One billion is a lot of zeros and a pretty impressive accomplishment.

You might have thought I was talking about McDonald’s with this headline, but burgers are a lot different than digital connections with people (OK, there are lots of dogs and cats in there, too).

You might have thought I was talking about McDonald’s with this headline, but burgers are a lot different than digital connections with people (OK, there are lots of dogs and cats in there, too).

When observers talk about who “the next Facebook” might be, the conversation may be bordering on the same shaky logic that’s been waiting for “the next Beatles.” It’s been more than three decades since the Fab Four broke up, and no one’s come close.

Facebook isn’t just a social media platform – it’s a place where more than 12% of the world’s population shows up to post pictures, share stories, and “chitty-chat” with one another.

There are lots of social sites and platforms but none is as engaging – or nearly as expansive as this one.

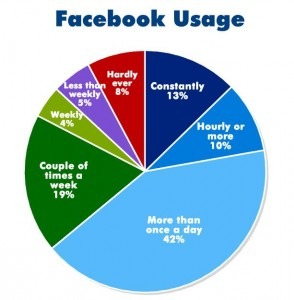

Our Techsurvey8 looked at the regularity of usage of Facebook earlier this year and found that nearly two-thirds of our 57,300+ radio respondents use Facebook daily or more. And an impressive 13% say they use it constantly, making it a regular part of their digital lives. No other social media platform comes close to this level of engagement.

Our Techsurvey8 looked at the regularity of usage of Facebook earlier this year and found that nearly two-thirds of our 57,300+ radio respondents use Facebook daily or more. And an impressive 13% say they use it constantly, making it a regular part of their digital lives. No other social media platform comes close to this level of engagement.

And yet, Facebook stock continues to suffer, having lost nearly half its value since going public just a few short months ago. Why is this?

As Brian Solis points out in a recent post and as Lori Lewis has talked about since the Facebook IPO filing, Mark Zuckerberg wasn’t focused on building a profit center when he launched The Facebook back at Harvard.

The money quote – or perhaps the non-money quote:

“Facebook aspires to build the services that give people the power to share and help them once again transform many of our core institutions and industries.”

There’s not a thing in there about net profits and EBITDA. And perhaps that’s why the investment community continues to turn away from Facebook, blaming Zuckerberg’s youth and arrogance for the company’s failure to understand how business works.

But, in fact, Zuckerberg may have a better handle on how people work.

You don’t amass one billion users without having an understanding of what motivates consumer behavior. Facebook’s IPO may have gotten off to a horrible start – a big cume but a lousy AQH (revenue). Zuckerberg is converting his audience to use the product, but is not hitting Wall Street’s margins for translating this massive population into cash.

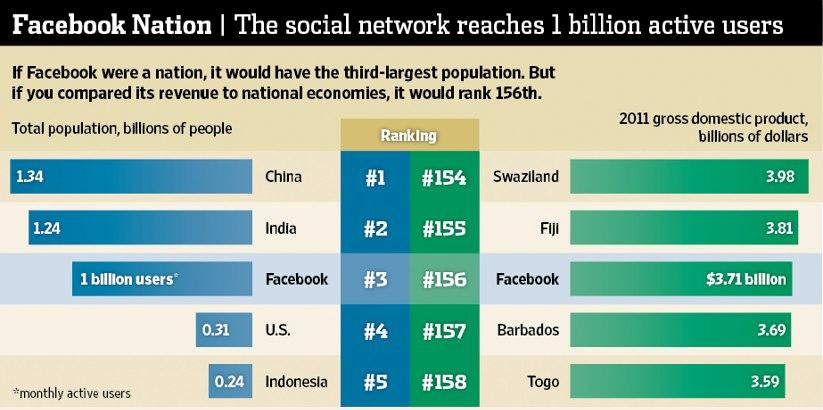

Solis ran a Wall Street Journal infographic on Facebook, and this piece tells an interesting story:

While Facebook’s audience would rank it 3rd in the world behind China and India in population, it would only rank 156th in revenue, just ahead of Barbados and Togo.

No one gets excited about a Togo economy. With less than 7 million people in that West African nation, you’re not going to get rich.

But you would have to think that with one billion loyal users – and still growing – Facebook is going to figure this thing out. The power of social media in people’s lives and in the business community should strongly suggest that Facebook is going to do much better than #156 within the next couple of years.

They will figure it out.

Thanks to Digital Trends for the graphic.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Maybe the explanation is simpler…the IPO price was too high. Had it been $15 or so, reactions might have been different. I think this may be where Zuckerberg’s inexperience was most impactful and where he may have been misled by the Wall Street Cabal that rarely looks beyond the next fee or quarter.

Wall Street often punishes companies that eschew short term profits in favor of long term strategy and Facebook seems to be looking to build its base first and then maximize its monitization. Time will tell if that strategy is correct – but with Wall Street so negative on it its hard to place the odds at less than 50/50.

I think Mark Zuckerberg is a smart guy who has more corporate smarts than many credit him with. It would be a shame if his hoodie was replaced with a suit before his vision was allowed to unfold.

Thanks, Bob. In fact, that could happen. But you think about how John Sculley came in to provide “adult supervision” at Apple. It wasn’t until the creative force, Steve Jobs, returned to make Apple what it has become today. That may be the future of tech companies, in spite of the fact that Zuckerberg has made mistakes and his company has been misunderstood. It is also interesting how “content guys” have become the heads of many radio companies, from Bob Pittman to Dan Mason. Wall Street pressures aside, these media companies will not prosper without a sense of content and the consumer at their foundation. Thanks, Bob, for taking the time to weigh in.

Hi Fred –

There is no doubt about the addiction that is Facebook as it accounts for 1 in every 7 online minutes. (www.zdnet.com/…/facebook/facebook…1-in-every-7…min…)

And yes a billion is cool but as Sarah Lacy of Pandodaily says in this Bloomberg interview today – “all eyeballs are not equivalent”. Here’s some real insight on monetizing Facebook –

https://www.bloomberg.com/video/lacy-facebook-is-not-monetizing-it-s-billion-users-gu~j6LikSk~jyM28yC82og.html

Like Brian Solis, Sarah is someone radio people should be reading and listening to.

Thanks, Mike, for including the Sara Lacy video. And she echoes some of our thoughts as well. There won’t be “the next Facebook,” but this one needs to do a better job of making the revenue model work. I still believe with this bulk audience and their level of engagement, it will happen. But as Sarah points out, not with “brute force” banner ads. Thanks again for the wisdom and perspective.