Last week, I checked in with a number of friends, clients, and media types looking to get an early feel for what will transpire in the new year. Q1 is always a mixed bag, characterized by slowness as we all try to get back on-track after the holidays. This year, the hope is that political advertising will be in abundance, but will it be an elixir or a steroid?

As you read this post, more details will be emerging about the Audacy bankruptcy. While the “business as usual” mantra will make the rounds, we know from similar events that have befallen some of radio’s biggest companies, there will be reverberations across the radio landscape.

Beyond these “current” events, some observers are anticipating real change in the “old order” as companies reshuffle their decks in the wake of shaky economic performances from past years. Exactly what the new year will bring is anybody’s guess, but many think we may look back on 2024 as a year of big changes for radio broadcasting’s future.

And while that may turn out to be true, we actually got some very promising news about the fortunes of radio that many – even those working in the business – may find surprising in a good way. By now, you’ve likely seen this CNBC story, happily covered in a number of radio trades and newsletters.

Written by Drew Richardson, the narrative points to AM/FM radio hanging in there in the face of intense digital competition, while Pay TV has cratered during the same time period. He quotes Guggenheim’s Curry Baker (pictured) who makes the case broadcast radio has hung in there quite well, thank you. And he attributes radio’s sustainability to its emphasis on personalities and serving local communities:

the case broadcast radio has hung in there quite well, thank you. And he attributes radio’s sustainability to its emphasis on personalities and serving local communities:

“Terrestrial radio has stayed steady even as other mediums like satellite radio, podcasts and Apple CarPlay have come on board. Historically, radio personalities and stations have engaged with local audiences. Cable networks never really did that.”

And to no one’s surprise who’s been loyally reading Edison’s Infinite Dial research or keeping an eye on our Techsurvey results, the key to radio surviving the tsunami of new media choices will be its ability to keep broadcast radio relatively stable while simultaneously building out digital infrastructure – namely, new content, better distribution, and an improved ability to monetize it all.

In other words, “Keep the patient comfortable” while growing new media platforms – something most radio companies have struggled to do.

The CNBC story provides an upbeat path for radio broadcasters, but many are simply not taking it. As we know all too well, too many companies have jettisoned personalities, while moving away from local service. Outside observers – and the data – continue to suggest this is not a smart plan for guaranteeing sustainability over the long haul. When the financial analysts are pointing to the power of live and local people behind the mic, broadcasters might want to get their drift.

And then there are the digital speed bumps, which many radio organizations – be they commercial, public, or Christian – struggle to overcome. Part of the problem is the lack of R&D. Many companies have invested heavily in digital assets, even buying new media companies, only to run into stiff competition and monetization roadblocks in businesses verticals they may not understand. Problem is, they don’t know the landscape.

And then there are the digital speed bumps, which many radio organizations – be they commercial, public, or Christian – struggle to overcome. Part of the problem is the lack of R&D. Many companies have invested heavily in digital assets, even buying new media companies, only to run into stiff competition and monetization roadblocks in businesses verticals they may not understand. Problem is, they don’t know the landscape.

“At these prices” as my father used to say, broadcasters cannot afford to make bad bets on the next big thing in digital. Nor can they create expensive content, only to see it not garner an audience or attract enough ad dollars to pay for it. Research might not solve all problems, but if well-designed, it could surely point out the sand traps…and money pits.

Digital IS the future, despite the current degree of uncertainty, and Guggenheim’s Baker suggest the linear, over-the-air traditional foundation of radio is on the clock. That means launching and growing digital enterprises swiftly but strategically. Here’s his call:

“If you model this out, the digital business simply overtakes the legacy terrestrial business in the next five to six years.”

That means by 2030 – not at all far off into the future. This suggests broadcasters will need to adapt quickly to an even more volatile digital environment. Winging it in the face of deep-pocketed global players with brilliant media mavens simply won’t get it done.

This is why Jacobs Media took steps last year to prepare for what we also believe to be a predictable outcome for radio broadcasters. Yes, we intend to continue our Techsurveys in commercial, public, and Christian radio, tracking the core audience. In fact, a random plan over the next five years is more likely a guarantee of being forced to sell remaining assets at pennies on the dollar.

