Man plans. God laughs. And the auto industry scratches its collective head.

For the past several years now, the conventional wisdom among the biggest car makers incorporates the following “givens” about Millennials and cars:

- They aren’t interested in owning one

- Many aren’t even interested in driving

- They’re the biggest users of ride services like Uber and Lyft

- They will be among the first to embrace autonomous cars (if/when that day ever comes)

But new research suggests some of those assumptions may, in fact, be faulty. Laura Bliss writes in CityLab how new data from the National Bureau of Economic Research suggests that older Millennials (wait for it) may be no different than the rest of us.

Their working paper studies car ownership among Millennials, as well as their driving habits. It controls for some of the key variables most researchers have assumed are keys to understanding major lifestyle preferences – marriage, urban residence, etc.

Their take?

Older Millennial Americans (those born between 1980-84) are just as likely to own a motorized vehicle as their parents.

The study suggests that when you just look at Millennials versus everyone else, they actually own 0.4 fewer vehicles per household than a Baby Boomer. But when you factor in lifestyle variables, these generational differences vanish. Yes, they profile about the same as everyone else.

In Techsurvey 2019, we ask about whether respondents are in the market to buy or lease a new vehicle in 2019. Among the entire study, 9% say they’re car shopping. Among Boomers, it’s 8%. Millennials? 11%.

But like most research, there are dangling questions – especially as it relates to younger members of the Millennial generation who may be more opinionated about not making cars as significant a part of their lives as their parents.

As they get older, enter the job market, and begin to move into the family zone, will the habits and lifestyle choices of the younger end of Gen Y mirror those of these older Millennials?

As Laura Bliss concludes, Millennials often find their “consumer life” delayed – but not canceled – thanks to the forces of the economy rather than a mindset sea change. The faster they can get their finances together – undoubtedly student loans and wage suppression are at work here – the more their habits echo those of older generations.

For radio, this is a hopeful sign. As Techsurvey points out once again, the car is becoming an even bigger part of broadcast radio’s past, present, and future.

Research provides a narrative – if you take the time to really “listen” to what consumers are trying to tell you. As a self-styled “Data Whisperer,” a deeper dive into our research suggests this study by the National Bureau of Economic Research may be dead on.

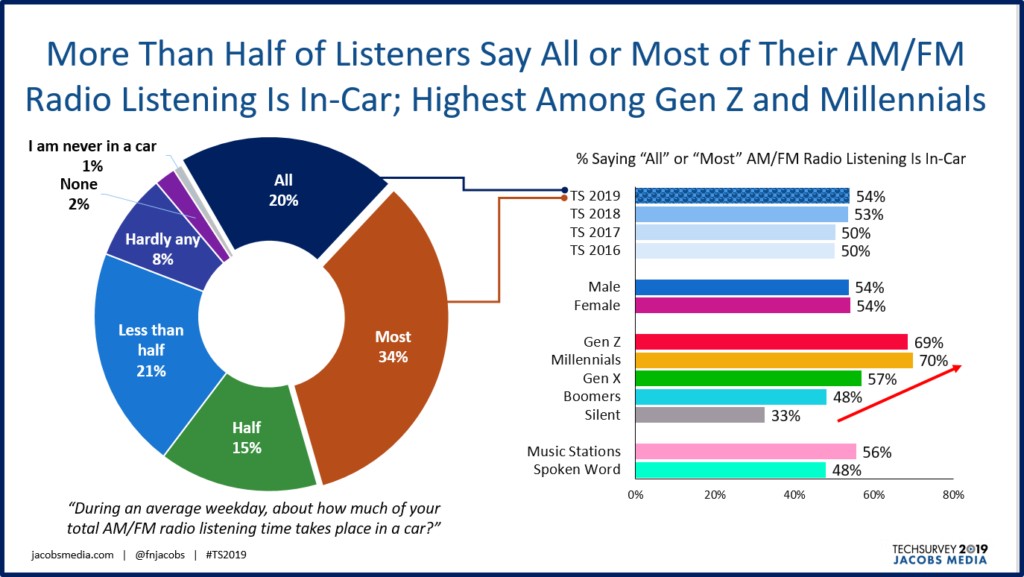

In our new study, 54% (the highest ever) tells all or most of their AM/FM listening takes place while they’re on four wheels. And when we look at our own generational data, we see Millennials are most likely to confine their radio listening to the times when they’re driving or are passengers:

That’s mostly good news for radio broadcasters because it suggests young people end up in the same in-car listening environment as much as anyone else.

