It’s amazing what you can learn by studying history – in this case, this blog. For today’s #TBT post, I went back exactly eight years ago to April of 2014. Sure enough, the NAB Show and Techsurvey had just wrapped up. Just like today, I was probably sitting in a Starbucks trying to make sense of it all.

In 2014, it was becoming clearer by the moment the digital wave was gaining great traction. For proof, I took a deeper dive into the Sports Radio format where digital was making up 30% of consumption – an all-time high back then. (I’ll give you the 2022 data in a postscript at the end of this post.)

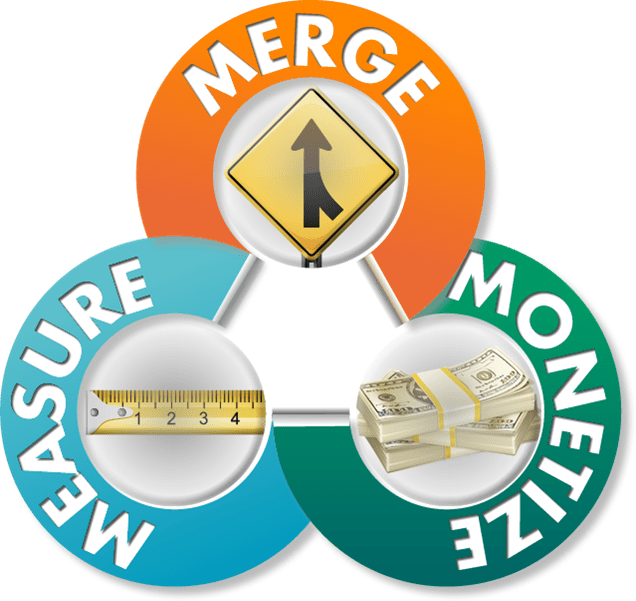

The graphic you see below isn’t another piece of stock art we bought from Getty Images or Shutterstock. We created it ourselves to make the point that listening to radio on “regular radios” and listening via streams needed to FINALLY be combined in one place in order to facilitate measuring it and selling it.

Sadly, we appear to be no closer to that goal than we were during Obama’s second administration, when Pharrell Williams’ “Happy” was on everybody’s lips, and celebrity businessman Donald Trump was hosting “The Apprentice.”

A long time ago in a radio industry far, far away. – FJ

April 2014

One of the exciting things about looking over the master spreadsheet for a mega-study like Techsurvey10 is discovering new data and findings that you’ve never seen before.

So over the next few weeks, you’ll see some key takeaways highlighted in this space and in the industry trades, but one finding that is truly recurring has to do with the shift to digital. And I’m not just talking about how brands like Pandora, YouTube, and Snapchat are changing the way that consumers entertain themselves.

The fact is, more and more people are accessing broadcast radio on digital devices. And many programmers are still trying to wrap their heads around it. First, it represents an entirely different usage paradigm. And second, there’s that gnarly topic of how it’s going to be measured and sold.

I can tell you that over the past few weeks as I’ve made my way through Radiodays in Dublin, the Worldwide Radio Summit, and the NAB in Vegas, the broadcasters are different but the theme is the same. There is a growing realization that digital is becoming the dominant mode of media transportation and yet, radio is still sitting around, waiting for the bus.

That’s because radio lacks the measurement standards that would tie it all together, providing advertisers with a true picture of overall consumption in both traditional and digital outlets.

If you talk to as many PDs as we do, they’ll tell you they’re conflicted. On the one hand, studies like ours and others that you see in your email boxes day in and day out confirm that streaming is growing, fueled by the increasing percentage of consumers who are purchasing smartphones and tablets. The app revolution is in full swing, and more radio fans are seeking out their favorite content on sources that were nonexistent just a decade or so ago.

