Just watch CNBC or pick up the Wall Street Journal on any given day. It’s conclusive:

Amazon killed retail.

After all, look at the sorry state of department stores in the U.S. – Sears, Macy’s, J.C. Penney, Neiman Marcus, Lord & Taylor, Nordstrom. They’re either in bankruptcy, they’re reeling, or they’re on the brink of extinction. And thanks to COVID and less in-store and mall traffic, hundreds and hundreds of once established stores have called it quits.

“The retail apocalypse” is an undeniable truth.

Or is it?

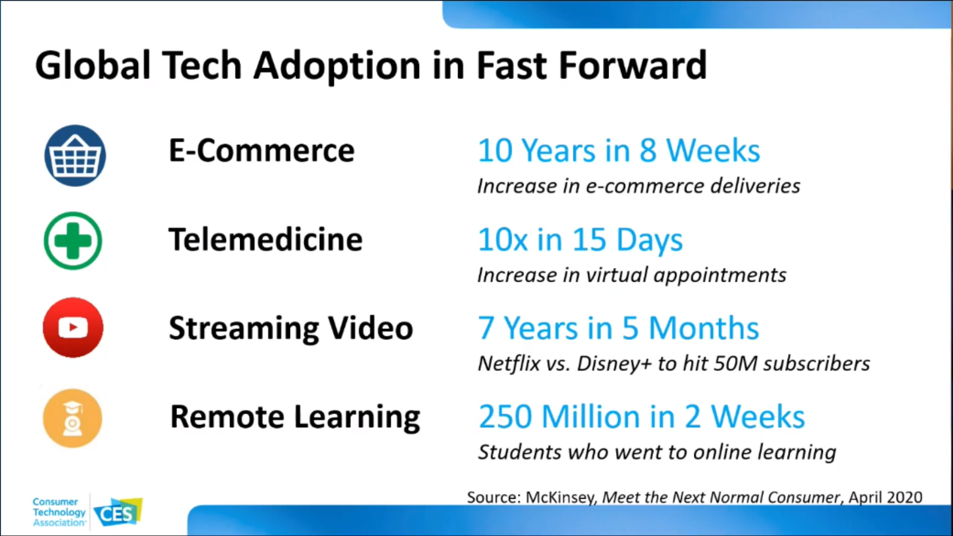

COVID accelerated the megatrend of online shopping, essentially pioneered and perfected by Amazon more than a couple decades ago. The Consumer Technology Association (the folks who produce CES) reported this past January how the pandemic sped up the online shopping frenzy. McKinsey did a study during COVID’s early chapters, and concluded that in just the initial 8 weeks of lockdowns, e-commerce adoption increased 10 years.

With most of America locked down, folks either figured out how to buy stuff online or go without. As the chart also shows, telemedicine, streaming video, and remote learning also experienced hyperactive growth during COVID’s early days. Americans had to master these technological steps in order to live their lives.

