It was one of the most anticipated earning reports so far this year. And that’s saying a lot, given the drama that surrounds the quarterly performance of bellwether companies like Tesla, Amazon, and Apple.

The fate of Netflix each and every quarter, especially since the pandemic, has been a major topic of speculation. Obviously, the company derived great benefit from the pandemic. As we all locked down during those fateful weeks in 2020, Netflix was poised to grow its subscriber base, as well as raising its subscription fees. It also didn’t hurt that some Netflix shows – the content they produce – have been wildly successful, fueling pop culture conversation.

In 2020, it was “Tiger King” that captured our collective imaginations. Last year, “Squid Game” generated a massive buzz. But to keep pace, Netflix has poured billions – with a B – into their content factories. Back in 2015, I wrote a blog post – “…And Distribution Is Queen” – highlighting big money spending on content by Netflix. The experts pegged their budget at $5 billion that year, placing Netflix second only to ESPN when it came to content costs.

To put that in perspective, Netflix spent a whopping $17 billion last year – more than 3x over those 2015 spending levels. And for good reason.

They have more serious competition now, especially from Disney+ whose parent company has never been shy about investing in content. Analysts believe Disney will spend $33 billion this year to entertain us, with $15 billion of that going directly into the subscription streaming video bucket.

Those billions of greenbacks hit the proverbial fan last week when Netflix announced it has lost 200,000 subscribers quarter to quarter. That was the first loss of paying customers in more than a decade. And it sent the expected shivers down the spines of the other streaming video platforms.

Wall Street reacted – to say the least – sending the price of Netflix stock plummeting 26% in one day. Netflix knew it was coming. They warned of softening subscriber numbers back in January.

Even a new season of “Ozark,” one of the best drama series in the Netflix stable couldn’t stop the slide. And Netflix is predicting it may see a reduction of 2 million subscribers in the current quarter.

So, what does any of this have to do with radio? Well, let’s start with Techsurvey 2022, where we’ve been tracking how core radio listeners have been spending their money on video and audio streaming content.

We have been in the throes of what I refer to as the “subscription economy” for several years now, but the trend accelerated during COVID. Our new Techsurvey data reveals that 86% of our total sample subscribe to at least one video streaming service; nearly three-fourths are currently paying for two or more. That’s about the same as 2021.

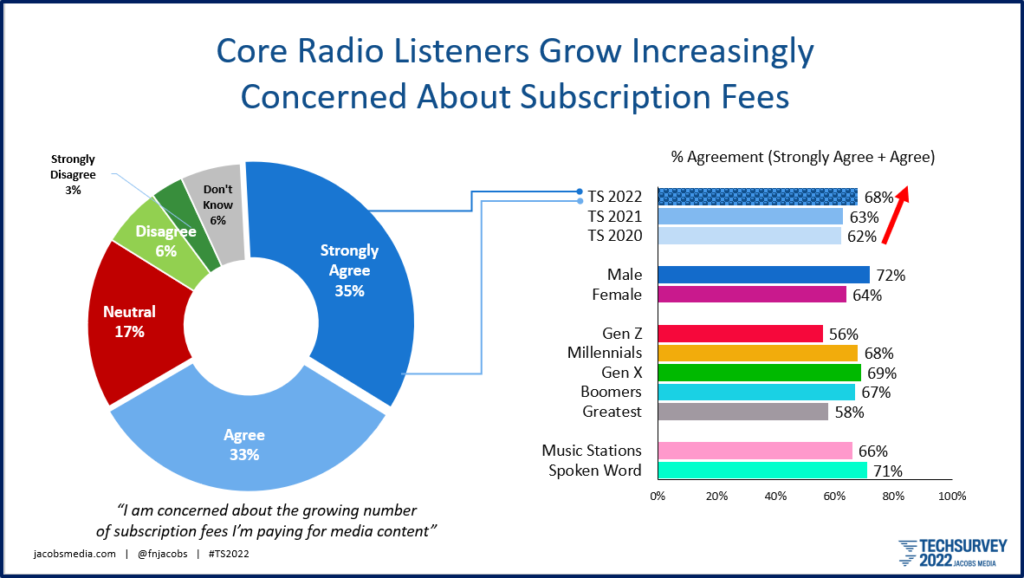

But here’s the difference: consumers are telling us they’re becoming increasingly concerned about the aggregated costs of subscription fees for content. In fact, two-thirds tells us these expenses are becoming an issue:

And consider this: Techsurvey 2022 was conducted in January and early February – weeks before gas and food prices reached their current peaks. You’d have to believe these numbers would be even higher.

