You might discount today’s blog post on the title alone and the fact I wrote it.

As those of you familiar with Jacobs Media know, I’m the content guy, Paul’s the sales maven. And yet, today’s post is all about sales – from the programmer’s point of view. As I’ve learned during my time as PD, and my very long tenure as programming consultant, I’ve watched our industry falter oftentimes because of the inability to make the sale.

“We can’t sell it” is an excuse most of the time – and a poor one. When it comes down to it, a lack of sponsorship and sales support can be heartbreaking and even debilitating for programming, especially when the content is worthy. And the cumulative effect is to stifle the creative process and limit radio’s effectiveness.

Case in point: the industry’s seeming inability to consistently sell on either side of the 25-to-54 “sweet spot.” As we’ve been told for decades, “the buys” generally fall in this 30-year range. And consequently, there’s not much appetite in the cubicles to sell outside of this parameter.

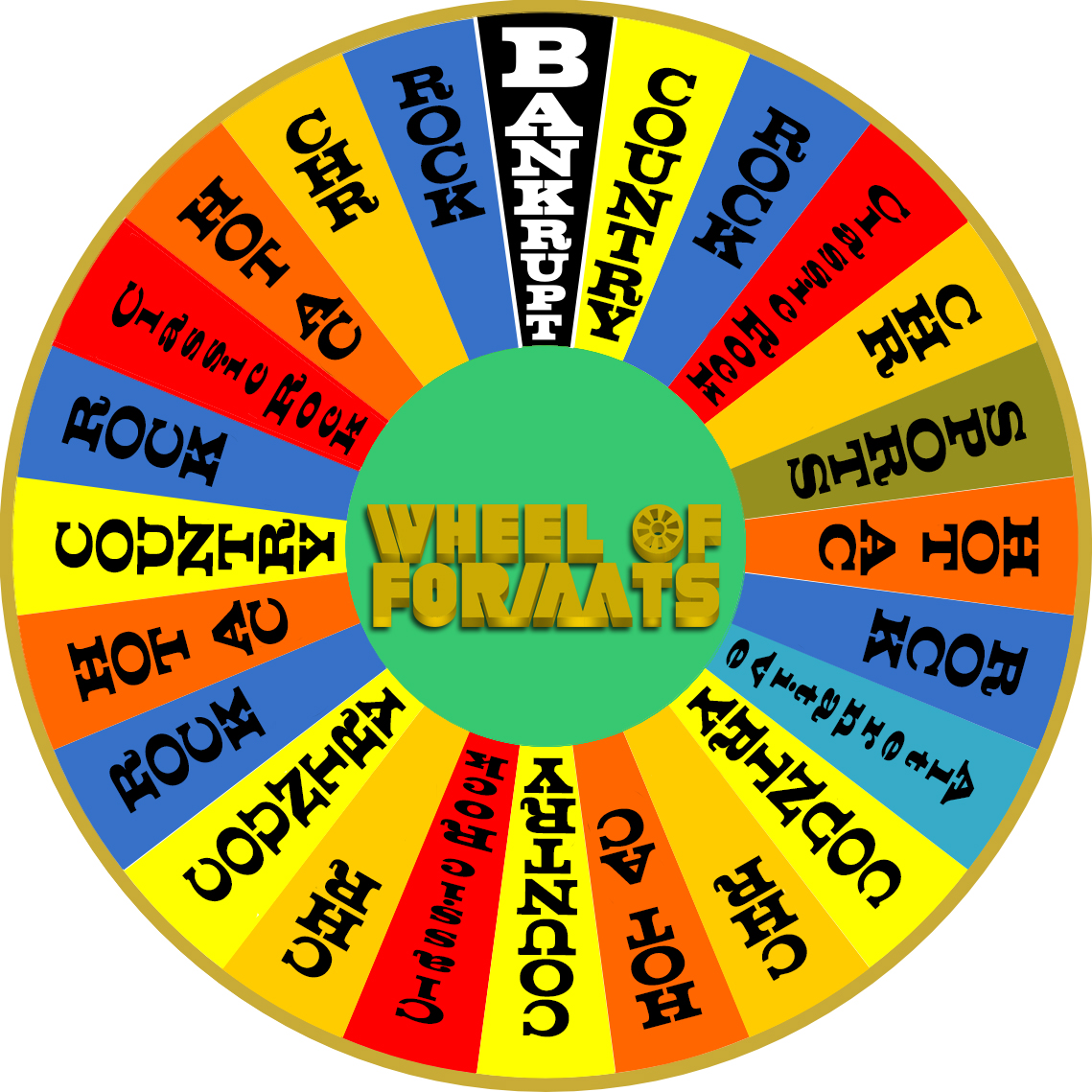

The end result of this myopic acceptance of advertiser dictate has been to kill formats – Jazz, Soft AC, Classical, and whatever a Gen Z format might sound like. This self-inflicted, restrictive philosophy has kept radio formats in a narrow and limited range. As a result of the inability of sales teams to figure out how to sell past a 30-year age parameter, most broadcasters would rather sign on a second Classic Hits or third Country station than take a chance on an option not on the “Wheel of Formats.”

to kill formats – Jazz, Soft AC, Classical, and whatever a Gen Z format might sound like. This self-inflicted, restrictive philosophy has kept radio formats in a narrow and limited range. As a result of the inability of sales teams to figure out how to sell past a 30-year age parameter, most broadcasters would rather sign on a second Classic Hits or third Country station than take a chance on an option not on the “Wheel of Formats.”

Because most radio formats aren’t designed to appeal those north of 54 or under 25, a lot of money has been left on the table. And on the floors, the chairs, and all over radio buildings. Especially when we’re thinking about an industry future that ought to have included Gen Z, the lack of interest in youth formats is directly connected to the sales department’s long-standing ennui with marketing younger audiences. If you think about radio’s current predicament, it is has a strong connection to radio’s lack of interest in making a play for America’s youth.

Salespeople tend to work in a self-imposed bubble where they compete against other stations and clusters for “radio dollars.” These are the budgets targeted at the radio industry. Since the Great Recession, they have consistently shrunk. This narrow view of marketing opportunities has helped enhance digital revenue, a pool of money that is far more likely to be wide open, across platforms and demographics. Radio used to be the medium with “something for everybody.” Not anymore.

