The more years you spend in radio, the more you realize how rarely the industry “speaks in one voice.” While most radio broadcast executives enjoy annual gatherings like the Radio Show, the NAB in Vegas, or Forecast, there are as many operating philosophies as there are companies. When it comes to issues as varied as consolidation, attribution, streaming, or podcasting, most companies are pursuing their own path.

The song, “Go Your Own Way,” could have been written for radio broadcasters. And while competition makes for better radio, the downside is that the industry rarely uses its heft to its advantage. Companies like Pandora and SiriusXM (now fused together) or Spotify are the entire platform, making it simpler and more seamless to cut deals, effectively lobby, create partnerships, and move the ball down the field.

Within radio, consensus is rare. While many broadcasters see macro issues similarly, the devil is almost always in the details. That’s especially true in radio’s approach to the automotive challenge that has grown in magnitude these past few years. I’ve seen this in my interaction and work with the  NAB’s connected car committee. Much progress has been made in connecting radio execs with auto moguls.

NAB’s connected car committee. Much progress has been made in connecting radio execs with auto moguls.

But the industry’s ability to form a unified front often falls short. Consider the RadioPlayer initiative in countries like the UK and Canada, where a single streaming platform makes it easy for consumers to seamlessly switch from station to station, from commercial to public. It wouldn’t happen here.

But guess what? The auto companies behave pretty much the same ways. And that’s why it’s fascinating to watch these two intertwined industries navigate the new challenges presented by technology and changing consumer wants, needs, and habits.

You see auto executives from a wide array of companies and countries come together at times. But when push comes to shove, they generally believe their company has the best solutions, while everyone else’s falls short.

That provincial attitude opened the door to intruders like Apple and Google invading their dashboard ecosystems. In just a few short years, CarPlay and Android Auto have all but taken over millions of dashboards, eliminating branding and control for companies as diverse as GM, Mercedes, Ford, Volvo, Audi and pretty much all of them.

And now that same philosophy could threaten the auto industry’s long-term ability to compete in a world where smart mobility and autonomous driving may become standards in just a handful of years.

A new story in the Wall Street Journal – “Will Tech Leave Detroit In The Dust?” (sorry, it’s behind a pay wall) by Mike Colias, Tim Higgins, and William Boston breaks down the potential impact that smart mobility will have on the auto companies.

Working together for a common purpose runs counter to the automakers’ history, a sentiment expressed by J.D. Power executive Doug Betts:

“Typically, car companies are not very good at that. There are these really strong and huge silos that over 100 years have gotten good at what they do and also good at throwing rocks at everybody else.”

For decades, automakers functioned as the equivalent of ununified mobile phone handset manufacturers – making the expensive machines that carried the media with nothing to do with its content or monetization. For decades, that space was devoted to AM, and later FM radio, along with an accompanying player like a cassette, 8-track, or CD unit.

Today, the touchscreen and Internet activity has opened up their dashboard real estate to a seemingly infinite number of content creators and platforms.

So, what is holding the car companies back from cashing in on their hardware  – $30,000 driveable media units used everyday by millions of consumers all over the U.S. and the world? As the late Bill Burton used to refer to that hunk of Motor City metal sitting in his driveway, “a radio on four wheels.”

– $30,000 driveable media units used everyday by millions of consumers all over the U.S. and the world? As the late Bill Burton used to refer to that hunk of Motor City metal sitting in his driveway, “a radio on four wheels.”

Perhaps we should amend that to “a smartphone on four wheels,” because that’s what cars and trucks have become.

Yet, as we’ve learned over these last several years as our company has moved closer to the auto industry down the street here in Metro Detroit, the OEMs (original equipment manufacturers, as they’re called) are adept at making hardware. Writing software? Not so much.

The Journal suggests another impediment holding the auto industry back is a condition that many radio execs are familiar with as well – an internal culture averse to change.

While new mobility companies from Uber to Tesla are investing billions into autonomous, electric, and other technologies, their operational differences between “The Big 3” mindset are palpable.

Just like in radio, there are legacy employees who are digital deniers, pushing back against the inevitable change in mobility, whether it’s the smartphone or the changing head units in dashboards. For many OEMs, this means creating separate divisions that myopically focus on the future, letting traditional teams continue to do what they do best – design, engineer, and build cars and trucks.

