As broadcast radio continues to fight the good fight against an expanding array of entertainment and information options, it becomes clear over time that strategic research is a foundational need.

And it’s an area where many companies simply don’t devote enough resources to understanding the marketplace and consumers. We know the tech companies are actively engaged in research and often have better listener metrics than radio.

But it’s not just a matter of DOING research – it is often about asking the right questions. And today’s post from last June addresses this need. How do people use radio in 2022, and what are the important attributes should broadcasters be thinking about?

The post gathered a lot of attention, as well as comments. As we close out the year, perhaps there are ideas here for your next research study. – FJ

June 30, 2021

No one loves a provocative research study more than me.

At Jacobs Media, we conduct our fair share of research every year – three Techsurveys among commercial, public, and Christian music radio fans, in particular. And throughout the year, I relish seeing OPR – other people’s research – to learn the questions they ask and the answers they yield.

My first job out of school was with the Frank Magid research firm in Marion, Iowa. At the time, it was the only company of its kind – well ahead of the media research trends. And among us research analysts, it was very competitive. Oftentimes, we vied to see who could come up with the best and most effective research questions.

So, when I bumped into the Signal Hill Insights blog earlier this week, Jeff Vidler‘s research findings almost jumped off the screen. In fact, he had me with the headline:

“All Audio Is Not Alike: What Each Type Brings To Listeners And Advertisers”

Wow.

We live in a world of metrics – what audio source has the most cume, the most eyeballs, the most downloads, the most TSL, etc. We’re into superlatives – hence all those “mosts.”

But the one we never ask is which audio source is most effective?

That’s what Jeff’s newest online research study attempts to tell us. He surveyed just north of 1,500 Canadian adults earlier this month. And he compared their use of audio: radio, streaming services, owned music, and podcasts.

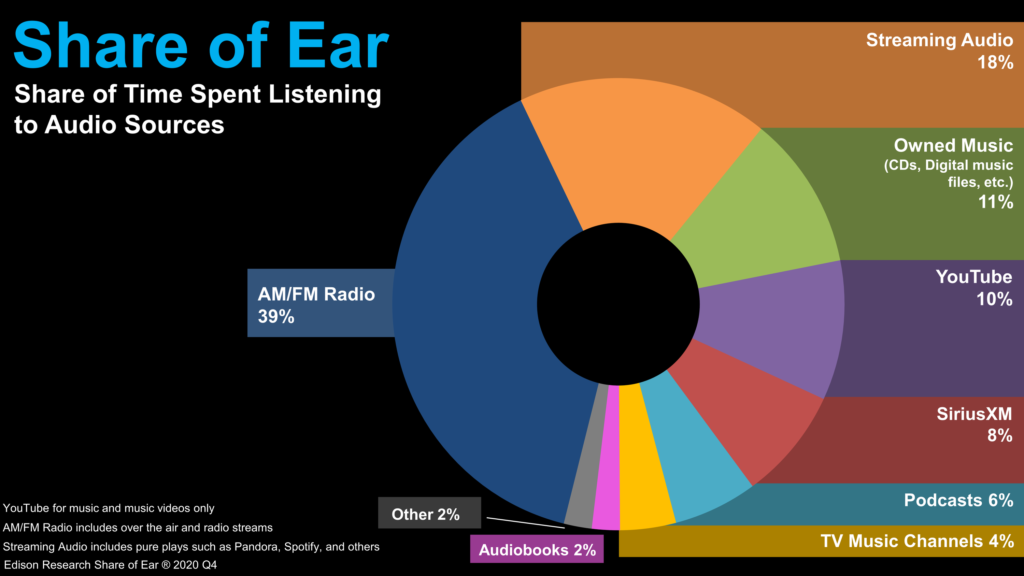

The findings are nothing short of spectacular. That’s because we tend to view audio listening as a pie – different sources make up different “slices.”

