For Immediate Release

On-Demand Video Consumption Signals Podcasting & On-Demand Audio Growth

245 stations | 12 radio formats | 39,503 respondents | 4 generations

Bingham Farms, MI — In Jacobs Media’s new web study of radio listeners, a big story is on-demand media consumption. Starting in television where a cultural change is taking place with video on-demand and binge viewing, podcasting and on-demand audio are experiencing impressive gains.

The media habits of 12 format core audiences along with four generations are examined in this mega-survey of radio listeners. From Boomers to Millennials, different patterns of consumption emerge, providing radio broadcasters with information from which they can map out game plans and strategies.

Techsurvey12 was conducted from January 19-February 22 of this year. Stakeholder stations participated in a webinar last week, and the results of the study will be released over the next few months.

As Jacobs Media President Fred Jacobs points out, “Every year when we sit down to analyze the data, we’re in search of ‘the one big thing’ that impacts radio. This year, we see strong signs that podcasting may emerge as a game-changer for broadcasters. This new survey also provides preferred podcasting categories for each format audience, providing a guide to station content creators. More and more consumers own connected televisions, and their changing video consumption signals similar increases for on-demand audio. Every broadcaster should be developing a podcasting content strategy.”

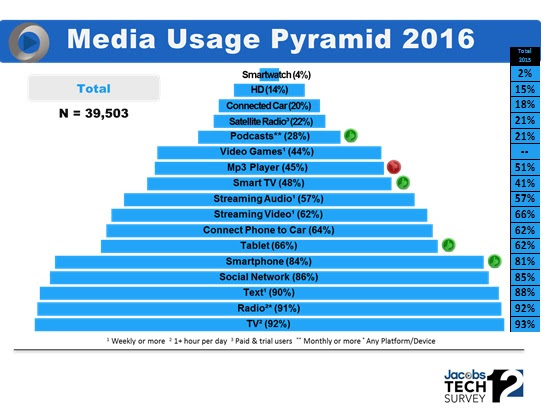

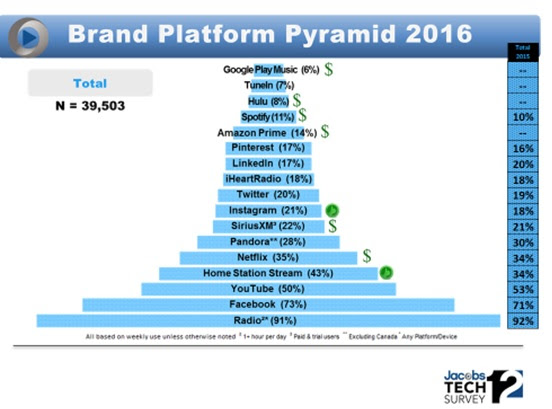

As was the case last year, Techsurvey12 provides two different “pyramids” for stakeholder stations. The “Media Usage Pyramid” contains broad categories from smartphone and tablet ownership to audio and video streaming. The “Brand Platform Pyramid” unveiled last year has been expanded to include new brands, including Hulu, TuneIn, and Amazon Prime. One of the key differences in this year’s analysis is the addition of a new “Brand/Platform Pyramid.”

Jacobs continues, “This year’s Media Usage Pyramid shows the continued rise of mobile, as well as increases for both Smart TV and podcasting.”

This year’s Media Usage Pyramid is below:

More than 90% of respondents spend at least one hour a day with radio and/or television, the foundation of this pyramid.

Other highlights include:

- The mobile revolution marches on: More than eight in ten respondents (84%) now own a smartphone and two-thirds (66%) now have a tablet – mobile continues to grow year after year.

- TVs are rapidly becoming “connected”: Nearly half of respondents (48%) own a Smart TV or one connected with a device like Apple TV or Chromecast – up from 41% last year.

- Audio streaming is steady: Nearly six in ten (57%) stream audio weekly or more often – flat from last year.

- Podcasting on the rise: Close to three in ten (28%) have listened to a podcast or on-demand audio in the past month, up from last year’s levels (21%).

- “Connected cars” continue to grow: One fifth (20%) drive a car with an in-media system like Ford SYNC or Chrysler UConnect.

- Smartwatches struggling: While ownership of a connected watch has doubled from last year, only 4% of respondents own one, a gadget that is in search of a market.

- This year’s Brand/Platform Pyramid” provides data points that helps broadcasters get more granular with their audiences, identifying the key media brands they use. For each of the brands and platforms, this pyramid shows weekly usage (with the exception of broadcast radio which is one hour/day or more, and SiriusXM which is based on subscribership/free trial).

Here are some of the highlights from this year’s Brand Platform pyramid:

- Facebook Rules: Nearly three-fourths (74%) are on Facebook weekly or more, making it the dominant social media platform. About one-fifth spend time on Instagram and Twitter at least weekly (21% and 20% respectively).

- Half (50%) now watch YouTube videos weekly more, while more than one-third (35%) connect with Netflix during a 7-day period.

- Nearly three in ten (28%) check out Pandora on a weekly basis, a slight drop from last year’s levels, while nearly one-fifth (18%) use iHeartRadio through the course of a typical week.

- Subscription-based brands are designated with “$.” This pyramid shows the degree to which consumers are willing to pay for their content.

Both pyramids are available by format, gender, and generation, making them useful tools in better understanding how radio listeners are expanding their horizons.

This year’s survey covers key areas of interest to all media brands, including actionable information about “connected cars,” traffic reports, social media usage, mobile devices and apps, audio and video streaming, and other key topics.

Techsurvey12 was powered by NuVoodoo who provided analytical and platform support.

- A Simple Digital Treat to Thank Your Radio Listeners This Thanksgiving - November 13, 2023

- Interview Questions When Hiring Your Radio Station’s Next Digital Marketing Manager - November 6, 2023

- A Radio Conversation with ChatGPT: Part 2 – Promotions - October 30, 2023