When it comes to providing digital solutions for advertisers, the radio industry has inherent advantages and disadvantages.

On the plus side, radio’s local sales staffs have built strong relationships with hometown businesses, many of whom need help finding smart digital opportunities to augment their radio spend. Unfortunately, the missing pieces are often the training, resources, and inventory necessary in providing great digital advertising solutions.

That’s where providers like Liquidus can help. From dynamic ads to making it easy to extend digital ad campaigns’ reach through programmatic buying, Liquidus gives stations the opportunity to go above and beyond for their clients.

For radio, the challenge and the opportunity is the car dealership sector. For decades, local stations and local car dealers were on the same page. They are all hometown businesses, involved in their communities, and seeking the same customers to help them build brands. But as the auto industry has moved its dollars to the digital arenas, radio is feeling the pinch.

Liquidus is in a unique position to help radio because they are at the intersection of car dealers and their media partners. They are able to identify digital co-op dollars, and then work with radio stations to develop solutions. We’ve spoken with several stations that credit Liquidus with helping them generate digital business they otherwise wouldn’t have.

Liquidus is in a unique position to help radio because they are at the intersection of car dealers and their media partners. They are able to identify digital co-op dollars, and then work with radio stations to develop solutions. We’ve spoken with several stations that credit Liquidus with helping them generate digital business they otherwise wouldn’t have.

After seeing the company’s President and Co-Founder Chris Carlton speak at our recent DASH Conference, we asked him to talk about how Liquidus partners with radio stations, what services they offer, and where he sees media sales heading in the future for this week’s edition of Radio’s Most Innovative.

JM: Describe what the company does and how you work with media partners like radio and advertisers.

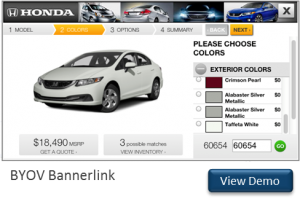

CC: Liquidus is an advertising technology and media company. We have been around for 14 years and have three primary sides of our business. One is our advertising technology platform BannerLink. We license that platform to our reseller partners — radio companies, cable operators, newspaper companies, etc.

Over about eight years, we have grown to have about 50 or 60 different reseller groups that vary in size from companies like CBS, iHeartRadio, Univision, Comcast, Time Warner, Fox, Tribune, Scripps and Gannet down to smaller, local media companies. What they do is resell BannerLink ad platform capabilities to their advertisers, which include local, regional and national clients.

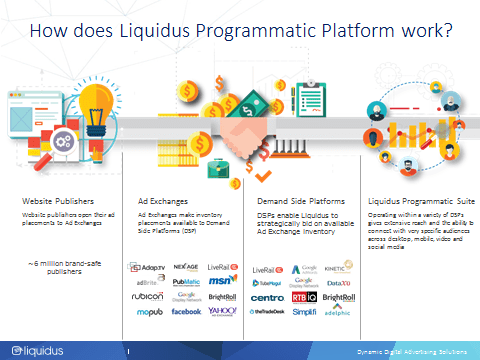

Another segment of the company is our programmatic media platform. We have developed our own programmatic media trade desk because many of the media companies we partner with needed additional inventory sources when they couldn’t fulfill the amount of inventory being requested from just their owned and operated properties. We provide them access to a whole suite of media services that are outside their owned and operated properties. It not only allows them to deliver on digital sales opportunities their sellers have cultivated but also has opened up many new revenue channels by providing them with media services that aren’t offered on their properties. These include pre-roll, targeted pre-roll, behavioral targeting, hyperlocal geo-targeting, and all kinds of mobile and social media advertising opportunities.

The third part is our video player technology called Videolink: a real-time data-driven video product that powers sites like Cars.com, Edmunds, Kelley Blue Book and Ford Direct. If you go to Cars.com and click on a listing for a Ford F-150 and it says “play video,” we dynamically render that video from digital assets, mostly images and text, and we add different features and functionalities to create a real, immersive, engaging video merchandising experience for auto shoppers.

JM: Let’s circle back to BannerLink, the platform you license to radio stations that enables them to sell additional inventory. Is that radio or TV inventory?

JM: Let’s circle back to BannerLink, the platform you license to radio stations that enables them to sell additional inventory. Is that radio or TV inventory?