Salespeople tend to work in a self-imposed bubble where they compete against other stations and clusters for “radio dollars.” These are the budgets targeted at the radio industry. Since the Great Recession, they have consistently shrunk. This narrow view of marketing opportunities has helped enhance digital revenue, a pool of money that is far more likely to be wide open, across platforms and demographics. Radio used to be the medium with “something for everybody.” Not anymore.

And then there are those creative, enterprising moments that often fall flat – not because they’re not good enough or haven’t attracted a sufficient audience, but because they generate little in the way of interest or enthusiasm from the sales department or because it is apparently too challenging for reps to market a concept that cannot be reduced to a spot schedule of :30s and :60s.

How many events, concerts, promotions, and audience get-togethers remain unsold, bonused, or are otherwise underperforming when it comes to sales and advertising support? And how many have been sunset, retired, or allowed to fade out because they lack commensurate ROI? Or because they simply don’t have enough client interest to justify continuing to do them? Of course, this exacts a toll on audience connectedness and station branding. And ultimately, it’s the marketing staff and the street team budget and staff that gets cut when times are tight.

Making matters more dire, the lack of sponsorships and advertiser participation hurts radio’s effectiveness. Which is more likely to make an impact – being one of ten commercials in a stopset or being a title sponsor at a station’s signature community event? Which will get more “emotional support” from the programming and airstaff? Which is most likely to make a lasting and indelible impression on behalf of clients?

It’s simple. Except that it’s not.

The low hanging fruit in sales is waving around a ranker, a printout trumpeting cost-per-point efficiency, a rate card, and other data that lean away from radio’s true strengths. And so often, the industry defaults to its smallest numbers to make its case. In a marketing world that rewards bigness – yes, size does matter – the reliance on fractions remains a constant. The sales department often debates the value of a station that has a .5 versus a .4, or laments the inevitable “compression” that occurs when an entire group of stations gravitates to a .3, thus making it difficult for sellers to make important distinctions to buyers.

That’s why when someone in a respected position comes along who truly values radio on its unique merits, we owe it it ourselves to intently listen to his argument. When it’s someone in the position of being a client, it’s an imperative we hear their point of view.

A example of that happened earlier this month when it was revealed Procter & Gamble is back to pouring more of their marketing dollars in radio. A story in AdAge (behind a pay wall) – “How Procter & Gamble Is Reinvesting In Radio To Find TV Audiences” – provides vague details about the how the consumer products giant is redeploying marketing dollars.