As they look down the road, the auto companies are often chasing very different futures. For smaller companies, it may mean partnerships. As Carlos Ghosn, head of the Renault-Nissan-Mitsubishi alliance notes:

“Obviously, every company would like to do everything by themselves…except that we can’t.”

And on the other side of the spectrum are the bigger players, much like in the radio broadcasting business. Talk to Daimler head honcho, Dieter Zetsche, and he’ll tell you that his company will determine their future path:

“As pioneers in automotive engineering, we will not leave the task of shaping future urban mobility to others.”

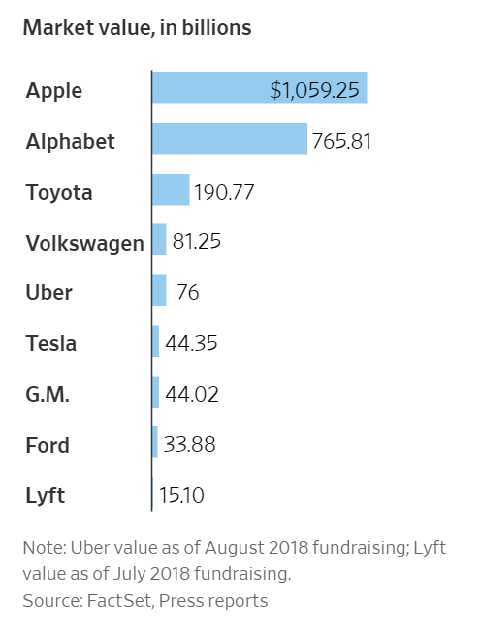

Not surprisingly, money will come into play. While the OEMs have traditionally been some of the most well-heeled companies on this planet, they now find themselves dwarfed in value by tech juggernauts such as Apple and Alphabet (Google’s parent), while relative newcomers including Uber are very much in the money game.

they now find themselves dwarfed in value by tech juggernauts such as Apple and Alphabet (Google’s parent), while relative newcomers including Uber are very much in the money game.

This chart in the Journal article clearly illustrates the challenge of the automotive companies’ “manifest destiny” strategy – cash.

The financial pecking order has changed for the OEMs, much like it has for radio companies, all of which are a fraction of the value of the lowest ranked player on this valuation totem pole, Lyft. Do even the biggest players in broadcast radio have anywhere near the resources – human and financial – to go it alone?

Despite these monetary headwinds, some of the biggest car makers persevere, undaunted by the challenges in culture, software, or financial. Not surprisingly, General Motors falls into this group. Led by the venerable Mary Barra, GM is a staunch believer they’ll take a back seat to no one when it comes to manufacturing scale, autonomous technology, and the other components necessary to meeting smart mobility needs:

“We are the only company that has all of the necessary assets under one roof.”

And she may be right.

But the fragmented nature of the auto companies continues to be an impediment as the future of mobility is taking shape. For radio broadcasters, there are object lessons taking place right now here in Detroit.

The NAB has made “giant steps” progress these past couple years toward cementing a meaningful relationship with many auto companies and consortiums. They’ve learned the OEMs are eager to own their own data, while re-establishing their traditional leadership role in how we travel from Point A to Point B over the next decade – or more

Whether they have the capital, the patience, the mindset, and the creativity to pull it all off remains to be seen. But for the radio industry, their travails serve as object lessons that strongly suggest the greater power of working together as an industry to accomplish mega-goals.

There’s a lot riding on the ways in which legacy companies – automakers and radio broadcasters – approach their forward-thinking strategies. Working together, going it alone, getting bigger, selling off, partnering, or purchasing are all options on the table.

Broadcast radio has distinct advantages – weekly usage, habit, personality, a sense of place, and the ability to function courageously during emergencies.

Those assets become even stronger when the industry speaks in one voice.

Thanks to Bruce Goldsen & Steve Goldstein who know me all too well.

- Can Radio Afford To Miss The Short Videos Boat? - April 22, 2025

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

Tuning complicated dashboard receivers is like texting behind the wheel. Keep radio’s local information front & center and easily accessible. Thank you, Fred.

Thanks for that, Clark.