The rise of deal sites in our online world has been nothing short of amazing. As of late last year, there were nearly 1,800 deal sites in North America.

Yet, to hear many broadcasters and other analysts talk about the deals vertical, you’d think that the whole thing was one big fad or even an opportunity that has already passed them by.

While the nature of Internet startups is pockmarked by lots of failure and dashed dreams, the fact is that Americans, in particular, are still very bullish about saving money at the stores and companies that are in their vicinity.

Much has also been said about Groupon, a seemingly daily debate topic on CNBC. Is it overpriced? Is it the next big bust? Will it ever turn a large profit? And sometimes there’s the false assumption that Groupon is the deal category. It may be the market leader, and the brand most people know top-of-mind. But like MySpace, BlackBerry, and Yahoo, it could eventually be replaced by a better deals architecture and concept. Just because you’re first-in does not mean you’ll eventually be on top.

There’s no shortage of companies trying to make a mark in the deal space. And many of them have hit some serious speed bumps. You may have read that in the last six months of last year, around 800 of these online deal companies went belly up. But in our part of the world, enthusiasm for deals remains quite strong.

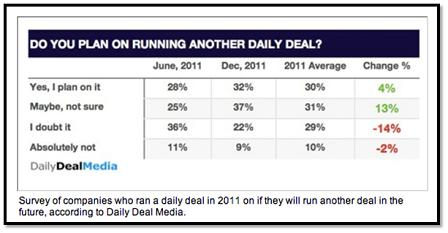

And more importantly, Daily Deal Media reports that many retailers who have tried deals tend to be solidly in support of doing more of them down the road. While there is a certain amount of attrition among those who ran a deal last year, the percentage willing to take the plunge again remains steady and solid:

So why then when I speak with many broadcasters about the deals concept, do I often get met with shrugs, and even derision about this concept? Some say that it’s too late – companies like Groupon and Living Social are so far ahead that it is no longer possible to compete in this space.

Others see no enthusiasm within the sales cubicles for deals – or that the available dollars are simply too small to even consider chasing.

And then there’s simply a lack of knowledge. How many sales reps – and even sales managers – are Groupon and Living Social subscribers themselves? How many have test driven this concept to analyze it, pick it apart, and determine whether there’s a way for a local station or cluster to make deals work perhaps in a unique and different way?

Simon Dumenco, “The Media Guy” in AdAge “Mediaworks,” believes that you might learn a lot about Groupon’s fatal flaws:

1. The lack of hyper-targeting – While all we hear about is customization and personalization (think Pandora), Groupon takes a mass-media approach. That’s why we all get the same bad deals no matter who we are. Unless you fall right into Groupon’s female target (and even then it’s often way off), the deals you get on Groupon are often instantly deleted.

2. It’s not as big as you think – Would-be competitors are flipped out over Groupon’s sheer size, but we all know about low open rates. And you can only imagine how bad Groupon’s are – especially when you get scads of bad emails from them week after week.

3. It’s bad direct mail – Dumenco calls Groupon “old media masquerading as new media.” It’s non-customized email that frequently offers non-relevant offers hoping that just enough will respond to generate traffic.

And here are a couple of my own:

4. There’s little to no retail flexibility – In a world where we all want to be able to make changes on the fly, retailers are held hostage by the Groupon system, making it difficult to make changes or put deals together on the fly. Like radio station inventories, many retailers don’t know from week to week (or day to day) when they’re going to need a customer steroid. An agile system could address that problem.

5. There’s no personalization or service – At least with Amazon, you get the feeling there’s people under the hood, dedicated to making sure the consumer (and the retailer) are satisfied. There are ratings, feedback loops, and other mechanisms in place to keep everyone accountable for their actions.

And I’m sure there are more. But Groupon’s drawbacks and difficulties shouldn’t be viewed as an indictment of the deals space. Maybe they just aren’t executing it well. And perhaps there are changes that some new thinking could institute that would re-energize deals and make them more attractive to people who have become disenchanted with Groupon. Isn’t that what Facebook did to MySpace?

The point is that while some broadcasters have taken the leap into deals, there’s a lot of disillusionment out there. While some companies have committed, I’m hearing the pitter-patter of cold feet in the deals space at many radio companies.

Last week, the RAB made the big announcement that in 2011, radio revenue was up just 1% (and spot sales were off 4%). It was digital and off-air leading the way – more evidence that radio simply has to leverage its brand strengths to generate revenue in new places.

Tomorrow, some ideas about how radio can start effectively making great deals.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Kudos, Fred. Thank you for revisiting this issue. My sense is you’re right on the money, there’s huge potential for radio in the local deal space. Say what you will about Groupon but, today, they enjoy a market cap of 12+ billion dollars and according to a recent filing “trailing twelve month gross billings per active customer, which is a proxy for total annualized spend per average customer, increased to $188 in fourth-quarter 2011 from $160 in fourth-quarter 2010.” This indication of a double digit increase is not insignificant. There may be many reasonable excuses for why radio didn’t enjoy the same fourth quarter same customer lift but not many good reasons.

The local ad spend is robust. The aggregate local dollars going into electronic is growing. In market after market radio’s biggest spender, automotive, is investing in building internet sales teams and directing major dollars to marketing online (e.g., Google Ad Words). These are the dollars not often tracked by local radio and they should be in any intellectually honest competitive analysis. The future of interactive is local and, that being radio’s true strength, this trend works to the advantage of the first tribe of wireless.

My take is it’s not at all too late for radio to get into the deal space. I agree with you that first mover advantage promises no real advantages whatsoever, in fact, my view is incumbency is increasingly irrelevant. What we have here is a problem that deserves to be on the agenda of every radio operator. As you have stated, how do we take our well known local brands, our influence with targeted consumers, our unique knowledge of local retail and seriously get into the game now at play. The core strengths of Groupon are creative and sales. Please allow me to suggest radio can best Groupon in each however that will require investments by leadership in focus and commitment. Physician, heal thyself!

Finally, taking the big picture view may add some needed perspective. The daily deal is nothing more than a version of that well worn retail price promotion tool, the coupon. The electronic coupon space is still growing. In fact, the majority of coupons are still distributed by those dead tree guys, FSI and direct mail continue to attract major investment. Let me invite your attention to a post “The Coupon Comeback: Are You Missing Out?” which includes an interesting infographic https://coupons.org/pages/the-coupon-comeback-are-you-missing-out

Dave, thanks as always for your great contribution to our blog. Your perspective is valuable and my hope is that radio operators – especially those who have soured on deals or feel they just don’t bring enough revenue to the table – reconsider. By the way, thanks also for the great infographic.