Yesterday’s post teed up today’s look at Techsurvey data in the hope of gleaning insights about the rapidly changing worlds of media – and broadcast radio.

As we know, research is in the eye of the beholder; in this case, the interpreter. And we can’t help but notice in the growing onslaught of political polls, the analyst often has outsized influence over how the data is reported and translated. In research presentations where I’m present – as an analyst or consultant – I often hear the question, “So, is this a good number or a bad number?” Or “How does this compare to stations like ours? Or “How are these numbers trending over the past couple years or so?”

Good questions all.

And the conversation is always complicated by methodology. Who did we talk to? What were the screening parameters? When was the study fielded? Was the data weighted? Sometimes the caveats and footnotes can take the impact out of research, often for good reason.

In this case of our Techsurveys, I always try to bend over backwards to be transparent about our respondent pool. By and large, they’re core listeners (the “20” in the “80:20 Rule”), they are tech-savvy enough to know how to take an online survey, and yes, we weight the data by population so that 400 surveys from a big market like Los Angeles counts for more than the same number of respondents from Lincoln.

In yesterday’s post, I started the ball rolling. What truths can we glean from these surveys that might otherwise be glossed over? What are some of the more basic findings that may be having outsized impact on how ratings are faring – in 2023 and beyond?

I’ve spent a lot of time with our data from our three Techsurveys this year – for commercial, public, and Christian music radio. And I’ve identified findings that have been often overlooked or simply drowned out by “sexier” questions revolving around AI, Elon Musk’s Twitter, video podcasts, and widescreen digital car dashboards.

Yesterday, I teased this post, a list of “reality check” research findings from these annual studies of core radio fans. As I always say when I present our Techsurveys, if you know what radio’s biggest fans are thinking and doing, you’re closer to understanding how those who listen a lot, engage the most, and consistently donate with regularity actually think about some of the basics of how they choose entertainment and information – including, of course, radio.

So let’s jump into some “reality checks” based directly on the research.

How can you “meet the audience where they are” when you don’t exactly know where they are? The concept of MTAWTA has become almost as common as the familiar mantra, “Content is king.” Radio operators who give lip service to this concept may be surprised to learn just how fast listening locations and preferred devices have changed in just the past few years. Once again, COVID may have been an accelerant. As millions found themselves virtually locked down at home, many found out they didn’t actually have a working radio where they lived or that it was in an inconvenient location.

That’s when so many figured out how to download a mobile app, connect Bluetooth speakers, and talk to Alexa. On the one hand, we’re aware these habits have accelerated. And yet, many programmers are still marketing their stations like its 1999, assuming everyone knows they have an app or the correct smart speaker command. That couldn’t be farther from the truth. We continue to conduct scores of Zoom focus groups each year, most recruited from those same email databases we use to populate our Techsurveys. Again, they’re core listeners who should know everything. But they don’t.

And now that the smoke has cleared as the pandemic has faded, we’re seeing the trend lines more clearly. As radio ownership on the homefront continues its inevitable fade, the arrows are pointing upward for mobile app downloads of station mobile apps and smart speaker ownership.

Radio simply has to do a better and more thorough job of marketing these digital touchpoints on the air, online, and anywhere the audience happens to be. We’ve come a long way from encouraging consumers to preset our stations on their car radios. Now, it’s a matter of reminding them to download our mobile apps, complete with ways in which they can take your station with them, wherever they go.

Most stations rarely address in-car listening in their on-air marketing, assuming consumers are still pushing old school presets to find their favorite radio stations. Instead, drivers are more likely to be commuting with vehicles equipped with ecosystems like Apple CarPlay. In fact, reminding listeners your station’s mobile app is now proudly displayed on the CarPlay “desktop” on their dashboard screens (assuming it is) is both basic and smart.

Listening locations and device usage has been rocked by the digital revolution, COVID, and other mega-forces. Radio has to get with the program.

The audience’s social habits are changing. (Or are they?) When we started our Techsurveys in 2004-05, Facebook was just expanding from college campuses, soon available to billions of us. YouTube was just learning how to crawl, mostly full of crude homemade videos.

What a difference a couple decades make. Social media has become a powerful force, impacting elections and creating all-powerful influencers making millions recommending makeup and shoes. New platforms have sprouted up, too. While some have proved to be short-lived or even duds (Vine, Google Plus), newcomers like Snapchat and now TikTok have proved to be resilient and immensely popular.

So, how do radio stations craft a social media strategy that matters? We see stations all the time that are winging it socially, going wherever they can have a profile.

