Oh, great – he’s starting the new week with a blog post about data. How exciting!

But I’m not just talking about any data – today’s post is about “first-party data.” Unlike so much of the data radio operators gets stuck with – Nielsen ratings, sales and revenue data from firms like Miller Kaplan, and most of the other numbers everyone’s attempting to analyze – “first-party data” is information you collect from your customers – your listeners and your advertisers.

What makes it special and valuable is that you own it. It’s proprietary. And from it, you can not only gain valuable insights, but you can exclusively use it to market your brand to your various constituencies.

In the world of broadcast – now known as “linear” – there is no “first-party data.” You shoot your signal into space and it’s received by people you cannot track. We know they’re out there, and the ratings provide basic info about the groups they fall into. But that’s where it stops. We know nothing specific about these people outside of basic demographics (age, gender, ethnicity) and their residential zip codes. So “first-party data” is a neat idea, but ultimately very elusive to many people in the business.

But digital marketing affords marketers the opportunity to aggregate “first-party data” if they’re smart and strategic about it. And not every piece of content will generate that all important “first- party data.” Podcasts are obviously a growing platform in the audio space, and many radio companies are in full pursuit of the opportunity. But podcasts don’t typically provide much in the way of first-party data. Like broadcast content, you put your podcast out there, consumers listen or download them, but as a creator, your ability to connect and interact with your fans is limited.

party data.” Podcasts are obviously a growing platform in the audio space, and many radio companies are in full pursuit of the opportunity. But podcasts don’t typically provide much in the way of first-party data. Like broadcast content, you put your podcast out there, consumers listen or download them, but as a creator, your ability to connect and interact with your fans is limited.

Therefore, it’s helpful in digital strategy sessions to not just map out the content you wish to create and market, but also the platforms that will generate “first-party data” – and those that won’t.

Many years ago, Jacobs Media was working with an Internet startup focused on utilizing AI data generated from car dashboards – specifically, the media drivers use, as well as their locations. Their CEO had an idea that involved working with broadcasting companies, so we helped him set up a series of meetings with a number of radio execs.

He led off each of these conversations asking the radio leader in the room the same question: “What’s the value of an average radio listener in your company?” And none of them specifically knew. It’s not the way we’re trained to think of the audience. On the one hand, we know how much a rating point is worth or an advertiser value of a cume audience at a certain level. But no one knows exactly what an “average listener” is worth, even though that is, in fact, the currency of most Silicon Valley companies.

But if radio corporations made it a priority to collect and amass “first-party data” from its audiences, they might be well on the way toward solving the “accountability” problem that limits most of the industry’s companies. Knowing who these people are and how to engage and connect with them on a 1-to-1 basis would solve many of radio’s inherent problems and drawbacks. They’d also know more valuable info about their audience they could share with advertisers. Insights gleaned from “first-party data” would provide most radio companies or stations with not only a definite marketing edge, but also data that would help programmers prioritize their efforts as well.

That’s where email and text messaging come into play. Those are the locations where people hang out, spend time, connect, and engage. A radio company that makes it a priority to collect email addresses and phone numbers is well on the way to solving “the problem.” It may not be the most glamorous of the digital spaces but it sure is effective.

It’s also how our Techsurveys are structured, allowing us to conduct inexpensive but highly effective research studies for clients, tapping into their “first-party data” – email addresses – that make it relatively easy to collect hundreds of responses to a survey in little more than 24 hours.

tapping into their “first-party data” – email addresses – that make it relatively easy to collect hundreds of responses to a survey in little more than 24 hours.

So, how can you focus on content initiatives that provide this information? Working down the list, it becomes obvious how to differentiate the activities that do and don’t allow you the ability to gather “first-party data” from your users.

Podcasts, for example, is a hot category. You may have seen in the newest Infinite Dial study, it is one of the stars of this year’s report. (Techsurvey 2025 reinforces this finding, too. A record number of core radio listeners are consuming podcasts every week or more often.) But you don’t know specifically who is listening, nor do you know much about them.

Similarly, a number of radio companies are pinning their digital fate on their websites, driving radio listeners to their content portals with interesting content, stories, and yes, “click bait.” Driving web traffic is something many stations and personalities have become skilled at. But stories that garner lots of “hits” and every once in a while, a story that “goes viral” fails to provide the “first-party data” about who specifically wants to see those post-plastic surgery photos of once stunning Hollywood stars. And when the week is out, stations are right back to ground zero, trying to hit a new week’s web numbers.

On the other side of the spectrum, there are newsletters, a more old school content category that actually has many attributes.  Aside from the fact newsletters generally have a lower “degree of difficulty” than podcasts, you can easily track who’s subscribing because most newsletters require (at minimum) an email address in order to subscribe. Once you’ve got that tidbit of personal information, you can tactically generate more information using surveys, contests, and other basic marketing techniques.

