Many radio broadcasters are taking a hard look at Nielsen PPM ratings in light of the COVID-19 outbreak. How does (nearly) a national stay-at-home orders impact routine radio listening? Now that so many consumers are at home, while the unemployment rate skyrockets, what effect is that having on broadcast radio listening? How will less in-car and at-work listening impact routine consumption of broadcast radio?

That’s been the topic of conversation here at Jacobs Media these past couple weeks as well. Our flash coronavirus surveys – presented to stakeholders and in separate webinars for the RAB, PRPD (for public radio), and CMB (Christian music radio) drew record crowds. We’re all trying to learn as much as possible about how this pandemic is rocking our worlds. (You can now watch our webinar from last week, in partnership with RAB here.)

As every corner of the radio industry tries to get its collective head around the changing ratings, it’s easy to forget a topic that received special attention from Nielsen in 2019:

Headphone listening – and how it’s being measured and credited in PPM markets.

The market has changed quite a bit since those days of those bulky Koss Pro4AAs – or “cans” as DJs called them – that everyone wore. In the past several years, technology has ushered in slick new products for the ear – “hearables” – as they’re now called. According to MediaPost, Jupiter Research indicates the number of these devices will grow to 970 million by 2024.

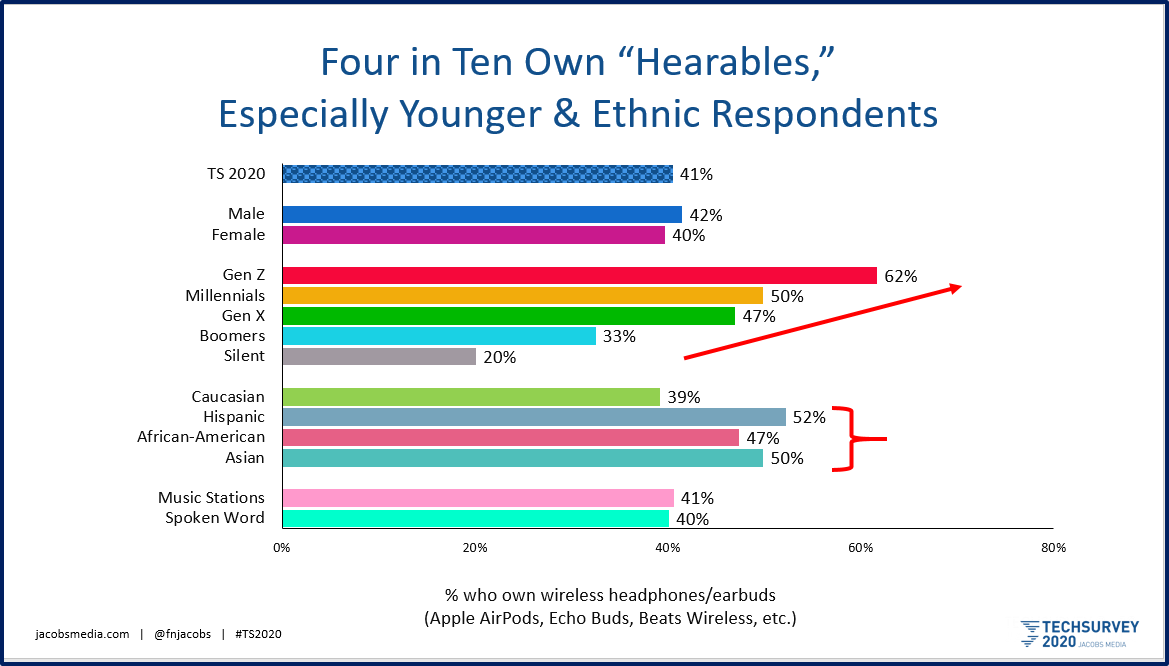

And this year in Techsurvey 2020, we asked about “hearables” – wireless devices like AirPods and the many other varieties we see with increasing visibility each year at CES. Keep in mind, our Techsurveys are mostly populated by core commercial radio listeners.

So, here’s what we learned. It turns out four in ten of our respondents already own “hearables” of one kind of another, the demographic patterns are fascinating and relevant to understanding new ways in which audio is being consumed.

Younger people, in particular, have a much greater propensity to embrace “hearables” as a cool, personal, and quality way to enjoy their favorite audio. And Latinos, Asian Americans, and African-Americans are considerably more apt to fall into this camp as well. When you translate that into radio format consumption, it’s not hard to define the ratings shortfall – especially in PPM markets.