Now so as to not be contradictory, we DO want to “socialize with the audience where they socialize,” most stations don’t have the resources or the expertise to be everywhere in the social space. Thus, choices have to be made. And once again, research can and should be used as a guide.

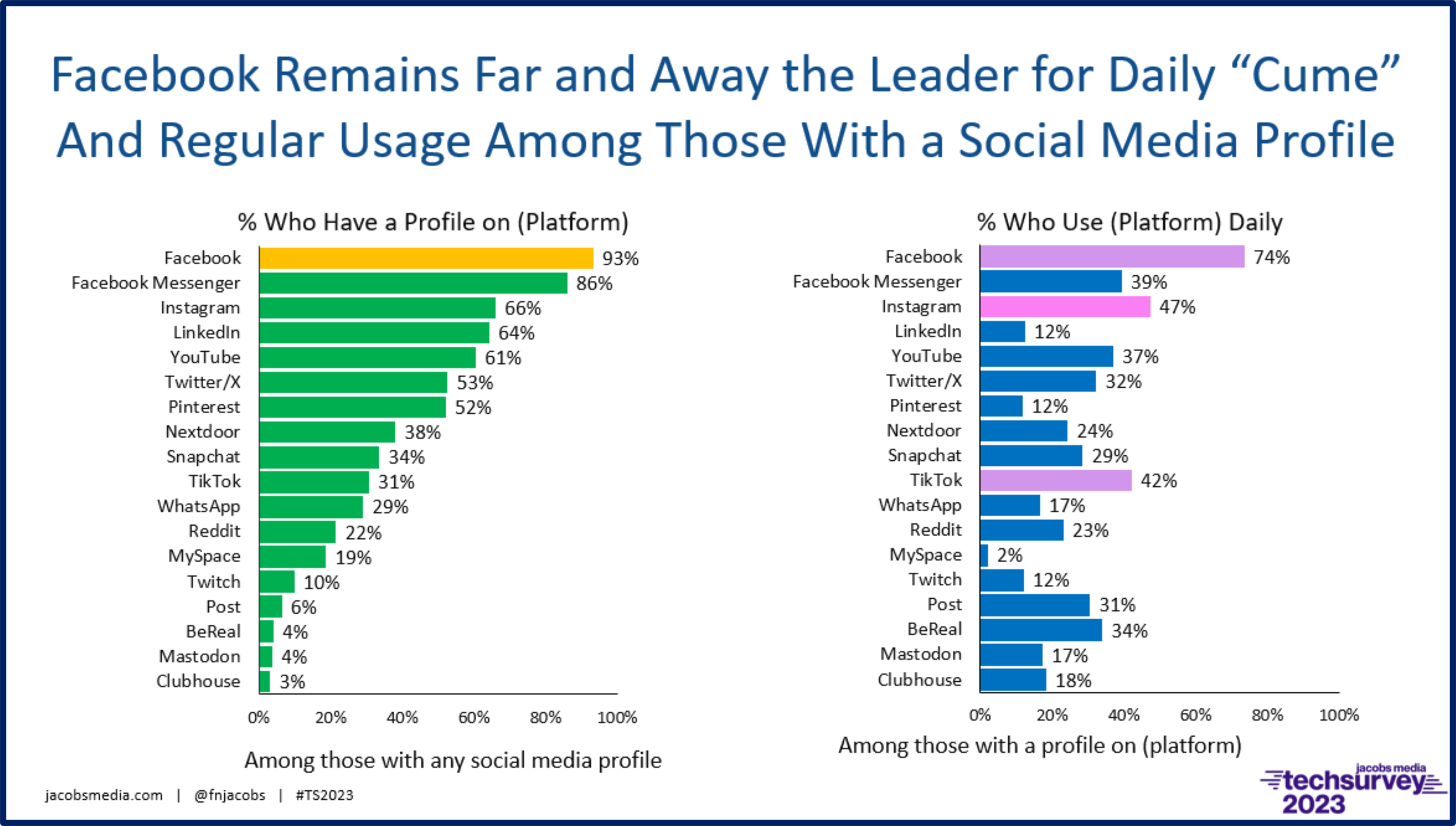

In Techsurvey we break out social media “cume” (the platforms where listeners have profiles) and “TSS” (time-spent socializing or the platforms they show up at on at least a daily basis). In this way, we can easily determine their locations socially and their levels of engagement with Instagram, X, Facebook, TikTok, and LinkedIn. We break this out by individual formats (there are differences) and by individual stakeholder stations to make this data even more relevant. Here’s the 30,000 respondent view:

Think of social media as a place where your station can plot out how to best utilize time and personnel to get the biggest bang for your social media buck.

