Possibly the biggest buzz term in the advertising industry today is “programmatic buying.” And while many think it refers to low-rate remnant advertising or auctioning off inventory, “programmatic buying” is actually any sort of automated ad-buying system.

The amount of advertising being sold through automated processes is skyrocketing. According to eMarketer, Magna Global predicts it will account for over $32 billion worldwide by 2017, nearly $17 billion of which will be spent in the U.S. Unfortunately, none of that money is being spent with radio which is where Jelli co-founder and CEO Mike Dougherty comes in.

The amount of advertising being sold through automated processes is skyrocketing. According to eMarketer, Magna Global predicts it will account for over $32 billion worldwide by 2017, nearly $17 billion of which will be spent in the U.S. Unfortunately, none of that money is being spent with radio which is where Jelli co-founder and CEO Mike Dougherty comes in.

His company’s original focus was creating crowd sourced radio with listeners controlling programming by voting songs up and down in real time. But over the past two years, Jelli’s focus has shifted to a new endeavor called RadioSpot, a platform that will make it possible to automate the process of buying and selling radio ads.

By the way, Mike is another example of someone outside of radio who is making a difference inside the industry. He got his start in banking as an analyst and moved into digital music and video with Loudeye. Mike later worked in biz dev for Tellme, which specializes in search on phones, and then founded Jelli in ’08.

Being the guy who could potentially help radio tap into a vast pool of new advertising revenue via his innovative Jelli platform, Mike is a great representative of reinventing the advertising wheel for radio – while reinventing his entire business model. We talked with him about what this could mean to both the radio industry and the people who work in it for this week’s edition of Radio’s Most Innovative.

JM: Define “programmatic buying” for us. What is it and how does it work?

MD: The majority of radio is sold through what you might call a salesperson-driven request for proposal or insertion order type model. It’s been that way for decades and frankly a lot of digital advertising, television and other types of media have been sold that way, too.

“Programmatic” is really defined by three aspects: automating a process for the buyer so they can move faster; self-service buying where the advertiser is using a tool to target and buy on their own; and the use of data to be smarter about buying the audience you want. Those three pieces are the reason for the surge in “programmatic buying” which has been primarily in digital but is starting to move to online video and television. And radio is next.

JM: So what led you to move Jelli to this new focus?

MD: It came from the best of places – customer feedback. We started the company with the idea of combining the power of a web-based platform with the power of radio. We believe that one-plus-one can equal three and that is still our mission.

Initially, we focused on the audience, hoping to make their engagement more real-time and creating a feedback loop. Because of that, we wound up meeting with one of the largest radio agencies.

They told us they wanted more data about the audience and mentioned needing help with simple ad serving. They suggested instead of serving all that music in real-time, our platform could work like an ad server for radio spots. It’s similar to what digital does with ad servers except it’s for radio. That was the start of our pivot.

JM: Did you follow that up by researching other potential clients?

MD: The good news was we had some recent history to look at. There was a platform called Google Radio that attempted to do something similar, albeit with 2008 technology. But yes, in addition, we reached out to more agencies and found they all shared the same needs around modernizing the methodology of buying and running ads on radio stations.

JM: So how does the system work?

MD: It starts with an individual radio station hooking a Jelli appliance to their existing automation and traffic systems. Then the station schedules a generic Jelli commercial and our platform takes over.

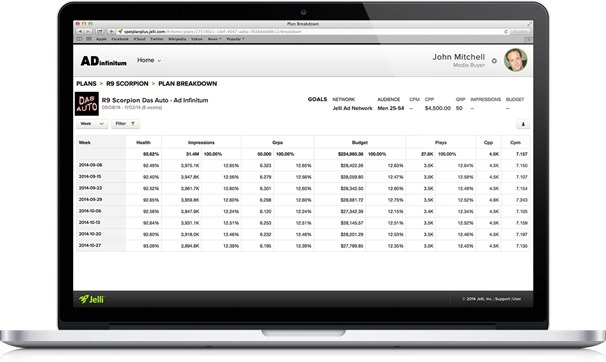

On the buy side, an agency or any buyer placing ad campaigns does an insertion order on our platform and uploads the creative into the Cloud. Since all the stations on the buy have our server, the audio is downloaded automatically and at the appropriate time, the system looks to the Jelli server and whatever ad is supposed to run at that moment plays.

