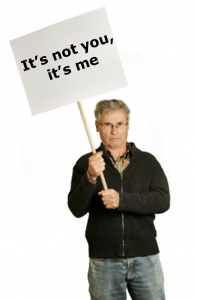

It’s one of the worst lines you’ll ever hear:

“It’s not you, it’s me.”

And the equivalent in the world of radio today:

“The problem isn’t with our ratings, it’s with our sales.”

How many radio stations – great ones, mind you – are hitting their ratings goals, are top 5 25-54 performers, are consistent winners – and yet, continue to lag seriously behind in sales?

Often by a lot.

I have heard this line so many times in the past five years, but never with as much frequency as the past 12 months. Great stations, great brands, and in some cases, market institutions are behind – way behind – in generating spot sales.

And the impact of these now-consistent quarter-after-quarter shortfalls is that the brand gets damaged. Through layoffs, cutbacks, less research, limited to no marketing, and a suffocation of resources, many great stations are finding that their greatness may not be sustainable.

So now everyone’s running around trying to figure out if this Radio Disney announcement portends the death of radio as we’ve known it, is it a statement about the future (or lack thereof) of AM radio, or is it something else altogether.

The radio industry can debate the state of AM radio at conventions, with FCC commissioners, and with carmakers, but its fate is overshadowed by the 800 pound gorilla that has taken up residence in the sales cubicles. The radio business is being buffeted by its own self-inflicted problems, and it has everything to do with the declining vital signs on the sales front.

It’s no longer dirt simple to generate carloads of cash from good ratings. It’s no longer a matter of answering the phone and quoting rates. The radio business is no longer easy. And that transmitter and tower is no longer a license to print money.

Consider the following pieces of information and data:

- Erica Farber has the unhappy task of announcing that radio’s Q2 performance dropped 3%. The culprit? Spot activity dropped 5% (while off-air and digital were up 13% and 9% respectively).

- Words and phrases like “general market softness,” “sluggishness,” and “corrugated” (huh?) are used to explain away radio’s Q2 malaise.

- KNDD/Seattle cuts the spotload in half – from 12 minutes to 6 minutes in a bold move to shake up the market – and its brand.

- Riviera’s Oasis/Phoenix promises no more than 5 minutes of commercials an hour.

- In Townsquare’s IPO filing for Q1 2014, 26% of revenue came from “sources other than the sale of terrestrial advertising.” And the goal is to ramp that percentage even higher.

So declining spotloads translate to less inventory, and that begs the question: where will the money come from in this rapidly changing, highly disruptive environment?

No matter how you read it, the Radio Disney announcement puts the onus of revenue generation and growth on business that will not be coming from the transmitter and tower model.

And no matter how you look at it, regardless of platform, radio continues to be in the audience delivery business. How it delivers that audience to advertisers – events, database, mobile, video, podcasts – is radio’s new cuisine – its secret sauce.

As more and more companies contemplate slashing spot inventory, the revenue is going to have to come from somewhere.

Raising the rates? Maybe, but that’s a big challenge, especially when there are major competitors willing to drop their Levi’s in order to gain market share – regardless of the incipient damage it causes to the overall perceived value of radio.

Providing value across different platforms? Connecting with the audience on their preferred platforms? Much more likely.

I was asked the other day about my reaction to the NPR One app (which we posted about earlier this month) and how it could siphon away audience from local public radio stations.

As a radio friend reminded me that same day, better that broadcasters disrupt themselves than Stitcher, Pandora, and SiriusXM does it to us instead.

For too long, radio has viewed itself as a limited inventory business. (And let’s get real: at at 14, 18, 20 or more units an hour, that’s a fallacy, too.) The fact is that these new platforms and distribution outlets offer more avails and greater opportunities to connect advertisers (and underwriters) with the audience. They should be viewed as mechanisms to attract revenue which is a way to offset inevitable lower spot revenue.

The answer is not in combining sales staffs, splitting up sales staffs, first quarter sales contests, reforecasting for the umpteenth time this year, shuffling sales managers in and out, or bonusing that loser FM.

It is in creating value and experiences for radio’s various constituencies – audiences, advertisers, and communities – whether on-air, online, in person, or on mobile devices. And it means training or replacing sellers who cannot survive in this new media world order.

How many more quarterly releases is Erica going to have to send out before that message sinks in?

It’s not the advertising climate.

It’s not a soft economy.

It’s not a harsh winter.

It’s not the World Cup.

And it’s not the elections.

We know what it is, don’t we?

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

This is a simple problem with a simple solution. Dumb down the programming and people listen less. Dumb down the sales team and people sell less.

If you cut compensation, add onerous restrictions like non competes and change the comp plan every few months, less talented and skilled sellers will be all you can attract. That’s what radio did and that’s what happened.

Offer an environment where people can thrive and grow without fear where if they get a better job the can take it and sales will grow again.

Bob, you said in 100 words what it took me probably 7 times that many to say. Thanks for the comment.

OK, I just took a look – more like 8 times!

