Throughout history, it has been about feuds – longstanding battles between two powerful groups.

The Hatfield’s vs. the McCoy’s, Navy vs. Army, Hamilton vs. Burr, Coke vs. Pepsi, Dick the Bruiser vs. the Sheik, and….

…programming vs. sales

If you’ve worked in radio, especially during the pre-consolidation 1990’s, chances are you’ve gotten a bit bloodied by being on one side versus the other.

The two departments often found themselves at odds with one another. Programmers often defending their format and their personalities against sellers focused almost entirely on generating revenue. Over the decades, P.D.s have fought to preserve a positive listening experience against commercial clutter and excess, while sales often battles to expand the spot load, and often, the limits of brand appropriateness.

The fact is, a P.D.s and a sales managers brains aren’t just wired differently – they are configured well apart from each other.

Interestingly, we may now be watching this classic battle play out on a bigger stage – Twitter. Elon Musk’s investment has lost a lot of its value in the eight months in which he’s owned the social media platform.

CBS News estimates Twitter is now worth only one-third of the value Musk paid for it. In hard numbers, he paid $44 billion, but now the company is estimated to be valued at only $15 billion.

So, there’d better be some big revenue coming from somewhere and soon. That’s a big reason why Musk finally may be turning the reins of the company over to a new CEO, former NBCUniversal exec Linda Yaccarino.

exec Linda Yaccarino.

She has a long history as a media/marketing exec – someone who intricately understands the world of advertising and knows how to put points up on the board.

Despite hiring Yaccarino, Musk has been a reluctant content-focused exec who has been leery about advertising. Here are some of his quotes in a recent Wall Street Journal article, “Can Twitter’s Odd Couple Make It Work? Elon Musk and His New CEO Are About to Find Out.”

“I’ve had an aversion to advertising because there’s…just too much trickery. They’ll have a bad product and then put it in a nice environment with good-looking people and then, like, trick you into buying it.”

Or this:

“Product matters incredibly because, if you’re going to recommend something to somebody, you’ve got to really love the product experience. Otherwise, you’re not going to recommend it because you don’t want to burn your friend.”

That kind of talk sounds more like Dave Hamilton, Oedipus, or Kevin Weatherly than the guy who launched SpaceX and Tesla. And in fact, Musk has shied away from advertising his EV company, leaning instead to press coverage, event marketing, and word of mouth.

Those techniques are unlikely to work at the embattled Twitter, losing value and failing to make a positive impact on ad sales. The Journal reports that at the end of May, Twitter’s Q2 global revenue was down in the neighborhood of 40%, compared to a year ago when Jack Dorsey was running the company.

Clearly, Yaccarino and Musk are polar opposites; she’s from the corporate media world while he’s about innovative startups. But was we know in radio, contrasting skill sets can meld together a successful business strategy, and eventually, results.

At a recent Tesla event, Musk admitted that Yaccarino’s arrival at Twitter must signal a change of heart about commercials on his social media site:

“So, we’re trying a little advertising, and see how it goes.”

Ironically, Twitter isn’t the only digital media  juggernaut experimenting with adding commercial units to its marketing strategy. Following other video streamers, Netflix launched a less expensive tier that now contains ads.

juggernaut experimenting with adding commercial units to its marketing strategy. Following other video streamers, Netflix launched a less expensive tier that now contains ads.

Instead of charging $20 a month, Netflix Basic with ads is now in the neighborhood of $7 a month – a huge difference, and a way to bring new subscribers to the platform. That “more commercials” plan now puts Netflix on an equal footing with Disney+ and Hulu.

Apparently, not to be outdone, Amazon Prime is making its own calculations, considering adding spots to its video channel. Last week, the Journal’s Jessia Toonkel reported Amazon is looking to launch an ad supported tier in an effort to generate more revenue.

Apparently, not to be outdone, Amazon Prime is making its own calculations, considering adding spots to its video channel. Last week, the Journal’s Jessia Toonkel reported Amazon is looking to launch an ad supported tier in an effort to generate more revenue.

Interestingly, Toonkel reports that advertisers have pushed the company hard to add units, allowing them to buy time on some of Amazon’s most successful programs, including live sports like “Thursday Night Football” from the NFL, as well as hit shows like “The Marvelous Mrs. Maisel.”

So, what might this mean for commercial radio?