The numbers are impressive. The story reports radio spend in 2022 increased by 43% reaching the $235 million mark, according to Vivvix. In fact, it was local radio – including Black-owned media – that led the spending surge.

Of course, P&G wasn’t about to reveal its secret strategy to AdAge – or to us. In fact, their spokeswoman grazed past the question:

“We continue to adjust where we invest as part of our overall strategy to reach our consumers where they are, when they are receptive, and in media that resonates with them.”

Thanks, but that’s not what sales pieces are made of.

AdAge’s take is that one of radio’s advantages is that it’s “not TV.” And that’s part of the reason radio held a “Reach Celebration” a couple of weeks ago to celebrate its victory over a broadcast television industry falling faster than we are.

Finally, the story concludes that radio’s other edge is that it provides cost efficiency – reaching the masses for “less than half the cost of linear TV and less than a fifth the cost of targeted TV.”

Woo hoo. Again, not exactly a ringing endorsement.

So when I read Inside Radio yesterday, a story titled “Global Marketing Director On Why Radio Ought To Be In Everyone’s Mix,” it spoke to me. Finally, someone who’s ready to spill about radio who’s in a position of authority.

Brent Christenson is the guy we’re talking about who holds the impressive position of Global Director of Marketing for Alcon Laboratories, an eye-care device company.

But it gets better. The industrious Erica Farber and her voracious RAB team tracked Brent down at a recent ANA event. You can listen to her full interview, part of RAB’s “Radio on Main Street Podcast” series here.

Brent Christensen is no novice when it comes to marketing. He’s held executive positions at the Hershey Company, Albertsons, and Hormel Foods.

And radio has been a constant companion – not just as a consumer who listens but as a marketer who’s a believer.

In the podcast interview, a wide range of topics is covered, including the radio piece.. And as Erica is wrapping things up, Brent says this to her:

“I do have a couple of other points about radio and why its worked so well….if you’re OK with that….”

Erica put her headphones back on, and the interview continued. The Inside Radio story does a nice job of detailing Christenson’s radio advantages. They include the following radio assets:

Captive audience – Brent is pointing to the car here. He underscores not the size of the radio audience, but the unique environment of being in a vehicle when they’re receptive to a message.

New ways to listen – There’s no one way to access radio content now, thanks to mobile phones and tablets, smart speakers and even smartwatches. Marketers are always looking for multiple touch points for their messages, and radio delivers.

Driving impulse purchases – Again, the car is a co-star here, as consumers can see “windshield businesses” as they hear advertising messages. That often leads drivers to pulling over and making a purchase.

Driving impulse purchases – Again, the car is a co-star here, as consumers can see “windshield businesses” as they hear advertising messages. That often leads drivers to pulling over and making a purchase.

Cost efficiencies – This, of course, was part of P&G’s strategy, too. As Brent told Erica, “….there are great cost efficiencies with radio.”

Highly targeted – While perhaps not as diverse formatically as it could be, radio’s choices deliver diverse audiences and lifestyles.

Added value: Here’s where the local piece matters. Brent Christenson talks about radio’s “fun factor” that emanates directly from its personalities. It’s a unique form on interactivity marketers cannot get from other media.

Amplifies other channels – The ability to deliver messages across a mix of media outlets is something marketers crave. Looked at in aggregate, this is where radio’s reach and audio-delivered content enhance campaigns.

And Christenson doesn’t even carry a list.

I caught up with him late yesterday, and he was kind enough to answer a few questions despite participating in an off-site meeting.

It turns out he’s a personal fan of radio, growing up with KIIS-FM in L.A., and worshipping at the altar of Casey Kasem. He notes how he “waited in suspense as Casey counted down to the Top 10 and ultimately revealed the top song in the country. It felt to me as if the entire world was listening to his radio broadcast. Hearing the songs, insights about the artists, and who would walk away with the top spot was a weekly highlight.”

It turns out he’s a personal fan of radio, growing up with KIIS-FM in L.A., and worshipping at the altar of Casey Kasem. He notes how he “waited in suspense as Casey counted down to the Top 10 and ultimately revealed the top song in the country. It felt to me as if the entire world was listening to his radio broadcast. Hearing the songs, insights about the artists, and who would walk away with the top spot was a weekly highlight.”