CC: No, no, it’s all digital. We really aid them in driving more digital dollars. We always talk about helping our partners get as close to 100% wallet share as possible with their advertisers. The cool thing is our radio partners, CBS, Tribune or Univision all have long-standing relationships with their auto dealer advertisers. So in order to really increase the digital share of wallet they can garner, it’s Liquidus’ job to provide them the ammunition, from both a knowledge and a product standpoint to arm their salespeople to do so.

JM: So you help train the sellers?

CC: Yes. The best practice scenario is being able to educate the salespeople as much as possible on the digital products that they have to offer, because if they don’t understand what they’re selling, they won’t sell it and therefore there will be no revenue. Therefore, you have to keep the message and the product as simple as possible. Otherwise, if things are too complex, they’re not going to gravitate towards it.

JM: Can you give me a specific example of a campaign or advertiser where the platform has worked really well to help illustrate how it works?

CC: Our BannerLink ad platform allows for the creation of dynamic display ads that have hundreds, if not thousands, of listings within that ad unit. This way, radio account executives can enable their dealership clients to put their entire new or used inventory into one ad unit that can run on the station’s site and, through our media reach extension, other major sites. So they’re not only providing that auto dealer with a radio plan, but also providing a digital plan and digital creative that allows that dealer’s inventory to really have an extended reach across a footprint they weren’t able to get to before.

JM: Looking back, when it came to partnering with radio specifically, what were the hurdles you had to overcome?

CC: The biggest hindrance to success can be the structure of the company we’re dealing with. Many radio corpor ations are very fragmented; there’s not a lot of top down management. So, in that instance, you are going to market reintroducing your product, finding the right people for implementing it and then educating their sellers, getting the onboarding process set in stone and operationalizing it. The most success we’ve had and, in turn, they’ve had, is with radio companies that were very centrally, top down organized.

ations are very fragmented; there’s not a lot of top down management. So, in that instance, you are going to market reintroducing your product, finding the right people for implementing it and then educating their sellers, getting the onboarding process set in stone and operationalizing it. The most success we’ve had and, in turn, they’ve had, is with radio companies that were very centrally, top down organized.

Then on the media side of things — this is kind of a touchy subject depending on who you’re talking to — at one point all these media companies, radio, television and print, gave away their digital resources as value added if the advertiser did a big deal. Now digital has become a much more coveted source of inventory and companies are worried that salespeople locally aren’t selling the inventory on their owned and operated web properties first. That has been kind of a roadblock to other digital sales tactics that involve outside opportunities.

JM: Why is selling the inventory on the owned and operated properties such a concern?

CC: Because from a corporate standpoint that’s the highest margin you could ever really achieve. But with that goes the fact that in addition to traditional broadcasters, there are so many other digital media players that have salespeople and are selling targeted digital media at a fraction of the cost.

So, for example, say there’s XYZ Radio Company that has stations in 20 markets. They’ll go and sell a local advertiser a digital package at a cost of $14 CPM, where a digital programmatic media company would go in and sell directly to that advertiser for a fraction of that. So, I think the days of really coveting their owned and operated digital properties for a high CPM are ending because they have to compete. If you were to ask me to look into 2016 and beyond, I think that’s going to become more of an issue for digital radio sellers. I tell a radio seller – and all media sellers – that 30% of something is better than 100% of nothing.

JM: Give us a basic explanation of programmatic buying.

CC: So there are publishers like cars.com, or CNN, or The Chicago Tribune, or CBS Chicago.com. And it used to be an advertiser would go directly to one of those digital publishers and say I want to buy an advertising slot on your website for X period of time for X number of impressions. Then those publishers began to be aggregated by different ad networks. Then those became ad exchanges where inventory would be bought and sold (often through real-time auctions). Those exchanges still exist today but now there are platforms that aggregate exchanges and allow people like myself to buy or bid on that inventory based on different criteria like behavioral data or geo targeting. So you’re able to bid on inventory and on audiences similar to how you would bid on any other kind of commodity.

JM: And how is that changing what you do?

CC: We can get much more targeted inventory and reach a much more targeted audience as opposed to targeting websites. So instead of saying ‘I want to buy these ten auto endemic websites,’ I can say ‘I just want to find auto intenders,” the people who have searched for autos, been to an auto site or an auto dealer, or bought a car recently. You’re finding an audience as opposed to buying purely contextual or websites.