But here’s another interesting finding. In a new question this year, we learned one in four subscribers to a video streaming platform has cancelled at least one of these services during the past year. We will be sure to trend this data next year and beyond.

For Netflix and its many competitors (at least CNN+ dropped out last week), none of this is a positive sign. Analysts have been warning about a “peak subscription” scenario where the market has simply topped out. ‘

That may mean most people will subscribe to one service – the one perceived to offer the best value proposition. But the days of consumers paying for three, four, or more services may be doing a slow fade.

That may mean most people will subscribe to one service – the one perceived to offer the best value proposition. But the days of consumers paying for three, four, or more services may be doing a slow fade.

So, what does Netflix’ s problems have to do with radio? And why am I calling this new point on the curve a potential slippery slope for Netflix?

It turns out there are four areas us radio veterans know a little something about when it comes to going down slippery slopes.

First, Netflix is moving away from the strategy that put them on the map. Here’s how this has come about. In order to broaden its subscriber base, Netflix is about to go against much of what it has stood for. Coming soon, a less expensive Netflix streaming service that – GASP! – contains ads. How far we’ve come (or perhaps fallen).

Variety (among others) reported on this rather surprising move last week. In a story titled “Netflix Will Launch Lower-Cost, Ad-Supported Streaming Plans, Reed Hastings Says,” the company CEO appears be doing a 180.

In the past, Hastings has railed against Netflix running spots. Now, he sees it as way to provide options for consumers, especially those who have been password stealing from other family members. Here’s how Hastings squares this economic strategy change:

“Those that have followed Netflix know that I’ve been against the complexity of advertising and a big fan of the simplicity of subscription. But as much as I’m a fan of that, I’m a bigger fan of consumer choice. And allowing consumers who would like to have a lower price and are advertising-tolerant get what they want, makes a lot of sense.”

OK, maybe. But this kind of shift might be reminiscent of broadcasters abandoning the core strategy because of one bad book.

Second, Netflix is undertaking this radical strategic pivot without the benefit of research. And Hastings tossed out a rationale that should make every programmer and strategist quake in their Crocs:

Crocs:

“I don’t think we have a lot of doubt that (the ad model) works,” mentioning Hulu and HBO Max as proof. That is, he knows how his audience will react to the new plan.

In essence he’s saying he knows his brand well. The last thing you’d want to do with a bold new plan is run it by the audience.

Hastings went on to explain Netflix won’t do any research on better fine-tuning this new model. In fact, he’s concerned survey research might end up putting the kibosh on this concept:

“I’m sure we’ll just get in and figure it out – as opposed to test it and maybe do it or not do it.”

Third – and perhaps most important – is that once those commercial floodgates open, the spot load inevitably escalates.

Every radio programmer has been there. What starts out as just a unit or two is usually just the beginning.

Every radio programmer has been there. What starts out as just a unit or two is usually just the beginning.

Eventually, another bad quarter happens. And once the precedent has been set, it’s just matter of time before more units start sneaking onto the log.

Even at Netflix.

Fourth and finally is the reality that despite all the billions spent on content, Netflix has no coherent Gen Z strategy. That seems counterintuitive because great content is, after all, great content.

But a Reuters story about Netflix affirms the notion teens have different tastes when it comes to video. They cite the latest Deloitte “Digital Media Trends” survey release last month.

