A big topic in media and technology these days is cord-cutting. That’s the practice of cancelling a subscription to Pay TV (cable and satellite), a practice that is undergoing a growth spurt.

A big topic in media and technology these days is cord-cutting. That’s the practice of cancelling a subscription to Pay TV (cable and satellite), a practice that is undergoing a growth spurt.

A new article in Fast Company talks about a new study by MoffettNathanson showing that in Q1 of this year, cord-cutting exploded – shooting up five times compared to the same period in 2016.

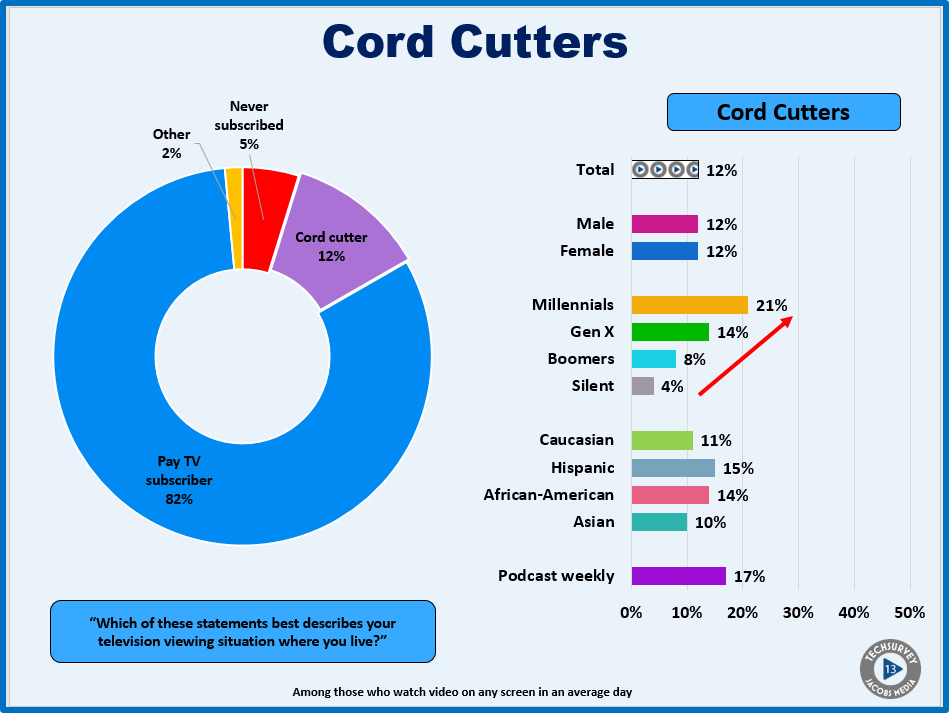

That looks like the same trend we’re seeing in the newly released Techsurvey13. This year, we included a first-ever question about cord-cutting. And we learned that across our entire mega-sample of more than 51,000 people across North America, 12% say they’ve cut the cord, ending their relationship with cable or satellite television.

But a deeper look at the metrics reveals that cord-cutting is especially prevalent among Millennials, more than one-fifth of whom have made the move:

So, what is driving this fast growing trend, especially among younger people? Part of it may be due to their desire to shape and personalize their content. If you look near the bottom of the chart, you’ll note that frequent podcast listeners are also more likely to be cord-cutters. And that supports the customization argument.

So, what is driving this fast growing trend, especially among younger people? Part of it may be due to their desire to shape and personalize their content. If you look near the bottom of the chart, you’ll note that frequent podcast listeners are also more likely to be cord-cutters. And that supports the customization argument.

But there is probably another explanation based on economics. Pay TV has become expensive, especially as channel and content “bundles” of services have expanded and have become bloated. Consumers often find themselves paying for channels they rarely if ever watch.