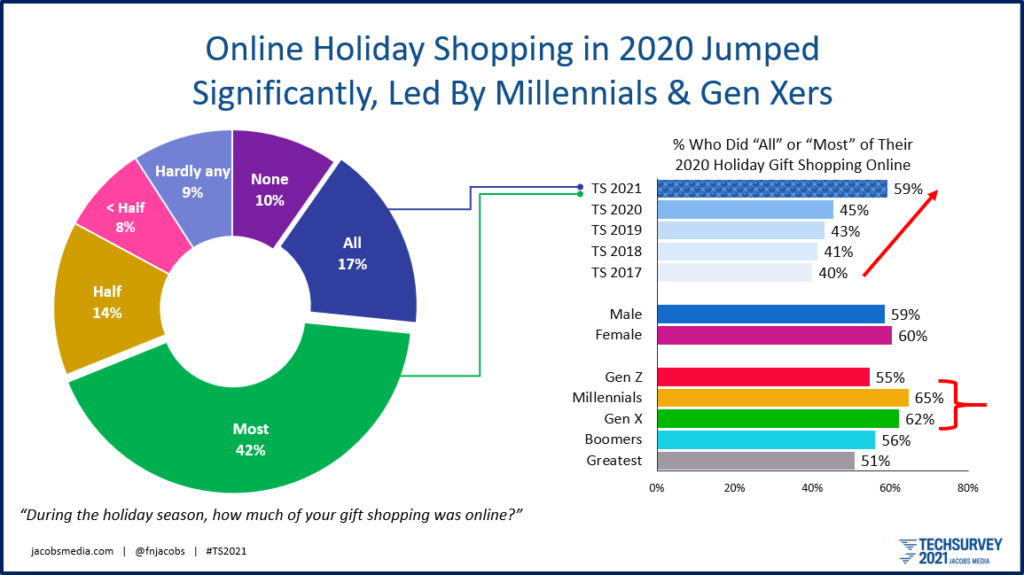

We have seen a similar trend in our Techsurveys as well. We conduct them in January/February each year – the perfect time to ask respondents about their recent holiday shopping habits. Note on the upper right trend section of the chart below, e-commerce had been growing pre-pandemic. But COVID accelerated the process. Last year, nearly six in ten told us all/most of their holiday shopping occurred online, a significant increase from previous years.

Many of you have asked whether we can expect continued growth during 2021’s holiday season. Clearly, the state of the pandemic this fall may dictate whether this pattern continues to remain steady – or experience even more growth. But it is safe to assume that many holiday shoppers discovered the ease of shopping on laptops, tablets, and smartphones last December. Many will not be headed to Main Street or the malls like they once did.

It’s no surprise when you see Millennials are overwhelmingly doing their gift-shopping online. It’s a whole other thing when a majority of Baby Boomers and the Greatest Generation (those born before 1946) are making more of their holiday purchases while staring at a screen.

Every ounce of logic suggests that e-commerce will continue to swamp brick-and-mortar stores, driving them into oblivion.

Except that Amazon has big plans to open up a series of department stores, thus confounding the experts yet again. By the way, it’s not their first foray into retail.

Amazon has launched 24 bookstores in the U.S. since 2015. They also have 30 “4-star” shops, and of course, there’s their purchase of Whole Foods, an iconic grocery brand. They’ve also opened Amazon Go stores as well as Amazon Fresh, a grocery store chain. All in all, that’s a lot of brick & mortar for a company famous for leaving their signature smiley boxes on your front porch.

And now a new story in The Economist – “Amazon’s department-store plans are less surprising than they appear” – is a reminder the company is still taking its founder, Jeff Bezos, seriously:

“The world wants you to be typical…Don’t let it happen.”

Thus, the company’s next move in retail shouldn’t surprise us. They’re opening up their versions of big box stores in California and Ohio. We’re talking 30,000 square foot retail giants.

Amazon has waited until retail business was already in a pretty rough place before making this next move. Walk into any department store – one that’s still open – and try to find good salespeople. Or any salesperson for that matter.

So, what’s Amazon thinking?

After bringing much of retail to its financial knees, Amazon is making heavy bets on the store traffic. Interestingly, they aren’t exactly killing it in the retail space. Amazon’s entire retail business was off 6% last year, compared to its 2018 performance. But that’s not what it’s about.

Amazon’s philosophy has a similar ring to a strategy we have talked about often in radio:

Meet the shopper where she is.

Sure, online shopping is a huge juggernaut that can’t be stopped, but there is still a retail market. Some people simply enjoy the shopping experience. It can be social. It’s something many families enjoy doing together. It’s a way to get out of the house.

And Amazon wants to dominate it all.

The financial community refers to it as an “omnichannel” strategy. And Mark Shmulik, a broker at Bernstein, wonders: “What took them so long?” He views retail as the next logical frontier for Amazon – another way for the company to increase its shopping share.

Our take on the big theme that dominated CES 2021 this year was a similar one:

Meet the customer where they are. (Or where they will be.)

And that is why we continue to encourage radio broadcasters to research its users in order to determine the optimal platforms they can use to entertain and inform their fans. It is why mobile, streams, smart speakers, and podcasts are all avenues worth pursuing. It is abundantly clear that transmitters and towers are making up a declining piece of the media pie. Thus, omnichannel.

So, if radio companies should be actively creating content and distribution in the digital space, what about tech companies like Google, Apple, Facebook, and yes, Amazon.

Their data reads just like ours. Broadcasting may be in decline, but it still constitutes a large and desirable share of media consumption. Why wouldn’t these “trillion dollar death stars,” as Evan Shapiro calls them, want their piece of the action?