A great example is Sports Radio. Now here’s a format that is very male-centric as we know. And its fans’ appetite for all things sports is seemingly insatiable, fueled by sports leagues that are smart, savvy, and excited to provide even more tools to access information, background, highlights, interviews, and behind the scenes content. From ESPN to MLB to the NFL, the content is excellent, accessible, and now a part of millions of fan content menus as they navigate the odds, the pundits, the trades, the fantasy leagues, the signings, and of course, the scores.

So when you look at the Sports Radio stations who participated in TS10 – 14 of them, producing more than 2,800 respondents – you can see that digital tipping point coming to life. Nearly 30% of listening to these sports-centric brands is occurring in the digital space, adding more credence to the importance of data that captures this usage. And not surprisingly for the entire study, young people’s media habits are moving even faster into the streaming, mobile, and social arenas.

But on the other hand, this consumption isn’t being measured or merged in ways that benefit radio marketers and their clients. The truth is that more people are listening to the radio on different devices, and yet, we’re still out there selling our cost per points based on terrestrial listening. And we continue to market our products to mostly traditional radio advertisers. As Gordon Borrell pointed out (once again) at the Worldwide Radio Summit, the radio industry is missing out on incredible amounts of dollars because we continue to chase “radio dollars.”

That’s why our “3 M” recommendation from TS9 not only holds water but is even more relevant today. It simply affirms the value of measurement of this non-traditional (that is, digital) usage, merging that data with listening that continues to take place on “regular radios,” and then monetizing that consumption by working in partnership with advertisers to provide more value and results.

And as Radio Ink and other sources have reported lately, that’s what the Nielsen team is working to accomplish. It is essential that stations be given proper credit for the totality of usage, making it acceptable for programmers to aggressively promote their streams, apps, podcasts, and other content portals – without feeling they’re losing meters in the process.

For everyone working today in radio, it can’t come a moment too soon.

Postscript: And here we are eight years later. The NAB Show 2022 is in the rearview mirror – the first in three long years.

As an industry, we’re still not measuring it all, even though every radio company now uses terms like “digital media” or “multi-platform” to describe themselves. Nobody is just doing “radio” anymore – it is but one of the many components sellers have in their marketing arsenals.

And yet, measurement is nearly the same as it was back then – meters and diaries – with digital metrics awkwardly coming from other sources, clumsily tacked on in sales pieces that are often more confusing to prospective clients than they are clarifying. Meanwhile, many of those same local businesses have discovered Facebook, Google, and other easier-to-buy digital media with better metrics and perceived ROI.

The advertising and marketing world is moving on. So, are consumers who were hardcore radio listeners.

And during this time, “radio” has changed more than we could have imagined. I promised you the traditional/digital split for Sports Radio in our new 2022 Techsurvey:

It’s now 51:46, as digital creep continues, making progress with each passing year. Eight years later, many sports fans have moved to digital for their everyday diet of sports info and entertainment.

Soon, the Designated Hitter will be the standard in both Major League Baseball leagues, Tom Brady will really retire, and sports betting will be a prime activity in the metaverse.

And digital consumption of Sports Radio will pass traditional radio listening. “Merge, measure, and monetize” still strikes me as an idea whose time has come. And gone?

We will soon regret we didn’t come together to push Nielsen – or someone else – to put it all together. – FJ

- Radio, Now What? - April 14, 2025

- The Hazards Of Duke - April 11, 2025

- Simply Unpredictable - April 10, 2025

This was a fascinating post. Some random reactions :

1) Radio will probably be resistant to price increases from Nielsen. The agency world assured radio that the immediacy/frequency of PPM would qualify it for more ad money and it didn’t happen and radio ended up paying more for two 8 minute stop sets instead of 4 four minute ones.

2) While there’s nothing but upside in making radio available on whatever platform people want to access it on, radio’s big problem is product, not platform. Elon musk could put every radio station on his satellites, but that wouldn’t make Ryan Seacrest interesting or local.

Bob, this is a good day. We’re on the exact same page. And I think you bring up truisms that are mandatory parts of the conversation – willingness to spend even one more dime on ratings, and putting distribution ahead of the content. Both are non-starters.