One of the more difficult challenges as a manager, consultant, or researcher in this environment is keeping up with the onslaught of data. As radio broadcasters that report to Wall Street release their Q4 2013 results, the trades are inundated with numbers, nuanced to tell stories about what worked – and what didn’t.

One of the more difficult challenges as a manager, consultant, or researcher in this environment is keeping up with the onslaught of data. As radio broadcasters that report to Wall Street release their Q4 2013 results, the trades are inundated with numbers, nuanced to tell stories about what worked – and what didn’t.

And so it goes with audience trends, too. A number of research companies produce their versions of national studies – well-conducted surveys that have the ability to teach us a lot about the changing space of audio consumption. It requires discrimination, thoughtfulness, and a dash of skepticism when reviewing this data, but these reports can be very telling, offering direction and confirmation.

We will be contributing to the data deluge in just a few weeks. Techsurvey10 is being crunched and analyzed as I write this – more than 42,000 respondents across 200+ stations across North America. These stakeholder stations will see the top-line report first, followed by our exclusive presentation at the Worldwide Radio Summit in L.A. in early April.

From headphone listening to social media acknowledgment to music discovery to interest in those new iWatches, TS10 will have a lot of data that radio analysts will be talking about for months. Trying to find just the right data points for a 50 minutes presentation is challenging, and hopefully, we’ll provide the industry and our participating partner stations with metrics that matter.

But what about some of the existing research that perhaps flies below the radar – and yet is loaded with important nuggets of information that have implications on what programmers, DJs, salespeople, and marketers do every day?

Nielsen Audio’s “State of the Media – Audio Today 2014” is one of those reports that came and went. It’s the modified version of what Arbitron used to call “Radio Today,” and this year’s report has some important gems.

It’s linked here.

Like any research, it’s not difficult to gravitate to data that reinforces your hunches or the way you’re used to looking at numbers. I was gratified, for example, to see that Nielsen breaks out its data generationally – something that we emphasized in TS9 and will again feature in our new survey. It is more meaningful than studying Men 25-54, for example, because it speaks to the cultural differences that define our country and its people.

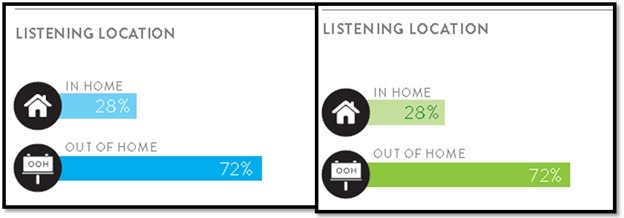

But here’s what caught my eye: the “out of home” data broken out by generation is highly attention-getting and loaded with implications. While two-thirds of Boomers listen to the radio away from home, more than seven in ten (72%) Millennials (blue) and Gen Xers (green) listen to the radio in locations other than a home or an apartment.

While Nielsen does not break out in-car and in-office listening specifically, our Techsurveys help fill in those blanks. We have learned that for more than half of our respondents, the lion’s share of radio listening takes place while people are in cars. And nine in ten of them listen to stations like yours every week while driving – the car is the top listening location.

It’s another reason why programming and differentiation strategies need to be geared to accommodate the growing audio entertainment and information options available to people on their computers, their mobile devices, and of course, the “center stacks” of today’s growing fleet of connected cars.

Nielsen is telling radio that the game is, in fact, changing. It is necessary to understand that environment matters, and that competitive strategies for the car, the workplace, and the home are going to have to be rethought. The language that stations use to communicate to audiences in these competitive, audio-rich environments matters greatly.

Rarely do stations clearly inform consumers about the different ways in which they can access their content. Instead, they often assume that terrestrial radios continue to be ubiquitous in all listening locations. That data – and best we pay attention to it- suggests otherwise. Many Gen X and Y consumers don’t have radios in all the conventional places, making streaming a more critically important part of the consumption menu. At this juncture, radio operators should take nothing for granted.

Nor should broadcasters cannot assume that consumers will intuitively know all the different touch points that stations offer, and how to seamlessly access them. Unlike the ease, convenience, and ubiquity of terrestrial radio listening, downloading an app, accessing a stream, subscribing to a podcast, and following a DJ on Twitter require explanation, direction, and guidance.

As Wait Wait, Don’t Tell Me! panelist Roxanne Roberts told a packed session at last year’s PRPD conference, “Take me by the hand.” And she’s on the air on hundreds of stations across America, but admits she doesn’t know all the ways her program can be accessed.

The Nielsen study suggests we better start connecting the tech dots for consumers.

We’d be wise to rethink our “old school givens,” and do just that.

Correction: I misquoted the data (although the point is the same). It should read that of Millennials and Gen Xers, 72% of their listening is out of home, while 28% is in home. Sorry for any issues this may have caused.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Leave a Reply