Our new initiative in collaboration with Mark Ramsey Media explores “Next Adjacent” opportunities for radio. It is time we shifted our research focus from testing music and ranking contests to betters understanding the existing opportunities broadcasters can realistically take advantage of in the digital space. You can read our “white paper” here. While written for public radio, its applications to other broadcast radio organizations are obvious.

A key to both thriving and surviving will be growing new audience. As broadcast radio’s audience has aged – even more rapidly since the pandemic – it has left the industry deficient in both younger and more diverse communities. Our research is designed to look at entire communities – regardless of whether they are radio listeners – to assess and identify opportunities to reach them with new content on other platforms.

We are seeing “lift” for this way of thinking in public radio circles. Not only are we having conversations, but we are also crafting market-specific research strategies to address these new opportunities.

We have also taken a key step in revenue generation, particularly for digital assets, by hiring industry veteran Chris Brunt last month as the next piece of our reimagined personnel strategy.

Chris has a unique and compelling depth of experience in both radio and digital, as a content creator and a digital sales strategist It makes him well-suited to help radio broadcasters figure out the monetization piece. And not a moment too soon.

Working with clients across the spectrum, Chris brings experience both as a programmer of music stations, but also as a digital PD, melding these critically important two spheres. The shared piece of our Venn diagram – whether traditional meets digital – is obviously the “sweet spot.”

We didn’t hastily give him a title. Chris is the aptly dubbed Director of Digital and Revenue Generation for both Jacobs Media and jacapps. He’ll also be joining us at CES 2024 this week to soak in the new trendlines that will no doubt impact broadcast radio’s immediate and long-term futures.

Backed up by our Techsurveys in commercial, public, and Christian, we have a base of understanding critical to figuring it out. And not a moment too soon.

As Guggenheim’s Curry Baker predicts, the time horizon for radio may be shorter than many think.

But wait…

Wasn’t this post supposed to deliver a feel good message as 2024 get underway?

Indeed it was, and it will deliver on that promise. That’s because Marketing Charts published a positive analysis for radio last week based on a recent Nielsen study (which I’ll link later in the post).

