It’s easy for radio people to feel sorry for themselves. Yesterday’s post on “polycrises” – the idea that things can actually get worse – elicited responses here, on my socials, and in off-line calls and emails.

I know it wasn’t a “good news” post in a year when there was initially so much hope things would get better economically. But rather than point fingers or cry in our beer, how about feeling better because someone’s actually having an even tougher time?

The emotion in question is known as “schadenfreude.” It’s a German term that refers to deriving pleasure from someone else’s pain.

And the target of our pity party is none other than Spotify, a company that often seems to have it in for radio. (Although haven’t they all?) A look at the box Spotify’s in may be an exercise in strategic futility. Most savvy business pros and marketing mavens look at no problem as unsolvable. There have been many companies that have come back from the brink, when all seemed lost.

But for Spotify, this will be a tough putt.

Let’s start with the 35,000 foot view of how it’s going – a check on the company’s stock price. Many media companies – including those steeped with radio holdings have suffered a rough patch, especially during the past 12 months or so.

But Spotify’s year-to-date performance has been – in a word – gnarly.

Spotify started 2022 at just over $247 a share. It closed yesterday at just over $73 – a loss so far this year of around 70%. For a digital platform that is immensely popular with younger generations while generally regarded to be a fine product, something is off here.

A look at financial analysts’ view of the company after their Q3 earnings were released is revealing. MarketWatch reported late last month that Spotify blamed its mediocre performance on “slower-than-forecast advertising growth given the challenging macro environment.”

Not surprisingly, podcasting led Spotify’s ad supported revenue segment but grew just 3%. Following a familiar pattern, revenue and monthly active users are on the rise, but losses are worse than forecast.

Perhaps part of the problem is the hefty salary of Spotify’s podcasting king, Joe Rogan. When he signed with the company in 2020, the deal was reported to be for $100 million. Some have estimated the tab could be twice that much.

$100 million. Some have estimated the tab could be twice that much.

And then there’s streaming, a tough business model, especially when it’s your bread and butter. That’s why during their earnings call, Spotify CEO Daniel Ek floated the idea of a rate hike in the U.S.

Ek noted Spotify had successfully engineered “46 price increases over the past two years in markets worldwide.”

But here in the States, elections are being won – and lost – on the inflation surge that has marked 2022. And it’s not like Spotify is the only service in the marketplace.

Take Amazon, for example. Its Prime service has an estimated subscriber count of 153 million in the U.S. In our most recent Christian music radio version of Techsurvey, nearly two-thirds (65%) of respondents are paying for Amazon Prime subscriptions.

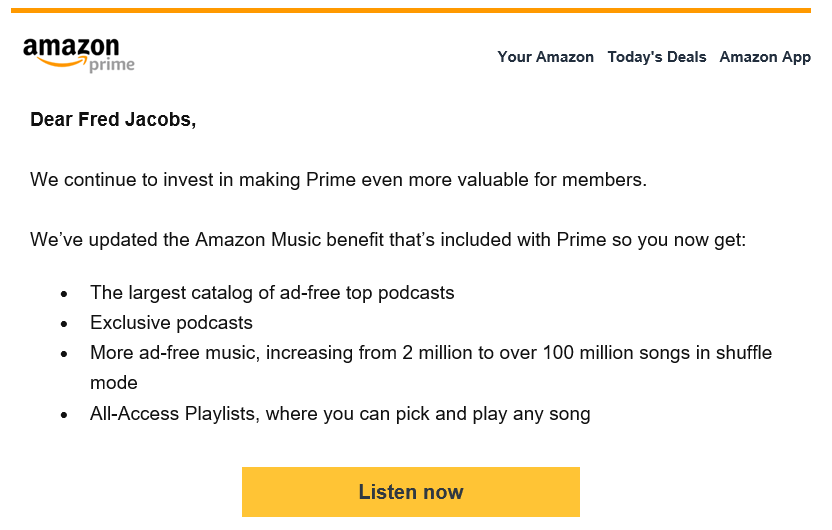

And last week, Amazon fired the proverbial shot across Pandora’s bow when they made this announcement to me and 153 million of my closest friends:

That’s right. We all get Amazon Music as part of our Prime benefits. That’s instead of having to pay $10 a month for Spotify Premium. Unlike Amazon, Spotify has no significant source of revenue. While Amazon can afford to run its music streaming division as a “loss leader,” Spotify doesn’t have that luxury.

