Over the last year of the pandemic, we’ve talked a lot in this space about some of the unintended consequences of the pandemic. Media disruption has taken many forms, creating winners and losers. In our COVID studies, conducted in three waves among fans of commercial, public, and Christian music stations, we were able to track these patterns.

By and large, Netflix, cable and broadcast TV, and social media all received a boost during the throes of 2020. On the other hand, satellite radio and broadcast radio – not so much.

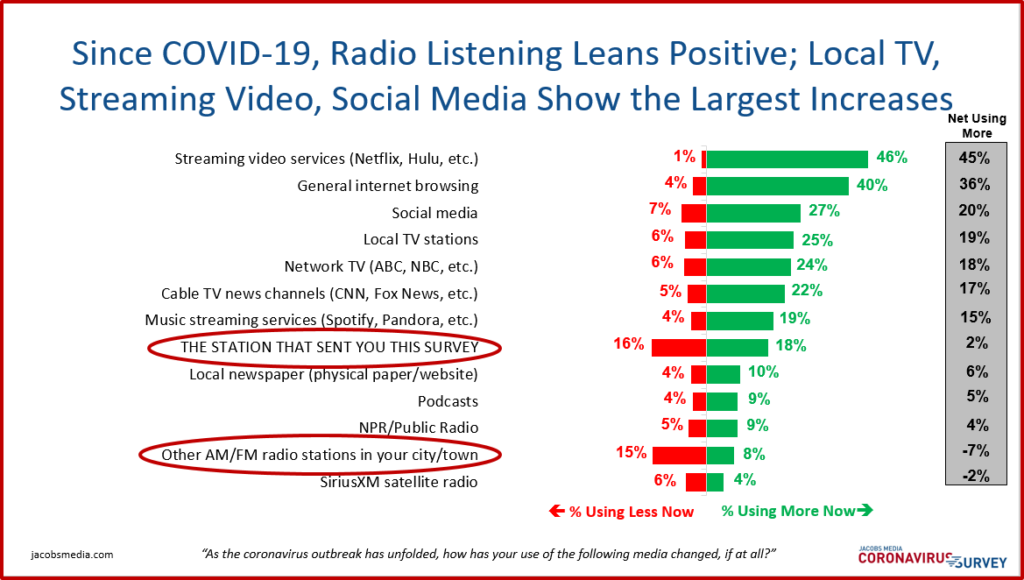

But when you took a closer look at the data, it became clearer the forecasts for radio weren’t so clear. The chart below is among commercial radio listeners from the first wave (late March/early April 2020). Overall, 16% said they had been spending less time listening to their favorite station since the onset of COVID. But 18% reported actually spending more time listening to their preferred stations. So, lots of give and take.

But when you worked down the list, you could see more erosion for secondary stations – P2 and P3 choices – with a much larger percentage tuning away from these other in-market options. So, how do we explain this?

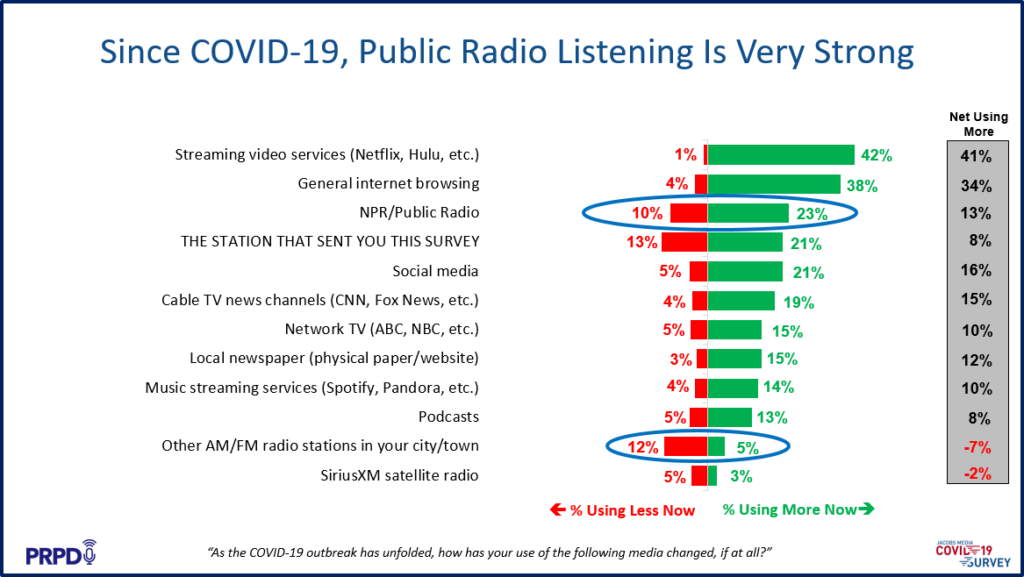

A look at our public radio companion survey, conducted at the exact same time, was more revelatory. Public radio local stations as well as NPR (we included both just to be sure) fared even better – 23% more/10% less. And like we saw in the commercial radio version of this study, local P2 stations were more likely to be abandoned by these public radio fans – 8% more/15% less.

