Last week’s post about the impending threat to broadcast radio posed by SiriusXM elicited comments from many corners. Some seemed surprised by all the machinations of Liberty Media, SiriusXM’s parent company.

And last week’s ruling by the DOJ greenlighting Liberty’s ability to purchase as much as a 50% ownership stake in iHeartMedia only intensified the conversation.

That would mean one company would control the assets of satellite radio, Pandora, a good chunk of Live Nation, and a near-controlling interest in broadcast radio’s largest company.

(If that makes you wonder about what the Justice Department must possibly be thinking, I would suggest we not go there. It would start a whole other conversation.)

But as I was reminded in various comments, both on social media and via email, let’s not forget what Spotify has been up to, especially during the throes of this pandemic.

A recent story in The Drum – “How lockdown is accelerating the at-home adoption of Spotify” by Imogen Watson – outlines how the Sweden-based audio streamer has stepped up its at-home listening initiatives since COVID-19 began to dominate our lifestyles.

As broadcast radio and SiriusXM have each had to deal with declining listening on the home front, Spotify has has enjoyed listening increases. Rak Patel, a sales exec for the company, told The Drum that Spotify is attempting to become the “soundtrack” for all sorts of household activities – including cooking, cleaning, working from home, working out, and just chilling.

Our homes have become our offices, our restaurants, our dance floors, our gyms, our schools, our movie theaters, our bars, soon our sports arenas, and our refuges as chaos reigns throughout our communities. And of course, all these activities require theme music or background audio. That’s precisely what Spotify has been gearing up to achieve.

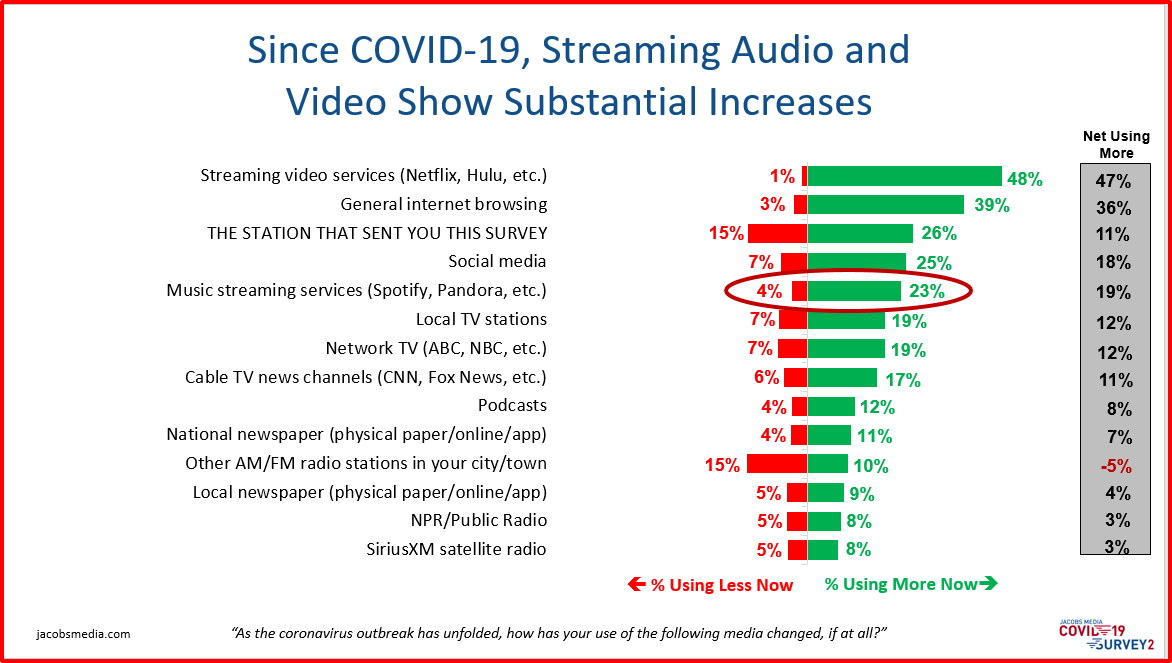

We saw this in our two COVID studies among core radio fans back in May. When asked about media changes since the start of the pandemic, video streaming leads all activities – no doubt, we’re bingeing a lot. But audio streaming services – like Spotify – are also up. We show a net positive of +19% – and that’s among broadcast radio P1s.