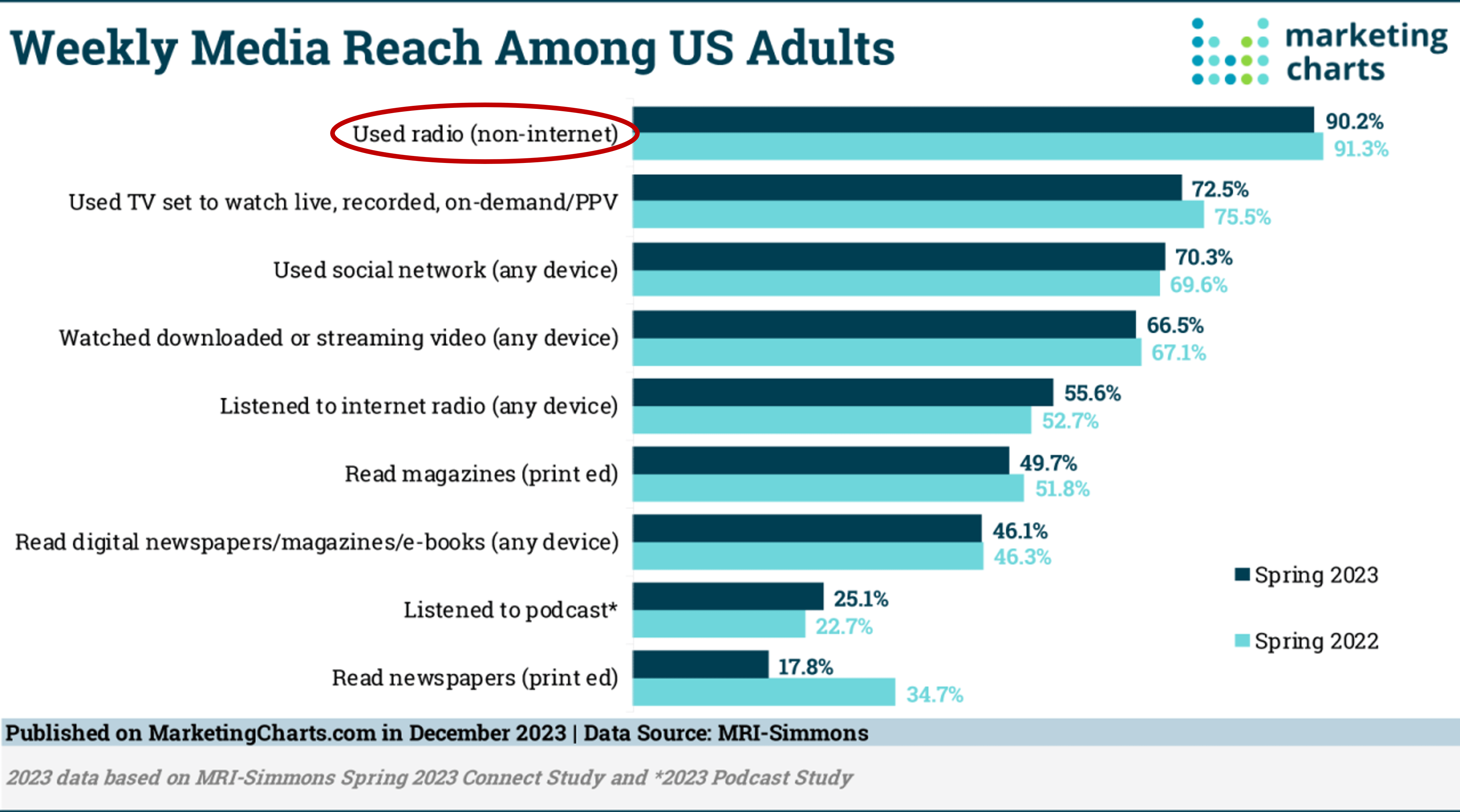

Titled “Media Audiences: Which Pandemic-Driven Changes Are Here to Stay,” the Marketing Charts’ team looks at nine media activities in which respondents engage. MRI-Simmons data from last year suggest that not only does radio “out-reach” everything else tested, it also has lost very little ground year over year.

Verticals gaining audience from Spring 2002 to Spring 2003 include social media, streaming audio, and podcasts. Those losing ground include TV viewing, streaming video, magazines, and print newspapers (down a whopping 49%!).

But wait…there’s more!