Aside from the fact newsletters generally have a lower “degree of difficulty” than podcasts, you can easily track who’s subscribing because most newsletters require (at minimum) an email address in order to subscribe. Once you’ve got that tidbit of personal information, you can tactically generate more information using surveys, contests, and other basic marketing techniques.

“We’re starting a newsletter” may not have the cache of launching a thrilling, multi-part “true crime” podcast, but it generally is an easier, more economical, less people-intensive activity. And importantly, it will generate “first-party data” for those who sign-up/subscribe. Public radio, in particular, has been the radio broadcasting platform that’s enjoyed the most success – so far – with newsletters. In fact, most public stations have one; many have multiple newsletters. Topics can be all-encompassing, narrow, and/or reflective of a local personality’s interests or focus.

Just like any content initiative, there are helpful hacks that can make this undertaking easier or at least more methodical. The web is loaded with “how to” info on newsletters, so some searching around won’t be difficult. I recently ran across a nifty guide from a group I’ve followed for some time, “Convince and Convert.” They’re all about sharing digital insights, and a recent content marketing memo makes several strong points.

Just like any content initiative, there are helpful hacks that can make this undertaking easier or at least more methodical. The web is loaded with “how to” info on newsletters, so some searching around won’t be difficult. I recently ran across a nifty guide from a group I’ve followed for some time, “Convince and Convert.” They’re all about sharing digital insights, and a recent content marketing memo makes several strong points.

In “Inbox Anarchy: An Audience-First Email Marketing Strategy,” C&C’s Jason Keath (pictured) offers up the basics of how newsletters can generate great first-party data.

A reason I gravitate to their strategy is that they rely on an annual research survey among their audience. Sound familiar? As consultants, we recommend the same regimen for our clients. And in fact, that’s the Techsurvey strategy, too. (I’m presenting the key takeaways to our stakeholder stations later this week, and I’ll have details in just a few days for how you can attend our all-industry webinar next month.)

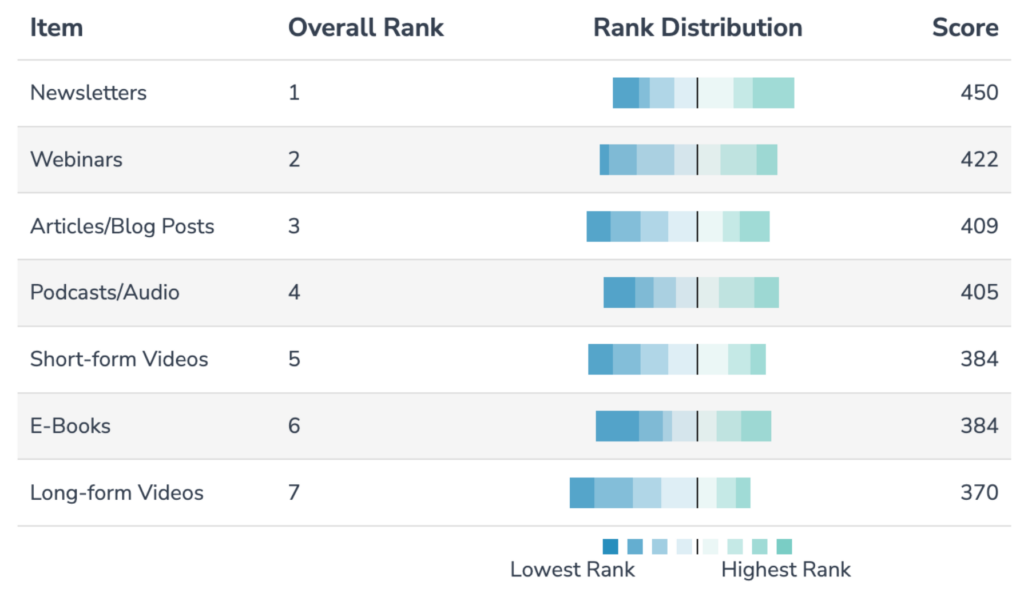

Here’s how the pecking order worked out for C&C’s audience:

It’s fascinating how basic data can clarify a strategic approach. In this case, it’s a no-brainer. Newsletters are clearly the highest scoring content among their fans. If you were to score each of these by their degree of difficulty to produce, newsletters would likely be at or near the top of that list, too – well above podcasts, videos, e-books, and even webinars.

