Yesterday, we talked about motorcycles. Today, it’s cars.

It’s hard to believe our first DASH Conference took place nearly eight years ago here in the Motor City. In partnership with Radio Ink and consultant Valerie Shuman, we created the industry’s first (and last?) mashup between the automotive and radio broadcast communities.

We went on to produce three conferences in 2013-14-15, when it became clear the changing dashboards in the vehicles we drive would have a massive impact on the radio industry. After attending CES for a few years, and watching our mobile apps company, jacapps, collaborate with Ford, we believed this was a mission critical issue for radio broadcasters.

The NAB did, too. And that’s why they pooled their resources – Sam Matheny, David Layer, and Steve Newberry, along with a board of engaged broadcasters led by Caroline Beasley all saw the need to engage with the automotive industry. And over the last several years, they’ve done just that – at CES and through organizations like GENIVI.

In just a few short years, change came hard and quick – especially for the auto companies (the OEMs) and their Tier 1 suppliers. Autonomous, electric, shared mobility, and smart cities all became part of the conversation. So did data, led in large part by GM, along with several companies trying to utilize and monetize the information being gathered by who we are, where we drive, and what we buy while on the road. And we’ve learned that valuable data can be used from drivers – or other passengers being carted around in cars or trucks.

Over the years, these through-lines have sharpened, especially with the emergence of Tesla, and their electric fleet equipped with their Autopilot feature. An outsider like Elon Musk has shaken the industry to its core, right down to how cars are bought, sold, and updated.

And then COVID struck. And that created both an opportunity and a challenge for automotive strategists. Suddenly riding in an Uber or Lyft became unappealing. So did public transportation and fleets of commuter vans, designed to relieve traffic jams and pollution. While the ripple effects of the pandemic are still being felt, you get the sense the automakers and their suppliers are not standing still. Instead, they are pivoting, maneuvering, and adjusting to the new conditions wrought by COVID.

These machinations will affect the entire auto industry. And with it, where broadcast radio stands in the hierarchy of new head units rolling off assembly lines. How will new dashboards be equipped? As electrification comes more quickly, what will that mean for AM radio? How will automotive designers imagine their infotainment bundles for drivers and “co-drivers” – formerly known as passengers? And what role will data play in this confluence of transportation, technology, and media?

I recently checked in with two of our original DASH speakers – John Ellis (pictured above right) who was with Ford back when we first gathered in Detroit, and now heads up his own consulting firm, Ellis & Associates. And Scott Burnell, Ford’s main man in their Developer Program, and someone who has become well-known in the radio industry for his vision and candor.

Here’s the latest from a couple of pros who know both automotive and broadcast radio:

1. Electrification is becoming more than just a trend – it’s the future – This year at CES, there were a number of key announcements around this technology, especially GM CEO Mary Barra’s keynote. She boldly predicted her traditional company would be all-electric by 2035.

How about that for an industry game-changer from a bellwether company not always known for its boldness? It would be analogous to iHeart announcing its content would be all-digital in just a few years. But the OEMs are moving away from gas guzzling vehicles, and to the promise of electric cars and trucks.

GM also unveiled a new logo that looks more “electric” than their traditional block lettering – a visual representation that signals the company is envisioning a very different future. To make the point on a big stage, GM enlisted the services of Will Ferrell and a humorous Super Bowl LV commercial:

https://www.youtube.com/watch?v=LxBQ2Q39Tq4

Other automakers with “electrifying” news include Jaguar who says they can achieve an all-EV fleet by 2030.

And then there are the ongoing rumors of Apple entering the electric car fray. While the tech giant has explored automotive partnerships, no deal has been inked – yet.

Tesla has been especially bold with its infotainment systems. In the Model 3, for example, they lean heavily toward apps for content – Spotify and TuneIn – rather than Apple CarPlay and Android Auto platforms.

And as we’ve written about in past blog posts, many Tesla vehicles don’t come equipped with AM radios, a troubling trend in EVs where some manufacturers say there are unavoidable interference problems.

If this trend continues, broadcast radio operators will have to give more consideration to devoting an FM signal in key markets to simulcasting key AM properties that are still viable – and profitable.

2. Screens are getting larger – and catering to all passengers – Not only is there a data play for drivers, but others in the car already play an active role. In a growing number of cases, everyone in the vehicle has their own screen, accessing their personalized, preferred content. So, four riders in a car are throwing off four data sets. More on that in a moment.

As we saw at CES 2020, the trend is for car companies to expand their screens and dashboard electronics. That trend accelerated this year with the release of Mercedes-Benz’s “Hyperscreen” show below – it’s 1.4 meters long and pretty much covers the entire width of the cockpit.

Dashboards are only becoming more sophisticated, customizable, and AI-enabled, meaning the car will learn your preferences and tendencies – and reflect them back to you on the display.

It also becomes critical for radio broadcasters to more aggressively address their dashboard displays, album and advertiser art, and the kind of content and sponsor information that can be provided via the metadata. This was an initiative we were involved with in partnership with the NAB a few years ago. It should be dusted off, revised where necessary, reissued to broadcasters in light of these shifts we’re seeing in infotainment.