And this data can settle those internal scores and debates. Facebook IS the big dog – in spite of its unhip image, Zuckerberg’s questionable policies, the screwed up metaverse bet, and the lame Congressional hearings. Still, of those with a social media profile (about 85% of the entire Techsurvey sample), more than nine in ten are on Facebook. And of them, nearly three in four (74%) make an appearance on Facebook daily or more often.

Other social platforms are showing progress as well, so understanding where your audience spends their social time is part and parcel in plotting out a smart strategic plan for your station’s social efforts.

We’re a digital brand (but what kind of digital content should we make)? As radio has learned these past few years, the making of digital content is often more difficult than it looks. That’s been especially the case with podcasts, an exploding platform that few radio companies have been able to capitalize on.

Part of the issue is “degree of difficulty.” Some podcasts are simply expensive to produce, requiring multiple voices and even casts, massive production expenses, and recording locations. As some stations have learned, it is possible to produce an award-winning podcast that turns out to be spectacularly unsuccessful, often for many of the aforementioned reasons. The ROI on some complex podcasts is simply unsustainable for the average radio company or station.

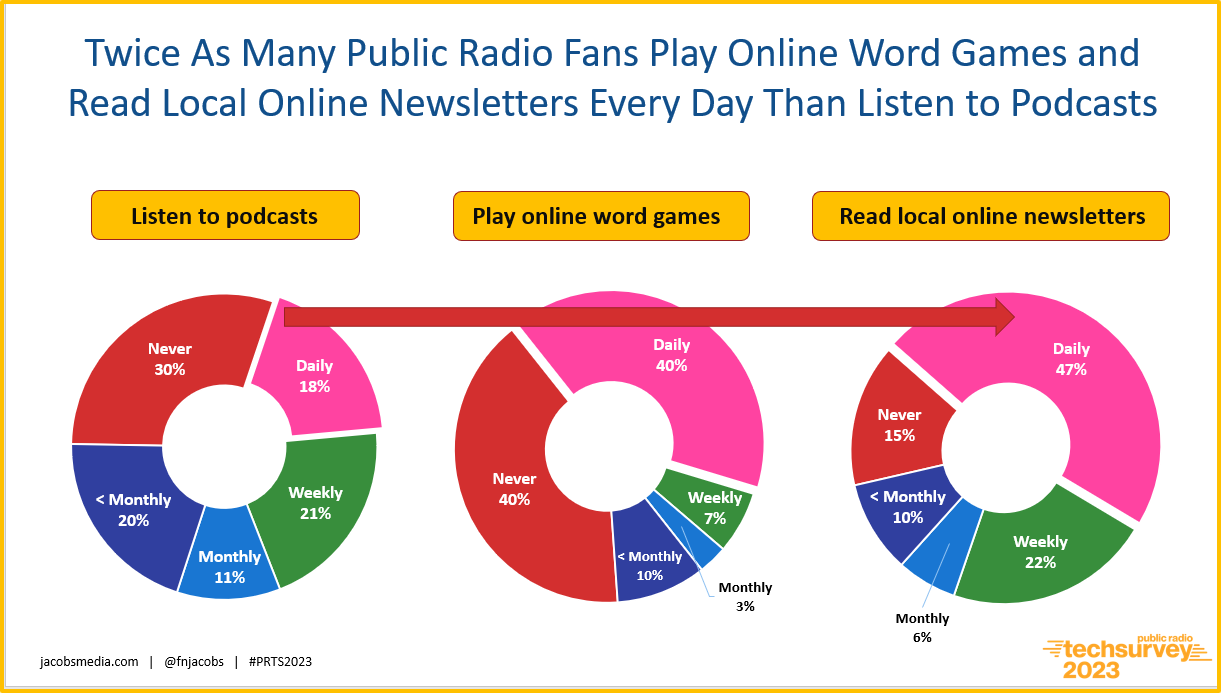

There’s also that sticky matter of available audience. While podcasting has experienced growth in the past few years, its users pale in numbers compared to say, radio listening or video streaming. A look at our most recent Public Radio Techsurvey tells the tale. As you no doubt know, podcasts are very much rooted in the public radio space. Many of the best productions and producers came out of shops like NPR, WNYC, and other public radio meccas.

Yet, when we look at what core public radio fans actually consume in the digital space, podcasts aren’t even close to the top:

These three pie charts tell an important story, especially in the public radio space. A look at the “daily” slice of these data pies is an important lesson in fishing where the fish are. While most radio stations don’t typically think about creating word games, the data suggest maybe they should.