Not surprisingly, Brent extols the virtue of radio personalities, especially those in-market. As he notes, “Local radio Djs are like family for local consumers…trusted friends providing traffic and weather updates, life stories, local news, as well as providing fun, life lessons, and laughs.”

From a brand standpoint, he looks to radio hosts to “amplify core messaging and bring brands to life, beyond a paid advertisement. Whether through contests, onsite activations, personal stories with the brand, etc.- radio DJs provide an emotional connection to the brand for his/her listeners that drives personal connection, sales lifts, and strong ROI.”

Of course, all that dovetails into the fun element. And while Brent didn’t specifically point to it, we continue to hear in focus groups, in particular, that post-pandemic, a contentious political environment, and economic uncertainty, many consumers could use a little fun in their lives.

Here’s a global marketing pro who’s checking off that box with radio. Christenson points to that emotional connection between listeners, talent, and music that makes radio a unique platform. He reminded me that “consumer contests,” brand activations and giveaways have been a highly effective way to connect FUN with brands.”

After all, most consumer brands, goods, and services and B2B businesses aren’t a party atmosphere. By connecting them up with radio, that fun element is a plus for marketers.

One last piece – and it’s an important one. After a century of success, radio is still an underrated advertising asset in the larger marketing world. Again, a consistently tepid sales effort has to figure into that. But so does a void created by radio companies, too.

Here’s Christenson’s take:

“I do not remember the last time I saw a presentation in a major marketing conference that highlighted radio. Digital and social media are important mediums, but radio has unique strengths that are hard to deny. However, there is limited awareness and understanding of the core strengths of radio’s benefits including- the audience base is massive, ads can be highly targeted, radio is cost efficient, it can drive impulse purchases, there is a captive audience, it can amplify messaging from other channels, radio spots are relatively inexpensive to produce, and radio campaigns can drive a strong ROI.

“I highly recommend marketers research radio as a means of connecting with their target audience, activating their brands, and accelerating sales growth and brand equity. I have seen the strong value first hand over the course of my career across multiple brands, categories, and products.”

Nowhere in Brent’s podcast with the RAB or in my exchange with him did he mention cost-per-point, average ratings, or an audience that is too old, too young, too ethnic, or chronically unemployed. All he sees is endless, unique opportunity, and plenty of running room for marketers in the radio arena.

Radio needs more brand champions working within the industry. When reps are selling for a half dozen stations in a cluster, they will naturally gravitate to that low-hanging fruit, the easiest sell. In the process, too many stations are being undersold or left behind.

Radio needs more brand champions working within the industry. When reps are selling for a half dozen stations in a cluster, they will naturally gravitate to that low-hanging fruit, the easiest sell. In the process, too many stations are being undersold or left behind.

Brent Christenson’s rationale ought to be the stuff that defines radio’s marketing message to the advertising community – in New York and on Main Street.

More research and more industry marketing to Christenson’s brothers and sisters in marketing is a great place to start.

All the innovation in the world won’t amount to much if radio’s sales force can’t market it. As a programming guy, I’ve learned the hard way – if we can’t sell it, it doesn’t matter.

In economically precarious times, it’s all about the art of the sale.

- The Hazards Of Duke - April 11, 2025

- Simply Unpredictable - April 10, 2025

- Flush ‘Em Or Fix ‘Em?What Should Radio Do About Its Aging Brands? - April 9, 2025

Right on target! Yet todays Manager says radio isn’t sold that way today when the points raised in your blog are suggested! They don’t appreciate those of us who have been around when our efforts were properly sold and effective. Yet they can’t understand why their sales continue to decline and are less than half what they were when they only had two stations perv market!

Perhaps, Dave. But it’s hard to argue against the idea the current model isn’t working. Time to try something different.

Always remember, agencies make huge profits shooting video.

So agencies will do anything to sell the advertiser (the client) on going in that direction. And since the agency is talking to the CMO not the CEO it’s not too difficult.

Radio stays as a secondary/tertiary medium because it abdicates the sales function to the agency. To move up to a prominent position with the client, radio must adopt a strategy very different than what is currently in use.

Barry, I appreciate the perspective. It seems (to me) the emphasis has been misplaced for decades.

As National Director of Musical Stations at Caracol Radio in Bogotá, Colombia, in the in the mid-1990’s and in the first half of the 2000’s, I was in charge of a cluster of 8 National radio netwoks with different formats and aimed at different audiences.