At the time, we posited this idea:

While work from home led to less time in the car, and the scourge of unemployment were the culprits in decaying radio listening time, many other respondents actually were spending more time with their P1 stations. We theorized that familiar and dependable radio choices – music and talk stations and their personalities – provided a sense of comfort and reliability “during these uncertain times.”

Now, an analysis by David Giovannoni in public media’s Current confirms what we’ve been seeing for more than a year.

If you’ve spent more than a cup of coffee working in pubic radio, you know Gio. He’s a 35,000 foot observer of the medium, a researcher who has consistently and brilliantly used analytics and logic to lay out the rationale for why things are the way they are in public radio.

Above the fray of the insane news cycles, changes in ratings methodologies, and the other variables that tend to confuse programmers and managers in the trenches, Giovannoni has held fast to his megatrend theories about public radio’s true health, its challenges, and its opportunities.

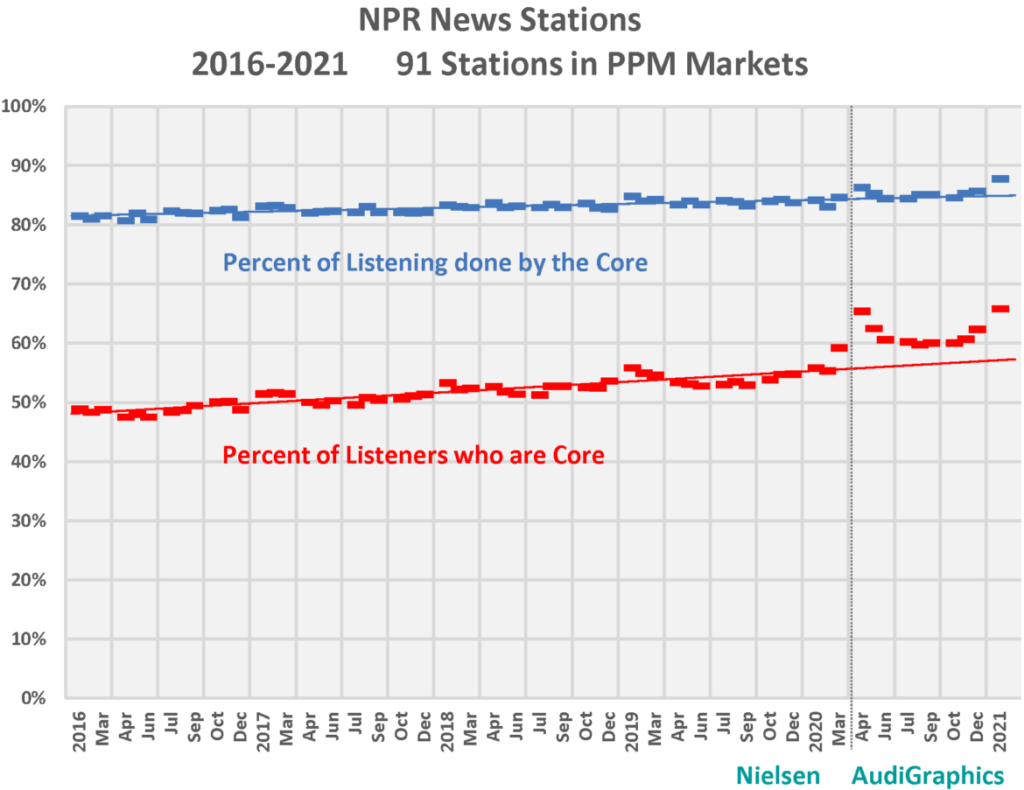

His AudiGraphics service puts Nielsen data (formerly Arbitron) in a much different perspective than commercial radio stations typically see.

In an aptly article titled article, “For their listeners, NPR News stations are the last thing worth listening to on the radio,” Giovannoni lays out a compelling case.