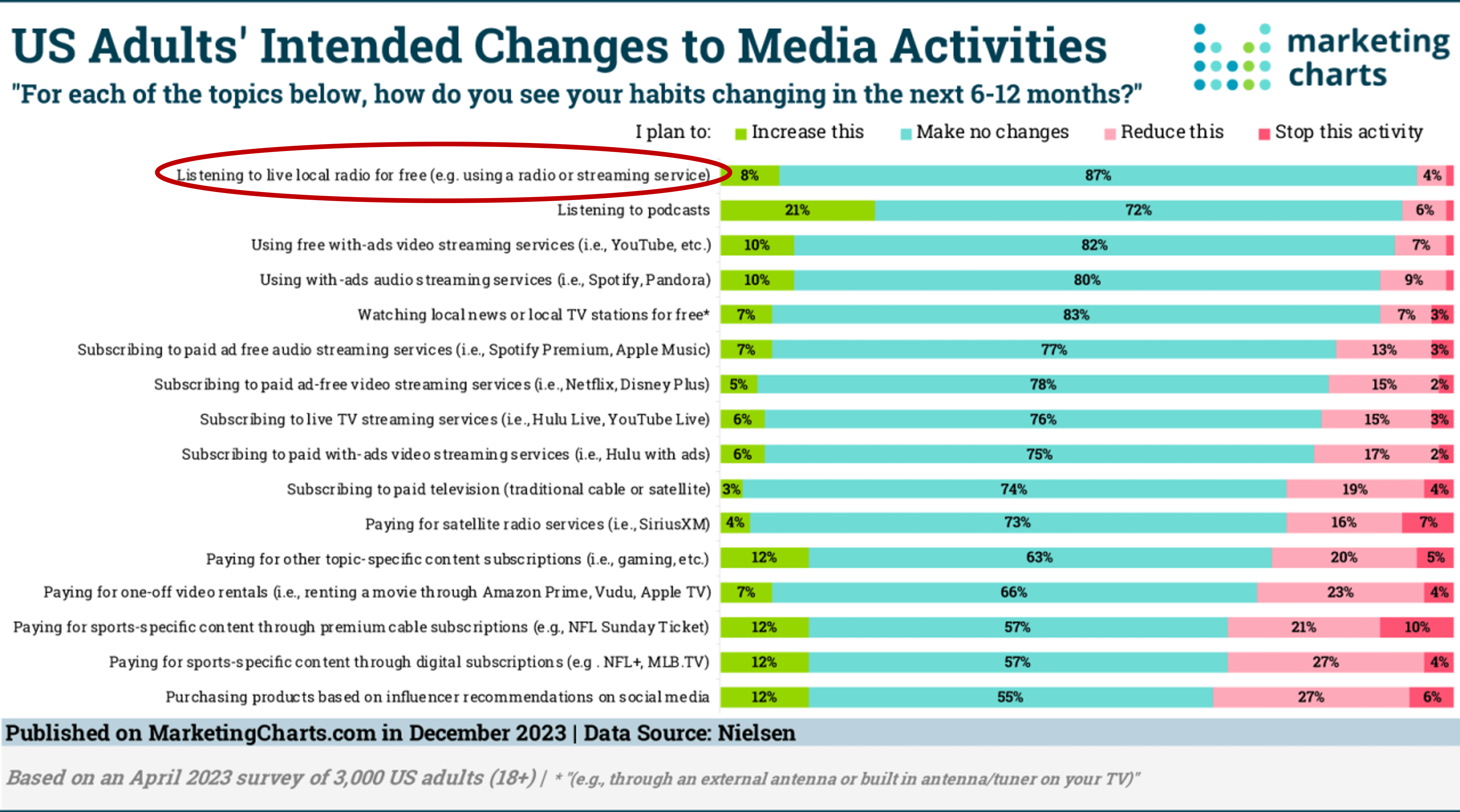

Another Marketing Charts was published last week, this one based on Nielsen data. And in many ways, it is equally encouraging. Culling the responses of 3,000 adults in the U.S., Nielsen measure how media audiences intend to change their activities in the next 6-12 months.

The results are from last April, so they continue to resonate in our content, distribution, and monetization strategies today. And they are surprising, indicating broadcast radio will hold its own, while many other media are facing headwinds, especially those that charge fees for content/subscriptions.

The best news for predicting what may be around the corner is for podcasts. More than one-fifth of respondents say they intend to consume more podcasts. For many of my radio friends who have made the leap to podcasting, this is hopeful news.

But for radio, the news is positive. Those who say they plan to listen more are markedly higher than those looking to reduce their radio listening. And an impressive 87% say they’re planning no changes to how they currently use AM/FM. Adding “increase”‘ to “make no changes” leave radio – once again – at the top of yet another broad media environment analysis.

For many media activities on this chart, the reduced consumption outweighs intent to use a medium more. That’s especially the case for DSPs (Spotify, etc.), video streaming (Netflix, etc.), pay TV (cable, satellite), and satellite radio. In fact, based on Nielsen’s projections, it could be an angst-ridden year for SiriusXM. And it’s not the least bit surprising they’ve kicked off the new year with a hopeful plan to stabilize or grow their legions with their new look, new app, and emphasis on streaming.

A look near the bottom also indicates the relatively new practice of charging for watching sporting events that have been traditionally been free is rankling consumers. While 12% expect to shell out money in order to watch baseball, football, and other sports content moving forward, more than 2½ times say they’ll reduce this consumption or stop it altogether.