Last week in a blog post about Nielsen’s newest measurement tool for TV – The Gauge – I questioned why radio doesn’t have a similar ratings tool. And I noted the closest metric is the Infinite Dial’s “Share of Ear” chart – for many, the industry standard.

And why not? For years, it’s provided a longitudinal look at the state of audio – based on share of use.

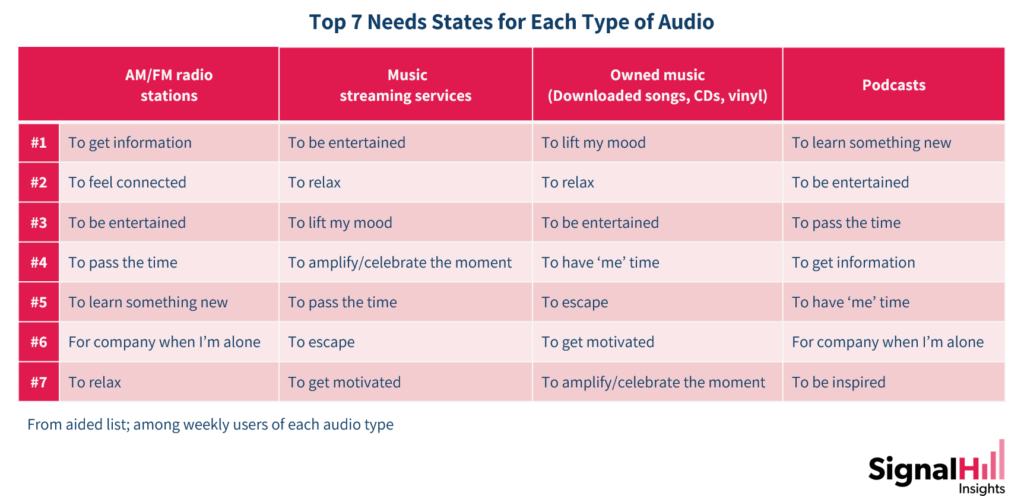

Vidler turns many of the typical questions we researchers usually ask about on their side. In his “all audio is not created equal” premise, he first asked about what he calls the “need states” for each audio platform.

In the telling chart below, Jeff ranks the top 7 for each audio category:

Music streaming services and owned music have much in common. For each medium, two of the top three “needs states” are the same:

- To relax

- To lift my mood

That is revelatory about how people listen to services that are often all music and no talk.

Podcasts are cut from a different cloth. Listeners point to the benefits of learning new things, being entertained, and uniquely, to pass the time

But then there’s broadcast radio – an entirely different audio animal. Entertainment and information, not surprisingly, are core needs. But in second place is a need that shows up in no other “Top 7” list:

To be connected.

Listeners get it. You don’t feel a true connection to a medium if it’s not live and in the moment. Streaming music, owned music, podcasts – all canned. They could have been recorded yesterday…or in 2019. You can pause and rewind them. Yes, they can be entertaining, and in the case of podcasts, even informative. But they aren’t live. They aren’t in real time. They aren’t connected to anything remotely local or in real time.

have been recorded yesterday…or in 2019. You can pause and rewind them. Yes, they can be entertaining, and in the case of podcasts, even informative. But they aren’t live. They aren’t in real time. They aren’t connected to anything remotely local or in real time.

A great radio station stands for something – music, entertainment, personality, community spirit, service. These other audio media occupy time but lack a sense of belonging.

This perceptive research question from Jeff Vidler provides a truer sense of the distinctions between these media – rather than staring at shares.

And it begs the question why we don’t ask a “needs state” question series for formats, and in the case of perceptual studies, each key station in the competitive arena. So often we get a ratings report only to find out the rock station with the big morning show, charity drives, and concert promotions has the exact same share as the Variety Hits station with no DJs, no van, and no radiothons.

Do you think the “needs state” pecking order would be a little different? And couldn’t that information be used with local buyers, agencies, and retailers? Yes, I’ve made a note for Techsurvey 2022.