That’s because for as long as there have been meters, there’s been a strong suspicion headphone listening has been severely undercounted due to the inaudible nature of this consumption. Remember that for the meter to credit listening, it has to “hear” an encoded radio signal. That doesn’t happen while a user is wearing any type of headphones or earbuds.

In fairness to Arbitron and Nielsen, a dongle supplied to their panelists was designed as a workaround. But many industry observers have long agreed that few Nielsen respondents take the trouble to use this rather clunky accessory, created back in the days when headphones were uniformly connected by a cord, rather than by Bluetooth technology so common today.

So, after considerable grousing from broadcasters, Nielsen committed to getting to the bottom of this issue last year, commissioning studies of meter panelists representing multi-format listening, as well as demographic representation in terms of age, gender, and ethnicity. The mission was to identify the audience subgroups and their go-to formats where headphones are more (or less) commonly used to listen to broadcast radio.

From there, Nielsen’s plan was to use this data to create listening models that can be applied to existing PPM ratings. And the hope has been that virtually every station in the biggest markets would see a boost in their ratings as a result of tacking on heretofore missing headphone listening.

It’s easy to forget about something this minuscule while radio is fighting its way through a global pandemic. But ratings matter, COVID-19 or not. What’s the status of this headphone study, and when can radio operators expect to see results?

It’s easy to forget about something this minuscule while radio is fighting its way through a global pandemic. But ratings matter, COVID-19 or not. What’s the status of this headphone study, and when can radio operators expect to see results?

An informed Nielsen source tells me both planned waves of their research have been completed. This data will first be shared with the Advisory Council and COLRAM, and then modeling will be done to determine how it will be applied to the ratings. The goal for deployment is 2021, and as I’m sure most broadcasters would agree, it cannot come soon enough.

That said, radio broadcasters shouldn’t expect a windfall of stratospheric ratings. While headphone listening will likely be substantial when Nielsen releases this data, it is not a large part of overall radio listening.

In fact, it is likely to indicate that most audio consumption with headphones is occurring on the digital side of the street (via laptops and smartphones). Much fewer listen to terrestrial radio broadcasts via headphones, ear buds, or AirPods.

Still, higher ratings – even a tenth of a point or two – will be welcomed by radio broadcasters, under pressure from all sides.

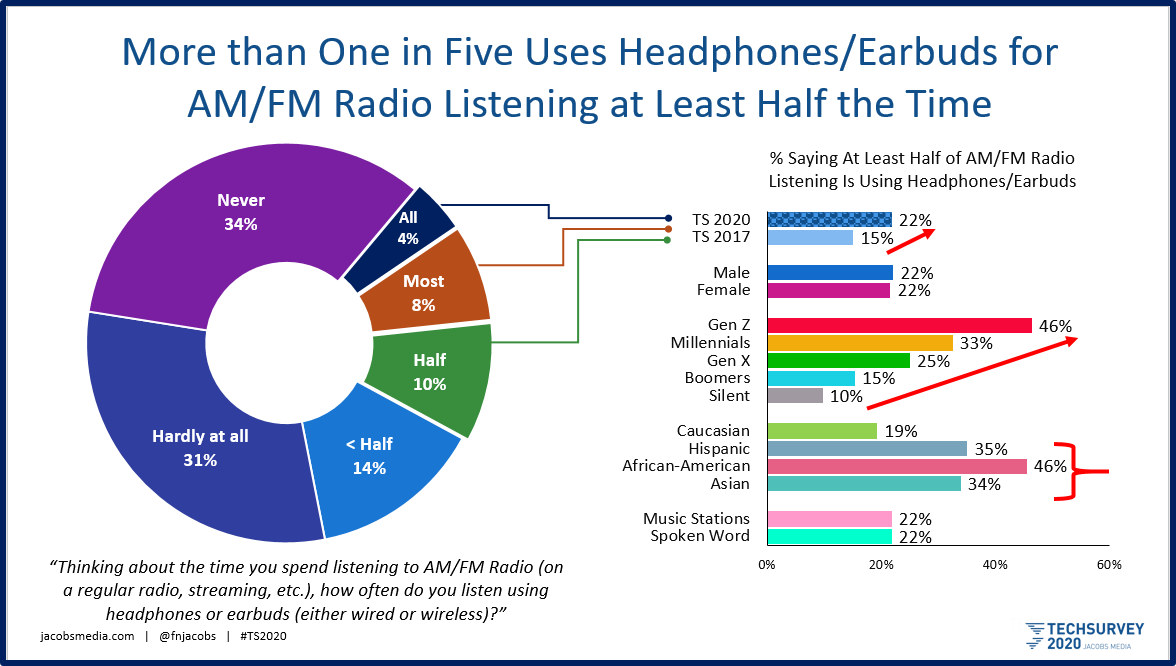

To get a head start about what this Nielsen headphone data is likely to reveal, we included a headphone listening question in Techsurvey 2020. It turns out the last time we included this question was back in 2017, so we actually have a benchmark for comparison.