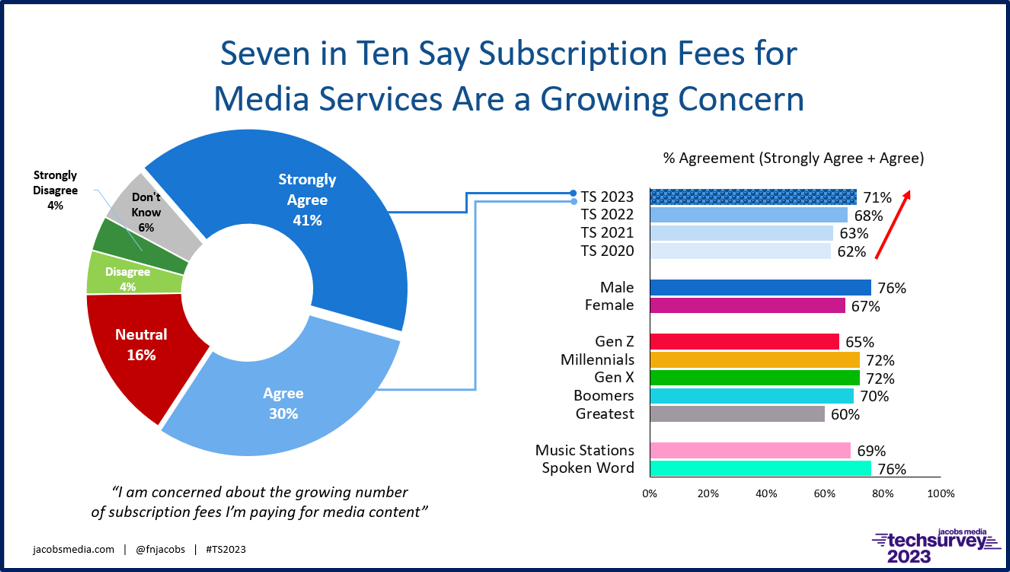

This chart also suggests a larger-than-expected percentage of today’s media consumers continue to show concern for the number and amount of media subscriptions and paid programming they see on credit card statements each and every month. In Techsurvey 2023, more than seven in ten were pushing back on subscription fees.

Our study’s 20th survey goes into the field starting tomorrow, so we’ll have updated data soon. I do not expect the direction of the arrow (below) to change.

