.

We’re in a different place in 2025 than we were even just a short decade ago. Any marketer will tell you that. Our goal ought to be to hang onto every listener we have. And we should challenge ourselves to create products (radio and digital, events, and others) that keeps the current audience engaged, connected, and happy. That’s how we convert them from garden variety listeners into “super fans.”

I got that drift while reading a story in Tech Dirt (via Hypebot) by Glyn Moody. In “Can Superfan platforms solve the musician income crisis?” Moody talks about how a service like Patreon helps artists make money from their biggest loyalists, “but they don’t help creators find those true fans in the first place.”

While the article specifically addresses the music industry, its obvious connection to the essence of radio brands and their fans is unmistakable. Moody bases his thinking on a recently released study commissioned by Patreon, “State of Create 2025.” The research surveyed 1,000+ creators and 2,000+ fans to gain a better understanding of both groups, as well as their connection to one another. It’s a very cutting edge-looking report that is worth your time even though the word “radio” doesn’t even appear in its 70 colorful pages.

Interestingly, the consumer fans in the research conducted by a company named NewtonX profile a lot like Techsurvey respondents. Of course, they’re a lot younger. The study’s generational profile features a plurality of Millennials versus Techsurvey’s heavy Baby Boomer skew. But they exude many of the same loyalty characteristics, whether the content discussed is music or radio. For example, nearly eight in ten consumers in the NewtonX study (78%) have given money to a content creator before. (That’s well above the historic giving levels among both public radio and Christian music fans.) In other words, they are indeed Super Fans, accustomed to paying for their entertainment and the artisans responsible for creating it.

The conclusion of the study is that that the aspirational triumvirate: revenue generation, consistently strong results, and sustainable loyalty – all emanate directly from forging valid, meaningful connection with fans – not followers. That is, P1s versus P2s, P3s, and beyond.

It’s about “superfans” – period.

This “Fans – Not Followers” mindset is why Patreon is focusing its resources and energies on what they call:

It gets better. Patreon is discovering the “For You Pages” algorithm that attempts to help creators on popular platforms like TikTok find new fans isn’t the only way to grow an audience. It’s not just about where you’ve been that dictates where you might go next. It is also about having reliable advisors – or sherpas – suggesting what you might like next – because they know you and you trust them. User recommendations are key, and Patreon is investing in discovery tools where fans of a creator can seamlessly spread their love of an artist to others.

At Jacobs Media, we’ve been thinking along these same lines for more than two decades. We are the only research company in radio that includes the Net Promoter Score in every study we’ve ever done, including each and every Techsurvey.

In this way, we produce these all-important scores for the radio industry in general, many different formats, and (here’s the Holy Grail) individual radio station brands. We also know the types of fans most likely to spread the word about a radio station, personality, or show their love.

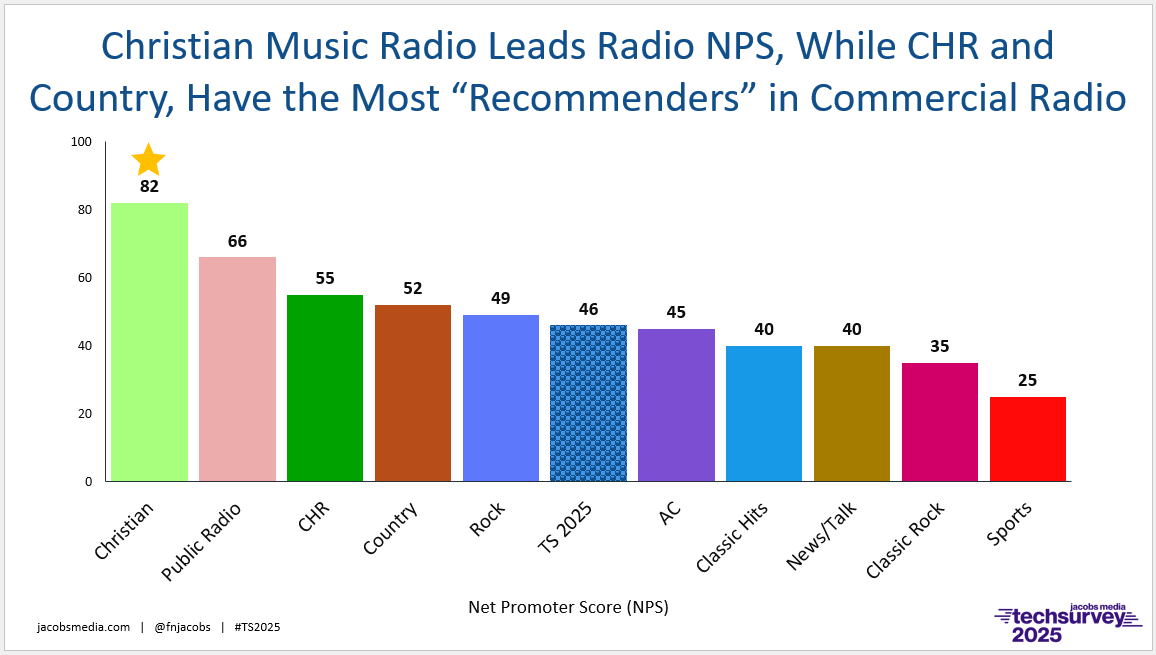

The NPS state of fan recommendation for broadcast radio in 2025 is below:

There’s a lot to unpack here, but if you look at the far left of the graph, you can see how thoroughly Christian music stations lead the radio league in the fan recommendation department. And the thing you can’t see here is their momentum since the pandemic. There’s a reason why you see these stations consistently scoring higher ratings.

While public radio appears to be in a strong second position, its NPS performance has been tepid-to-down during the same time frame. And that “meh” performance has also been generally reflected in public radio ratings as well.

And from there, the commercial radio formats follow, fairly consistent over the past few years with some jockeying for position. Of course, we’re aggregating tons of listeners across these formats. And lately, I’ve spent time in the data catacombs to analyze Net Promoter Scores for individual stations. While there are some sorry looking numbers every year, there are quite a few commercial brands showing impressive NPS performance in the 60s, and a few even touching the 70s. These stations are in a much better position to apply some of the “superfan” strategies.

Most radio strategists rarely think along these lines. The concept of facilitating recommendations from existing fans is just not a part of the plan. But in fact, it may be a more direct path to growth and loyalty than typical radio marketing or contests designed to score a good spring book.

That’s where we’ll pick it up tomorrow – seeing how fan connections with brands could look. We’ll also explore how well-built radio stations and personality shows can put information like this to work, as well as how both public and Christian music radio can apply these principles so their fans contribute more dollars to the brands they love.

- The Exponential Value of Nurturing Radio Superfans - April 28, 2025

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

Fred, you’re speaking DMR/Interactive’s language this morning. While you have been including NPS for two decades, we’ve been including Tell-A-Friend referral in our contest registrations to grow the station database equally as long. It used to be via reply cards and fax, then email, now it’s by text message, socials and QR codes. Best of all, when a station Super-Fan shares a contest with a friend or co-worker, the acquisition cost is zero. These Audience Amplifiers are worth their weight in gold and we help stations treat them accordingly. It’s all about Facilitating the Share.