On Monday, we addressed the way the radio broadcast industry often reacts to the competitive threat posed by Pandora. Today, we’ll take a deeper dive into some alternative ways to think about Pandora and its impact on both traditional radio programming and sales. But first, the question that many in radio are (for some reason) asking:

Is Pandora radio?

Well, you can parse any definition you like, but to get an expert opinion, ask the experts. In this case, consumers, and let’s think about television.

Viewers – especially those under 40 – don’t differentiate between a “network” or a “cable” channel. It’s TV – 200+ channels that offer entertainment that you can watch on one or more screens.

Viewers – especially those under 40 – don’t differentiate between a “network” or a “cable” channel. It’s TV – 200+ channels that offer entertainment that you can watch on one or more screens.

The source of the content is irrelevant to viewers. They’re simply looking for something good to watch. Does anyone really care that NBC is a broadcast network and CNN is a cable network? Does it matter that HBO, AMC, and Comedy Central all run movies? No, it’s strictly about the content and the experience – not the source.

Like it or not, radio is headed down that same path. As in-car systems incorporate Internet capability and allow drivers to seamlessly connect their smartphones, the origin of a station or audio source becomes secondary to the content and the payoff that is being delivered. The growth of iHeartRadio as a streaming portal along with individual mobile apps blur the line between broadcast and streaming.

So how to proceed?

A tool that radio has used to its advantage for decades – audience research – would be advisable here. The Arbitron/Edison “Infinite Dial” studies have provided a trend line of Americans, while our own Techsurveys have illustrated the narrower characteristics of your MVLs – your Most Valuable Listeners. In the “80:20 Rule,” these are the 20% of your listeners that contribute the most quarter-hours and passion for your brand. Your database members are far and away your biggest fans.

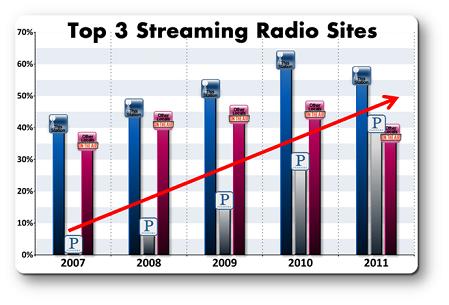

But their tastes are changing. This trender shows Internet streamies from our 2011 Techsurvey – conducted among radio listeners who are largely members of station databases. It speaks volumes about Pandora’s trajectory and its potential impact on the broadcast radio establishment. We expect Pandora’s levels in our upcoming Techsurvey8 to move even higher.

And while many argue that Pandora is a completely different animal and shouldn’t be compared to broadcast radio, let’s go to Pandora’s home turf – the stream. To its credit, radio companies are finally jumping whole hog into streaming – on their websites, on mobile apps, and the growing number of stations that have made the leap to the aformentioned iHeartRadio.

And while many argue that Pandora is a completely different animal and shouldn’t be compared to broadcast radio, let’s go to Pandora’s home turf – the stream. To its credit, radio companies are finally jumping whole hog into streaming – on their websites, on mobile apps, and the growing number of stations that have made the leap to the aformentioned iHeartRadio.

But what kind of streaming experience are they getting – and how does it compare with the streaming product that Pandora provides? On the Internet, that is apples to apples. And broadcast radio needs to start paying serious attention to its streams and how their quality impacts the CX.

But maybe the best way to go is to end this argument about whether or not “Pandora is radio” is to focus instead on broadcast radio’s inherent strengths, qualities, and ability to serve its customers. Instead of demonizing, fearing, or attempting to minimize the new competition, radio could benefit by going to school on Pandora, studying its strengths and weaknesses, and then putting a plan into action.

The real heart of the matter is determining what broadcast radio does better than Pandora, and then leveraging those strengths around creating better content and driving higher sales.

And what does Pandora bring to the table that broadcast radio might apply to its own model (remember yesterday’s Kodak story), thus modernizing a medium that has played a key role in entertaining and informing Americans for decades? What could broadcast radio do to go beyond Pandora to create a better, more meaningful, entertaining, and innovative audio product?

Broadcast television has taken on some of these same issues, and to a certain extent, dealt with disruptive innovations like the DVR, video streaming, and social media in clever ways. An on-demand site like Hulu, streaming (the Super Bowl will be streamed this year), and providing and enabling the ability for viewers to “socialize” about what they’re watching in real time on Twitter and Facebook – these are all part of the changes and innovations that TV has made in the face of new technology. It has actually become more interesting and rewarding to consume television.

Broadcast television has taken on some of these same issues, and to a certain extent, dealt with disruptive innovations like the DVR, video streaming, and social media in clever ways. An on-demand site like Hulu, streaming (the Super Bowl will be streamed this year), and providing and enabling the ability for viewers to “socialize” about what they’re watching in real time on Twitter and Facebook – these are all part of the changes and innovations that TV has made in the face of new technology. It has actually become more interesting and rewarding to consume television.

I know that some of my friends in radio have read these posts and questioned my loyalty to the medium. But the fact is, radio looks bad when it goes into deep denial over a competitor that is legitimate and real. That doesn’t mean that Tim Westergren will be successful, but acknowledging a threat is the first step in addressing it, and ultimately beating it back – or simply getting your own house in order.

For too long, broadcast radio has asked the wrong questions or spent too much time denying a competitor, rather than getting to the core questions at hand. What are consumers looking for? How can we improve their experience? How can we better serve them in a more complex media environment? What do they love about what we’ve always done that we can build on throughout 2012 and beyond?

Answer those questions and maybe radio will start looking good again. And in the process, recapture some of that “mindshare” that Pandora has won.

In that spirit, there is still time for your station or your company to get the answers about Pandora, along with learning about the technology and content your audience enjoys when they’re not listening to you.

Our new Techsurvey 8 will be a landmark radio study, now open to all formats. It will be the largest radio study ever conducted. We have 170 stations signed up, and we would like to add more before the survey goes into the field next week.

Our new Techsurvey 8 will be a landmark radio study, now open to all formats. It will be the largest radio study ever conducted. We have 170 stations signed up, and we would like to add more before the survey goes into the field next week.

This is an investment in your station’s future, because you no longer just compete with The Eagle or Z92 down the dial. The world is changing and your station needs research that goes beyond what songs are testing or the prizes your audience would like to win. There will be numerous questions to help you better understand Pandora – the good and bad – as well as smartphones, tablets, social media, and the reasons why consumers still love broadcast radio.

You can participate at no charge or for a small fee you can receive your local market data that you can compare to the national totals. Even if you have no research budget, you can still learn important things about your audience and your future.

To compete in this environment, this is information that will make you better, smarter, and more competitive.

Contact Lisa Riker for more info.

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

- I Read The (Local) News Today, Oh Boy! - April 15, 2025

Leave a Reply