One thing we know about consumers, especially those on the younger end of the spectrum:

Commercials suck

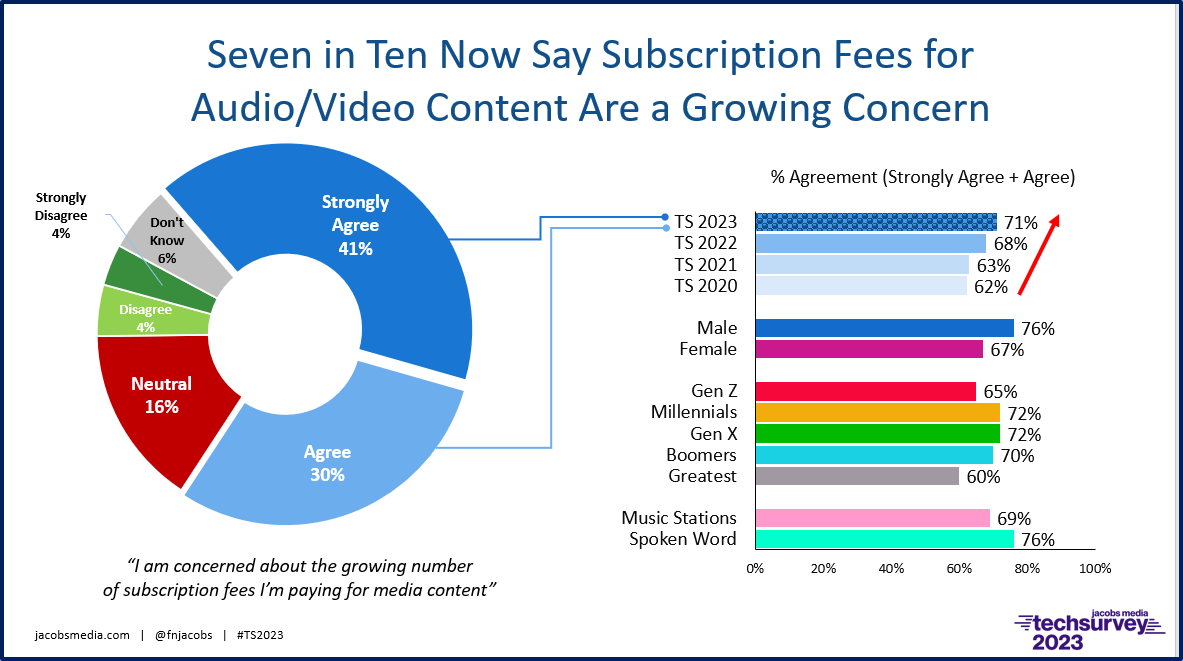

And many have been more than willing to shell out several dollars a month for the privilege of not having to watch any. Over time, however, the mounting costs of media subscription fees have taken their toll. More and more consumers are doing the end-of-the-month math. The results are vivid – and alarming – for subscription media brands, especially tracked since the onset of the pandemic:

Today, consumers are more and more willing to put up with some commercials if it means lower monthly subscription fees.

You’d have to think SiriusXM has to at least be considering a lower priced tier that carries a few ads as a way to keep consumers paying for their service, along with making it a no-brainer for new subscribers to come onboard.

Perhaps then, the environment is moving in radio’s direction. After all, pretty much all audio content players carry commercial matter, including podcasts and even those “underwriting announcements” on public radio stations.

But 15-20 commercials an hour?

That hasn’t cut it in eons, and it won’t compare favorably to a handful of spots an hour in these other services. By adding a conservative number of units, platforms like Netflix and soon, Amazon Prime Video, will be driving up demand. The fewer the commercials, the more demand, the higher their rates.

Just like Adam Smith (pictured” the “Father of Economics,” drew it up.

Just like Adam Smith (pictured” the “Father of Economics,” drew it up.

When you’re running 15, 20 or more spots an hour across a dozen or two radio stations in medium and larger markets, there’s lot of supply, but not much demand.

Among other reasons, it’s why there’s now no shortage of advertising inventory on the radio. And why rates may be lower than they’ve been since the Nixon Administration. It’s simply not sustainable.

As Elon Musk will learn real soon, it’s a matter of doing the math.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

May I add, Fred, when a computer plays the same commercial twice in a row, I instantly exit whatever station allows it to happen. When commercials were creative and good, it was tolerable to sit through a set, but not at these volumes, and Production Departments had the time and passion to realize that spots should be entertaining, and not “Yell and Sell” like Phil Swift and the Pillow guy.

I agree, Mr. Kelly. And that is one of the main problems with “programatic” ad distribution on digital forms of media. “We have the spot inventory. Let the computer fill them. “What ever happened to the :90 seconds point of pain tolerance for an ad break. I just heard the same tacky :30 second ad repeated 3 times in an 8 minute spot break on a local music radio station. How much longer will ad buyers tolerate this abuse?

I’m down with that, Ed. And I’m so old school, I get irritated when I see two same-industry commercials (lawyers & cars are most common) back-to-back. It’s bad for viewers and it can’t be doing much for the advertiser.

Please, lets not forget about the Traffic department after sales gets the call from the client asking why their spot ran next to a competitor.

You bet.