(Note how challenged SiriusXM has been during this time, necessitating constant free sampling to levitate their COVID numbers.)

Patel attributes the growing ubiquity of connected devices in people’s homes to the uptrend for audio (and video) streaming:

“Smart speakers, connected TVs and game consoles have exploded in the last few months. (Spotify) usage across all connected devices at home was up by 40%.”

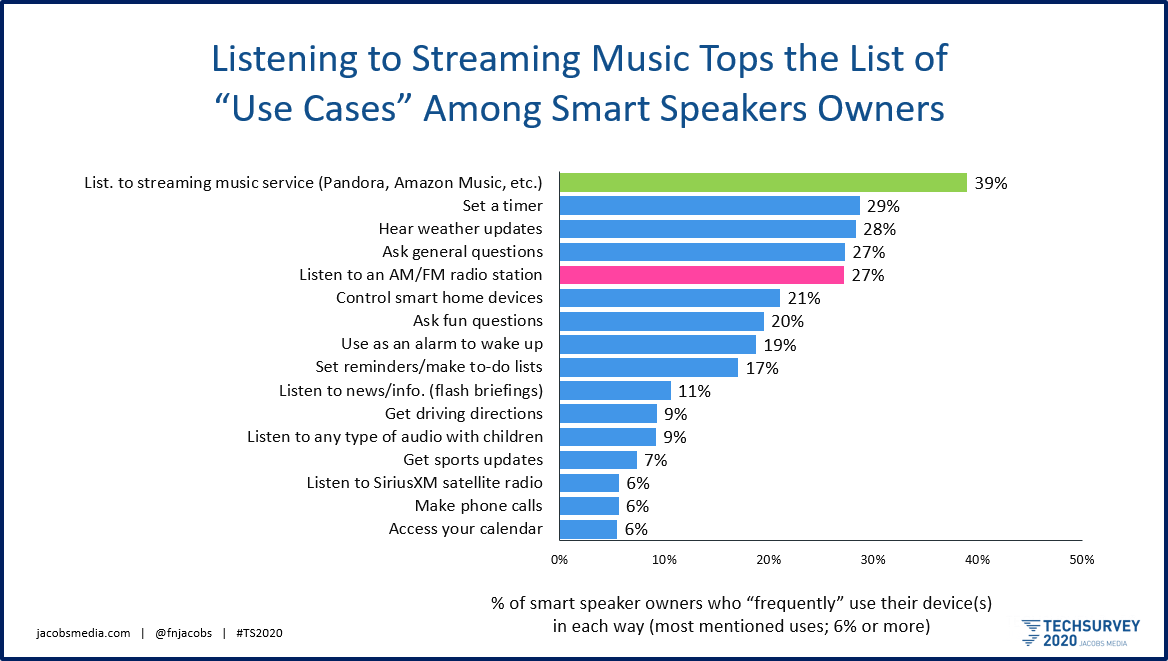

The smart speaker wave may be playing into Spotify’s inherent strengths. Tuning in broadcast radio is a key “use case” among existing listeners who own devices like an Amazon Alexa or a Google Home,

But the #1 activity of those measured is listening to streaming music on a service like Spotify, Pandora, and Amazon Music:

And then there’s podcasts.

Spotify has invested heavily in on-demand audio. Some analysts suggest their podcast play is all about chasing this fast-rising medium and the millions of sponsor dollars and ad revenue already flowing into the space.

But then there’s the extra benefit for Spotify – while streaming music carries the onerous burden of steep royalty fees, podcasts are mostly spoken word. Podcasting greatly diversifies Spotify’s audio portfolio, as well as providing ownership of key brands and personalities – something it is not able to do with its music streaming.

Perhaps that explains why since 2019, Spotify has shelled out nearly $1 billion to purchase Gimlet, Anchcor, Parcast, and The Ringer – all podcasting assets.

And then earlier in 2020 came the blockbuster announcement that immensely popular “The Joe Rogan Experience” podcast moved over to Spotify for a fee in excess $100 million. That’s LeBron or Beyoncé money, and it shows you the lengths the Swedish streamer is willing to go to build a foundation in this highly competitive space.

And then earlier in 2020 came the blockbuster announcement that immensely popular “The Joe Rogan Experience” podcast moved over to Spotify for a fee in excess $100 million. That’s LeBron or Beyoncé money, and it shows you the lengths the Swedish streamer is willing to go to build a foundation in this highly competitive space.