He makes five key points:

- As pandemic listening quickly shifted from out-of-home (at-work and in-car) to in-home exactly one year ago, NPR News fans found a way to tune in their favorite stations. We’ve talked about the upsides of easy, seamless, and well marketed digital distribution. NPR and most of its member stations have been well ahead of this curve with apps, streaming, on-demand content, podcasts, and clever smart speaker strategies. As cars sat in driveways, public radio P1s were tuning in their favorite stations on other devices – in droves.

- Listeners focused on their NPR News P1 stations, often at the expense of their in-market competitors. You can see that in our slide above, as well as in David’s data below. This convergence toward one’s favorite, most trusted station benefits brands that have consistently done great work.

- COVID amped up core loyalty to favorite stations – especially NPR News outlets. Public radio has always been near and dear to its fans. Often after conducting focus groups for stations or the network, I’ve walked down to the parking lot only to discover a group of passionate, energetic respondents still talking about the station, the shows, and the personalities they love and value. COVID served as a call to action for fans who were already dyed-in-the-wool believers.

- Listener loyalty didn’t just happen – it’s been “decades in the making.” That’s Giovannoni’s quote, and he’s spot on. And it took the pandemic to trigger this behavior. A lot of money, effort, and time has been spent researching the audience, and responding with programming, content, and services that meet their needs. It all paid off during COVID.

- A greater percentage of an NPR News station’s audience is now made up of core listeners. In fact, it is now pushing the 2/3s mark. (It used to be closer to 1/3.) Listeners are truly coalescing around their favorite stations –and spending less time with everyone else. What implications does this have post-pandemic? While it’s impressive to see P1s expanding their time (and contributing financially), is there a downside for secondary and fringe listeners perhaps not being as engaged as they once were? Gio’s slide below shows the growing importance of core listeners to public radio’s new-found success:

Perhaps it took a life-changing event like a pandemic to put all this into focus, and the aftermath of the “Trump Bump” as it was referred to in public radio circles is uncertain. But Gio’s analysis suggests NPR News has never been more important to its audience during the COVID Era, and never served its audience better.

This is no accident. Both at the network and station levels, public radio has spent years understanding its audience, crafting content to meet their needs, and developing distribution channels that keep up with – or even stay ahead of – the trends.

The result? An even greater willingness to support these stations financially – one of the key metrics that determines public radio’s health and success.

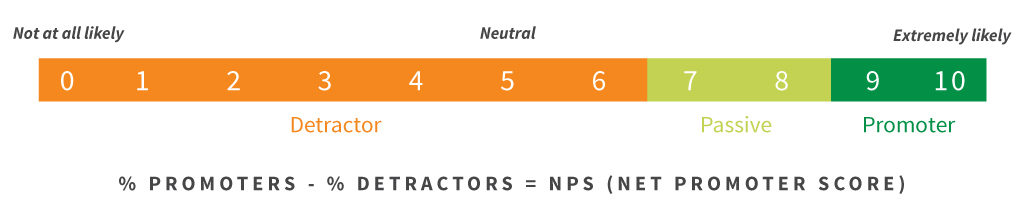

So, how do we measure this phenomenon of loyalty – especially when it morphs into word-of-mouth recommendations, the Holy Grail of marketing?

Is public radio loyalty an anomaly with these stations – especially the news outlets – or does commercial radio have a similar story to tell?

That’s why we’ve been asking the Net Promoter question since 2004 in our Techsurveys. Now, we have nearly two decades of tracking data, creating a clearer picture of how public radio has fared over the years.

And thanks to our new Techsurvey 2021 coming out of the Excel oven, we’ve got comparative data for commercial radio – as well as the 14 different formats we track – everything from Rock to News/Talk to Urban AC to Country.

Loyalty and word-of-mouth are key performance indicators for radio – the perceptions that drive listening, support, and engagement. And like in David Giovannoni’s research for public stations, commercial radio listening has also evolved into more of a fan-based activity.

In this year’s Techsurvey 2021 – the first one conducted during COVID – there have been some fascinating shifts, fueled by the impact of the pandemic. There’s plenty of good news here for commercial radio and some surprises when we drill down to formats.

We’ll break it all down in tomorrow’s blog post.

Loyalty is back. So, how do we hold onto it?

Thanks to Abby Goldstein for the heads-up.

- What Is It With Female Robot DJs? - April 30, 2025

- Why “Dance With Those Who Brung You” Should Be Radio’s Operating Philosophy In 2025 - April 29, 2025

- The Exponential Value of Nurturing Radio Superfans - April 28, 2025

Leave a Reply