And now you can do it very fast and get massive amounts of reach. Back in the day, I’d be calling a network to find 500,000 impressions in Gurney, Illinois for auto intenders and they would only have 100,000. Now you can get the number of impressions you want by utilizing tactics that are available through the programmatic platforms.

JM: Programmatic buying is still relatively new. Where do you see this heading?

CC: I see programmatic radio and programmatic television evolving in the next 2 years. The ability to buy those types of platforms in a similar way to how we buy digital media is becoming pretty interesting. I also see Private Marketplaces becoming pervasive in the next 12 months. That’s when a particular publisher, like a Univision, allows for a certain amount of digital inventory that only I, as their reseller partner, have access to. This ensures a number of things for Univision – quality of the digital inventory, highly viewable inventory, and it ensures that Univision’s owned and operated inventory is being utilized first and foremost. Because Univision knows it’s their inventory and that most of their ads are above the fold, they don’t have any bots, etc. It secures the quality of the inventory, but allows somebody to buy it in a really efficient and cost effective manner.

JM: Watching your presentation at DASH, a lot of what Liquidus does seems to work really well for automotive campaigns. Is that the leading category for the types of technology you offer or does it work equally well for other product categories?

CC: Well, a couple of things. One, we work with media companies and their number one advertiser category is automotive. So by the nature of who they’re selling to, that’s where we’ve really concentrated the breadth of our targeting. But that said, from a product standpoint, we’ve really designed our ad type to be as effective as possible for listing based advertisers like auto dealers, real estate agents, or retailers. Places where we can target the particular listings an individual sees based on specific criteria, whether it’s where the person is, what kind of vehicles they’ve purchased in the past, or what kind of vehicles they’ve searched recently. It has been, from a product standpoint, something that we have really focused on, just because of the need of our resellers.

JM: Based on your unique viewpoint, what area of the radio industry most needs innovation in order to stay relevant?

CC: I think that it’s mobile. Digital publisher’s desktop inventory is decreasing every day as their mobile inventory is increasing. In addition, the targeting capabilities are growing ever more precise because we all live on our mobile devices. This year was big for mobile and 2016 is going to be bigger.

JM: According to your website, Liquidus started on a cocktail napkin at a Chicago Cubs game. What advice would you give someone who has a great idea and is sitting around a place that features cocktail napkins?

CC: The number one thing you have to concentrate on is product and services. Those two have to work hand in hand. There is a lot of parity in the marketplace as far as the products out there. What really sets people apart is their ability to provide the right level of customer service to their clients and making them feel like more of a partner than a client.

INNOVATION QUOTE OF THE WEEK

“Innovation almost always is not successful the first time out. You try something and it doesn’t work and it takes confidence to say we haven’t failed yet…ultimately you become commercially successful.”

Clayton Christensen, Harvard Business School professor

More of Radio’s Most Innovative

- Radio’s Most Innovative: Entercom Sacramento’s “Eat Farm To Fork” Initiative

- Radio’s Most Innovative: Dan Vallie, National Radio Talent System, Part 2

- Radio’s Most Innovative: Radio Woodstock

- Radio’s Most Innovative: WTOP Digital

- Radio’s Most Innovative: Jeff Smulyan/WFAN

- What’s Fair Is Fair - April 1, 2025

- What’s On Your Bucket List? - March 31, 2025

- “Honey, would you please talk to Alexa?” - March 28, 2025

Fred, I know the body of your post has less to do with the remote broadcast pic and more to do with new win/win solutions. But, because radio continues to embarrass itself in public with the prize wheel, the van, the card table, & the bored interns it is worth mentioning that the most recent SLC Women’s Auxiliary Annual Bake sale looked more high tech and interesting. Hey, the WAA has cakes. Station key chains and crap are as interesting as free reams of paper from the copy room. “Spin the wheel on this flimsy card table and win a ream of plain, white paper!”

If radio is going to continue to display itself with it’s pants down in public, some entrepreneur needs to come up with a reasonably priced solution that looks more high tech than a child’s lemonade sale. A la Eric Rhoads, Giant Boom Box of the 80s.

You will get no argument from me, Sean. Everything else aside, radio has to represent professionally in public and when attempting to help clients market their businesses. Thanks for commenting.