In countries like ours, demos go beyond gender and age, and you have to have in mind the distribution of social classes.

In this way, we avoided cannibalizing sales, offering different products, so we had stations for younger demos both for the upper middle class and for the lower class. Also had Tropical music stations for Mid-Class listeners, Ballads in Spanish for Women, Local Music (Vallenato) for lower classes and even an AM station for children. Likewise, we had a successful station focused on upper-class executives that, generally, and although it never ranked in the Top 10, was the one that obtained the highest income.

In this way, the products were differentiated by the segment to which they were focused in a great job of audience segmentation that gave very good commercial results.

A critical part of my job was to try to keep the targets of each format clearly defined and to try to maintain the established limits so as not to cross with the other formats and to work on advertising campaigns and marketing events according to the public to which each brand was directed.

Customers of any type would always find a product to advertise on, and their advertising was vastly more effective because it was more narrowly focused.

Sure, not everyone can afford to have 8 music stations in a single market, but this segmentation also worked very well in markets where we only had 3-4 local formats.

This model is still applied today in Colombia with great success. For example, juvenile radio formats continue to attract big audiences. La Mega is number 3 in Bogotá and most of his audience is young. Its strongest age segments are 12-17 (23%) and 18-24 (24%).

In this way, ‘Captive audiences’ are always being reached in different targets; ‘cost efficiencies’ can be managed with the possibility of creating marketing and advertising campaigns that can be applied locally in each city under a national brand, and it’s possible to have a ‘highly targeted’ strategy, running away from the 25-to-54 “sweet spot.”

To expand upon one of those points, I’ve run into at least a few other countries where socioeconomic classes are indeed listed among ratings-related demos. An example that jumps out right away is Portugal–where Grupo Renascença Multimédia’s official statement regarding this year’s first Marktest/Bareme Rádio ratings specifically references some classes. More interestingly, the section about Mega Hits (the group’s CHR) describes its strength among students and even middle/senior management.

https://gruporenascencamultimedia.com/2023/03/15/rfm-e-a-radio-que-mais-cresce-na-manha

(Archrival Bauer issued its own “everyone’s a winner” statement about the ratings–although it wasn’t as broad or detailed.)

Better lifestyle data would no doubt help sales. But an intrinsic belief in radio and the brands they’re charged with marketing wouldn’t be so bad either.

It sure sounds more logical than some of the messes sale has gotten itself into here in the U.S. Thankw for sharing this logical approach, Tito.

Powerful and a much needed “smack up the side of the head” directive, Fred. The resilience of the industry proves itself everyday in a changing environment. It’s time to exploit that when compared to other traditional media.

No doubt about it, Art, radio is resilient, able to overcome flack hurled from the outside and from within . And I tried to smack too hard.

Late to the party here, but if radio wants to sell something other than cheap 25-54 delivery, it will have to hire sales people and managers that have done that kind of work. Mid level enterprise sales people make roughly $250k/year. Managers make in the $350K range and up. I think most comlerable positions in radio pay a bit more than half of that.

Or maybe we should give Brent Christenson a list.

Really gives you hope when a guy outside of radio has such passion and sees so much value and potential in the medium. If only we could get more people inside radio to appreciate the qualities Mr. Christenson sees. I know there are still those out there, like yourself and your brother, Fred. Keep fighting the good fight. Radio is worth it.

Thanks, David. I was impressed with Brent when I heard his interview with Erica. That an influential person outside the business believe more in radio that some who are charged with selling it says something.

Here’s one for you, Fred. After more than 60-years of programming, I now own the station, do the morning show, and SELL it! (THAT’S a group off hats that qualify me to endorse this latest observation of yours with total confidence! I’m not only live personality on the air but my station is fortified with a couple more industry vets including Shotgun Tom Kelly (formerly K-EARTH) and Bob Malik (formerly K-EARTH and syndication with “The Beatle Years”). Although they don’t live here, I bring ’em in for almost every major promotion we do and they update their daily entries frequently. We’re “sold out” 6a – 7p daily and totally control 35-plus in the entire market on the South Coast of Oregon. I would have given nearly ANYTHING to be in this situation when I was on the air in San Francisco or Seattle or any of the other markets I worked as a “jock”. I’m 80 and enjoying this business more than ever before for a couple of GREAT reasons!

Roger, I love the fact you’re killing it out there whether you’re 80 or 50. Congrats on figuring it out and making it work.