In much the same way SiriusXM has bolstered its content and marketing assets with acquisitions like Pandora and Stitcher, Spotify is taking a similarly aggressive approach – even in the midst of the pandemic.

At-home usage has become an important focus – in contrast with how marketers may have been thinking back in February. Until then at least, we were an especially mobile world, conducting business and vacationing to and from far away cities like we were running an errand at the neighborhood 7-Eleven. Since COVID, all that’s changed.

I’m a great example. Since 1983, I have been on the road 40 weeks a year. But in the last four months, I haven’t seen the inside of an airport, the double beds of a Marriott Courtyard, or the back seat of an Uber.

As Bob Dylan warned us, “The times they are a-changin'” and he was right. Radio broadcasting’s  competitors – especially SiriusXM and Spotify – have heeded those prophetic words, bolstering their at-home presence, their marketing, and their acquisitions.

competitors – especially SiriusXM and Spotify – have heeded those prophetic words, bolstering their at-home presence, their marketing, and their acquisitions.

A recent commentary in Fast Company by futurist Dr. Bianca Finkelstein views the pandemic as an opportunity to re-evaluate our traditions, our isms, and the “because-we’ve-always-done-it-this-way” mindset:

“COVID-19 has shaken up nearly every industry, giving us all a chance to hit the reset button, override the inertia of stale traditions, and rewrite the big rules. Though this may not be our last chance to make the leap, the current seems to be whispering that now is a really good time.”

The Drum’s Watson says that for Spotify, “lockdown has been a welcome exercise in accelerating at-home adoption.” And given that WFH is a trend that will clearly continue through this year – and beyond – the home front will remain a highly contested audio environment.

SiriusXM CEO, Jim Meyer, is no doubt nodding his head as well.

These are two very different companies, of course, but they are approaching their strategic planning with great similarity – focusing on music streaming, podcasting, celebrity and personality, content distribution, device access, and the at-home experience.

These are two very different companies, of course, but they are approaching their strategic planning with great similarity – focusing on music streaming, podcasting, celebrity and personality, content distribution, device access, and the at-home experience.

Far from suggesting either company’s moves should be viewed as “best practices,” it is their willingness to audible during unstable, fast-changing times that is impressive and worth examining.

For radio broadcasters – as difficult a time as this has been and will no doubt continue to be – it is the rarest of opportunities to do so much more than just cut budgets, trim staffs, and batten down the hatches.

To compete in the post-COVID environment, new thinking will have to replace rapidly outdated traditions. In our personal lives, we are already doing this.

How can we “reset” our companies, our stations, our brands, our shows to lean into the change that’s all around us?

As Dr. Finkelstein reminds, “Now is a really good time.”

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Here’s the thing about Spotify. When my daughter began college in 2015, Spotify offered her their services for $5/month. PLUS they threw in HULU and Showtime for free. She was able to keep all three services for 1 year after graduation for the same price. She now pays the regular price for Spotify. She dumped Showtime, but kept HULU at their regular price. When she listens to music, it’s always on Spotify. I asked her why. She said it’s because she can program her playlist and listen to full albumns anytime and anywhere she wants. Plus, she said, I don’t have to listen to annoying commercials or idiots talking between songs. So, I asked her if I was idiot. She said, no, but sometimes you have to say idiotic things on your show. The point is, Spotify captures college students at a low price, keeps that price for 5 years. Then they throw in free stuff. They build their audience loyalty at an early adult age

It’s brilliant marketing, and designed to win over young consumers – and hold them for years. Thanks for the story, Gem.

And the Spotify stock has pretty much doubled in just a few months.

Not a surprise. Of the audio streamers, they appear to have the pole position – at home.

SiriusXM owns Pandora so why hasn’t their stock seen any kind of material increase?

Owning them and operating them profitably are often two different things. While I’m impressed with SiriusXM’s acquisitions in recent months, the ability to integrate these brands and platforms isn’t always easy. iHeartMedia (formerly Clear Channel) learned this the hard way when they owned a streaming brand, an outdoor advertising agency, a concert promotion company, and of course, hundreds and hundreds of radio stations. And they struggled. So, we’ll have to see how SiriusXM is able to integrate these assets, achieve scale, and make them work together.