The newsletter space looks even more tantalizing through this lens. When nearly half of a medium’s core audience reads a locally-flavored newsletter every day, there’s loads of potential to create one. Or a second or third one. Our data also provides insights about the types of newsletters most desired. So while not as simple as a paint-by-numbers digital guide, Techsurvey can provide a data map for smart, savvy decision-making. And when it comes to digital content creation, every radio station can benefit from a reliable guide.

How is public radio’s drive to diversify its audience going? The mantra in public radio these past few years has been D.E.I. But saying it and even committing it to a plan has proved to be immensely more difficult than AFDI, as Lee Abrams reminds us.

The most disheartening slide in our PRTS 2023 deck this year is the one you see below, suggesting very little audience diversity progress has been made during the past decade. The chart may be deceiving. The mini-trend of “urban alternative” startups is not included among our “stakeholder” stations – not our choice.

But perhaps we can learn a little something from these efforts, namely that different platforms apart from the public radio “motherships” may be more propitious than trying to cram this content into the existing schedule. The “urban alternatives” are typically on additional “sticks” or HD2s – seemingly a smart move. And as the City Square data we have quoted these past couple months suggest, new platforms (podcasts, streams, mobile apps) might be more appropriate for these diversity efforts.

The data clearly tell us stations cannot simply attract and engage emerging audience by simply repeating their commitment to diversity. It will take a more informed, focused effort to be successful in this space. And lots of research in communities public radio will need to learn about in order to serve.