But I digress because Jeff’s new research has produced another important chart I’d like to share with you. Similar to the “needs states” data, it’s a true platform differentiator.

Respondents who used the aforementioned audio sources at least weekly were asked about the activities that most frequently accompany each one. This time, I got out my red Sharpie:

You don’t need my markings to see what’s going here. Music streaming, personal music, and podcasts are most associated with RELAXING. AT HOME. Not out shopping or being engaged. Chilling out at home, kicking back, and listening.

AM/FM radio listening? It goes best with commuting by car and shopping/running errands while you’re in that car. In other words, engaged, spending money, buying stuff. Looks like pretty good fodder for a media buyer. But maybe that’s just me.

Last week, this blog talked about “windshield media,” such as radio where consumers listen while they are in the vicinity of local businesses.

Jeff Vidler reads his chart this way:

“It places radio firmly on the last mile in the path to purchase. Radio is the ultimate medium for timely messages to reach consumers when they are out, about and ready to spend.”

That all-important “last mile” helps us understand that effectiveness as a marketing medium is not just about time-spent listening or share of use. It is what those users are doing, where they’re located, and how much they’re engaged that truly matters.

The chart clearly delineates between media where you “lean in” – like radio and podcasting – versus those where you “lean back” – streaming and personal music.  Where would you rather market your products and services?

Where would you rather market your products and services?

Jeff breaks it down this way:

“We see both podcasts and radio as ‘lean-in’ audio (see above), but we do see another important distinction between radio on one hand and both podcasts and music streaming on the other. People usually listen to radio when they are ‘plugged in’ — driving to work or around town, or while they’re working.

“They listen to radio to connect to what’s going on around them. But they listen to music streaming services or podcasts to unplug, to disconnect, or to escape. That provides a very different context for both programmers and advertisers.”

Now some of my more cynical readers will remind me that this Signal Hill Insights’ research is conducted among Canadians – not Americans. And to that I say, do you really think there’s much of a difference? Here’s what Jeff says:

you really think there’s much of a difference? Here’s what Jeff says:

“The cultural borders between Canada and the US are very porous. Having spent the better part of my life doing audio research on both sides of the border, I am still amazed at how much similarity there is in audio consumption in both countries. There are some big differences from Europe, even from the UK and Australia. But the North American audio landscape is as flat as the Great Plains or the Canadian Prairies.”

In other words, Fuji apples versus McIntosh apples.

Apples.

Jeff’s big takeaway from his research is an important one:

AM/FM radio, music streaming and podcasting each serve a distinct set of needs and listening activities, creating opportunities of their own for advertisers.

True that. And those distinctions are what radio sellers need to communicate to advertisers, especially in this moment in time where we’re at the precipice of the rebirth of shopping and spending habits this summer, this fall, and the December holidays.

The study is also a reminder to programmers – and those who oversee them – about the unique and basic relationship great radio has with its fans. It is all about being in the moment, connecting listeners with their favorite music, people, and topics, and reflecting the community.

oversee them – about the unique and basic relationship great radio has with its fans. It is all about being in the moment, connecting listeners with their favorite music, people, and topics, and reflecting the community.

So, let’s put “shares” aside because while they’re a handy way to understand the hierarchy of use, they say nothing about engagement or connectedness. A pecking order alone comes up short in explaining a medium’s true activity patterns, consumer passion and value proposition, or marketing efficacy to advertisers.

You can thank Jeff Vidler for helping us understand why we do what we do.

Jeff Vidler has been an audience researcher for 25+ years, in addition to programming and managing radio stations. He serve clients throughout North America, and is obsessed with the changing audio landscape, and using innovative research to measure it. Reach him at j[email protected]

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Radio is immediate, locally connected, personal and effective. When we do it right, they will find it. Delighted for digital but Content Remains King. Happy, safe, holidays! Thank you, Fred.

Back at you, Clark. Enjoy your holidays.