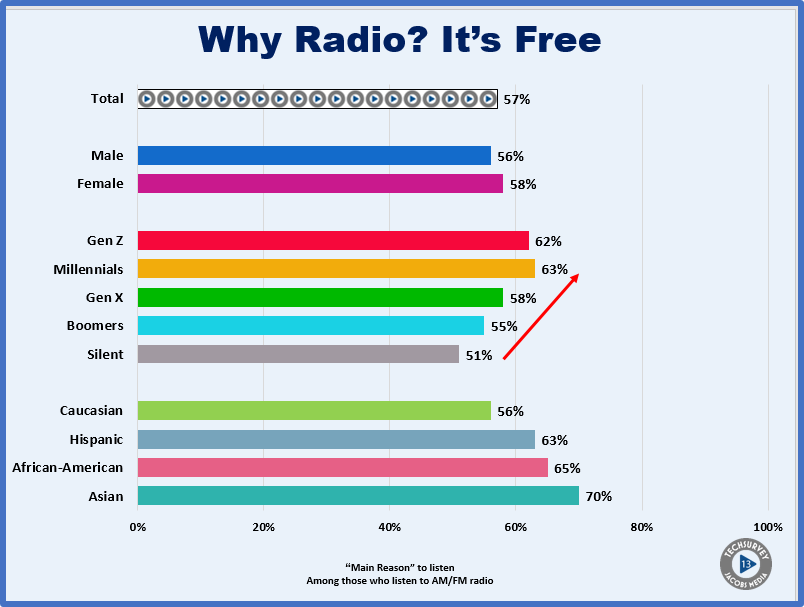

And while they enjoy entertainment and information options, at a certain point, money matters. And to test that out, we added a new option to our “Why Radio?” series in TS13. This is the question that asks respondents to identify us the main reasons why they enjoy listening to broadcast radio from a long list.

Typically, favorite songs and DJs/personalities are the top two responses. But this year, “It’s free” debuted in the second slot, mentioned by nearly six in ten respondents (57%) as a key driver why they listen to AM/FM radio. That tells you that while content is critically important, the ability to listen to radio without the burden of a subscription payment moves the needle.

And when we look at the respondents especially appreciative of radio being a free source of entertainment and information, check out what we learned:

Yes, the generational group that puts the highest value on radio being “fee free” is once again those Millennials. While they are especially willing to pay for services like Netflix and Spotify, when something comes along that provides solid content at no cost, it’s a distinct advantage. Interestingly, Millennials are the consumers most driven by radio’s lack of monthly fee.

Now of course radio comes with costs. And when we also looked at the respondents in TS13 who are spending less time with broadcast radio, too many commercials and repetitive music topped that list. But that value proposition – that radio is free, albeit with regularly commercial breaks – turns out to be one of radio’s clear advantages over its digital competition.

In our recently completed “Millennial Research Project” in partnership with PRPD, a focus on expenses and financial reality is something mentioned by a number of our Millennial public radio respondents. Most are just getting started, often in their first or second job. And while Netflix, Spotify, and even supporting their local public radio station were popular media expenditures, cable and satellite television were not. In fact, several indicated they had cut the cord, and were more selective about the content they’re willing to pay for.

In my travels around the country, I typically hear radio stations brag about their music specialties, as well as features like commercial-free music blocks and “traffic and weather on the 8s.” But rarely do I hear positioning statements that extol the virtues of being “free” in a subscription-heavy media world.

At a time when radio needs to take advantage of each and every one of its assets, this is most-assuredly one of them.

Free is good.

Thanks to Seth Resler for the inspiration for this post.

See the Techsurvey13 Results

Want to see what else we learned in Techsurvey13?

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Fred, was there a distinction in the study between people who pay for Spotify, etc rather than ride for free? And if that’s eating into broadcast radio share? The numbers are probably smaller. But in the “free model” of pureplays vs broadcast funny how the discussion should circle back to “the stuff between the songs”– even after all these decades.

No, Phil. Same with Netflix, where many people “share” someone else’s account. And your observation about the in-between content is spot on. Thanks for chiming in.

Radio, as a “free” service, has been the gateway drug to get people interested in music. Those who wanted more paid for that. In the past, people bought albums and CD’s.

Today, people have Spotify and Itunes. This fact was shown by the two biggest releases of the last 15 years. Both Taylor Swift and Adele realized that radio enhances sales while Spotify and Itunes are not nearly as lucrative as CD and album sales.

They had no problem with their music being played on the radio but denied it to the paid services.

It is a lesson for the labels as well.

I’m not sure anyone made the connection in the ’70s, ’80s, or ’90s that a radio benefit was that it was free. But as you note, consumers have gotten used to paying for information and entertainment. I have to believe radio’s position has improved over time as a result. And as covered in the post, it would seem to me to be a promotable benefit. Thanks.

There is probably a reachable sweet spot between free and too many repetitive songs and commercials. Radio probably hasn’t tried to find that sweet spot and has a lot to gain by spending some time and money on it.

Free can mean you get what you pay for or it can be something people love (Facebook/Twitter/Instagram/Snapchat). Radio is somewhere in the middle and could probably move closer to social media and add some listening/profit as a result.

Bob, I think you’re right there’s a balance involved. People weigh those prices all the time, and that’s part of the value proposition. Stations should take a look at their commercial loads, of course, but TS13 also provides promise in marketing the “free” piece, too. Thanks for the comment.

Reminding listeners that radio is free is so obvious but I understand how it can be treated as a given. Selling the free aspect probably gets a knowing nod but listing the perks…the content….the human touch of the listening experience, now that is a bundle that gets attention.

Obvious, yes, but as you point out, Dan, it’s missing benefit that has (probably) gotten bigger in a world of subscription services. Thanks for the comment.