Now, Daniel, about the rate hike.

Over to Apple. Two weeks ago, they introduced a new subscription bundle in the U.S. – Apple One.

As TechCrunch reported, the Comptrollers in Cupertino have conjured up a package that combines up to six Apple services – like Apple TV+, Apple Arcade, and yes, Apple Music. (By itself, Apple Music’s subscription price goes up $1 a month, but if you buy the bundle…)

Apple Music. (By itself, Apple Music’s subscription price goes up $1 a month, but if you buy the bundle…)

In the main, both Amazon and Apple have a lot of value added services they bundle together that packages in their streaming music platforms. For many people, these other features and services may be enough to tip the equation.

Spotfiy’s business model continues to revolve around their streaming music – something that’s rarely been profitable. Apple can always fall back on its smartphone, app, tablet, computer, and cloud division. The fate of Apple Music is purely a rounding error.

Let’s not forget about the venerable YouTube. The YouTube Music product has a premium tier (just $9.99 month that also lets you watch videos commercial-free). Again, parent Google has a lot of assets to package in.

month that also lets you watch videos commercial-free). Again, parent Google has a lot of assets to package in.

And when it comes to irritating Spotify, let’s not forget about everyone’s albatross, TikTok. Last summer, this headline blared in Input:

“A TikTok Music app could be Spotify’s toughest competition yet”

The story is premised on a U.S. patent filing for a product called TikTok Music. The fine print describes an app where users could “purchase, play, share, download music, songs, albums, lyrics…” and other features.

According to writer James Pero, TikTok has already launched a streaming platform in a music gaming app, Resso, in Brazil, India, and Indonesia.

TikTok already has a leg up in the teen market, more than 1 billion active monthly users, and as Pero speculates, might even tactically pay artists in exchange for licensing their music. Music is also in TikTok’s DNA – so many of its bite-sized videos use music as the creative engine.

@420doggface208 ♬ Dreams (2004 Remaster) – Fleetwood Mac

And finally, Spotify is still wrangling – albeit poorly – with broadcast radio. Recent attempts to launch their own morning show (“The Get Up”) and an in-car device

premised on Apple CarPlay (“Car Thing”) have turned out to be “fast fails.”

premised on Apple CarPlay (“Car Thing”) have turned out to be “fast fails.”

Let’s not paper over broadcast radio’s bumpy competitive path against these behemoths. When it comes to music and the “attention economy,” FM radio is head-to-head with all these same players, as well as SiriusXM, increasingly improving its content offerings and customer experience.

But it should also be remembered that high-flyers like Spotify have their work cut out for them in a space that is constantly moving, shaking, and morphing – while operating expenses keep rising with each new subscriber signup.

Spotify may be struggling to make its streaming ends meet in an increasingly tough entertainment landscape. Joe Rogan, however, is no doubt having a good year.

Watch out for those flying anvils.

- I Read The (Local) News Today, Oh Boy! - April 15, 2025

- Radio, Now What? - April 14, 2025

- The Hazards Of Duke - April 11, 2025

Fascinating Radio makes it’s OWN MUSIC and LOCAL CONNECTIONS.

Appreciate it, Clark.

I didn’t realize until just now that Deezer officially went public earlier this year.

https://www.deezer-investors.com

The royalty structure imposed on music streaming by the major labels make it impossible for Spotify or anyone else to make a consistent profit in that business – there is, effectively, no business model. Spotify is consistently portrayed as the villain, but IMO, they’re more the victim. At some point, their stock price had to reflect that reality and it still may be too high. That said, Audacy is currently selling for $.30/share and their market cap ($43 mil) is probably less than the value of furniture in Spotify’s offices.

I enjoy Spotify for 6 hours on and off throughout the day and love it. I hope it doesn’t go away I may have to pay for it one day but even their commercials are clever especially the Reeses Peanut Butter Cups and the PSA’s for Domestic Violence Abuse Shelters you can take your pet to. Its well done…

Kim, the listening experience is good (as you point out), but their business model is problematic. The more you listen, the more it costs them.

Audacy has a large problem.

You can’t be 100% (or mostly) streaming and make it work (at least for now). You need other revenue streams to fall back on – and that’s a major Spotify challenge. Similarly, a radio company whose revenues are nearly all broadcast is going to have challenges, too.

You must have a different version of Amazon Prime. I tried to sign up for Amazon Music, and it’s $8.99 a month.