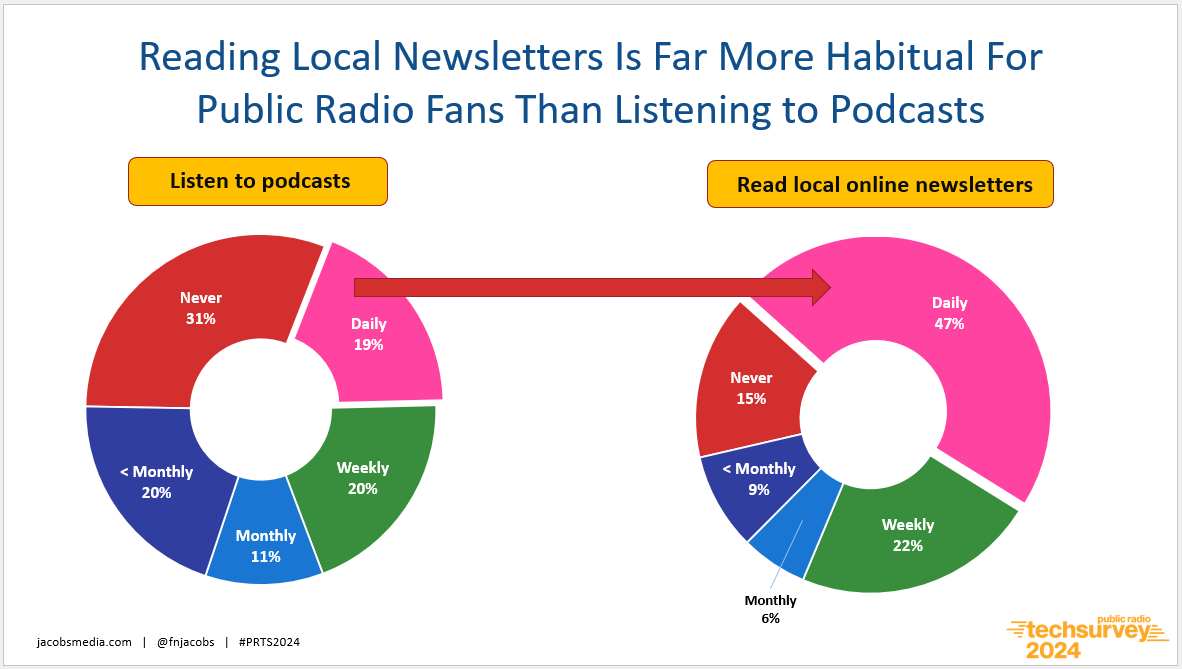

The results might likely be quite a bit different for your brand – specifically, your radio station. A look back at our Public Radio Techsurvey conducted early last summer shows that regular newsletter readership is especially popular among their core listeners. The chart below compares newsletters to podcasts. Keep an eye on those pink daily consumption slices of both pies:

Comparing weekly also gives the strong advantage to local newsletters – nearly seven in ten core public radio fans read them weekly or more often.

But that’s public radio stations where newsletters have been a routine content piece for many years now. It’s not unusual to attend conferences where newsletter “best practice” panels are common.