That’s mostly good news for radio broadcasters because it suggests young people end up in the same in-car listening environment as much as anyone else.

But here’s the rub.

More and more vehicles are “connected” now – offering the ability for consumers to connect their phones to their cars. New cars are all connected and most are well-appointed with touch screens.

And younger people are especially likely to have mastered the ability to plug their smartphones into their cars via Bluetooth, an AUX IN jack, as well as using after-market options like Apple CarPlay.

As a wise researcher once said, the car is now a smartphone on wheels. That means the challenge for radio may have less to do with this notion they don’t like to drive or own cars. Instead, it may boil down to whether programmers can devise ways to keep their stations relevant to younger lifestyles while they’re on the road.

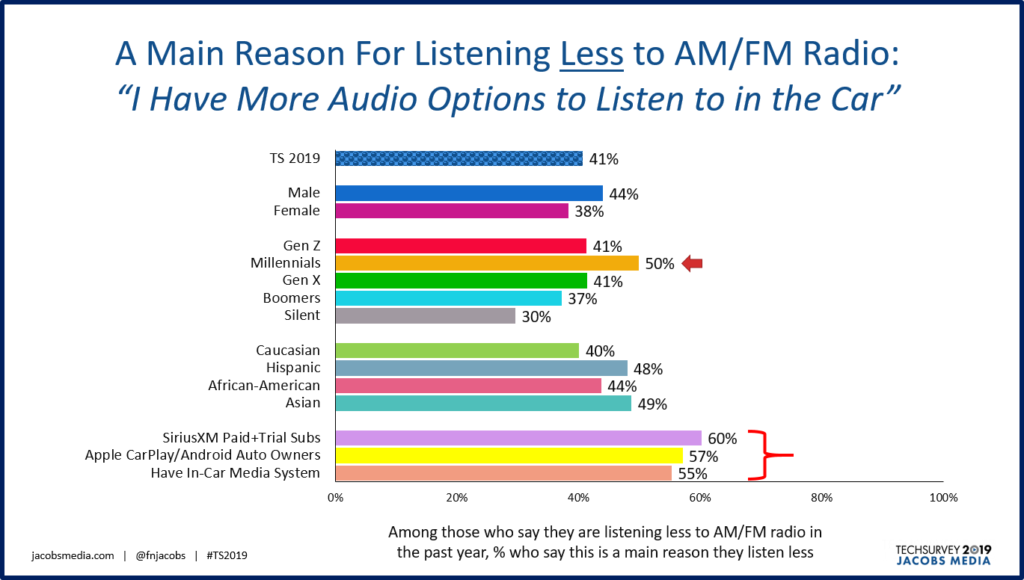

We also saw this in the Techsurvey data. When we asked those who told us they’ve been listening to less broadcast radio during the past year, the #1 reason was this:

“I have more audio options to listen to in the car.”

Four in ten of those for whom radio usage has decreased cite this as the culprit. Among Millennials, it’s 50%.

These studies underscore the notion that in cars at least (we’ll talk about the home and smart speakers in future posts), radio has a good shot at continuing to be a major player. Yes, there are increasing numbers of audio entertainment options available to virtually every car buyer. But as we discussed in yesterday’s post, radio’s “one button solution” combined with force of habit should keep the medium very much in the game for years to come.

But that assumption is also predicated on broadcasters making it a priority to include young people in their strategic plans. And not just Millennials (who mostly occupy the younger slice of radio’s obsession with 25-54 year-olds). Their younger brothers and sisters – Gen Z – will soon outnumber them – a cohort that grew up clinging to smartphones and tablets, rather than rattles.

I have every confidence that smart, savvy radio programmers can devise content and distribution strategies that can effectively appeal to and enthrall  this emerging generation of young Americans.

this emerging generation of young Americans.

But it starts with taking the time to research and understand them.

As the auto companies know very well, they are the future.

May they keep buying and leasing cars.

And may radio continue to have strong presence in the center stack.

- What’s Your Radio Station’s “TUDUM?” - February 3, 2025

- Appreciating What We Have (When Our Lives Aren’t In Jeopardy) - January 30, 2025

- AI: Oh, The Humanity! - January 29, 2025

Learning to drive is a right of passage. Cars are our personal, utilitarian sanctuaries. Your audio is sacred. It all fits together. Hard to leave once you grow into it. Thank you, Fred.

Appreciate it, Clark.