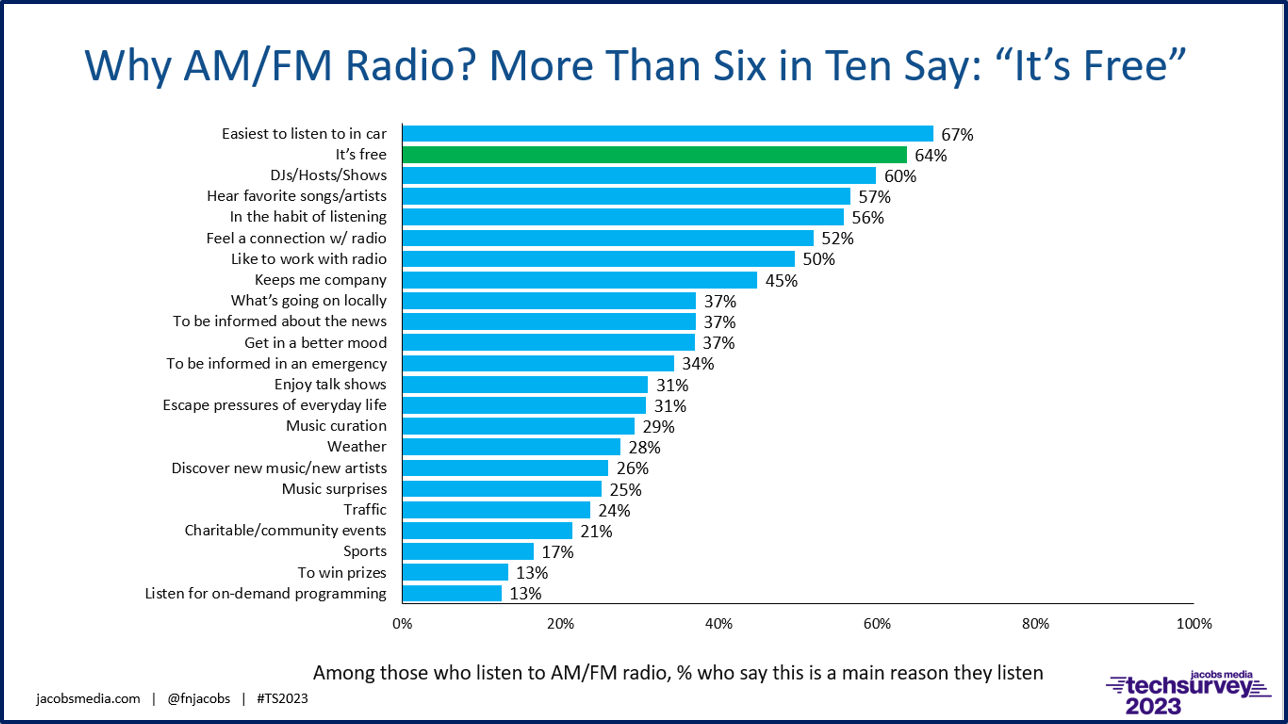

And that suggests radio’s “free” status is resonating with audiences more than ever. As we’ve seen in recent years in our “Why Radio?” report, this “no subscription fee” advantage for radio only becomes more relevant over time. Now if only we promoted it with (more intention and frequency.)

Both Marketing Charts provide statistical support for broadcast radio’s ongoing consistency and validity. But digging deeper, they should also encourage radio executives to read a little deeper into what the media consuming public is trying to tell us.

First, the obvious difference-maker – personality and a commitment to local communities and service – has been sadly overlooked by so many companies during the last decade+ of cutbacks, reductions, RIFs, and terminations. Stations well-staffed with host ambassadors that matter, supported by local staffs that can generate visibility and revenue, will be best positioned to maintain their relevance and survivability moving forward.

And on the “intended change” chart, why wouldn’t radio operators make it their goal to grow the percentage of “increase this,” rather than settling for a big number in “make no changes.” In other words, let’s give them reasons to actually listen more to our stations with programming, people, and community services that matter in 2024.

our stations with programming, people, and community services that matter in 2024.

Even with less resources – human and financial – what essentials can radio provide consumers that other platforms cannot? And as the above chart shows, radio stations and on-air talent with “emotional intelligence” and market knowledge can connect and engage with listeners. Bonding with the audience has less to do with contests (which are near the bottom of the list) and much more to do with meeting audience needs.

This is radio’s challenge – and opportunity – for 2024: making audience members feel like they’re part of something special – a part of a community.

You can access the Nielsen report here.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Excellent and a great article to start 2024! Color TV didn’t harm B&W TV. Digital brings essential, loud & clean licensed radio content to more receivers, more ways, more often. Thank you, Fred!

Many thanks, Clark.

Such a great read. Those of us in small markets, especially those markets in the shadow of major markets, who have lots of competition for ears, have always operated like this because it is how we create engagement. It is how we have survived and thrived in an ever crowded landscape. Local personalities and service to the community are what create relevance. We need to be in touch in all ways…and our radio popularity has transferred to our on-line and social popularity, but you don’t have one without the other. In a local test we grew on-line engagement over 100% with just 3 live radio announcements….they walk hand in hand. Thanks for a good start to the week!

Much appreciated, Julie. I only wish more broadcasters would be “on it” like you are. Wishing you a prosperous and happy new year.

Great, positive news for sure. For me, the last line says it all. Yes, I loved the music, and yes, I loved the personalities, and yes, I loved winning countless contests–but most of all, I loved being part of it all. Make me feel part of the community–part of the family–and you’ll have have the love and loyalty reserved for family and community…as well as a fan (and listener) for life.

Appreciate it, David.