One of its key findings? Gen Z (14-25 year-olds) would much rather spend their screen time playing games than watching movies or TV shows and series. In fact, they prefer gaming to music.

rather spend their screen time playing games than watching movies or TV shows and series. In fact, they prefer gaming to music.

Radio programmers in the U.S., in particular, have learned just how slippery the slope can be when you mortgage your brand’s future on hitting adult ratings goals, rather than investing in the next generation of consumers.

Radio’s lack of a Gen Z strategy has already hampered the industry’s growth outlook. How can you remain viable 5, 10 or more years from now when you turn your back on what will soon become the biggest generation of American consumers?

For Netflix, the lack of a Gen Z strategy will hamper the brand’s ability to keep those quarterly growth numbers competitive. Yes, a slippery slope indeed.

Wall Street will be watching Netflix over the next few quarters to determine whether these “fixes” actually end up bearing fruit – or new subscribers.

I have a feeling many of us radio people will be, too.

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

- Can Radio Afford To Miss The Short Videos Boat? - April 22, 2025

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

Ok, I’ll bite. In my view, Fred, Netflix, in seeking an alternative to their subscription model that might salvage their cashflow problem, is just exploring an avenue radio chose forever ago: advertiser support. I won’t rattle on about the commercial radio industry’s choice (other than by SiriusXM) to eschew an ad-free subscription model, which they could’ve had through conditional-access technology (see Xperi), in favor of commercial support, ie, ads. If ads have worked for commercial radio for a century, why not for Netflix? No one has to relinquish their ad-free stream, it’s a consumer choice based on their own cashflow situation.

The fact that commercial radio remains (at least for now) a financially viable business should tend to make Mr Hastings more confident of a decision to offer ad-supported streaming. Advertisers will show alacrity, I think. And if, against the odds, it doesn’t pan out, Netflix can abandon the effort pretty easily.

Mr Hastings has legitimate concerns about subscribers’ over-sharing of their accounts; I am surprised they haven’t moved sooner to stem this IP theft. As a technical matter, they should be able to identify login instances that are outside the IP address range of a subscriber’s LAN and deny access that hasn’t been paid for (unless there’s no current login on that LAN, eg, when a paid-up subscriber is traveling and using his fireTVstick on the road, as I do). Free-riders will quickly decide either to pony up (and they’ll have a choice of full ride or ads) or they’ll go away and take their chiseling with them. I see no downside for Netflix. Your mileage may vary.

No knock on Hastings for launching another tier of service to bring in new viewers (subscribers). But so many of his moves have that uncomfortable ring of familiarity – the lack of research, commercial-creep, etc.

As for radio remaining financially viable, the industry is (mostly) profitable, but learning – in some cases the hard way – that 10 minute stopsets won’t cut it in this world. It will be interesting to see how Netflix- looks.

Thanks, as alwlays, for the coomment.

To be fair, it is tough to have a Gen Z strategy when their style is moving away from our style.

In addition to them loving video games more than music, they, like Millennials, are an on demand generation who have not grown up with advertising paying for content, let alone 10 minute Iheart stopsets, which, as we know, attract no one.

If you’re manufacturing line is geared for producing Hummers, it is tough to retool when consumers don’t want them anymore.

One way to bring them back is with personality but, as you have noted, we have been abysmal in developing new talent. Or even the talent we have currently.

Mike, I understand your position, but that’s the whole point. If we stay the course, we lose the next generation(s). This is where our digital assets come into play – our streams, HD2 channels, podcasts, apps, videos, social posts. It’s not going to be cheap, but we have the tools to connect with “next gen” if we make the proper investment in research, content, and peoplee.

If we stay the course, we are out of business. But OUR digital assets, not speaking of the digital assets we sell (as most groups sell some sort of white label digital these days) won’t make up the shortfall for independents.

We sell OTT, display and other products but we are never going to be making that money with our own streams or web assets. Only Iheart may be able to do that.

We need to develop content and personalities the next generation wants and then monetize it but again, we have been cutting rather than developing people.

And it’s road to nowhere, Mike. Thanks for engaging on this.