Even though drivers (and passengers) have more options than ever, radio programmers can strategically create better user experiences through more useful, rich display information. Most working in radio today have simply accepted frequency/call letters/artist/title in a written form in dashboards.  But the trend line is better, more helpful, more attractive, and more detailed displays.

But the trend line is better, more helpful, more attractive, and more detailed displays.

Xperi and Quu are two companies working together to create better in-dash displays to keep broadcast radio stations competitive with streaming platforms, satellite radio, and apps populated on CarPlay and Android Auto via smartphones.

And given larger, higher resolution displays, it’s imperative radio steps up its look, feel, and user experience in the car. Pandemic and all, it is still broadcast radio’s #1 listening location.

3. Partnerships are becoming more prevalent – Just a few weeks ago, another post-CES announcement involving technology and automotive made headlines. Ford and Google inked a long-term collaboration for in-car/cloud services.

CNBC’s Michael Wayland and Jordan Novet reported this new hookup means Google will now have the onus of handling connectivity in Ford and Lincoln vehicles. This covers everything from AI to remote services to infotainment systems.

It’s another indication automakers are increasingly looking for collabs to bolster expertise and services. Ford CEO Jim Farley put it this way when he explained the “why” of this big announcement:

It’s another indication automakers are increasingly looking for collabs to bolster expertise and services. Ford CEO Jim Farley put it this way when he explained the “why” of this big announcement:

“One of the most important parts of our strategy is to partner. That means that we have to get out of the business of doing generic things that do not add value, like navigation systems and a lot of the in-car entertainment experience.”

As an owner of one of these vehicles, I can tell you the native navigation system in the dash pales in comparison to firing up Google Maps or Waze on my smartphone.

Scott Burnell (pictured far right on our CES 2021 Virtual Tour) says the Ford/Google marriage will have a positive effect on the SYNC platform experience:

“The easiest way to think of it is the next generation of SYNC will (now) run on an Android operating system. SYNC has been powered by different operating systems including Microsoft and QNX throughout its evolution. Moving on to such a widely accepted platform such as Android will really allow Ford to concentrate on developing compelling features and experiences for our owners.

“Personally, I am excited about how stepping in to the Android ecosystem will broaden Ford’s industry leading developer community and I really expect to see some amazing innovation when we combine what we have today with those future capabilities.”

When you see these types of influential companies bring their areas of expertise together, it’s a reminder how radio broadcasters need to seek out their own complementary mashups with brands that have specific capabilities. Purchasing or collaborating with successful podcasting producers has become increasingly popular.

Yesterday’s announcement of iHeart’s acquisition of Triton Digital from Scripps underscores the value of bringing together different skill sets in ways that benefit both companies. According to the Wall Street Journal’s Anne Steele, Triton brings a lot to iHeart Media’s digital strategy: advertising infrastructure, measurement tools, dynamic ad insertion capabilities in podcasts and streams, and automated digital ad buying/selling.

Strategic partnership is a trend – and we can expect both automakers and broadcasters to continue to seek out more of these advantageous marriages.

3. The value of our data is growing in importance to automakers – As we learned at early CES events, automakers other than Tesla don’t sell cars and trucks to us – they sell them to dealerships. Once the vehicles roll off the assembly line, Ford, Toyota, Subaru, and the other OEMs are unable to monetize their products. Service, re-sales on used cars, and aftermarket products all benefit other players in the chain.

Until now. And that’s because of the power of data.

The auto industry is all over this trend. And there’s a lot more money at stake than profits from oil changes and rustproofing. Actually, the data conversation has been active for some time now.

The auto industry is all over this trend. And there’s a lot more money at stake than profits from oil changes and rustproofing. Actually, the data conversation has been active for some time now.

In fact, at an early DASH conference, John Ellis actually suggested that in the future, automakers might give their cars away, relying on consumer data to generate profits. (Of course, that is not the model the smartphone industry has adopted – selling their best handsets for lots of money while also generating massive profits from user data.)

Ellis admits he may have gotten a bit ahead of his skis in the combustion world. But as he recently explained, Tesla shows how the world of vehicle depreciation values will change once cars are fully software updateable.

When cars can be refreshed and modified with software updates, they retain their value. Ellis notes that with Tesla’s Model S, software updates often show up on at least a monthly basis, helping to correct problems and add new features, not unlike your smartphone. In Ellis’ estimation, that means new car prices will eventually come down – just like they have with computers, televisions, and other tech products.

As a result, your data could one day become more valuable than the car. According to Ellis, with the Tesla line, we’re already beginning to see it happen:

“If you look at the Model S, it doesn’t follow the depreciation schedules that all the other vehicles do. And it’s because of software.”

