For some time now, most observers of social media have been well aware that the youngest consumers – members of Generation Z – have not been especially engaged with, or much less enjoyed, Facebook. Given the “mother of all social media’s” amazing heft and influence, it may seem difficult to imagine a generation that wants little to nothing to do with Mark Zuckerberg’s invention that has changed the world.

But in the rough and tumble tech world, dominance is often transitory, often defying logic and conventional wisdom. Just a few years ago, it may have been unthinkable to imagine a large group of Americans shying away from Facebook – in droves. Nielsen data shows that Gen Z is now the largest of the generations, more than 77 million strong. Defined as 3-21 year-olds born between 1997-2015, this is a big group of consumers for any product or platform to lose. And it represents more consumers than Boomers, Xers, and even Millennials.

And yet, new research among teens by Piper Jaffray suggests that may be precisely the way Facebook is trending. It wouldn’t be the first time a tech leader has faced its comeuppance. Remember that before there was an iPhone, Blackberry dominated the smartphone market. And pre-Google, search engines like Yahoo! and Lycos were top dogs. And the aforementioned Facebook made its mark well after MySpace dominated the social ecosphere of the early 2000s.

That may be the same lens in which we should view the fast-developing smart speaker race. Our Techsurveys – as well as most research about these devices – indicates Amazon has roughly a 75:25 advantage over Google here in the U.S. When I present that data at conferences and events, there are often people who predict how Amazon will never relinquish that advantage, especially given Jeff Bezos’ brilliance and his pocketbook, as well as the power and reach of Amazon Prime and the company’s e-commerce empire.

But count Google or Apple out at your peril. The former rules the roost in search, a critically important part of the Q&A format that has become the foundation of the voice revolution. As for Apple, it sometimes takes them a while to get it right – witness iPod, iPhone, and Watch. But when they do, there’s no stopping them. Declaring the smart speaker sweepstakes over in 2018, and declaring Alexa the winner is jumping the gun.

So, what does this have to do with social media in 2018?

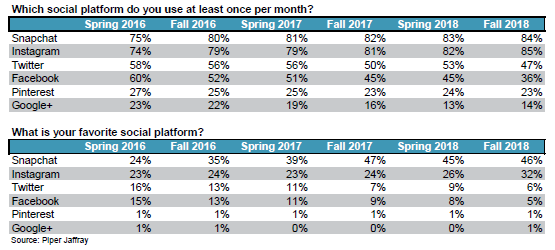

Well, the winds of change are upon us and the social hierarchy is undergoing change. The aforementioned Piper Jaffray research, conducted among a robust sample of 8,600 teens with an average age of nearly 16 reveals how the social media pecking order is anything but stable. Their tracking data – from just the last couple years – reveals some incredible shifts happening at the top of the heap among teens, whether we’re talking the most used or most popular social platforms:

In the new Fall 2018, it is Instagram now edging out Snapchat among Gen Z that is making the most noise. CNBC’s coverage was a case in point with the blaring headline, “Instagram inches ahead of Snapchat Among Teens.”

As the trend shows, the two social networks have actually been running neck and neck for nearly two years, but a lead change – in Instagram’s favor – is newsworthy largely because of the size of Gen Z and its burgeoning influence.

Note that when these same respondents are asked about their favorite social platform (the bottom chart), Snapchat maintains a healthy lead over Instagram. In fact, those two social media machines dominate teen tastes, making all other platforms irrelevant.

Including Facebook.

As hard as it may be for adults to believe, only 5% of teens point to Facebook as their preferred social network – clearly an all-time low for the demographic that helped get Facebook off the ground a mere dozen or so years ago. Today, even Twitter is more popular.

And when it comes to monthly usage, Facebook has cratered in the Piper Jaffray research, falling from 60% in the Spring of 2016 to only 36% today. That represents a 40% drop in just over two years, underscoring the fact that the downtrend for Facebook among teens is picking up steam.

Any market manager would be tossing and turning at night over watching its “big dog” get pummeled in the social media equivalent of the ratings. But Mark Zuckerberg is sleeping soundly, and not because he’s made more money than he ever dreamed of making.

That’s because competitively, Facebook has seen this slide coming – and they’re employed a smart strategy to not just hold onto, but grow their social market share.

In some ways, Facebook is performing much like a radio format that cannot keep up with the times – or the teens. Facebook is now appealing to an increasingly older audience. Teens have seen their parents – and grandparents – posting selfies on the platform, exchanging memes, giggling over web humor, and screaming over politics.

In some ways, Facebook is performing much like a radio format that cannot keep up with the times – or the teens. Facebook is now appealing to an increasingly older audience. Teens have seen their parents – and grandparents – posting selfies on the platform, exchanging memes, giggling over web humor, and screaming over politics.

Few self-respecting 16 year-olds want to commune with their closest friends in a social setting where AARP members and Medicare recipients are hanging out in droves.

In some ways, Facebook’s odd trajectory mimics how formats like Oldies and Classic Rock behave, appealing to older and older listeners.

So, what do you do when you’re a radio company faced with a very successful, but radio brand getting a little long in the tooth.

Simple – you purchase or create a younger station to entice up- and-coming consumers who want nothing to do with your heritage brand. That balances out your portfolio, allowing your sellers to offer the entire spectrum of consumers in your space.

and-coming consumers who want nothing to do with your heritage brand. That balances out your portfolio, allowing your sellers to offer the entire spectrum of consumers in your space.

That’s precisely what Zuckerberg did back in 2012 when he bought Instagram for the then-whopping sum of $1 billion. And two years later, he doubled down on the social youth movement by acquiring WhatsApp for $19 billion. In each case, Zuck is hedging his bets by adding younger appeal social outlets to his “cluster.”

This strategically constructed “social wall” guarantees Facebook’s continued dominance even as it ages out, while investing in the next generation of social media users. As Google+ is soon to be shuttered, Twitter continues to try to define its role and prove its ability to deliver revenue, and Snapchat’s feels ongoing pressure from Instagram, Zuckerberg’s social holdings look pretty smart.

Even as Facebook loses its grip on teens.

Whether you’re building social networks or radio networks, the best strategy wins.

“Like” it or not.

Thanks to Randy Kabrich for the heads-up on this story.

- What’s Your Radio Station’s “TUDUM?” - February 3, 2025

- Appreciating What We Have (When Our Lives Aren’t In Jeopardy) - January 30, 2025

- AI: Oh, The Humanity! - January 29, 2025

Picture is hilarious. Communications have always been Anthropological. Something us humans constantly crave or avoid so many ways, right? Talking money, just wait until ‘apps’ are decoupled and become something modern. What then, is the purpose of a ‘smartphone’ going to become? In my view, the current deep pockets like Amazon, Google first look to get into the transportation dash, home speaker markets and businesses like coffee shops to modern casual food. What changes for Radio? Probably ‘consumption mannerisms’ but NOT the need nor want for content! All the kids require is any screen, device, surface, or connected sensors. That respond to a gesture, voice, smart speakers are rather far away from being there skill set wise. But are the concept that matter most. Good news for what becomes of ‘Radio’ as long as you can deliver the right content and onviously the formats and economics will change. Great read!

Spot on, Josh. Content IS king – always will be. But distribution is queen. Radio needs to do both really strategically and really well to avoid being left behind. Appreciate the comment.

Great headline. As I was scrolling through my Facebook News Feed this morning I said to my radio partner – “how many REMEMBER WHEN YOU WALKED TO SCHOOL, or DID YOU EVER DRINK HI C memes and posts can you see in one morning. Facebook is becoming my mom”. Our listeners use it, but less and less if they are under 30.