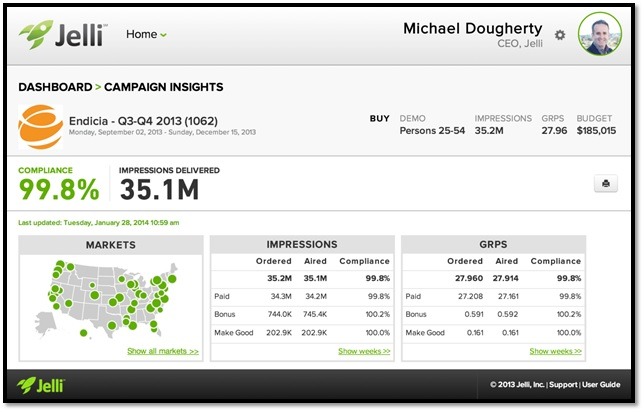

The system also automatically creates a log that buyers can access on a real-time dashboard. It’s the first time they’ve been able to track their ads as they run. They can use that data to match up against sales or whatever ROI they’re trying for. It essentially automates a lot of the process in the middle which happens around what you might consider traffic or continuity and helps increase radio’s level of accountability for these clients.

JM: So how does that redefine the buyer’s end of the process?

MD: First, you can target in a way you couldn’t ever before. It’s sometimes called an unwired network where you can build every proposal with a custom lineup of stations that meets the specific needs of that client. You’re not forced into something that’s not flexible.

Being able to tailor the buy to the needs of the client puts a lot of power at the fingertips of the salesperson. Then when the campaign is running, the dashboard enables the sales team to compete against digital. Radio becomes both a powerful medium that reaches people in their cars right before they make a purchase decision with the same sort of reporting buyers are used to with other media.

JM: How does the radio salesperson participate when there are self-service ads being bought?

MD: Essentially the salesperson provides a tool to their client. They don’t have to babysit every single avail and watch the email thread to make sure they’re following up on closing each and every buy. It’s similar to how Google operates when you set up an AdWords account. There’s the Google team making sure you keep spending money with them, but they’re not worried about every little keyword you’re buying.

JM: So what does this mean for an account executive working at a radio station today?

MD: If you’re a local rep, probably not much. “Programmatic” is primarily going to come into radio on the national level first. If you work at a radio network, a rep firm or something else on a national scale, your processes over time are likely going to change.

JM: What about when national advertisers want to activate local programs?

MD: That’s where this really creates value for the sales rep at the national level. They can spend their time on that sort of high CPM/ high value integration work, where you’re talking about sponsorships, and cross channel programs. That stuff is very complex and it’s what you’re going to put your best people on.

JM: As you’ve been putting this together, what’s the biggest hurdle you’ve faced?

MD: The biggest hurdle with any big industry like radio is they tend to like operating on the model they’re used to, which leads to moving more slowly on technology innovations. Radio typically innovates in other ways, such as around content and business models but much of the innovation in our culture now is tech driven.

JM: Does a platform like this make radio more competitive with products like Pandora?

MD: No question, because the alternative is status quo. Every year, digital media offers clients easier ways to buy their platforms. Radio doesn’t get harder to work with, but we don’t change, so we look harder to work by comparison. The bar is being raised every year.

For a marketer who is thinking about audio, Pandora or someone like that looks attractive because they have systems which are similar to existing digital options. Doing a nationwide radio campaign where the reporting takes a long time and you might need to hire an agency feels very different.

We’re trying to enable radio to have elements that are similar to digital so it’s both easy to use and reaches a person in their car, a place it’s been historically difficult to reach with digital buys.