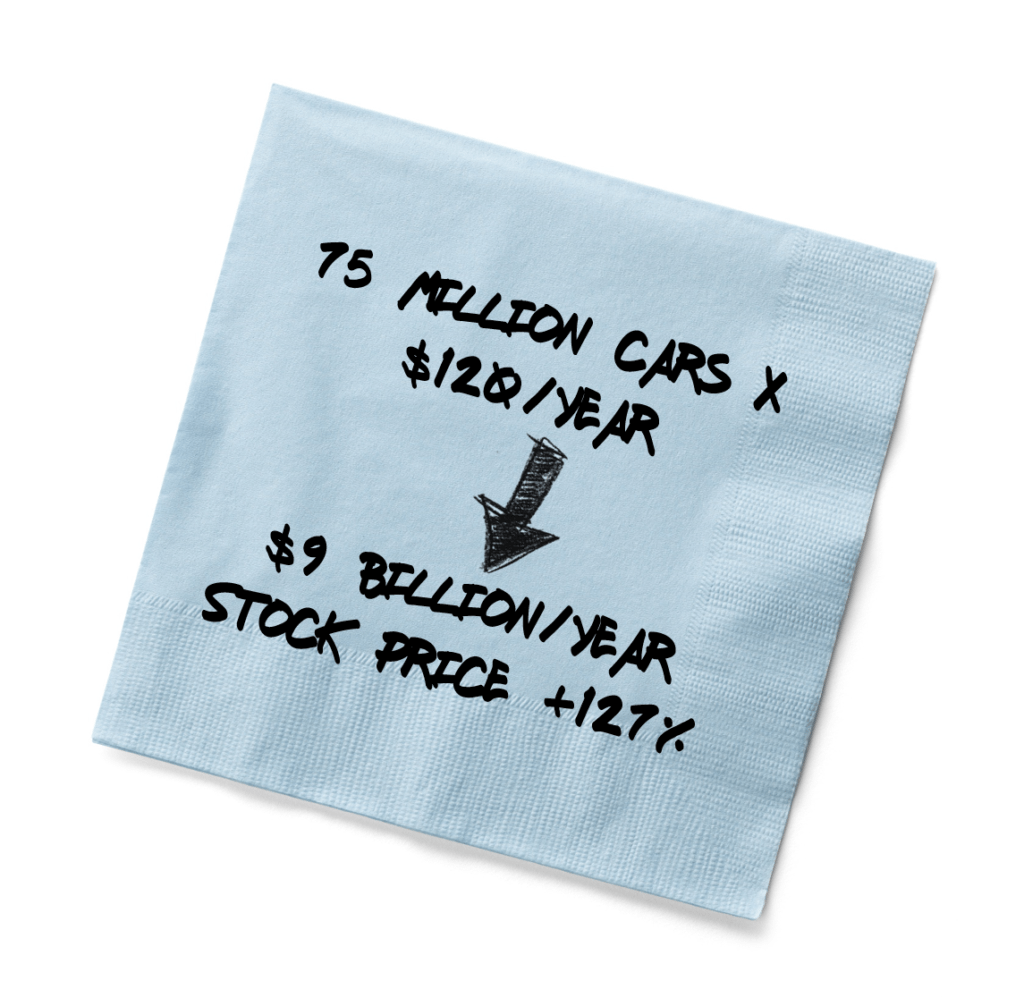

But how much money might there be buried in data for automakers? A fascinating article in Business Insider does some serious back-of-the-cocktail-napkin math on the Ford deal. Actually, the financial analyst firm doing the drinking is a familiar name making a huge claim:

math on the Ford deal. Actually, the financial analyst firm doing the drinking is a familiar name making a huge claim:

OK, maybe binge drinking.

But here’s the calculus. Morgan Stanley posits that each Ford/Lincoln vehicle sold could generate $10 a month in data subscriptions. Given all the other subs we pay for, this would be a rounding error on most of our credit card statements.

For Ford, it represents $9 billion in annual recurring revenue based on around 75 million vehicles on the road. And Morgan Stanley estimates the company’s stock price could skyrocket 127% as a result.

John Ellis might have been out on a limb all those years ago, but his predictions about the power and value of data could become true. And none of that accounts for the ways in which automakers use our data for marketing, research, and development.

When we first started those DASH Conferences, we could see how crucial the automotive company’s dashboard strategies would be to radio.

Back in 2013 and 2014, we asked many of our attendees from the auto industry to predict where the technology would be in five years. And to a person, they all refused to speculate because everything was already moving too fast.

Here we are in 2021, and we’re beginning to see things take shape. Radio broadcasters would be wise to keep abreast of automotive trends and relationships in their community. The NAB and its board would do well to turn their sights back to automotive to ensure radio broadcasters retain a pole position.

You never know where that next partnership will come from.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Easily, the most compelling read for radio broadcasters that they’ll see for quite a while. I sure hope it’s understood and engaged with by the industry.

As those enlightening DASH conferences showed us all, these are defining moments for audio providers (and that was BEFORE the data collection dynamic was even really considered)

As you say so frequently, Fred. Radio must meet the consumer where they are, not where they’d like them to be.

Incredibly important information.

Appreciate it, Dave. After a few years where things were relatively quiet for the autos, COVID has boomeranged the industry. And of course, radio is along for the ride. We need to understand just what’s at stake, and the areas in which we can have impact. Thanks for engaging.