Bob Bellin is right re creating value and experiences for radio’s various constituencies – audiences, advertisers, and communities – whether on-air, online, in person, or on mobile devices. The simple solution is that our medium can jump premium rate spot and digital revenue double digits and deliver significant measurable results, irrespective of ratings and economy. Having done the following in four markets, contact me here: [email protected]

Andy, thanks for the thoughts. The document you left is a sales piece and that’s not what the post was intended for. I’m leaving your email on your comment, so if broadcasters want to contact you, they may do so.

Fred, thanks for the thoughtful blog post.

The reality is that the world changed and we didn’t. Ten years ago we owned an incredibly scarce resource: tens of thousands of people aggregated to hear an advertiser’s message. Today advertisers have hundreds of places to reach tens of thousands of people.

It is not enough to sell access to our audiences. Our salespeople must be well versed in how to communicate to those audiences in a way that changes consumer behavior. They’ve got to triangulate a deep understanding of the client’s business with a piercing understanding of how consumer’s purchase the client’s product and match it up with the resources they have to reach that target consumer.

That’s a whole lot different than simply selling access to your scarce resource.

True enough, Sean. These are insightful comments and speak to the need to redefine radio’s ways of interfacing with advertisers, consumers, and the people we hire to market our brands. Thanks for taking the time to say it so well.

The real question is are your sellers able to address your clients new needs of today? Are they able to deliver true cross platform solutions that help the client see the ROI that radio along with digital can achieve? Are your PD’s and personalities able to engage with their listeners in a smart and consistent way organically through social platforms? Is your marketing department able to deliver your station’s message and positioning across multiple platforms digitally? Has your station made an investment to develop a great UX for your listeners across all platforms? Have you grown your digital assets to scale?

I see radio AE’s with cross platform titles on their cards today but hardly any of them can address mobile, MMS, database, search and social solutions for their clients. Is your station able to purchase mobile, social or search for your client in house? Do the sellers truly understand how much more powerful digital can be with a traditional element added to the campaign? Can they site studies and make suggestions? Do sellers and radio station marketers understand conquesting through mobile and search? Do PD’s really understand how to raise their PTAT scores? I would say no as the average radio station might be engaged with 2%-4% of their Facebook likes at any given time. Heavy investment is needed in all areas mentioned above. If you’re unwilling to spend the time and money, then you’re unwilling to grow. Hard but simple at the same time. Commitment and consistency is the name of the game here.

Thanks, Peter, for specifying some of the key areas that radio sellers – let’s call them marketers – need to be proficient at in order to effectively present their brands to advertisers. Reach, frequency, rate cards, and ROS sound like hieroglyphics in the modern-day light of digital delivery and our changing media ecosphere. Appreciate you taking the time to nail it.

Great article Fred.

In my view, it all comes down to one goal: GROWING DIGITAL SHARE. More than 1/2 the US population listens to some radio online (the majority of which is not A/F stations streaming). In the 60s/70s when the AM to FM migration occurred, AM owners invested in FM signals and prospered. Today as the migration from FM to mobile/online accelerates, we see very little investment in content innovation for the mobile/online platform. Minimal content innovation for the platform that is attracting tens of millions of people = minimal share of that platform. Pandora, Spotify, Apple, Google, Microsoft and Amazon are now in the radio business & they are all stoked that broadcast radio is seemingly stuck, unable to invest in building huge audiences online. CC is trying w/iHeart but according to their Triton #s, they’re seeing little success compared to the big tech companies that are dominating mobile/online radio. The situation is now urgent – broadcasters must step up and invest in content innovation in order to grow their digital share. Apple, Google, Spotify and Pandora are betting they won’t. So far, they’re right and positioned to siphon even more of broadcast radio’s audience to their services.

BTW, what’s coming soon to major markets is this: Let’s say you own a CHR station in a major market. You will be attacked by a song-skipping, data-driven, multi-channel app which provides many of the features and benefits of which FM radio is not capable. Broadcasters will either disrupt themselves or they will be disrupted. Apple was willing to cannibalize iTunes MP3 sales by launching iTunes Radio (now with 40 million ACTIVE users). Broadcast radio seems unwilling to cannibalize their A/F audiences. That’s great news for Pandora, Spotify, Apple and Google.

This them of “disrupt yourself” is tough, but a necessary part of turning that corner. Many broadcasters still have some strong assets, but some of the practical realities – notably, ratings crediting – prevent many of them from more openly promoting them. It’s a gnarly dilemma, to be sure. Thanks for weighing in.

Love this! It’s not Radio Sales, it’s Media Sales. You’re selling synergy, not singularity. So simple yet so hard for some to implement. If you have compelling content… offer it across popular platforms where your intended target thrives, effectively utilize those platforms to benefit a client (partner’s) botton line you win!

It’s not brain surgery, it’s common sense.

The right skill sets are out there, Radio needs to embrace and attract Media Managers (sellers) who possess them.

So much potential… so little time!

Tim, it IS simple, but it’s not necessarily easy to pull off. It’s a lot like yesterday and even today’s posts – they’re about doing remotes and on-site appearances like they matter; like having emergency systems in place so then when a catastrophe occurs, the staff understands their roles and is ready to implement. So much of what many of us were trained to do is still the fundamentally right thing to do today. But those priorities need to be handed down and enforced. Thanks for taking the time to comment.