JM: So that’s part of how this builds value for radio as a medium – by creating tools that are similar to digital and more flexible for the adverting industry?

MD: Exactly. Recent reports indicate “programmatic buying” is expected to grow to $20 billion in the next 24 months, none of which is coming to radio because it is all spent using automated systems. The money is being allocated to a way of buying versus a type of media.

I believe that we can tap into that $20 billion and pull some of it in our direction as well as bring back advertisers who left and add ones who never bought radio because they’ve been digitally native with their marketing.

JM: Jelli doesn’t use real time bidding which other media have. Why the decision not to do that?

MD: It’s a little early for that for radio. The notion of bidding on inventory makes broadcasters more uncertain about the price and the value they’re able to maintain for that inventory even though you have the ability to put a floor on the price.

There’s likely going to be technology and announcements in that category in the future but for right now, it’s sort of an evolution starting with more automation and better targeting.

JM: So it’s about bringing the industry along slowly?

MD: And carefully, because there are also mistakes that have been made in digital. For example, the CEO of iHeartMedia (Bob Pittman) points to the focus on price versus ROI. Current algorithms focus on the lowest price as opposed to the highest ROI. Remember, advertising isn’t about the spend; it’s about what you’re trying to accomplish. All impressions are not created equal and sometimes spending more money on a per CPM basis can lead to more ROI. A radio ad on a great radio station inside of a great morning show may be more valuable than an ad that runs in more generic programming. I think we have a chance to meet these challenge and maybe come up with concepts digital can learn from.

JM: Are there other areas where radio sales organizations should be focused on innovating?

MD: As the audience becomes more multi-channel, sales teams need to think in a multi-channel way. It’s not just about the FM broadcast; it’s the broadcast combined with the stream, combined with activity on social media. It’s such a critical thing for radio and it’s just starting to be pulled together in a coherent way on the programming side. I think the future of radio sales is selling that multi-channel experience. The advertisers aren’t waiting. They’re spending money on digital and aren’t holding off while radio catches up.

Thanks to Mike Stern for writing this week’s Radio’s Most Innovative profile.

INNOVATION QUOTE OF THE WEEK

“Advertising is the greatest art form of the twentieth century.”

Marshall McLuhan, sociologist and author

More of Radio’s Most Innovative

- Radio’s Most Innovative: Dave Ramsey

- Radio’s Most Innovative: Radio Everyone

- Radio’s Most Innovative: XAPPmedia

- Radio’s Most SKINnovative: Jim McBride

- Radio’s Most Innovative: Film House

- What’s On Your Bucket List? - March 31, 2025

- “Honey, would you please talk to Alexa?” - March 28, 2025

- On The Radio, It’s Always 5 O’Clock Somewhere - March 27, 2025

Radio spent the 80’s consolidating and 90’s going public without a thought to innovation or reinvesting in their business models (merely in making quarters and resetting industry “standards” to the then-Clear Channel and Cumulus models of staff and resource reduction due to analyst pressure). This is as old as the Harvard Business review article of 1960 by Theodore Levitt “Marketing Myopia” about the railroads’ insular thinking. Railroad executives couldn’t imagine people drinking cocktails in a steel tube hurtling through the air at 40,000 feet. And radio executives, most close to retirement, couldn’t see or acknowledge the Pandora’s and Spotify-type channels coming. It will never be Tuesday.

The new exception is iHeart though Clear Channel, and their prior top management and controlling ownership had to go before Pittman could really change it up and point it to this century.

This is an idea 10 years overdue in radio, but the model of “programmatic buying” is “pay when booked”, not 90 days after airing or invoicing. How many agencies can Jelli convince to change up their 90 day A/P model to pay in advance?

Laura, thanks for the prescient comment and observations. From railroads to newspapers to film, there are many tales of disruption and lack of innovation by those in the legacy industry. I find it fascinating that so many of the innovations we’ve been highlighting – including Jelli – are “outside in.” Appreciate you taking the time and BTW Fresh Tape looks like a pretty cool product.