This year, we learned that more than one-fifth of all respondents listen to terrestrial radio via headphones or earbuds half the time – or more often. And compared to four years ago, headphone listening to broadcast radio stations is trending up.

And predictably, headphone listening to radio closely mirrors the same demographic patterns we saw with “hearables” ownership. It portends better numbers for radio stations that target these subgroups – Alternative, CHR, Hip-Hop, and formats that focus on young listening, African-Americans in particular. Will Nielsen’s study of its own respondents show the same demographic patterns? I wouldn’t bet against it.

Why is ‘hearables” ownership happening at a rapid rate of speed, and when did the wireless headphone trend take flight? You might trace it back to the release of the Beats line of headphones in 2008. Dreamed up by two (in)credible music icons – Dr. Dre and Jimmy Iovine – Beats headphones became more than just listening devices. They quickly became fashion statements.

That trend continues a decade later with lightweight AirPods, and other new listening technologies today from companies as credible as Bose and Sennheiser. Not a company to pass up coll gadgetry, it’s no coincidence Apple bought Beats in 2014 for the then eye-opening price tag of $3 billion.

This is a trend to watch, especially now that its impact on broadcast radio – while not through the roof – will likely be both measurable and additive to existing ratings. A ratings steroid? Not likely. But many stations – especially those with audiences mostly south of age 40 and those with high ethnic compositions – could end up with better numbers.

This is a trend to watch, especially now that its impact on broadcast radio – while not through the roof – will likely be both measurable and additive to existing ratings. A ratings steroid? Not likely. But many stations – especially those with audiences mostly south of age 40 and those with high ethnic compositions – could end up with better numbers.

Any audio consumption activity – whether it’s on mobile phones, smart speakers, or wireless headphones – is important for Nielsen to measure, and for radio operators to understand. In broadcast radio, that sentiment has intensified in just the past few weeks as more consumers are at home, often listening to their favorite radio station’s streams on devices as diverse as mobile phones, tablets, laptops, and smart speakers.

We’ve seen the renaissance of audio taking shape these past several years. Most of the data confirm the notion the listening “pie” has expanded, thanks to new content and new distribution choices. The confluence of audio streaming, playlist services, podcasts, and “hearables” technology are fueling this movement.

It is likely to gain strength, especially as consumers spend more time on couches rather than in cars.

Hearing is believing.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

I swear Fred, have you not been writing about this vitally important issue since PPM was first being proposed? Mid-late 90’s?:(

Sure seems that way. Finally, change is in the air. Hope all’s well, Dave.

There’s an elephant in this room: People stuck at home are listening through earphones for a reason, and it isn’t necessarily that their listening choice clashes with the preferences of others similarly stuck in that home. NPR’s public editor reports that 22 percent of public-radio listeners do not have a radio in their home that they can listen to. [Insert bold exclamation point.] Assuming this is typical across the board and the country, hasn’t the electronics industry failed the radio industry? Or turn it around: Has NAB proven ineffective in advocating for the radio industry to electronics manufacturers? Or have radio broadcasters themselves failed to create content their listeners want other than when they’re stuck in their cars commuting? There are plenty of darts that can be thrown, but somehow people have to be encouraged to “bring it all back home” again.

John, too late for arrow slinging. It is what it is. And our Techsurveys confirm that low 20-something percentage (it’s worse in the Infinite Dial) of homes without a “regular radio.” So, the good news (sort of) is that 70%+ of consumers still have a radio where they live (perhaps inconveniently located on a nightstand or a basement workbench). Perhaps the better news is that consumers can listen to “radio” on different devices: computers, mobile phones, tablets, smart speakers.

It’s another reason why stations need (needed) a digital strategy, as well as investment in digital distribution and quality streams. And it’s essential broadcasters aggressively promote these other ways to listen to a station. Some stations (companies) are well ahead of the curve. Others – not so much.

Thanks for the comment.