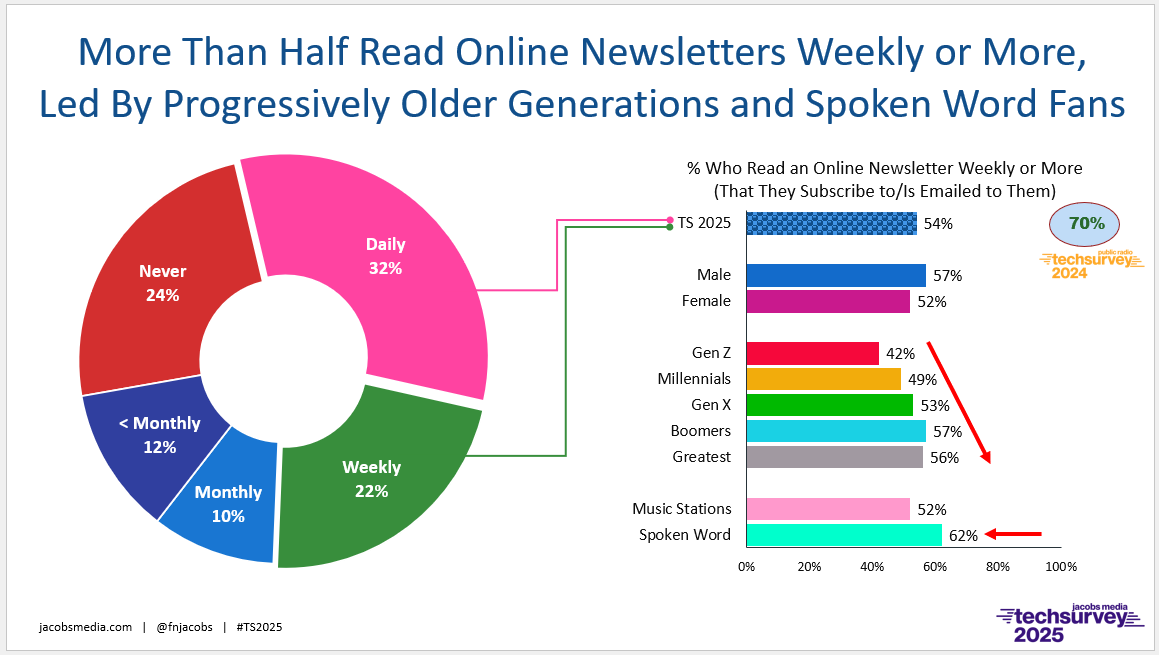

On the commercial radio side? Not so much. Local newsletters have sprouted up at spoken word stations – sports and news/talkers – but they are far less common on stations famous for playing music. In our new Techsurvey 2025, we included the newsletter question for the first time ever. And we were surprised by the robust levels we measured for weekly readership:

Yes, their appeal skews older and toward those fans of spoken word radio. But roughly half of Millennials and partisans of music stations read online newsletters weekly or more often. And for the overall sample of our nearly 25,000 commercial radio respondents, almost one in three read an online newsletter every day.

So, the appetite of there. But a key is to be both strategic and smart about starting up that newsletter- especially when your station or morning show hasn’t produced one before. The C&C piece is loaded with wise advice as it references the thought process behind relaunching (and rebranding) their original newsletter.

You can read their “how to” paper for yourself (there are great ideas about features and structure), but one of their best observations revolves around the importance of curated content. And here’s where your personalities can play a key role – not only in making the newsletter more credible and appealing, but also in driving sign-ups.

So a newsletter specializing in family-friendly weekend activities could feature the morning personality everyone knows has four kids under the age of 12. And instead of being a comprehensive list of every event and activity going on in town, perhaps the newsletter’s focus is on the top 3 activities good for the entire household.

Or a newsletter about new music releases doesn’t have to be the complete A-Z of new stuff that’s out this week. It could be your staff’s “music head” (an on-air talent or music director) who can boil it down to the top three best songs of the week. Links embedded in the newsletter can play hooks of the songs, the entire song, or the video version. Obviously, selected songs/artists might attract attention from the label and/or local concert venues where the artist will be performing.

staff’s “music head” (an on-air talent or music director) who can boil it down to the top three best songs of the week. Links embedded in the newsletter can play hooks of the songs, the entire song, or the video version. Obviously, selected songs/artists might attract attention from the label and/or local concert venues where the artist will be performing.

There are two key points about C&C’s article that should be kept in mind. First, their newsletter is B-to-B: business to business. For most of you reading this post, your effort is more likely to be B-to-C: business to consumer. The basics are the same, but the nuance is important in effectively connecting with your target audience.

And the other reminder is the importance of audience research, whether you’re starting up a newsletter or refining and improving an existing one. Take it from C&C:

“Every portion of this (newsletter) refresh relied on customer surveys, polls, and direct feedback from our ICPs (Ideal Customer Profiles). In other words, do your homework.

To that end, C&C’s new effort includes an online poll (called “Sound Off”) at the end of each newsletter. It’s interactive and insightful, providing the team with feedback from the newsletter’s key users:

To that end, C&C’s new effort includes an online poll (called “Sound Off”) at the end of each newsletter. It’s interactive and insightful, providing the team with feedback from the newsletter’s key users:

“Listening to our audience and noticing what they click, share, or comment on is important as we work to understand their needs and help them make better decisions.”

Techsurvey 2025 suggests most stations have sufficient audience interest in online newsletters. (Of course, “stakeholder” stations can check their actual core listeners to be sure.) Aside from an online engagement tool, it is (relatively) easy to attract aligned sponsors, and producing most newsletters isn’t usually a Herculean task.

But let’s not forget that extra edge that motivated this conversation in the first place:

The opportunity to aggregate first-party data – starting with email addresses.

If you put the pieces together wisely on the front end, you could amass an impressive number of direct contacts with your most important fans – your P1s – in the newsletter’s first year.

Thinking about a newsletter for your station or show? Reach out to Jacobs Media’s Chris Brunt and tap into his expertise here.

- What If Radio Tried Something Right Out Of Left Field? - May 9, 2025

- Why Radio PDs Are A Lot Like NBA Coaches - May 8, 2025

- Memo To Radio: We Have Met The Enemy And It Is… - May 7, 2025

Are they:

—Reading?

—Skimming?

—Scrolling down to todays “Wordle”