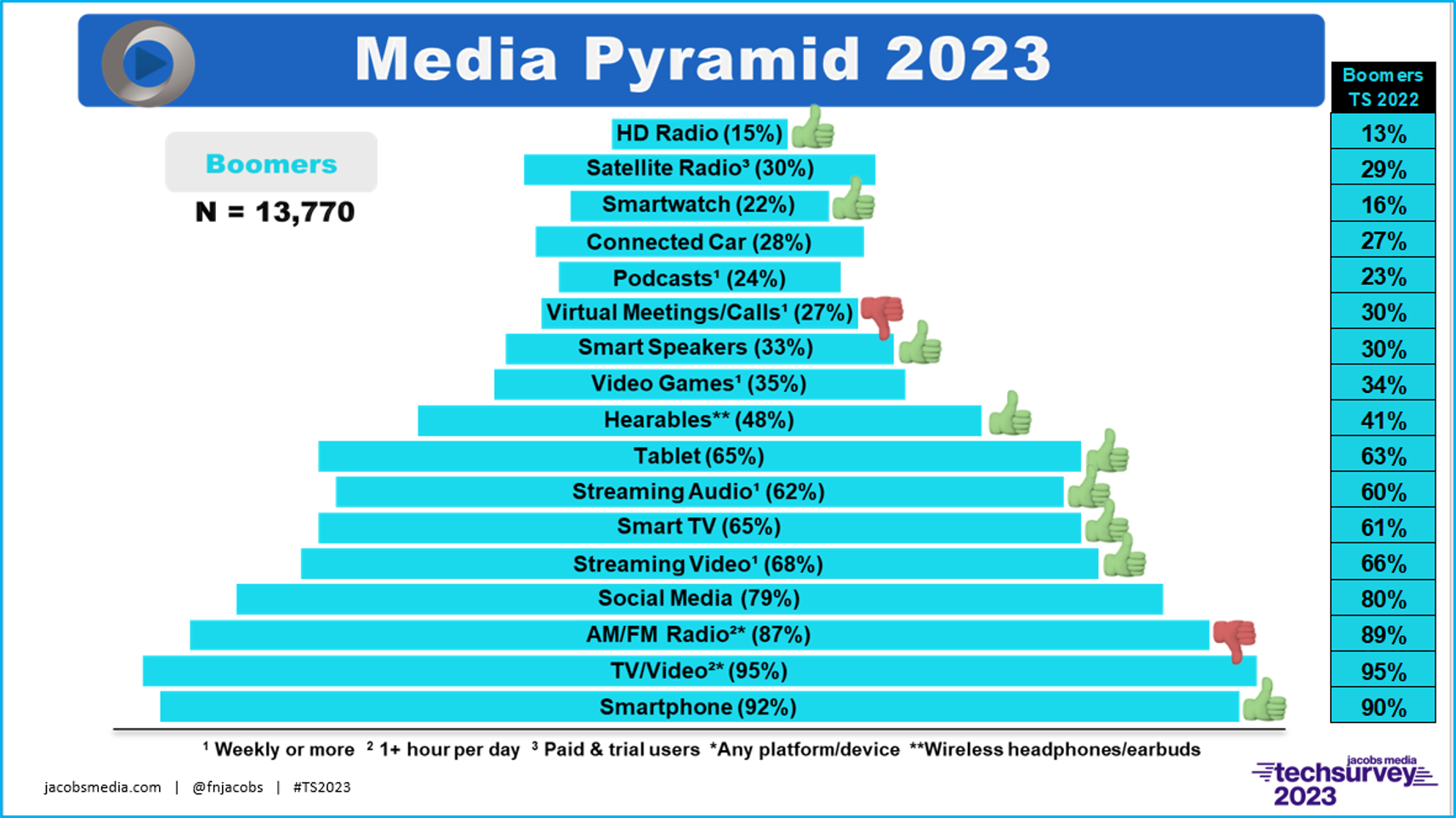

Those old Baby Boomers are catching up. It is easy to overlook the massive numbers of Americans born between 1946-1964. Their numbers are still impressive, but their marketing desirability is not. Most advertisers pay scant attention to them, instead going after Millennials and Gen Zs. (Let’s not even talk about Gen Xers.)

In fact, the “OK Boomer” eye roll, a move perfected by younger consumers, has become an accepted way to dismiss these millions of AARP members as irrelevant. Many believe they are behind the curve, Luddites, and not worthy of marketing attention.

But the reality is they have made great strides in the tech space. Nearly half walk around with “Air Pod” type devices, two-thirds own a smart TV, eight in ten are on social media, and more than nine in ten are walking around with smartphones.

How do I know this? Simple. I’ve been to the “pyramids,” the graphic summary of key Techsurvey findings. A look at our nearly 14,000 Baby Boomers reveals an evolving generation. The thumbs-up emojis indicate growth from year to year (2022 is on the “stripe” on the far right).

How you talk and market to them needs to be predicated on their gadget and media use. (Of course, Techsurvey stakeholder stations receive their format’s pyramid, as well as a pyramid for their specific audience, a great tool for planning and growing.)

Reality checks don’t need to be scary when you have a better idea about where you’re coming from, where you are, and even where you may be headed. The future, of course, is highly difficult to predict but with great data, a smart analyst can read the room.

In order for radio to stay competitive these next five years, the industry is simply going to have to invest in research that provides insights.

In this environment, guesswork will not get it done anymore.

To participate in Techsurvey 2024, check out our info sheet and registration form here.

To read our public radio “white paper” about “Next-Adjacent Audiences,” go here.

If I can help you better understand and use your station’s Techsurvey data, reach out to me here.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Technology is wonderful. It has allowed many to put their audio in every single car that rolls off the assembly line. Spot on Fred, we need to let everybody know just that.

Here’s my stab at it.

https://on.soundcloud.com/itAwF

Excellent, Sir Fred! Bring on More Radio Receivers and Respect Boomers are The Fabulous Force.

Amen. And for any radio station or network that fails, Fred has demolished plausible deniability.

Great post! I would also add, regarding the lack of diversity in the Public Radio TechSurvey results, that stations may indeed be engaging with and serving diverse audiences, but those audiences aren’t signing up for the station’s e-newsletters, which means they aren’t getting the link to this survey. I think part of the problem is that public radio stations aren’t doing enough to grow their email databases, relying mostly (or solely) on the membership database. So they are only communicating with the people who both give them money and opt in to their emails. Since being out in the community and being visible to current and potential audiences is a key recommendation from our Meta-Analysis, perhaps stations should be actively signing people up for the email database when they are out in the community. Seems like a no-brainer to me.

Good analysis Ms. Goldstein. *Advanced* technology can help with data capture on smarter “listening devices”.

Good points all, Abby. I mentioned in the post PRTS has not attracted any of these Urban Alternative stations, which would likely profile much differently than WBUR. And your idea about attending to and growing the database is so important. We’ve talked for years about the limitation of having a member dataabase. And the Meta-Analysis truly backs this up.

Genius post, Fred. Some of us learned early on that we needed to be EVERYWHERE!! Give the listener the chance to hear what u got. If they like it you can win. In many cases they don’t know it’s there because broadcast marketing is purely dismal in 2023. Look at Film House! Their website still has spots from nearly 40 years ago…but (I’m guessing) nothing from 2023.

The finding about word games was very surprising, though a quick scroll of my personal social feed could have told me lots of folks play Wordle, if I had been sharp enough to see it.

If I was running a radio station/cluster right now, I’d either create or license a Wordle-style game, put it behind a registration screen and hold weekly/monthly tournaments with modest prizes. Our email newsletter would carry tips and tricks for playing the game along with leaderboards, along with the day’s news and information.

Seems like a winner.

There you go, DB. That’s my whole point. You fish where the fish are. If they Wordle (and Spelling Bee and now Connections), what else will they play?