And that begs the question: If they’re getting into retail, it’s not much of a leap to buy radio companies.

As iHeartRadio, Townsquare, and others are proving, even a diminished broadcast portfolio can drive ears and eyeballs pretty much anywhere – to web pages, to apps, to podcasts, and of course, to car dealerships, concerts, and other destinations.

That’s why it’s not a major stretch to imagine one of these mega-tech companies trying their hand at radio.

Imagine what would happen if Amazon bought a regional broadcast group to test drive the concept, like they’ve done with book shops, and soon big box retail stores.

They’d surely learn about the efficacy of radio, its strong presence in local communities, its ability to make fan connections, and its value in selling just about anything.

And at the same time, they’d teach us valuable lessons about new and innovative ways in which to run radio companies that have eluded broadcasters for decades.

Would it shake the radio broadcasting industry to it core?

One can only hope.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

What a fabulous column – one of your best, for sure. As you might expect, I have some issues with your belief that there is significant growth opportunity in expanded distribution for radio. Radio has consistently, systematically cheapened its product in the face of more competition, concentrating its cuts on the places where its own research reveals its audience values the most. So, in the face of that, the real problem is whether its available on one device that everyone owns or another one that everyone owns? Don’t misunderstand me – I have no problem with making radio available anywhere its convenient, I just don’t think that’s anything close to the crux of radio’s biggest challenge.

Amazon was smart, they beat up on retail and can jump in and pick up the easy pieces (I am steadfastly avoiding the outdated “low hanging fruit” cliché} that remain. In this analogy, it wouldn’t be Amazon that would get into radio, it would be Spotify, Apple or Sirius/Pandora. What radio has been dumbed down to would be reasonably easy for one of them to replicate and improve on – remember they can track each customer’s reaction to every piece of programming they access in real time and transform that data into actionable research. Condense a podcast and add some news, traffic and sports and you have a morning show that could be better than a lot of ones on radio right now.

I never understood why retails’ reaction to Amazon was to make the in-store experience worse and more inconvenient than the online one in every way, any more than I understood why radio reacted to innovative competition from Spotify and Pandora by making their existing product demonstrably less valuable to its core customers.

Is there any data on how much Sirius/XM listening is on the app vs car radios? That might be predictive. is it about the radio or the phone app? I don’t think so.

Good thinkin’ Bob. The points on how radio has dumbed things down, and how the pureplays have tried to accelerate their adoption brings up the point that the pureplays have still come off as “dumb” as radio is in 2021. The answer (as Fred points out) is to give the listener what it wants. Have you heard “Tik Tok Radio” on Sirius? It’s a wide variety of current music, much of it could never make it on over-the-air radio (content) but you can bet there’s an abundance of younger listeners flocking there, with Tik Tok’s billions of online users, they have a great advertising platform to drive ears to the Sirius service. The big broadcasters are still trying to put 80% to the bottom line and many of the online services are struggling to load the revenue columns. There must be a happy medium somewhere (pun intended). Sound familiar? Find out what they want-and give it to ’em.

Thanks as always for the thoughtful response.

Whether Amazon, Spotify, or another tech giant wades into radio is immaterial. The questions IMO is whether any of them value radio enough of an asset to buy a company AND whether an outside operating philosophy could be seismic for the industry.

Regarding your Sirius/XM question, our Techsurvey data indicates that while in-car listening is dominant, their in home and at work usage is growing, thanks to the app.

Appreciate it, Bob.

I hope it happens – I think radio could benefit a lot from some outside thinking and might require it to thrive – maybe even survive long term. And it wouldn’t be any strain for them to do it. Amazon has a market cap of 1.7 trillion, Jeff Bezos is worth roughly $200 billion and Audacy has a market cap of just over $500 million, or 1/400th of what Jeff Bezos has. To someone with $10 million, that’s like buying something for $25K. With those numbers, they just must not see an opportunity.

It could easily elude a trillion dollar company, Bob, but all it takes is one. Thanks for responding back.

An Amazon Fresh just opened up a few blocks from my office. The big irony is that it’s even closer to a longtime Whole Foods.

https://wtop.com/montgomery-county/2021/08/hundreds-line-up-as-amazon-fresh-opens-in-chevy-chase

That IS ironic.